Hello, I need help , how to prepare two word documents showing general journal entries for the employee and employer side, payment of wages, accrual of vacation time, and payment of tax liabilities. and create formatting features of Excel to give the worksheet a professional appearance.

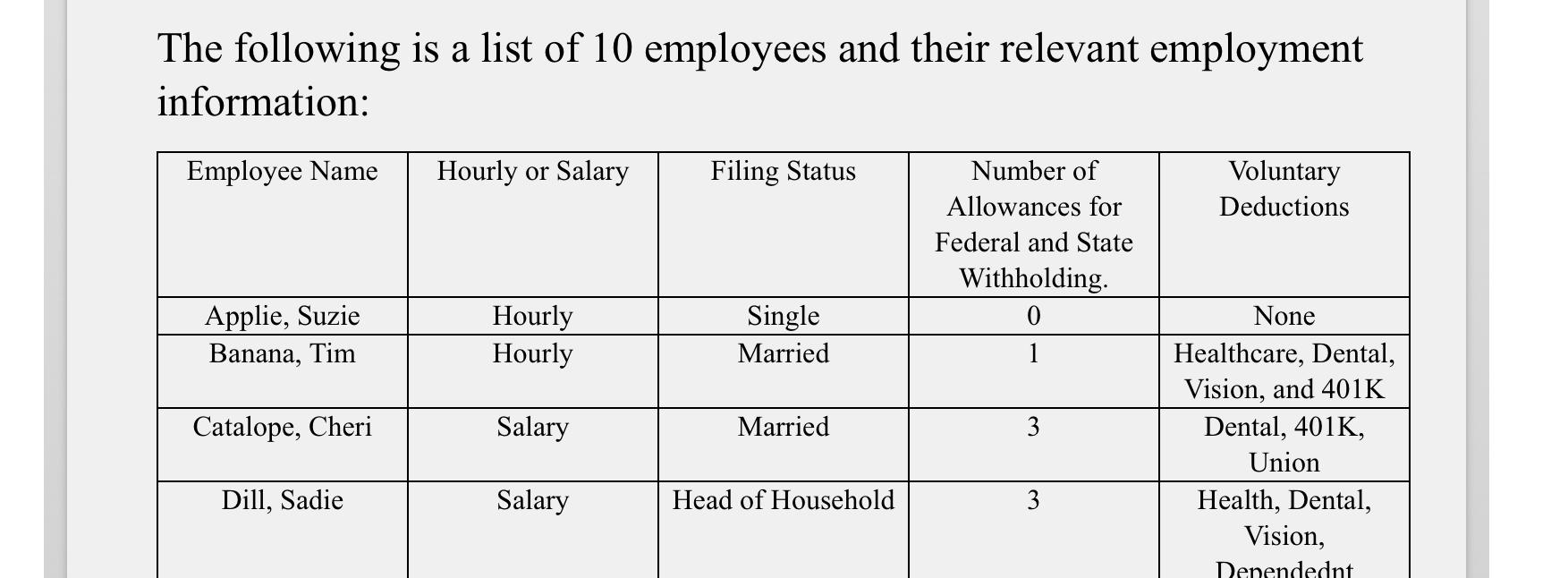

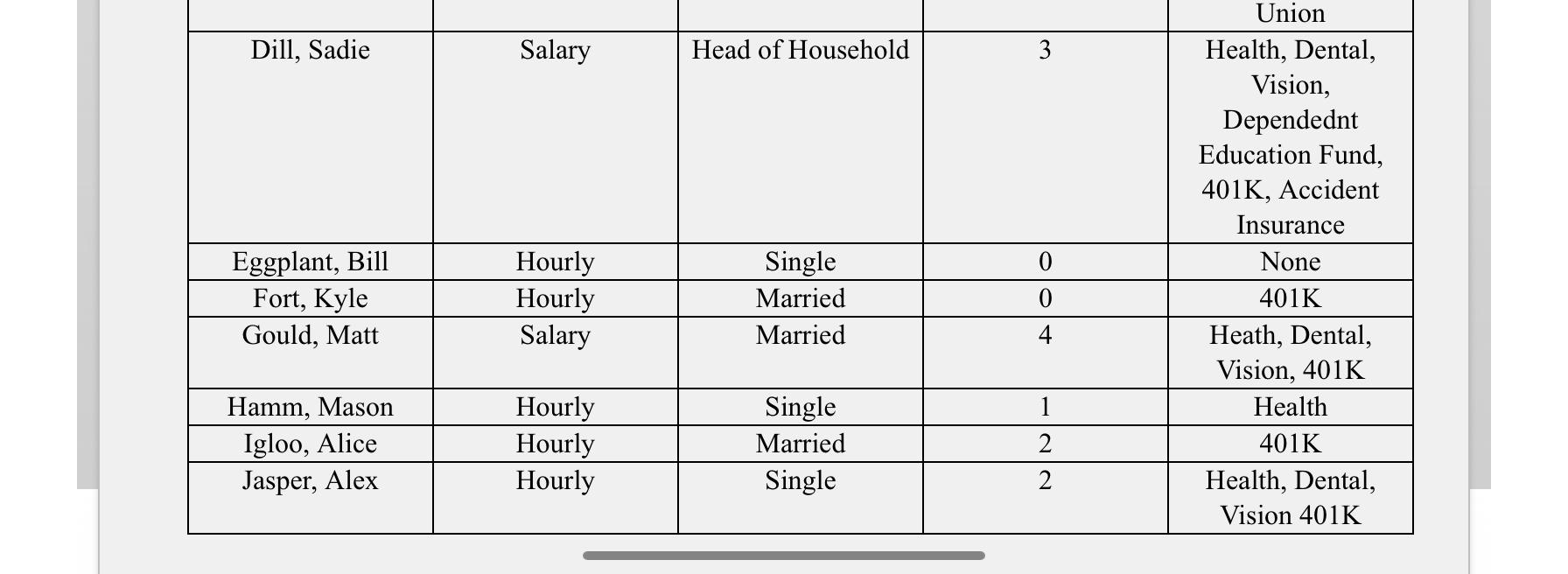

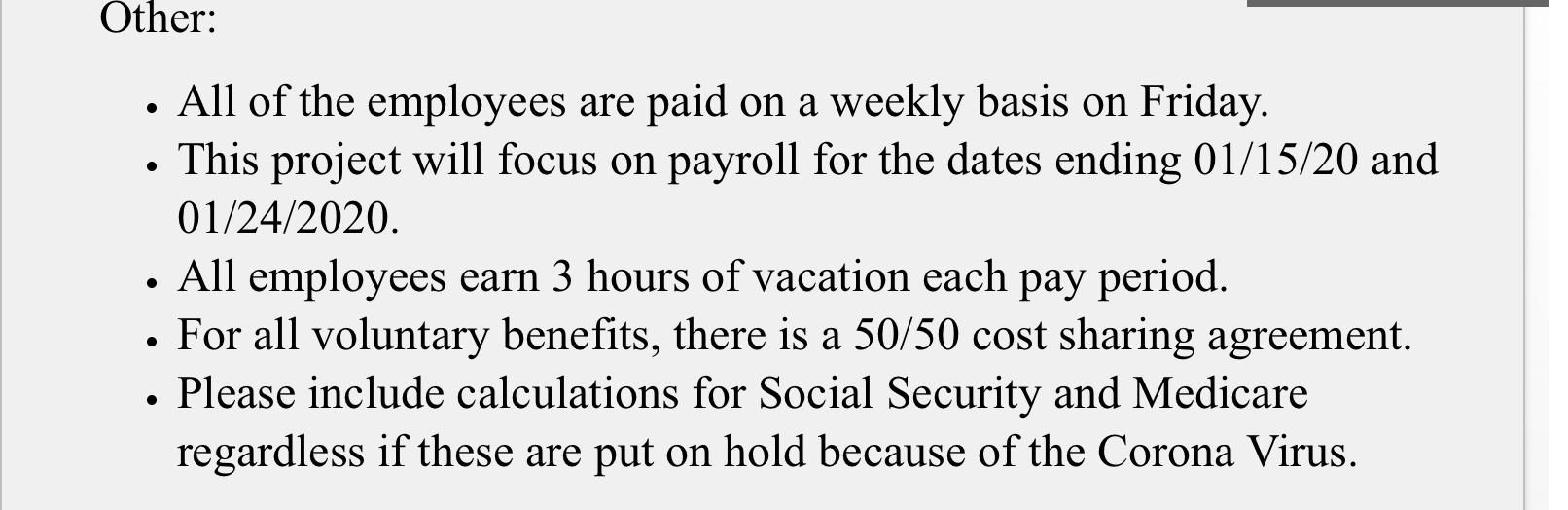

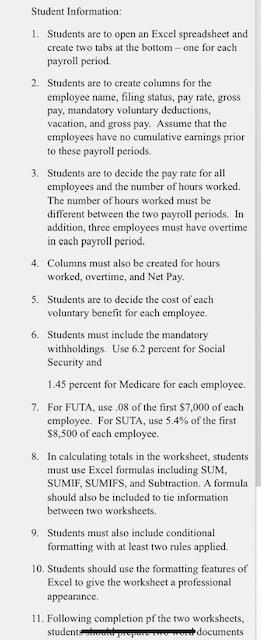

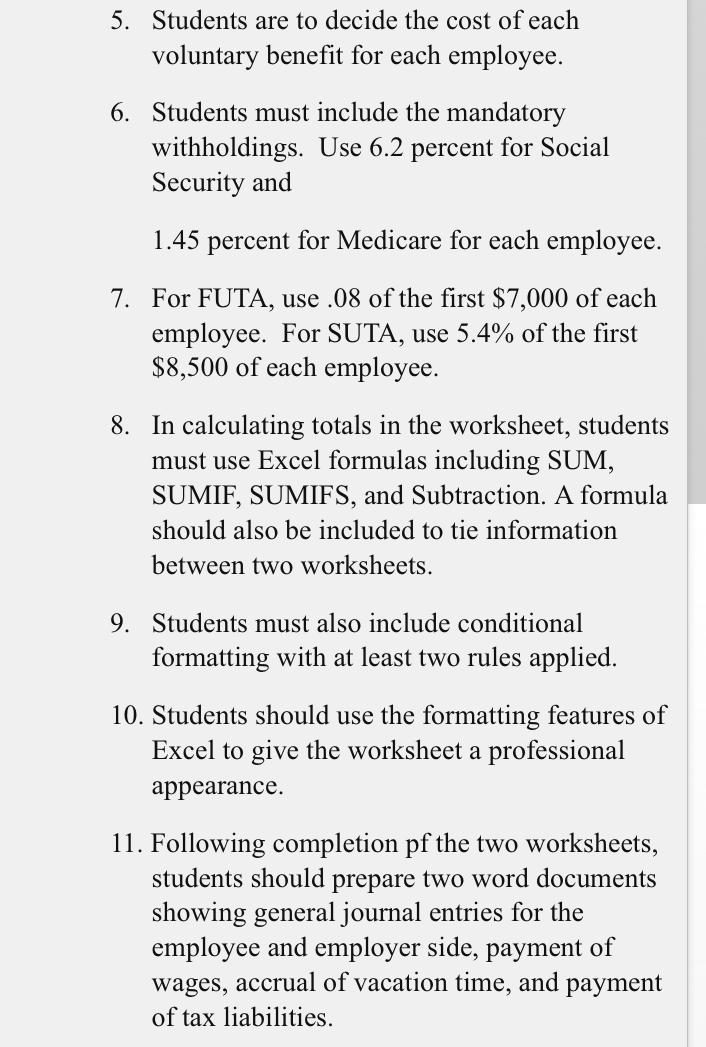

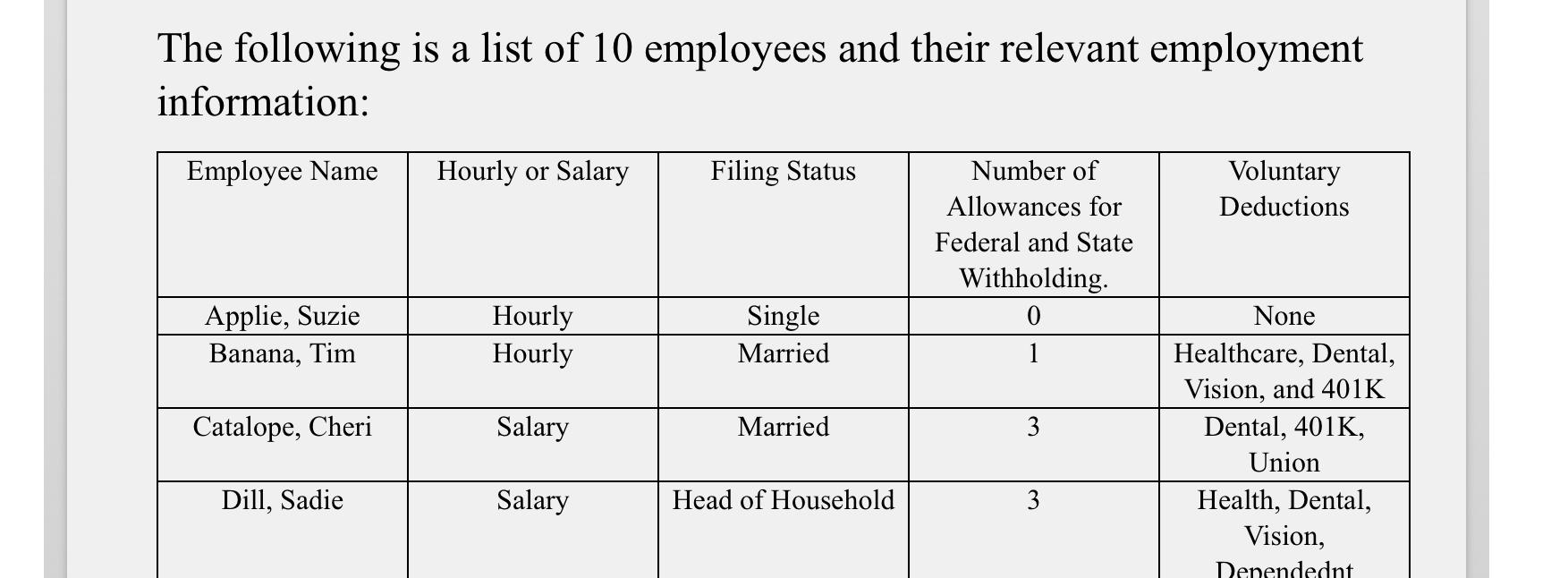

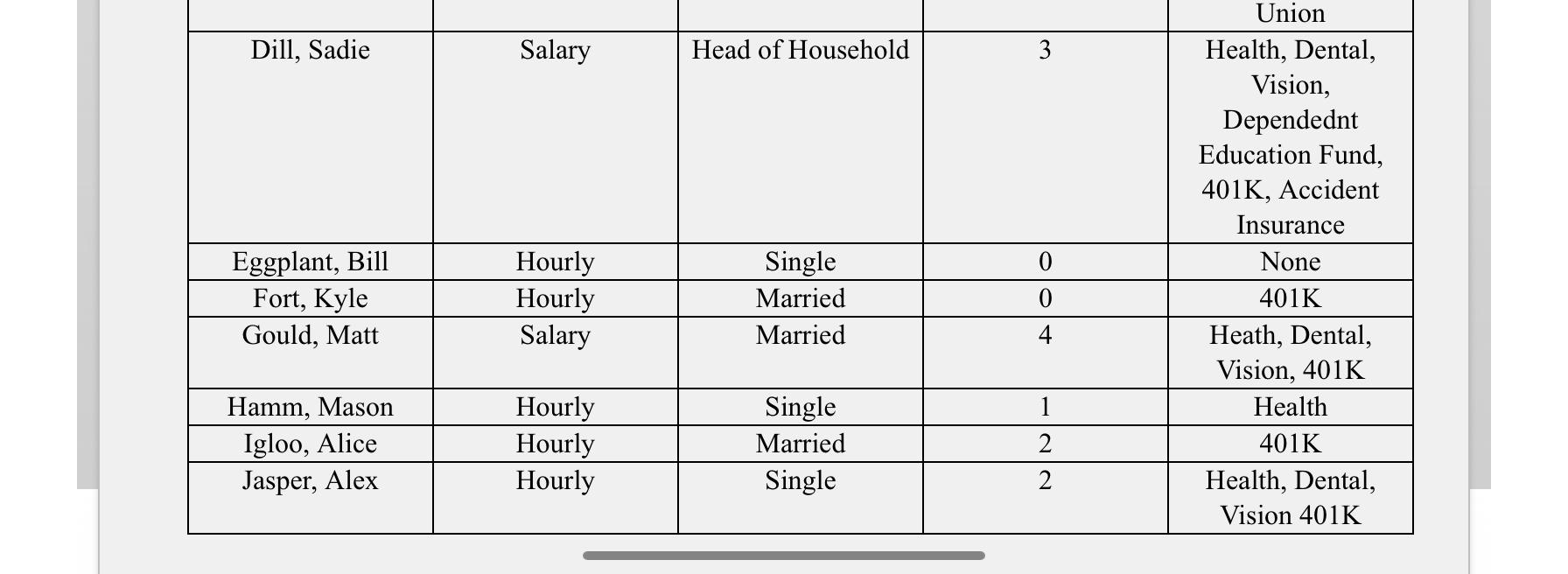

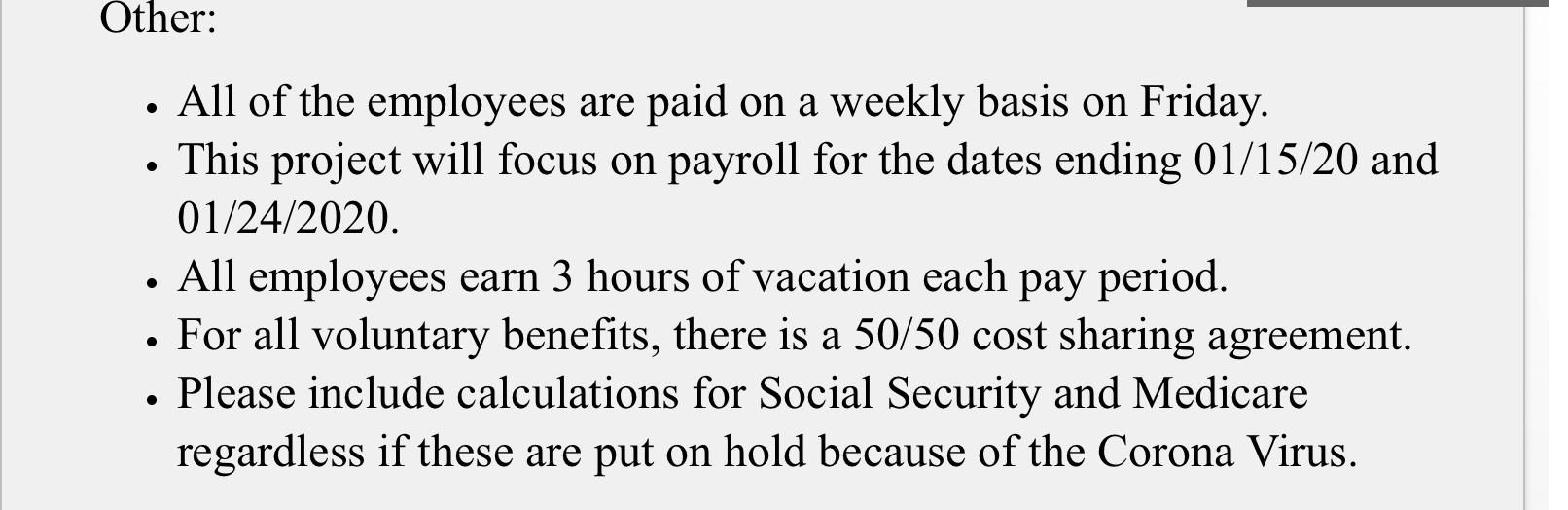

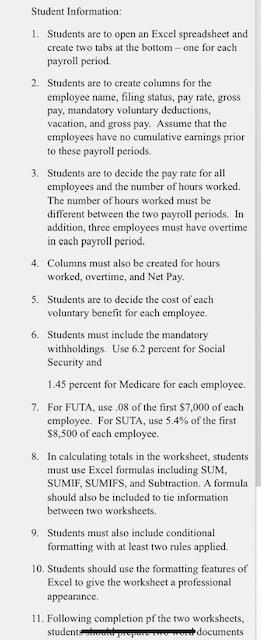

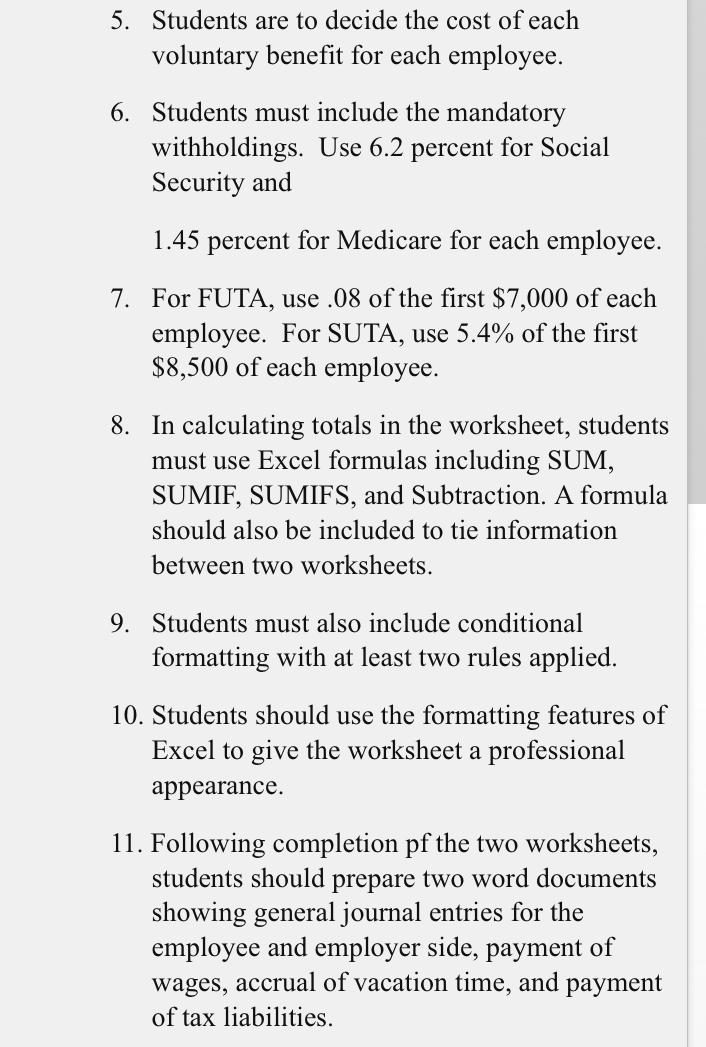

The following is a list of 10 employees and their relevant employment information: Employee Name Hourly or Salary Filing Status Voluntary Deductions Number of Allowances for Federal and State Withholding 0 1 Applie, Suzie Banana, Tim Hourly Hourly Single Married Catalope, Cheri Salary Married 3 None Healthcare, Dental, Vision, and 401K Dental, 401K, Union Health, Dental, Vision, Denendednt Dill, Sadie Salary Head of Household 3 Dill, Sadie Salary Head of Household 3 0 Eggplant, Bill Fort, Kyle Gould, Matt Hourly Hourly Salary Single Married Married Union Health, Dental, Vision, Dependednt Education Fund, 401K, Accident Insurance None 401K Heath, Dental, Vision, 401K Health 401K Health, Dental, Vision 401K 0 4. 1 Hamm, Mason Igloo, Alice Jasper, Alex Hourly Hourly Hourly Single Married Single 2 2 2 Other: . All of the employees are paid on a weekly basis on Friday. This project will focus on payroll for the dates ending 01/15/20 and 01/24/2020. All employees earn 3 hours of vacation each pay period. For all voluntary benefits, there is a 50/50 cost sharing agreement. Please include calculations for Social Security and Medicare regardless if these are put on hold because of the Corona Virus. Student Information: 1. Students are to open an Excel spreadsheet and create two tabs at the bottom - one for each payroll period 2. Students are to create columns for the employee name, filing status, pay rate, gross pay, mandatory voluntary deductions, vacation, and gross pay. Assume that the employees have no cumulative camings prior to these payroll periods 3. Students are to decide the pay rate for all employees and the number of hours worked The number of hours worked must be different between the two payroll periods. In addition, three employees must have overtime in cach payroll period. 4. Columns must also be created for hours worked, overtime, and Net Pay. 5. Students are to decide the cost of cach voluntary benefit for each employee 6. Students must include the mandatory withholdings. Use 6.2 percent for Social Security and 1.45 percent for Medicare for each employee. 7. For FUTA, use 08 of the first $7,000 of each employee. For SUTA, use 5.4% of the first $8,500 of each employee. 8. In calculating totals in the worksheet, students must use Excel formulas including SUM, SUMIF, SUMIFS, and Subtraction. A formula should also be included to tie information between two worksheets. 9. Students must also include conditional formatting with at least two rules applied. 10 Students should use the formatting features of Excel to give the worksheet a professional appearance. 11. Following completion pf the two worksheets, studente documents 5. Students are to decide the cost of each voluntary benefit for each employee. 6. Students must include the mandatory withholdings. Use 6.2 percent for Social Security and 1.45 percent for Medicare for each employee. 7. For FUTA, use .08 of the first $7,000 of each employee. For SUTA, use 5.4% of the first $8,500 of each employee. 8. In calculating totals in the worksheet, students must use Excel formulas including SUM, SUMIF, SUMIFS, and Subtraction. A formula should also be included to tie information between two worksheets. 9. Students must also include conditional formatting with at least two rules applied. 10. Students should use the formatting features of Excel to give the worksheet a professional appearance. 11. Following completion pf the two worksheets, students should prepare two word documents showing general journal entries for the employee and employer side, payment of wages, accrual of vacation time, and payment of tax liabilities. The following is a list of 10 employees and their relevant employment information: Employee Name Hourly or Salary Filing Status Voluntary Deductions Number of Allowances for Federal and State Withholding 0 1 Applie, Suzie Banana, Tim Hourly Hourly Single Married Catalope, Cheri Salary Married 3 None Healthcare, Dental, Vision, and 401K Dental, 401K, Union Health, Dental, Vision, Denendednt Dill, Sadie Salary Head of Household 3 Dill, Sadie Salary Head of Household 3 0 Eggplant, Bill Fort, Kyle Gould, Matt Hourly Hourly Salary Single Married Married Union Health, Dental, Vision, Dependednt Education Fund, 401K, Accident Insurance None 401K Heath, Dental, Vision, 401K Health 401K Health, Dental, Vision 401K 0 4. 1 Hamm, Mason Igloo, Alice Jasper, Alex Hourly Hourly Hourly Single Married Single 2 2 2 Other: . All of the employees are paid on a weekly basis on Friday. This project will focus on payroll for the dates ending 01/15/20 and 01/24/2020. All employees earn 3 hours of vacation each pay period. For all voluntary benefits, there is a 50/50 cost sharing agreement. Please include calculations for Social Security and Medicare regardless if these are put on hold because of the Corona Virus. Student Information: 1. Students are to open an Excel spreadsheet and create two tabs at the bottom - one for each payroll period 2. Students are to create columns for the employee name, filing status, pay rate, gross pay, mandatory voluntary deductions, vacation, and gross pay. Assume that the employees have no cumulative camings prior to these payroll periods 3. Students are to decide the pay rate for all employees and the number of hours worked The number of hours worked must be different between the two payroll periods. In addition, three employees must have overtime in cach payroll period. 4. Columns must also be created for hours worked, overtime, and Net Pay. 5. Students are to decide the cost of cach voluntary benefit for each employee 6. Students must include the mandatory withholdings. Use 6.2 percent for Social Security and 1.45 percent for Medicare for each employee. 7. For FUTA, use 08 of the first $7,000 of each employee. For SUTA, use 5.4% of the first $8,500 of each employee. 8. In calculating totals in the worksheet, students must use Excel formulas including SUM, SUMIF, SUMIFS, and Subtraction. A formula should also be included to tie information between two worksheets. 9. Students must also include conditional formatting with at least two rules applied. 10 Students should use the formatting features of Excel to give the worksheet a professional appearance. 11. Following completion pf the two worksheets, studente documents 5. Students are to decide the cost of each voluntary benefit for each employee. 6. Students must include the mandatory withholdings. Use 6.2 percent for Social Security and 1.45 percent for Medicare for each employee. 7. For FUTA, use .08 of the first $7,000 of each employee. For SUTA, use 5.4% of the first $8,500 of each employee. 8. In calculating totals in the worksheet, students must use Excel formulas including SUM, SUMIF, SUMIFS, and Subtraction. A formula should also be included to tie information between two worksheets. 9. Students must also include conditional formatting with at least two rules applied. 10. Students should use the formatting features of Excel to give the worksheet a professional appearance. 11. Following completion pf the two worksheets, students should prepare two word documents showing general journal entries for the employee and employer side, payment of wages, accrual of vacation time, and payment of tax liabilities