Answered step by step

Verified Expert Solution

Question

1 Approved Answer

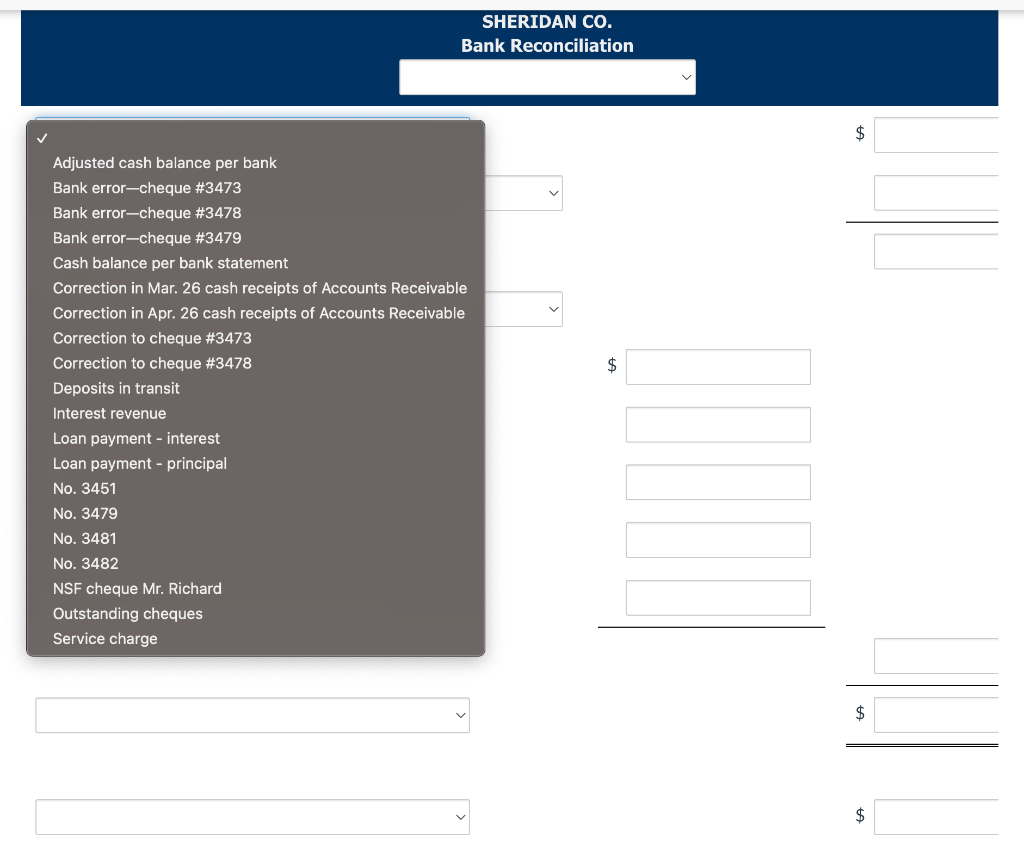

hello i need help on this question and in the last picture those are the names that should be put in the bank reconciliation 1.

hello i need help on this question and in the last picture those are the names that should be put in the bank reconciliation

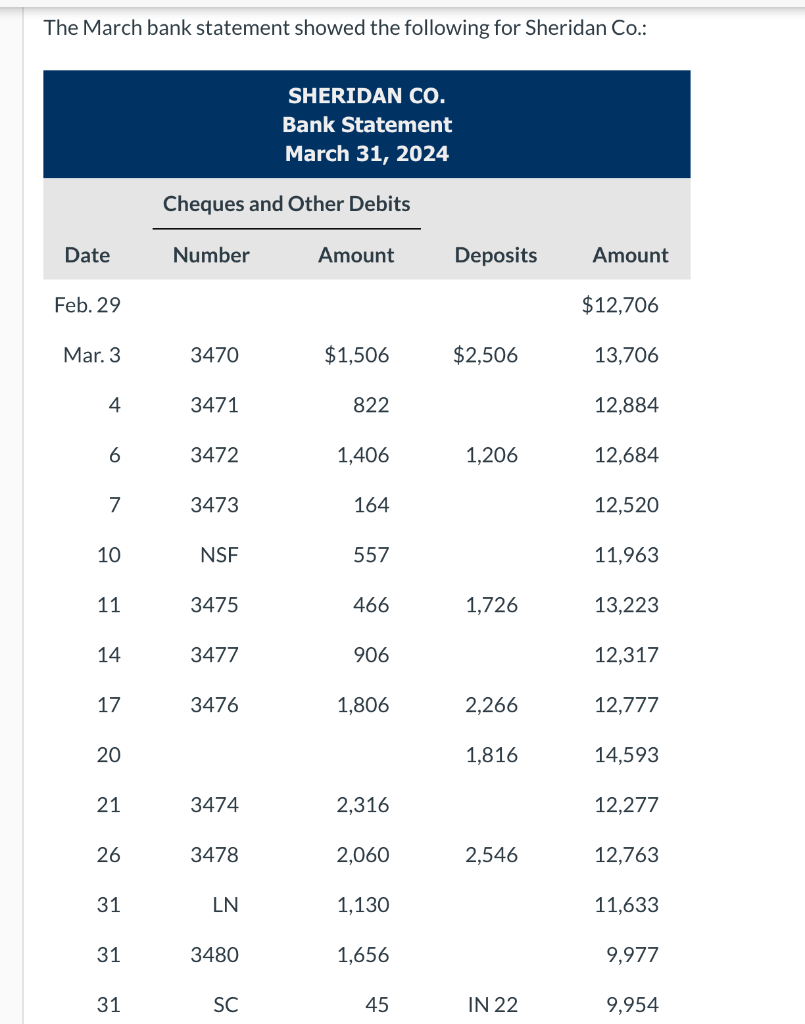

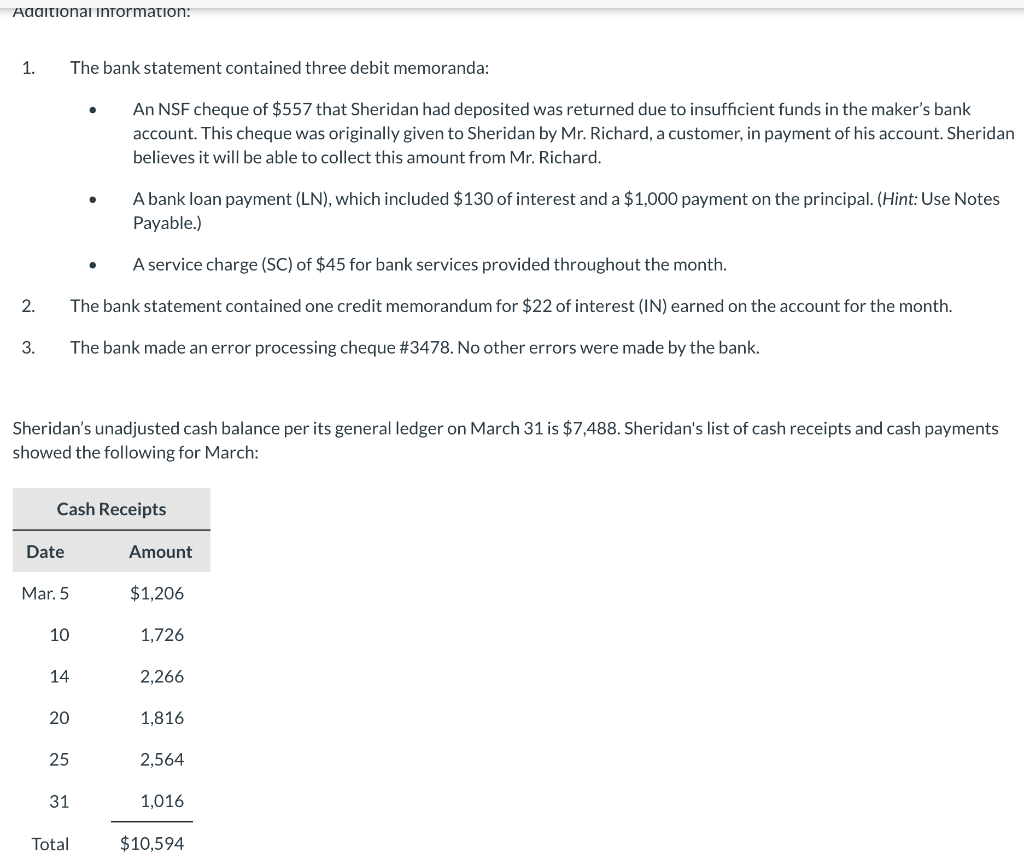

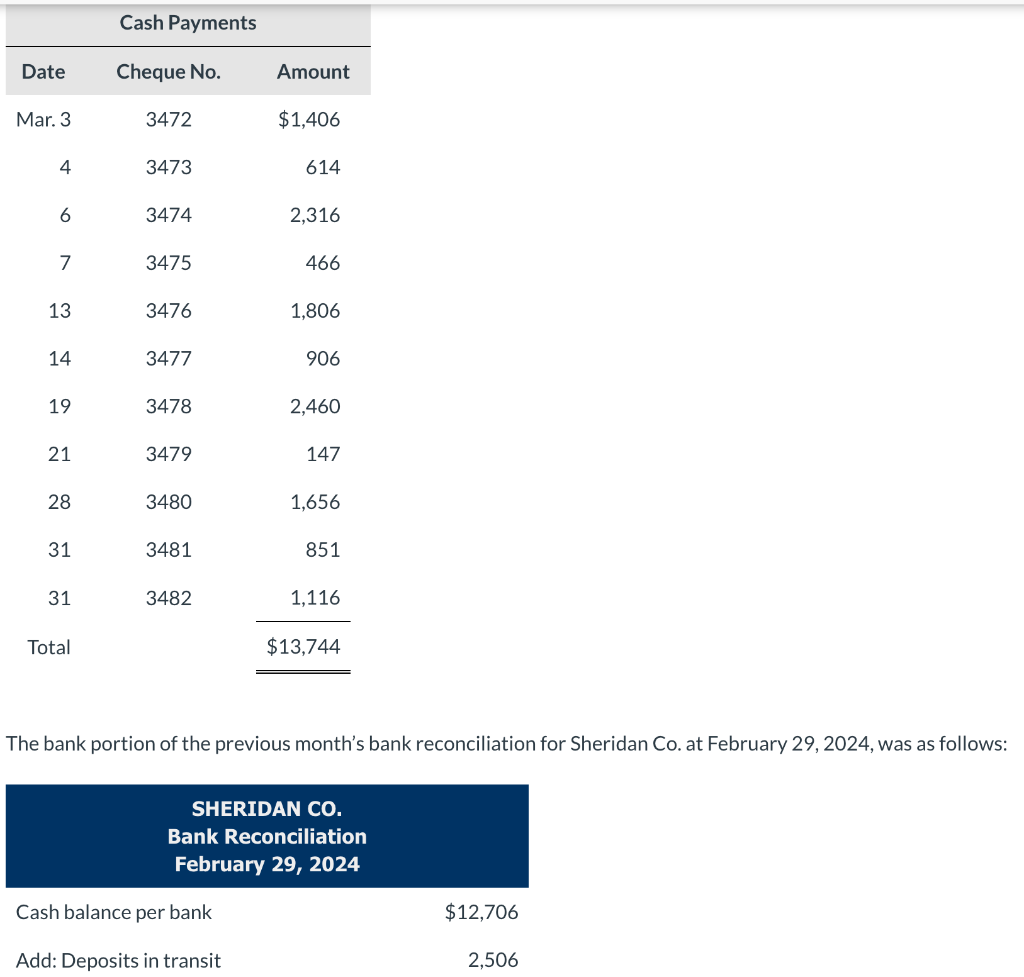

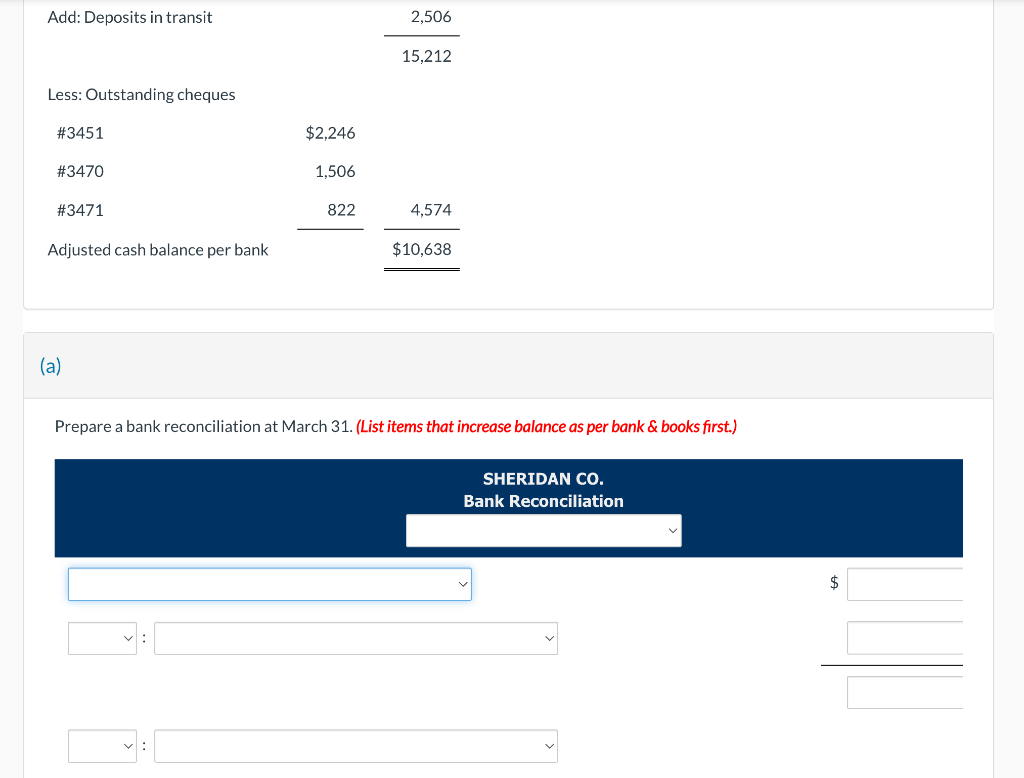

1. The bank statement contained three debit memoranda: - An NSF cheque of $557 that Sheridan had deposited was returned due to insufficient funds in the maker's bank account. This cheque was originally given to Sheridan by Mr. Richard, a customer, in payment of his account. Sheridan believes it will be able to collect this amount from Mr. Richard. - A bank loan payment (LN), which included $130 of interest and a $1,000 payment on the principal. (Hint: Use Notes Payable.) - A service charge (SC) of $45 for bank services provided throughout the month. 2. The bank statement contained one credit memorandum for $22 of interest (IN) earned on the account for the month. 3. The bank made an error processing cheque \#3478. No other errors were made by the bank. Sheridan's unadjusted cash balance per its general ledger on March 31 is $7,488. Sheridan's list of cash receipts and cash payments showed the following for March: he bank portion of the previous month's bank reconciliation for Sheridan Co. at February 29, 2024, was as follows: Prepare a bank reconciliation at March 31. (List items that increase balance as per bank \& books first.) List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer SHERIDAN CO. Bank Reconciliation Adjusted cash balance per bank Bank error-cheque \#3473 Bank error-cheque \#3478 Bank error-cheque \#3479 Cash balance per bank statement Correction in Mar. 26 cash receipts of Accounts Receivable Correction in Apr. 26 cash receipts of Accounts Receivable Correction to cheque #3473 Correction to cheque \#3478 Deposits in transit Interest revenue Loan payment - interest Loan payment - principal No. 3451 No. 3479 No. 3481 No. 3482 NSF cheque Mr. Richard Outstanding cheques Service chargeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started