Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, i need help only with the LAST PART ( knocked-out ). this is the Q: and this is my Excel sheet: what can i

Hello, i need help only with the LAST PART ( knocked-out ).

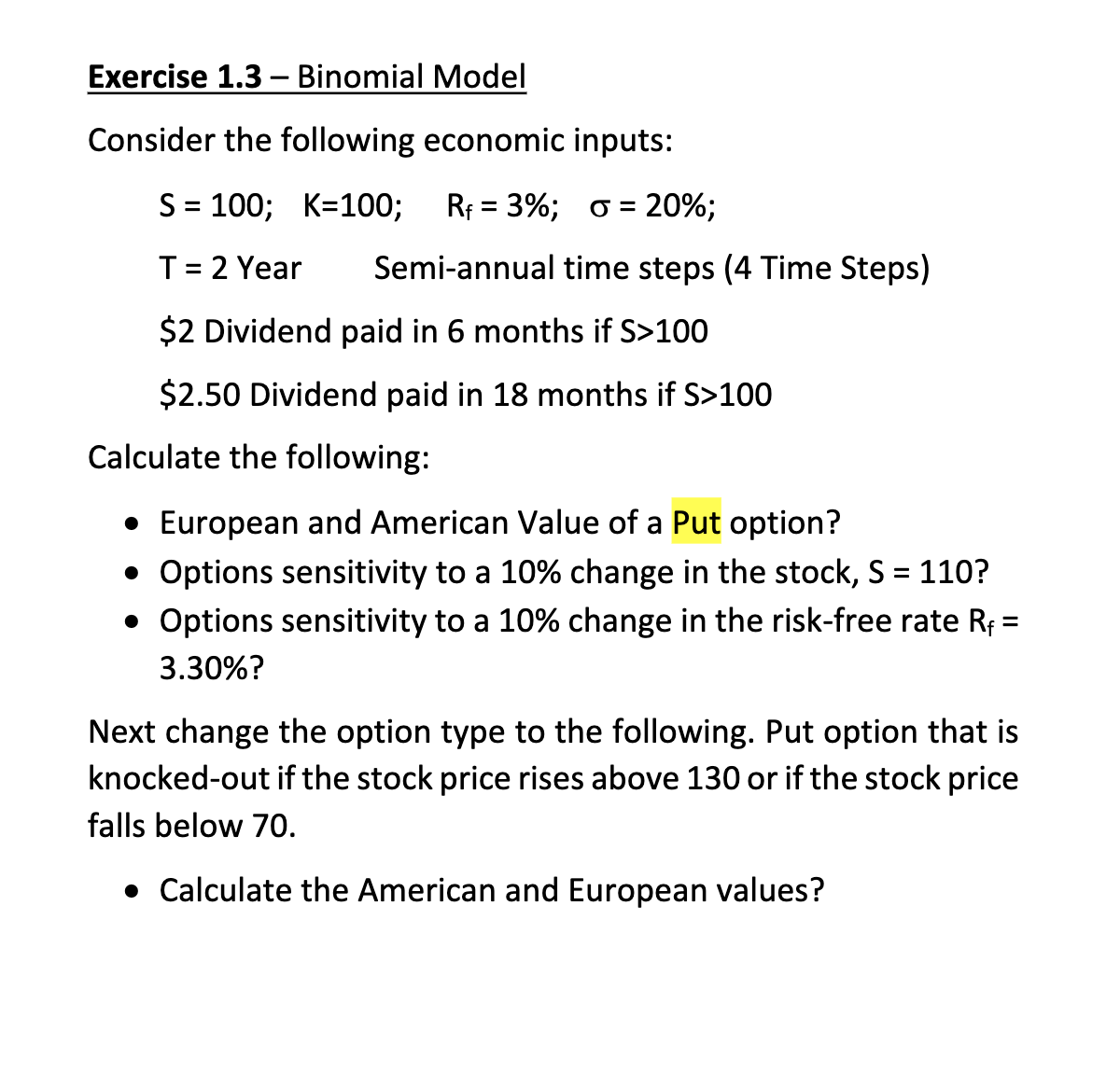

this is the Q:

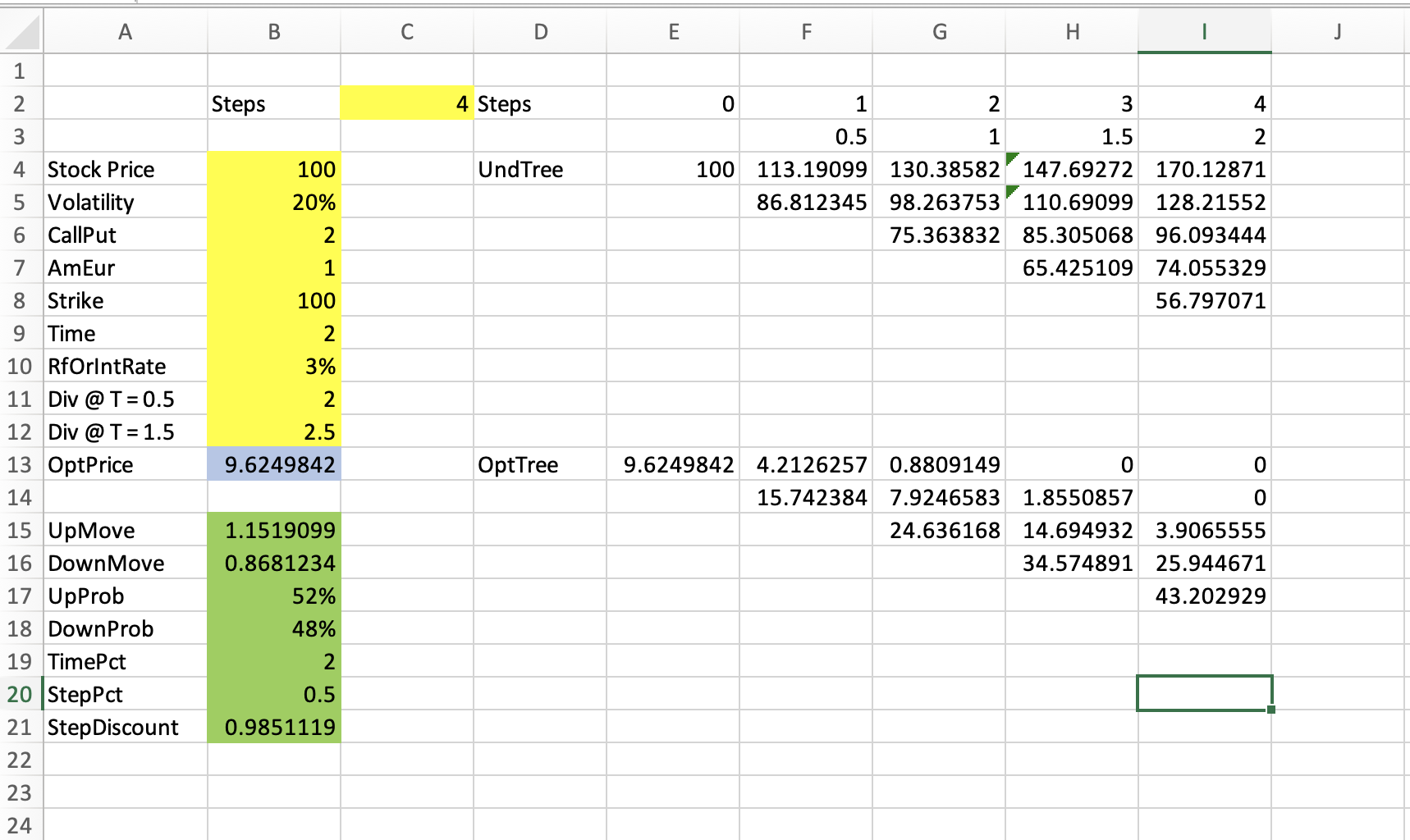

and this is my Excel sheet:

what can i add/change to solve this!

thank you.

Exercise 1.3 - Binomial Model Consider the following economic inputs: S=100;K=100;Rf=3%;=20%; T=2 Year Semi-annual time steps (4 Time Steps) $2 Dividend paid in 6 months if S>100 $2.50 Dividend paid in 18 months if S>100 Calculate the following: - European and American Value of a Put option? - Options sensitivity to a 10% change in the stock, S=110 ? - Options sensitivity to a 10% change in the risk-free rate Rf= 3.30% ? Next change the option type to the following. Put option that is knocked-out if the stock price rises above 130 or if the stock price falls below 70 . - Calculate the American and European values? Exercise 1.3 - Binomial Model Consider the following economic inputs: S=100;K=100;Rf=3%;=20%; T=2 Year Semi-annual time steps (4 Time Steps) $2 Dividend paid in 6 months if S>100 $2.50 Dividend paid in 18 months if S>100 Calculate the following: - European and American Value of a Put option? - Options sensitivity to a 10% change in the stock, S=110 ? - Options sensitivity to a 10% change in the risk-free rate Rf= 3.30% ? Next change the option type to the following. Put option that is knocked-out if the stock price rises above 130 or if the stock price falls below 70 . - Calculate the American and European valuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started