Answered step by step

Verified Expert Solution

Question

1 Approved Answer

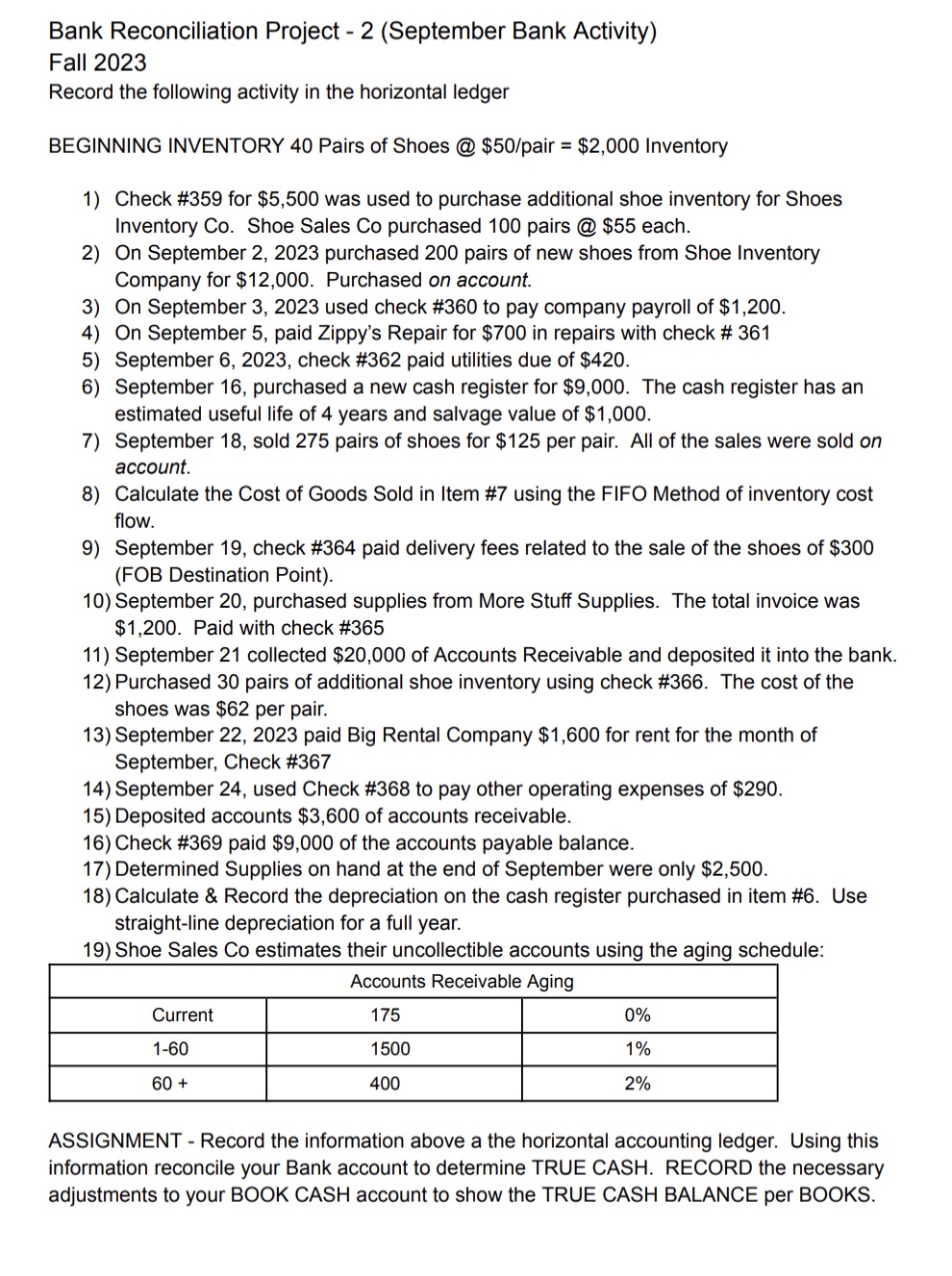

Bank Reconciliation Project - 2 (September Bank Activity) Fall 2023 Record the following activity in the horizontal ledger BEGINNING INVENTORY 40 Pairs of Shoes

Bank Reconciliation Project - 2 (September Bank Activity) Fall 2023 Record the following activity in the horizontal ledger BEGINNING INVENTORY 40 Pairs of Shoes @ $50/pair = $2,000 Inventory 1) Check # 359 for $5,500 was used to purchase additional shoe inventory for Shoes Inventory Co. Shoe Sales Co purchased 100 pairs @ $55 each. 2) On September 2, 2023 purchased 200 pairs of new shoes from Shoe Inventory Company for $12,000. Purchased on account. 3) On September 3, 2023 used check # 360 to pay company payroll of $1,200. 4) On September 5, paid Zippy's Repair for $700 in repairs with check # 361 5) September 6, 2023, check # 362 paid utilities due of $420. 6) September 16, purchased a new cash register for $9,000. The cash register has an estimated useful life of 4 years and salvage value of $1,000. 7) September 18, sold 275 pairs of shoes for $125 per pair. All of the sales were sold on account. 8) Calculate the Cost of Goods Sold in Item #7 using the FIFO Method of inventory cost flow. 9) September 19, check #364 paid delivery fees related to the sale of the shoes of $300 (FOB Destination Point). 10) September 20, purchased supplies from More Stuff Supplies. The total invoice was $1,200. Paid with check # 365 11) September 21 collected $20,000 of Accounts Receivable and deposited it into the bank. 12) Purchased 30 pairs of additional shoe inventory using check #366. The cost of the shoes was $62 per pair. 13) September 22, 2023 paid Big Rental Company $1,600 for rent for the month of September, Check # 367 14) September 24, used Check # 368 to pay other operating expenses of $290. 15) Deposited accounts $3,600 of accounts receivable. 16) Check # 369 paid $9,000 of the accounts payable balance. 17) Determined Supplies on hand at the end of September were only $2,500. 18) Calculate & Record the depreciation on the cash register purchased in item #6. Use straight-line depreciation for a full year. 19) Shoe Sales Co estimates their uncollectible accounts using the aging schedule: Current 1-60 60+ Accounts Receivable Aging 175 0% 1500 400 1% 2% ASSIGNMENT - Record the information above a the horizontal accounting ledger. Using this information reconcile your Bank account to determine TRUE CASH. RECORD the necessary adjustments to your BOOK CASH account to show the TRUE CASH BALANCE per BOOKS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Horizontal Accounting Ledger Shoe Sales Co September 2023 Date Account Debit Credit Balance Descript...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started