Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello I need help with my case study assignment The answer has to be like the following: Tax Problem, Facts, Issue, and Research Thank You

Hello I need help with my case study assignment

The answer has to be like the following: Tax Problem, Facts, Issue, and Research

Thank You !!!!!!!

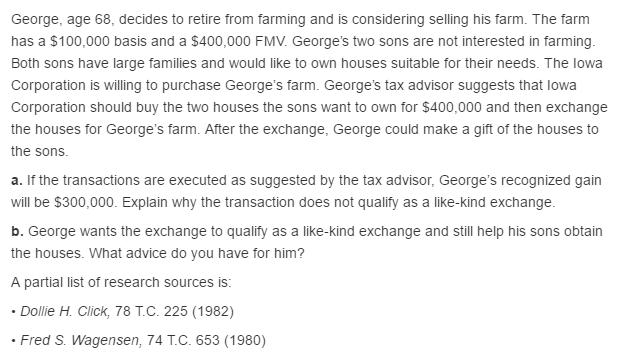

George, age 68, decides to retire from farming and is considering selling his farm. The farm has a $100,000 basis and a $400,000 FMV. George's two sons are not interested in farming Both sons have large families and would like to own houses suitable for their needs. The lowa Corporation is willing to purchase George's farm. George's tax advisor suggests that lowa Corporation should buy the two houses the sons want to own for $400,000 and then exchange the houses for George's farm. After the exchange, George Could make a gift of the houses to the sons. a. If the transactions are executed as suggested by the tax advisor, George's recognized gain will be $300,000. Explain why the transaction does not qualify as a like-kind exchange b. George wants the exchange to qualify as a like-kind exchange and still help his sons obtain the houses. What advice do you have for him? A partial list of research sources is Dollie H Click, 78 TC 225 (1982) Fred S. Wagensen, 74 TC. 653 (1980)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started