Hello i need help with my homework, please give me your best answer. I promise to give you high rate :)

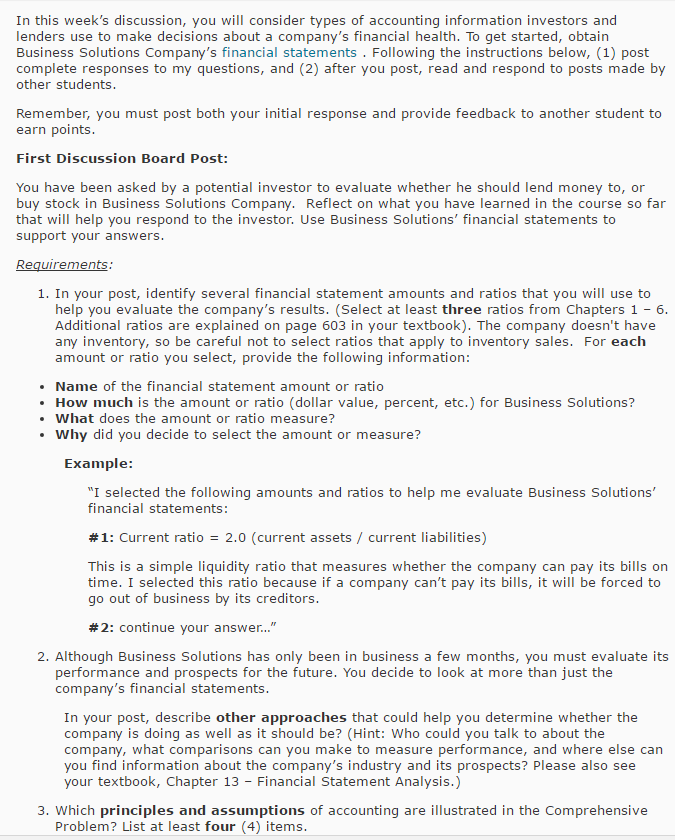

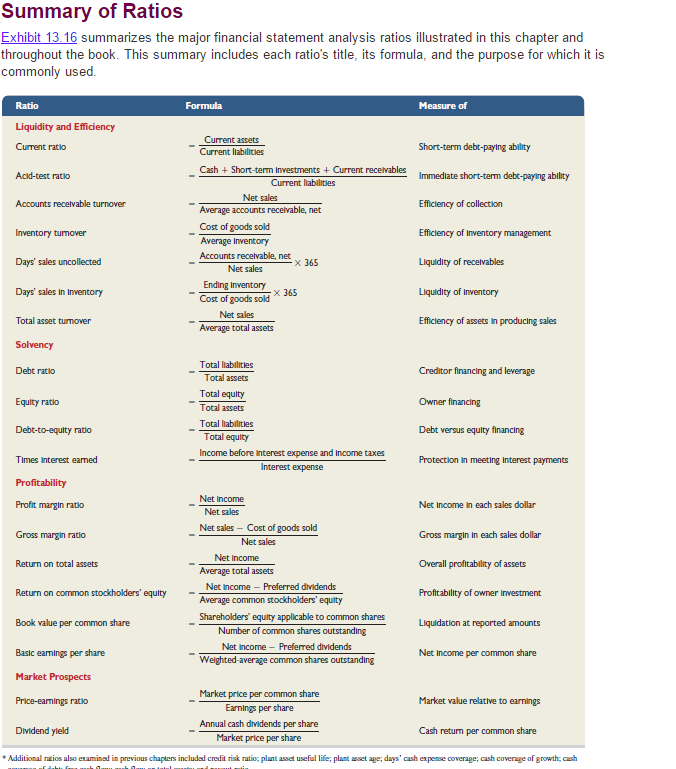

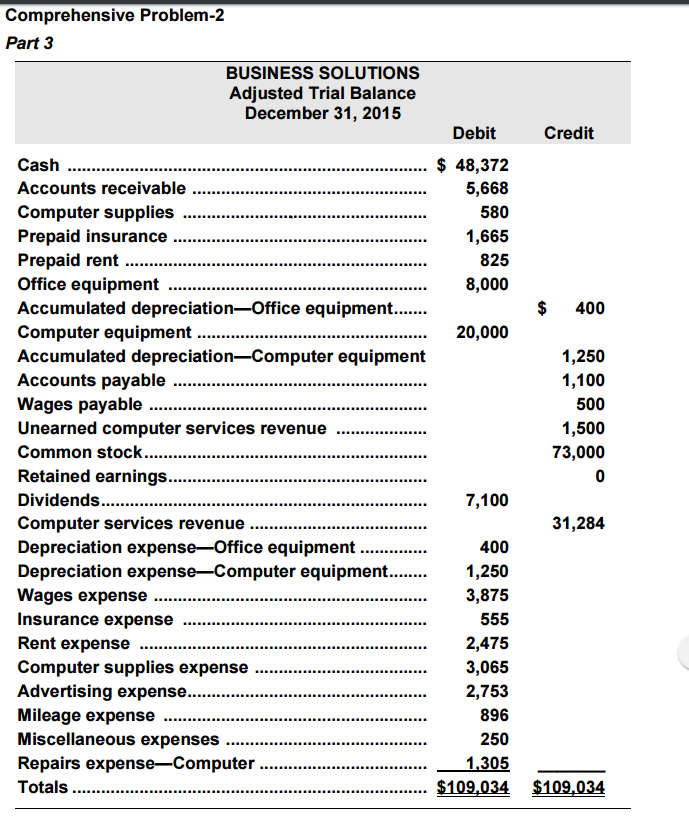

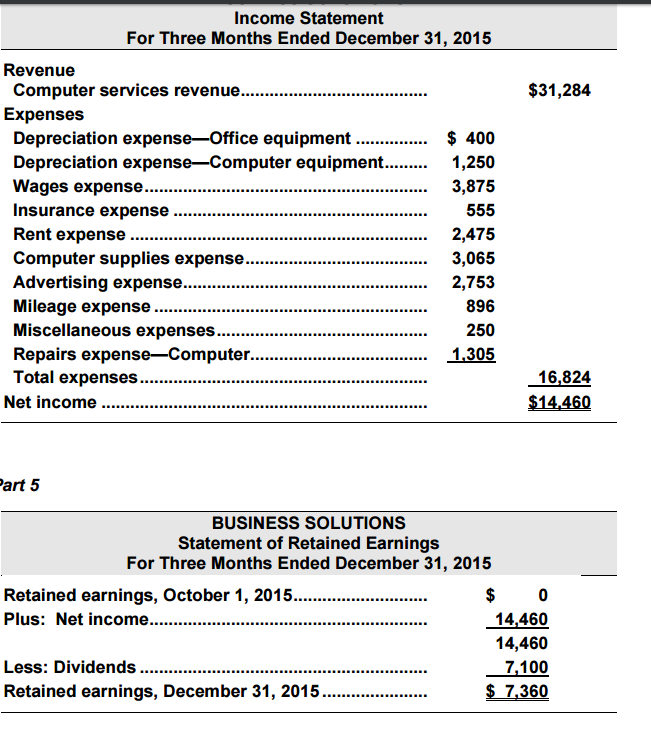

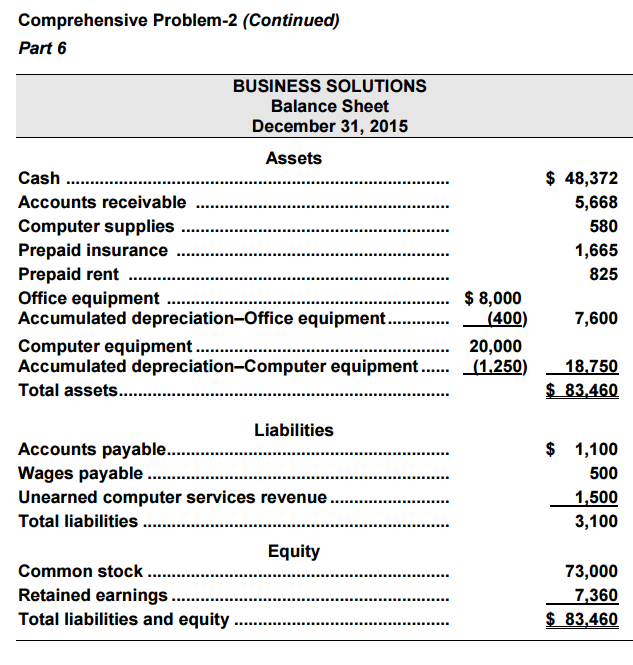

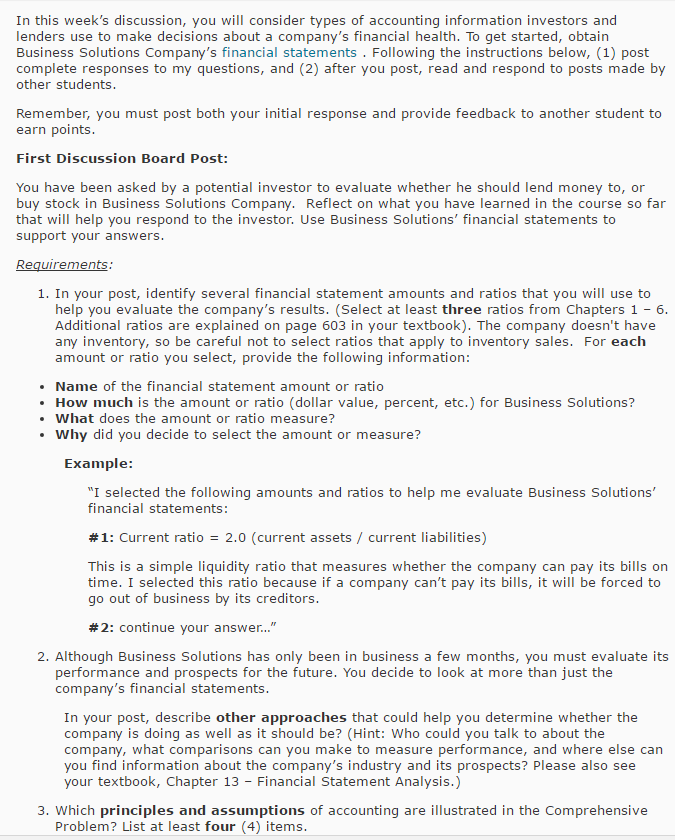

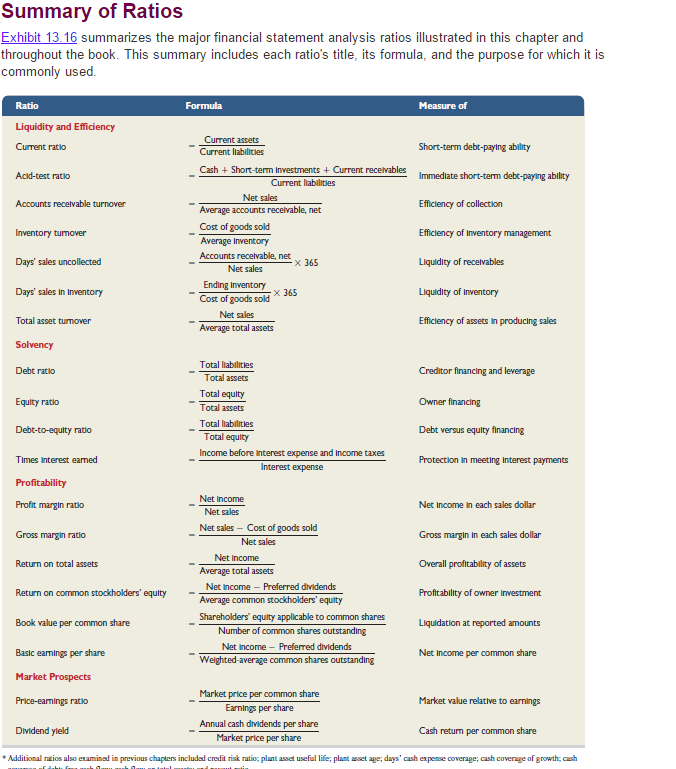

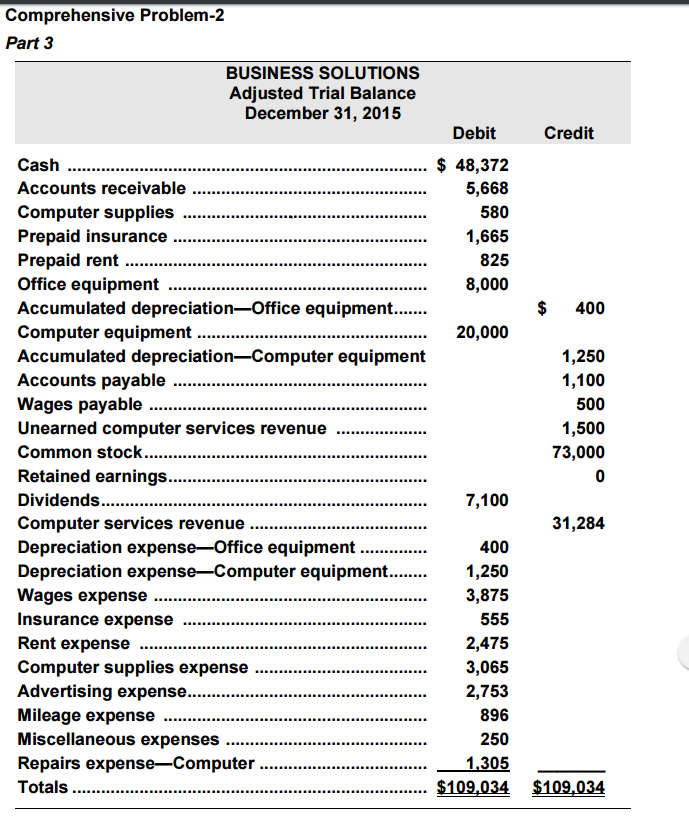

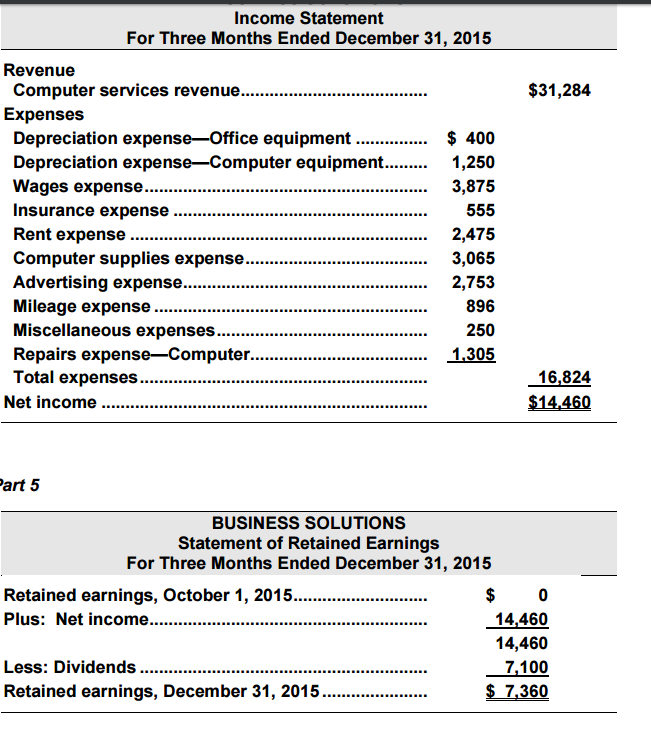

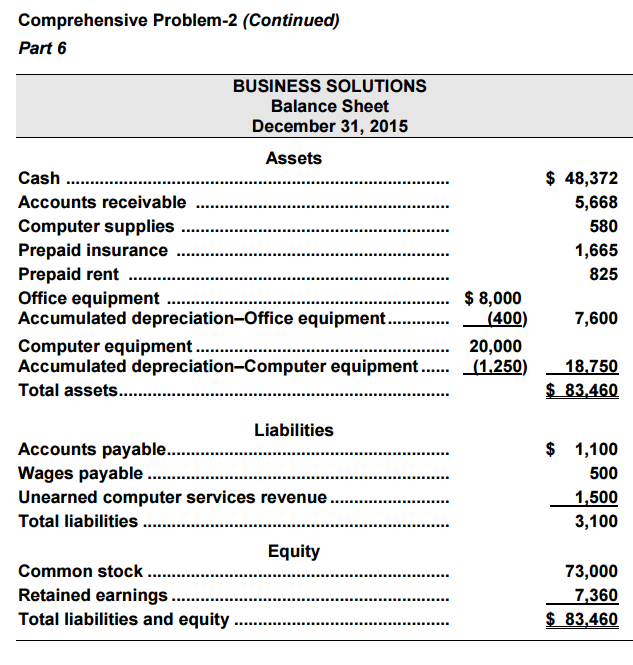

In this week's discussion, you will consider types of accounting information investors and lenders use to make decisions about a company's financial health. To get started, obtain Business Solutions Company's financial statements Following the instructions below. (1) post complete responses to my questions, and (2) after you post, read and respond to posts made by other students Remember, you must post both your initial response and provide feedback to another student to earn points First Discussion Board Post: You have been asked by a potential investor to evaluate whether he should lend money to or buy stock in Business Solutions Company. Reflect on what you have learned in the course so far that will help you respond to the investor. Use Business Solutions' financial statements to support your answers Requirements 1. In your post, identify several financial statement amounts and ratios that you will use to help you evaluate the company's results. Select at least three ratios from Chapters 1 6 Additional ratios are explained on page 603 in your textbook). The company doesn't have any inventory, so be careful not to select ratios that apply to inventory sales. For each amount or ratio you select, provide the following information: Name of the financial statement amount or ratio How much is the amount or ratio (dollar value, percent, etc.) for Business Solutions? What does the amount or ratio measure? Why did you decide to select the amount or measure? Example: "I selected the following amounts and ratios to help me evaluate Business Solutions' financial statements: 2.0 (current assets current liabilities) #1 Current ratio This is a simple liquidity ratio that measures whether the company can pay its bills on time. I selected this ratio because if a company can't pay its bills, it will be forced to go out of business by its creditors 2: continue your answer 2. Although Business Solutions has only been in business a few months, you must evaluate its performance and prospects for the future. You decide to look at more than just the company's financial statements In your post, describe other approaches that could help you determine whether the company is doing as well as it should be? (Hint: Who could you talk to about the company, what comparisons can you make to measure performance, and where else can you find information about the company's industry and its prospects? Please also see your textbook, Chapter 13 Financial Statement Analysis 3. Which principles and assumptions of accounting are illustrated in the Comprehensive Problem? List at least four (4) items