Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I need help with these 2 questions. Thank you Question 1: A B Question 2: a Aggregate Mining Corporation was incorporated five years ago.

Hello, I need help with these 2 questions. Thank you

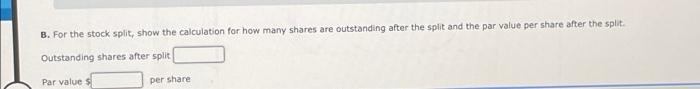

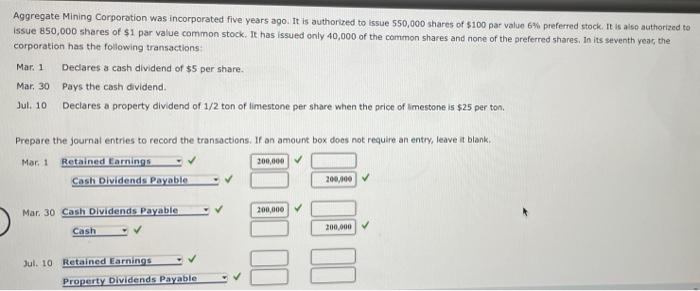

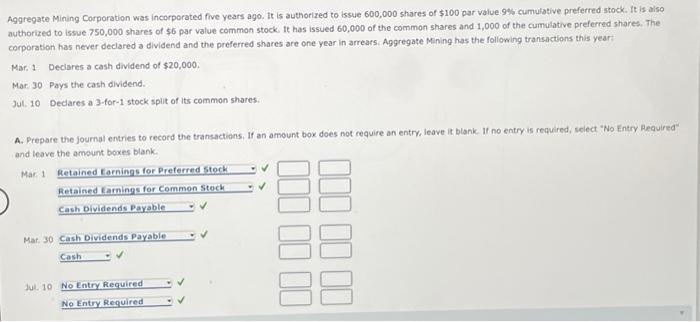

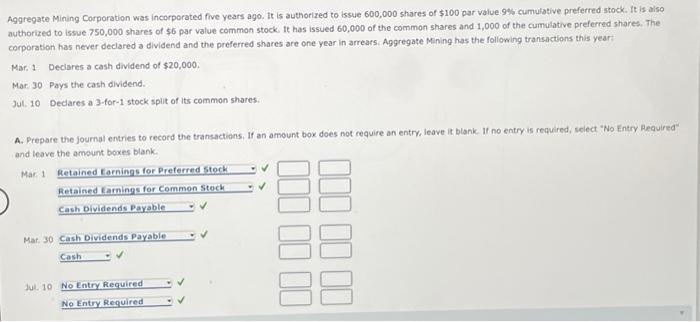

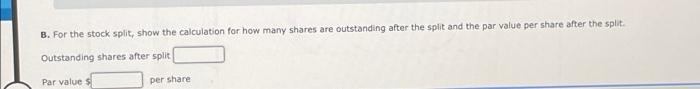

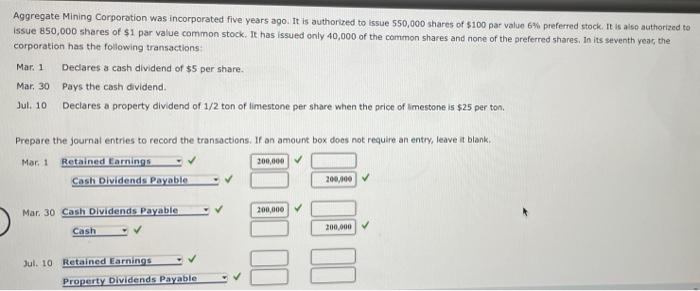

a Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 600,000 shares of $100 par value 9% cumulative preferred stock. It is also authorized to issue 750,000 shares of $6 par value common stock. It has issued 60,000 of the common shares and 1,000 of the cumulative preferred shares. The corporation has never declared a dividend and the preferred shares are one year in arrears. Aggregate Mining has the following transactions this year Mar. 1 Declares a cash dividend of $20,000. Mar 30 Pays the cash dividend. Jul, 10 Declares a 3-for-1 stock split of its common shares. A. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank. Mar 1 Retained Earnings for Preferred stock Retained Earnings for Common Stock Cash Dividends Payable 11 II II II II III Mar 30 Cash Dividends Payable Cash Jul 10 No Entry Required No Entry Required B. For the stock split, show the calculation for how many shares are outstanding after the split and the par value per share after the split Outstanding shares after split Par values per share Aggregate Mining Corporation was incorporated five years ago. It is authorized to Issue 550,000 shares of $100 par value 6% preferred stock. It is also authorized to Issue 850,000 shares of $1 par value common stock. It has issued only 40,000 of the common shares and none of the preferred shares. In its seventh year, the corporation has the following transactions Mar. 1 Declares a cash dividend of $5 per share. Mar 30 Pays the cash dividend. Jul. 10 Dectares a property dividend of 1/2 ton of limestone per share when the price of limestone is $25 per ton. Prepare the journal entries to record the transactions. If on amount box does not require an entry, leave it blank. Mar. 1 Retained Earnings Cash Dividends Payable 200,000 200,000 200,000 Mar 30 Cash Dividends Payable Cash 200.000 Jul. 10 Retained Earnings Il Il Property Dividends Payable Question 1:

A

B

Question 2:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started