Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello I need help with this please I need to follow instructions in order to get all points. This is from principals of accounting and

Hello I need help with this please I need to follow instructions in order to get all points. This is from principals of accounting and please post in a picture. It needs to be detailed

Thank you

bellow are some examples of the answers I need, I need to post an answer for both examples as well five sentences at least

EXAMPLE 1 NEED AN ANSWER

EXAMPLE 2 NEED AN ANSWER

THANK YOU

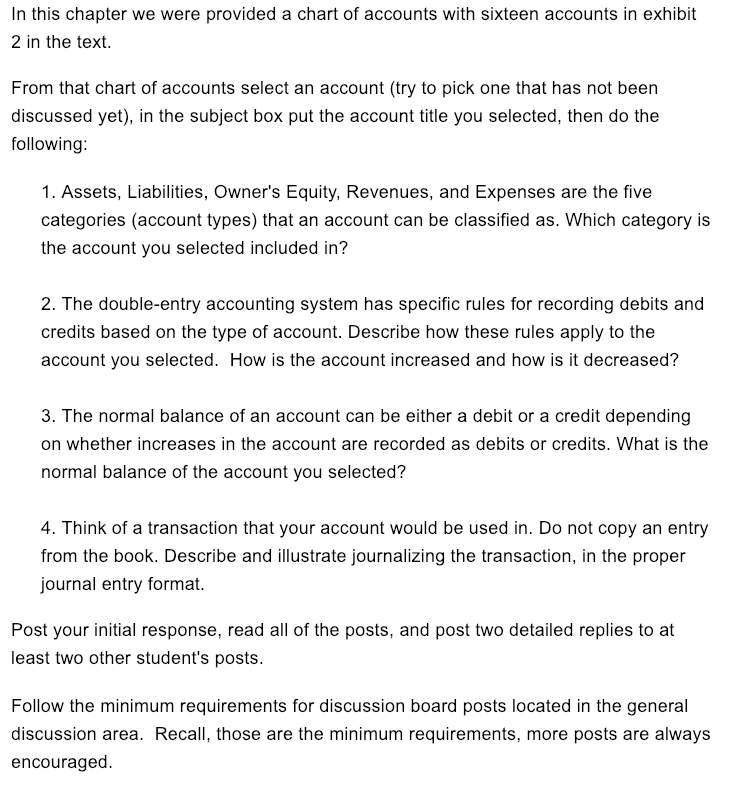

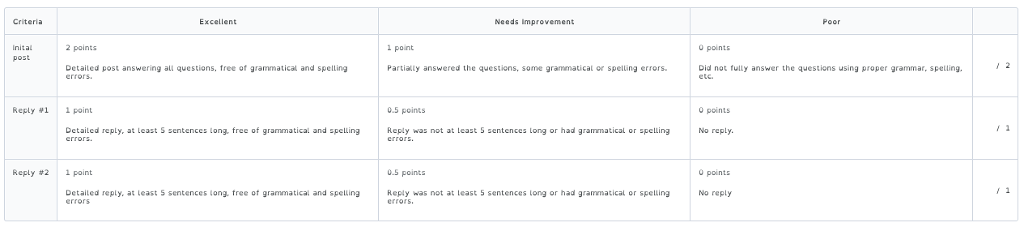

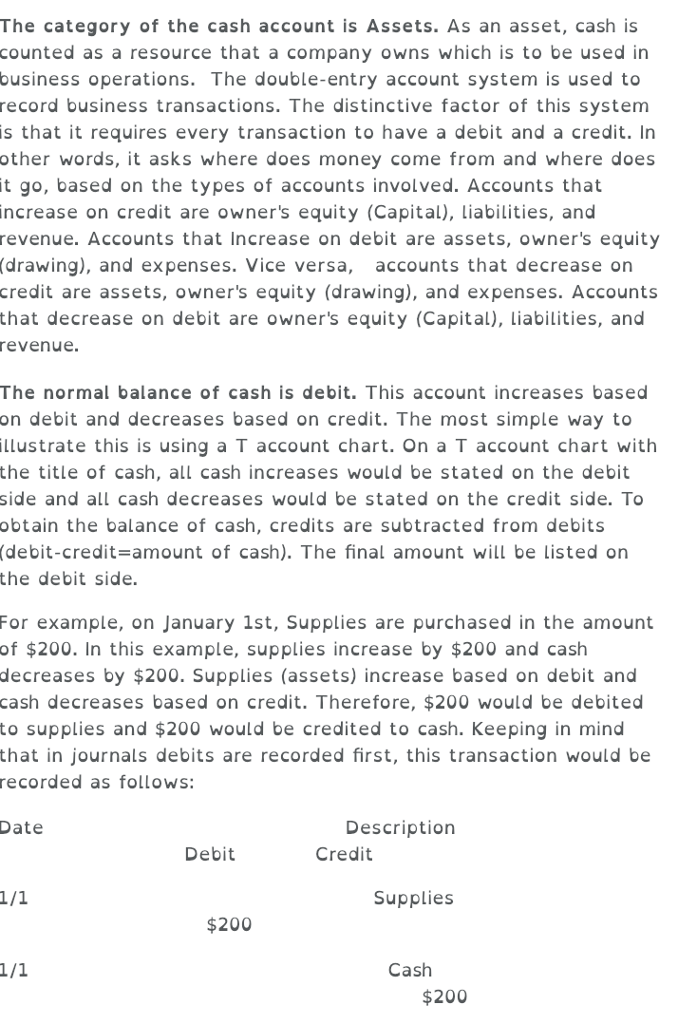

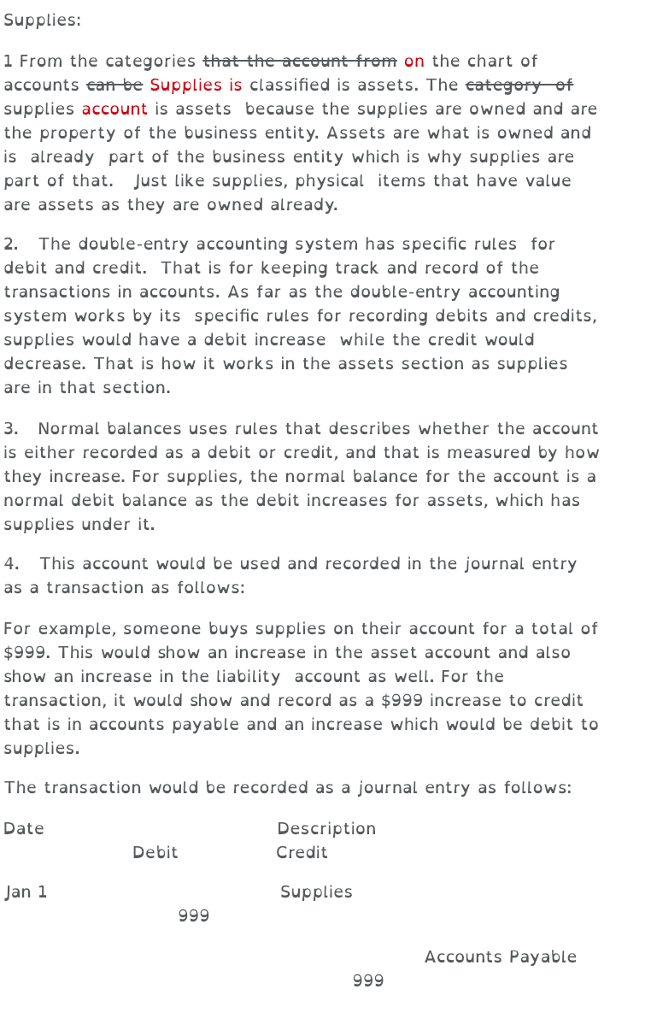

In this chapter we were provided a chart of accounts with sixteen accounts in exhibit 2 in the text From that chart of accounts select an account (try to pick one that has not been discussed yet), in the subject box put the account title you selected, then do the following: 1. Assets, Liabilities, Owner's Equity, Revenues, and Expenses are the five categories (account types) that an account can be classified as. Which category is the account you selected included in? 2. The double-entry accounting system has specific rules for recording debits and credits based on the type of account. Describe how these rules apply to the account you selected. How is the account increased and how is it decreased? 3. The normal balance of an account can be either a debit or a credit depending on whether increases in the account are recorded as debits or credits. What is the normal balance of the account you selected? 4. Think of a transaction that your account would be used in. Do not copy an entry from the book. Describe and illustrate journalizing the transaction, in the proper journal entry format Post your initial response, read all of the posts, and post two detailed replies to at least two other student's posts Follow the minimum requirements for discussion board posts located in the general discussion area. Recall, those are the minimum requirements, more posts are always encouraged Criteria Excellent Needs improvement Poor inital 2 points point points Detailed post answering a questions, free of grammatical and spelling Partialty answered the questions, some grammatical or spelling errors ions, some grammatica Did not fully answer the questions using proper grammar, spelling. Reply 1 1 point .5 points points Detailed reply. at least S sentences long free of grammatical and spelling | Reply was not at least 5 sentences long or had grammaticalspclng No reply. Reply #2 1 point .5 pointa points Detailed reply, at least s sentences tong. tree of grammatical and spelling Reply was not at least 5 sentences tong or had grammatical or spelling No reply The category of the cash account is Assets. As an asset, cash is counted as a resource that a company owns which is to be used in business operations. The double-entry account system is used to record business transactions. The distinctive factor of this system is that it requires every transaction to have a debit and a credit. In other words, it asks where does money come from and where does it go, based on the types of accounts involved. Accounts that increase on credit are owner's equity (Capital), Liabilities, and revenue. Accounts that Increase on debit are assets, owner's equity (drawing), and expenses. Vice versa, accounts that decrease on credit are assets, owner's equity (drawing), and expenses. Accounts that decrease on debit are owner's equity (Capital), Liabilities, and evenue. The normal balance of cash is debit. This account increases based on debit and decreases based on credit. The most simple way to llustrate this is using a T account chart. On a T account chart with the title of cash, all cash increases would be stated on the debit side and all cash decreases would be stated on the credit side. To obtain the balance of cash, credits are subtracted from debits (debit-credit-amount of cash). The final amount will be Listed on the debit side. For example, on January 1st, Supplies are purchased in the amount of $200. In this example, supplies increase by $200 and cash decreases by $200. Supplies (assets) increase based on debit and cash decreases based on credit. Therefore, $200 would be debited to supplies and $200 would be credited to cash. Keeping in mind that in journals debits are recorded first, this transaction would be recorded as follows Description Credit Date Debit Supplies $200 Cash $200 Supplies: 1 From the categories that the aeeeut frem on the chart of accounts ean ee supplies is classified is assets. The eategef supplies account is assets because the supplies are owned and are the property of the business entity. Assets are what is owned and is already part of the business entity which is why supplies are part of that. Just like supplies, physical items that have value are assets as they are owned already. 2. The double-entry accounting system has specific rules for debit and credit. That is for keeping track and record of the transactions in accounts. As far as the double-entry accounting system works by its specific rules for recording debits and credits, supplies would have a debit increase while the credit would decrease. That is how it works in the assets section as supplies are in that section. 3. Normal balances uses rules that describes whether the account is either recorded as a debit or credit, and that is measured by how they increase. For supplies, the normal balance for the account is a normal debit balance as the debit increases for assets, which has supplies under it. 4. This account would be used and recorded in the journal entry as a transaction as follows For example, someone buys supplies on their account for a total of $999. This would show an increase in the asset account and also show an increase in the Liability account as well. For the transaction, it would show and record as a $999 increase to credit that is in accounts payable and an increase which would be debit to supplies The transaction would be recorded as a journal entry as follows: Date Description Credit Debit Jan 1 Supplies Accounts Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started