Hello i need help with this questions please.

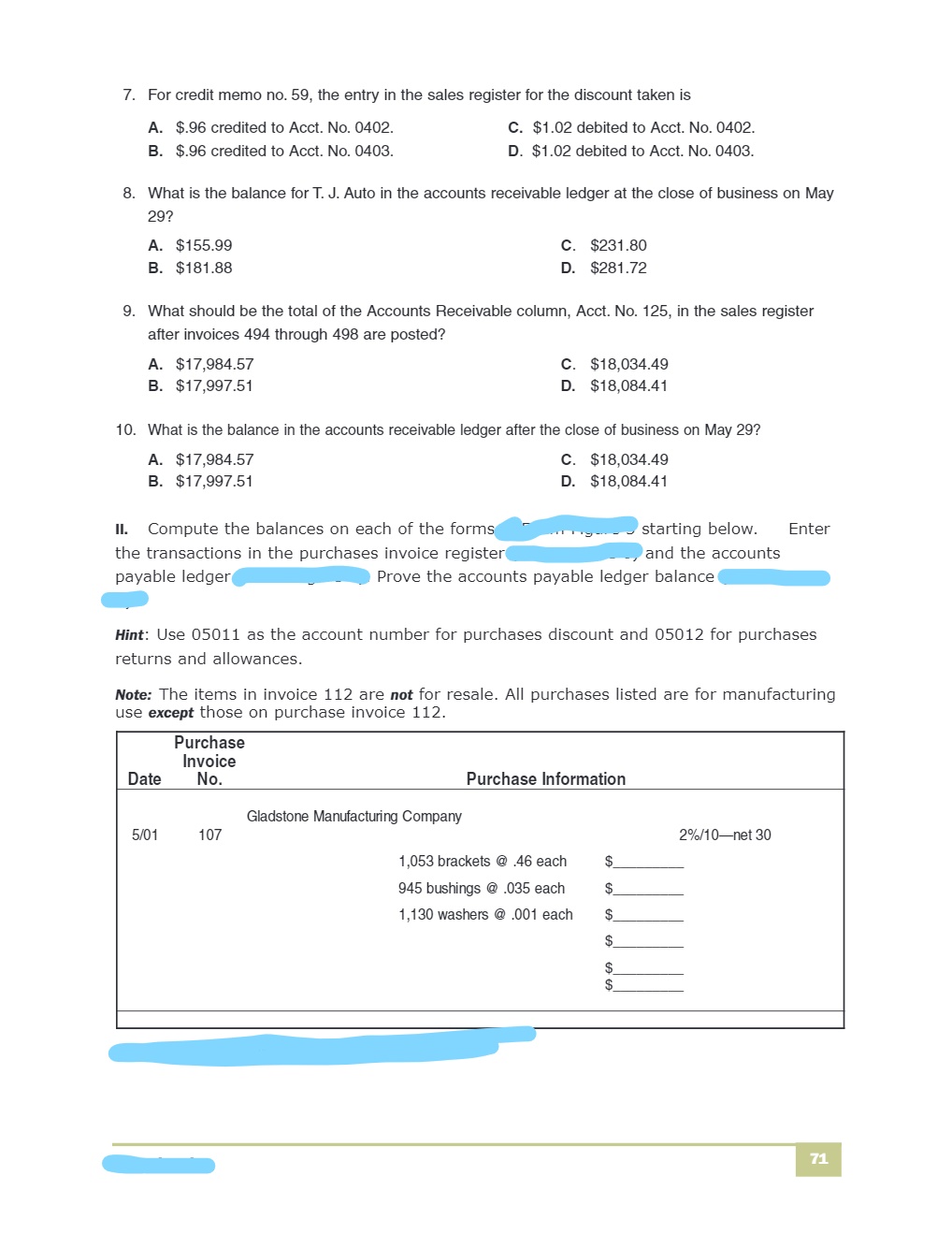

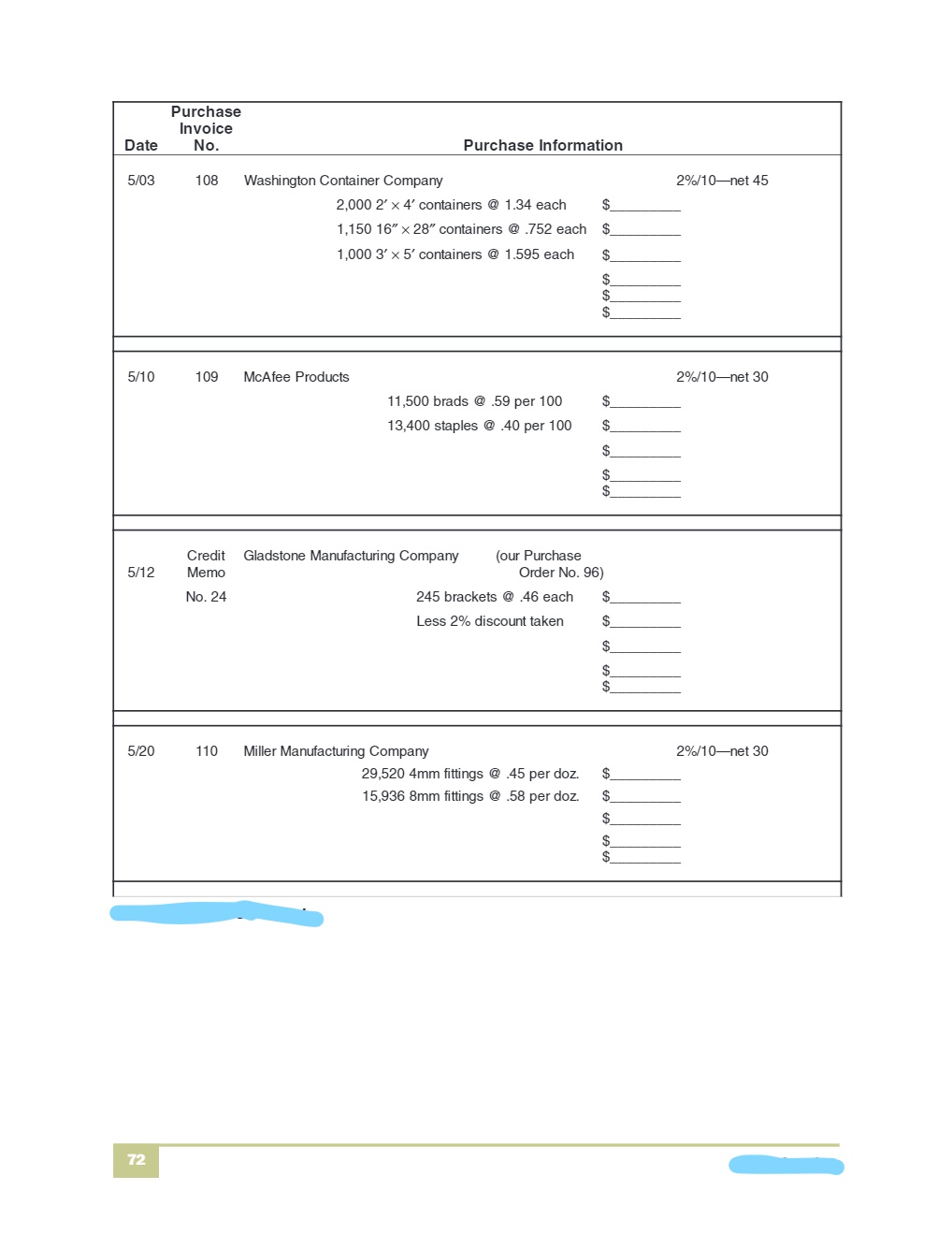

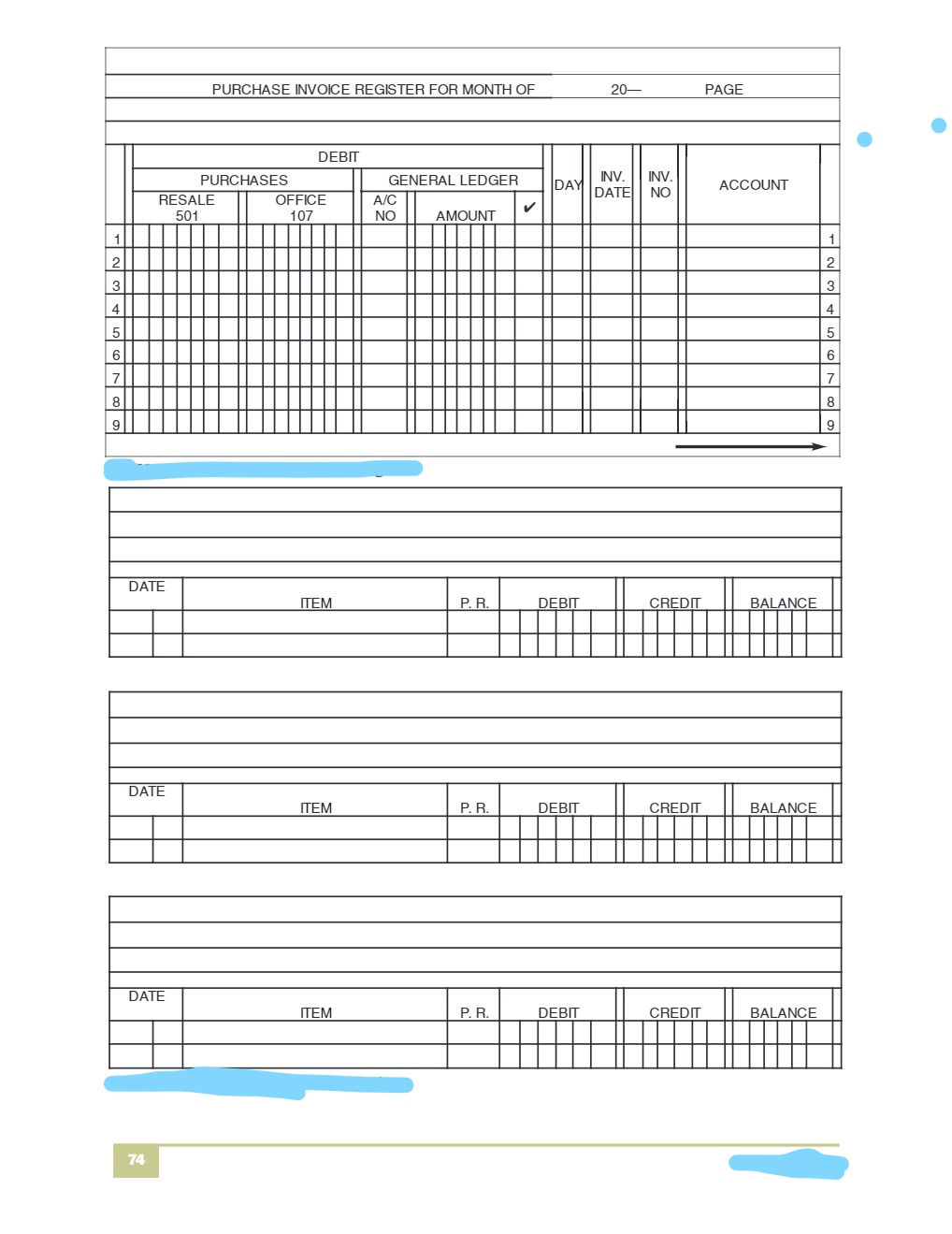

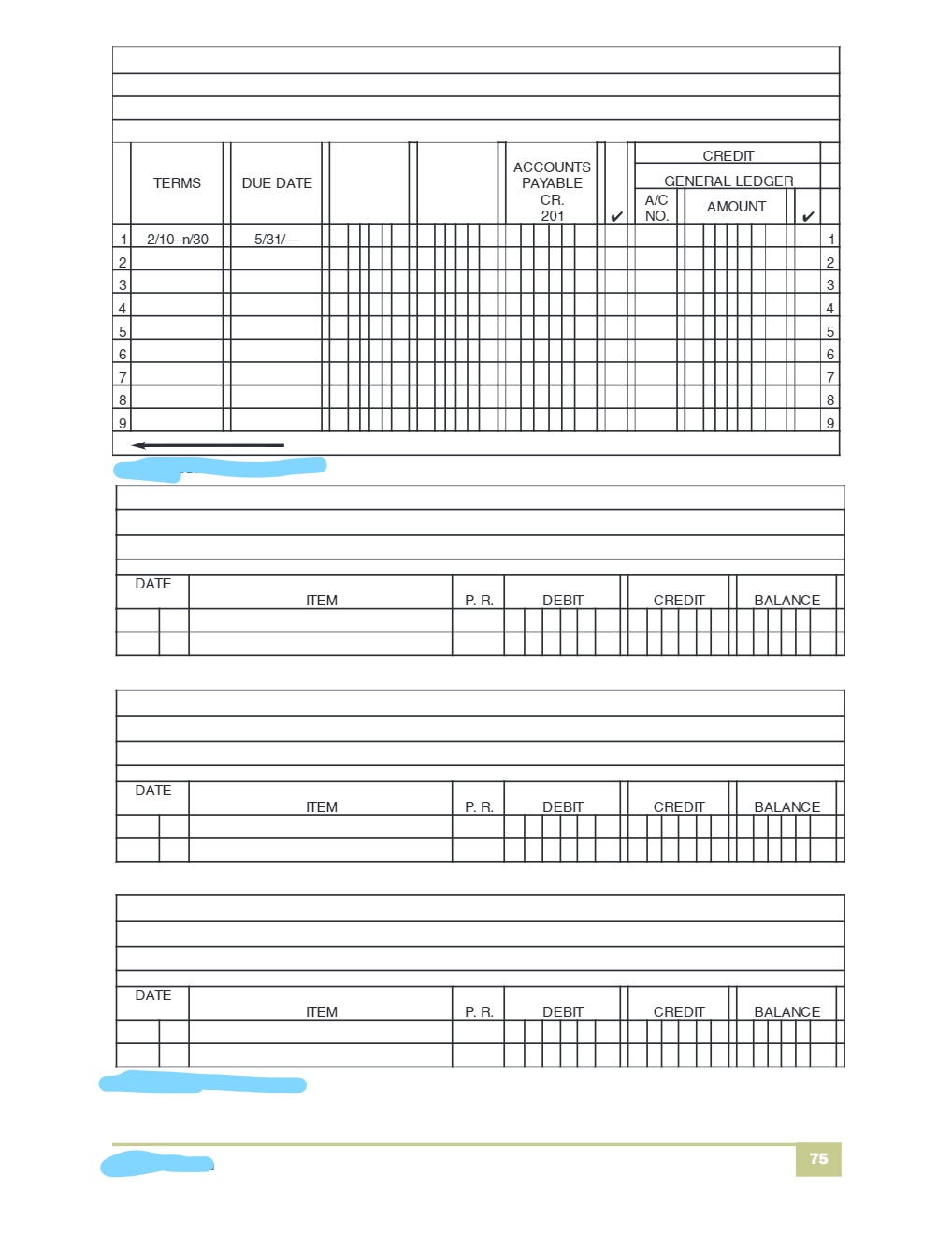

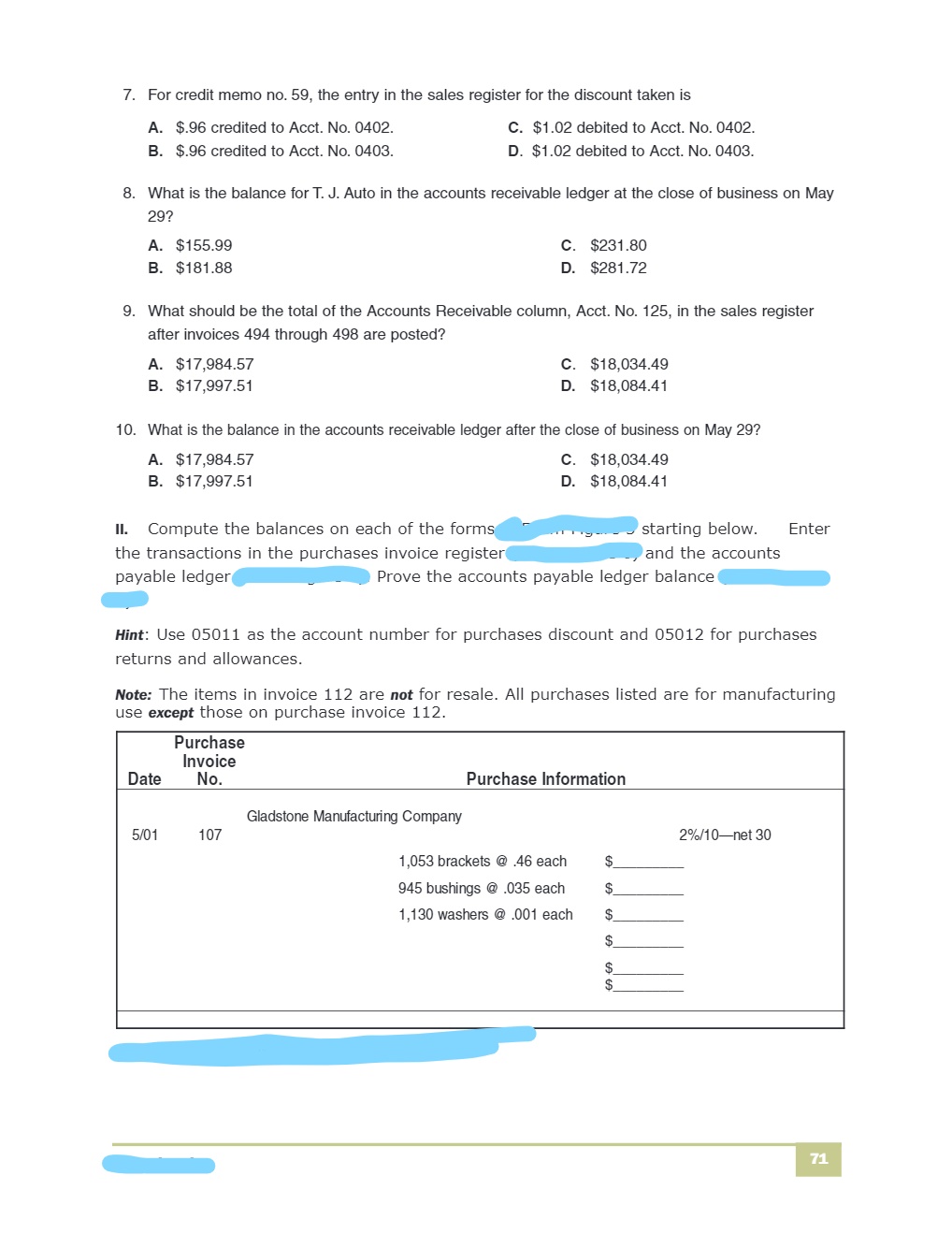

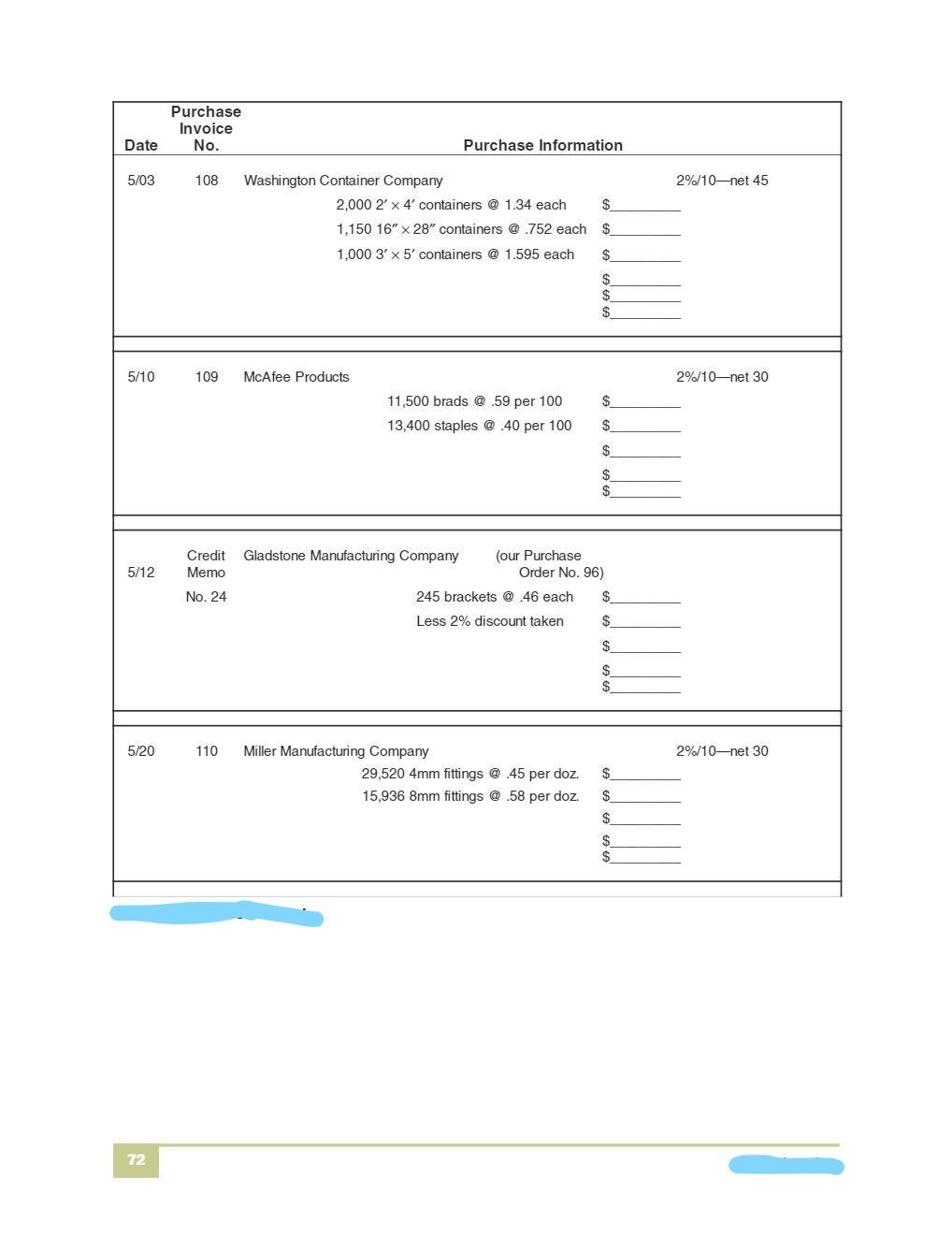

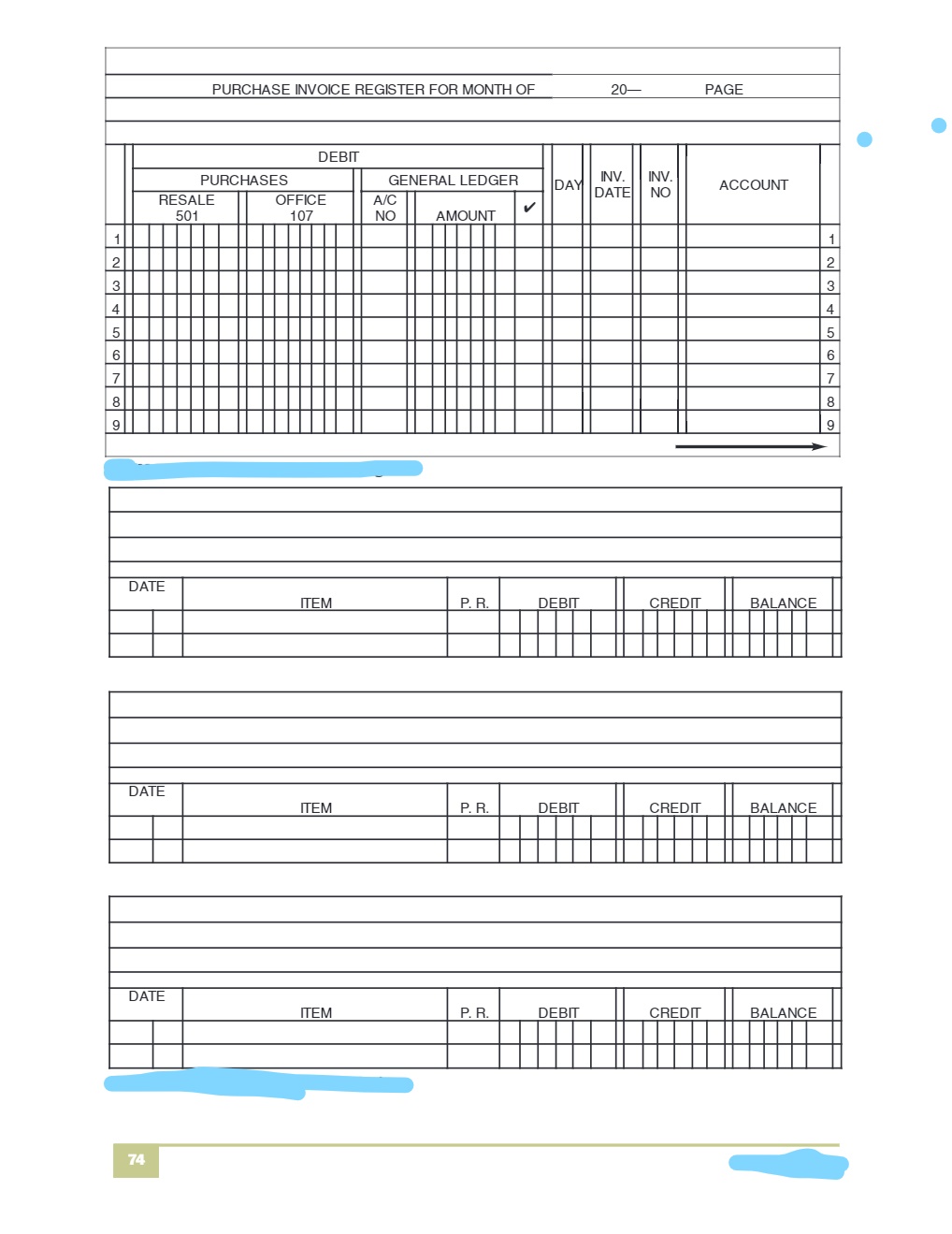

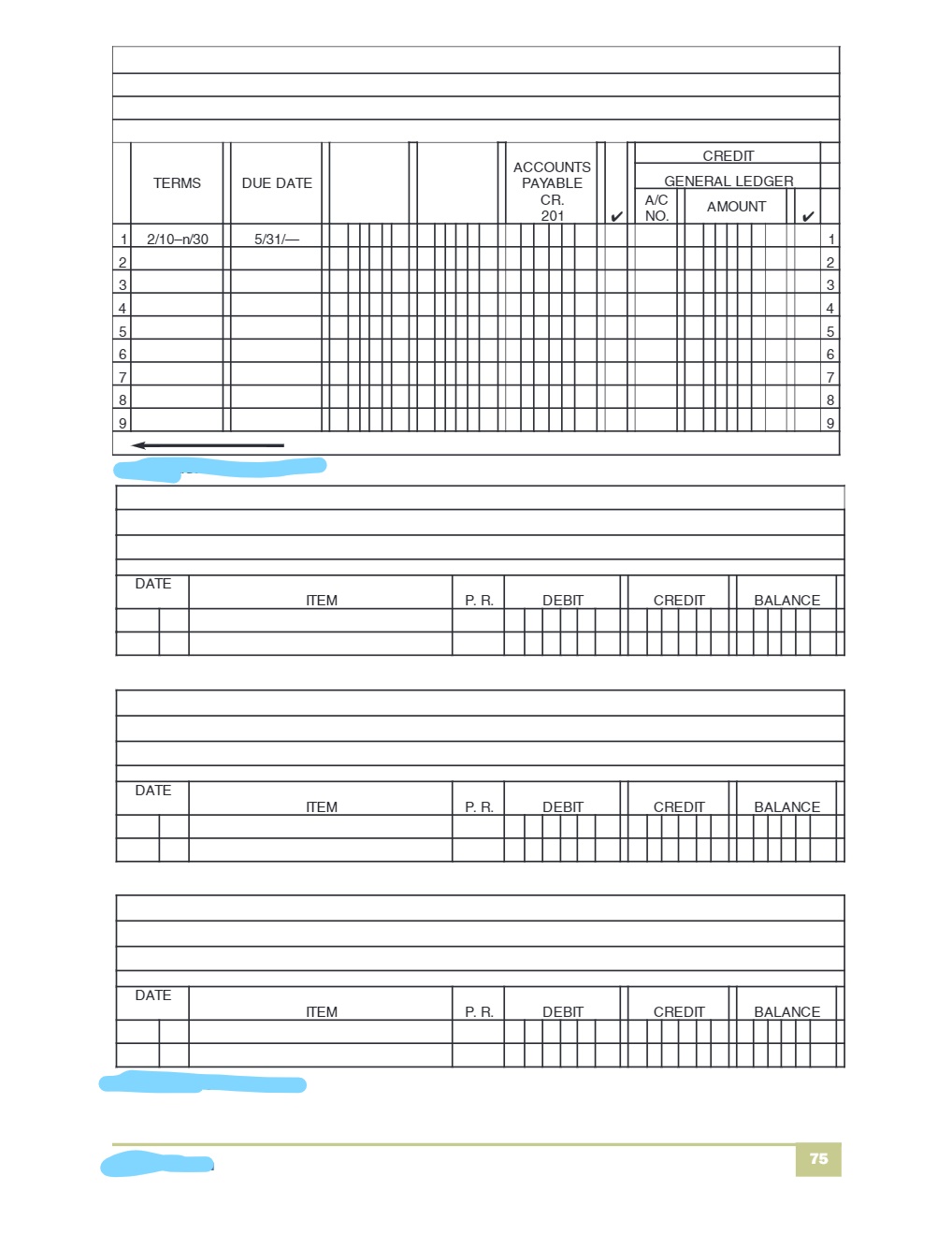

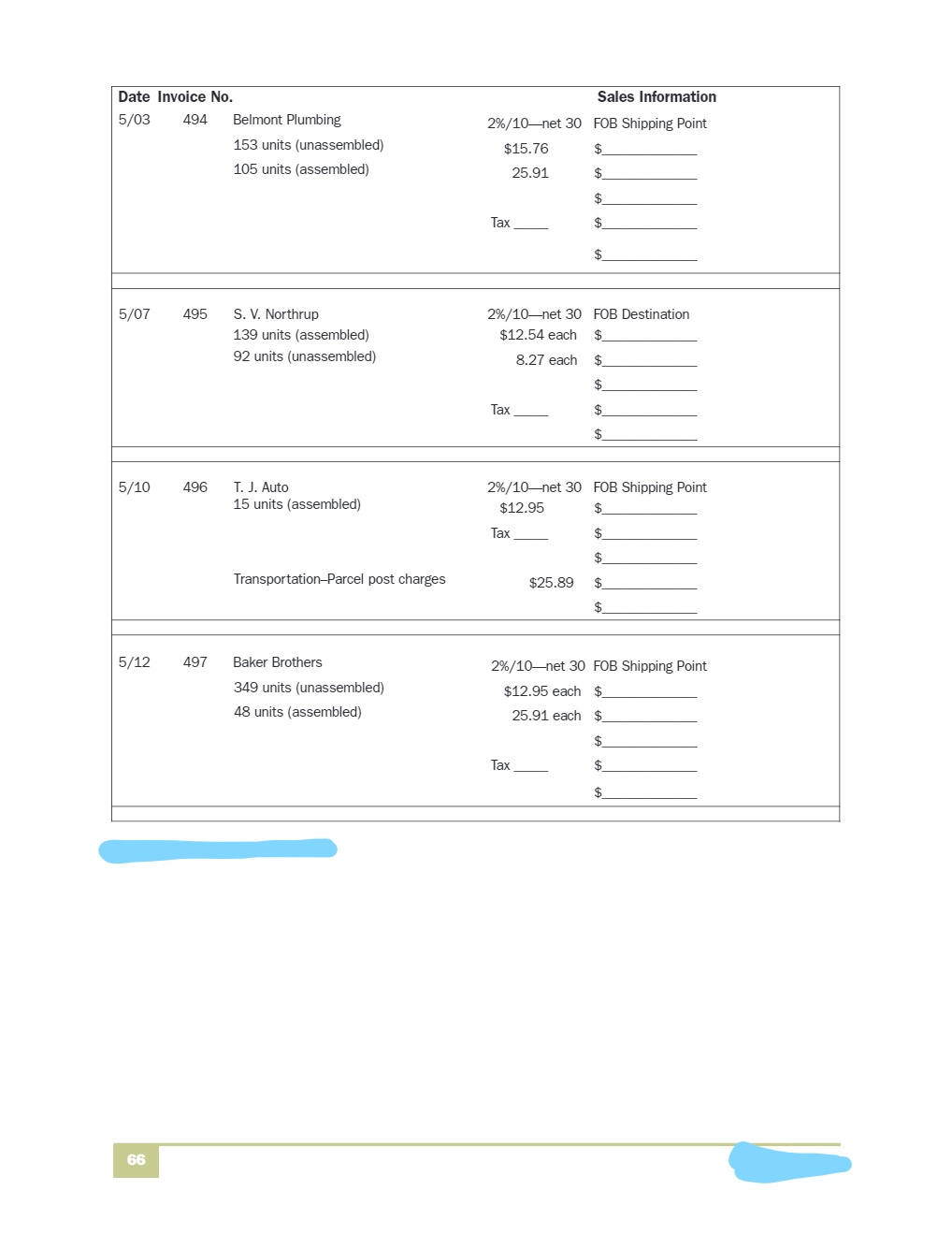

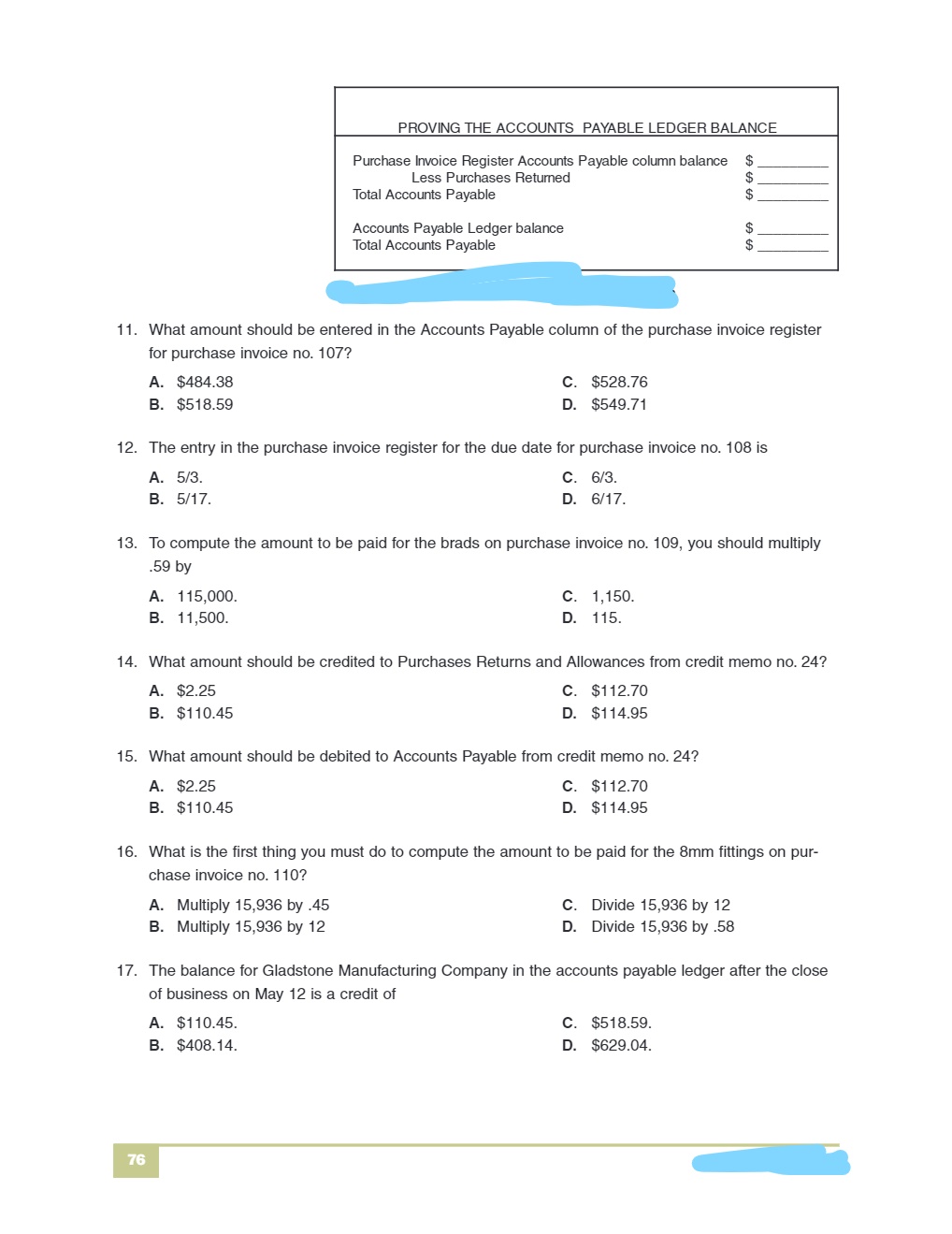

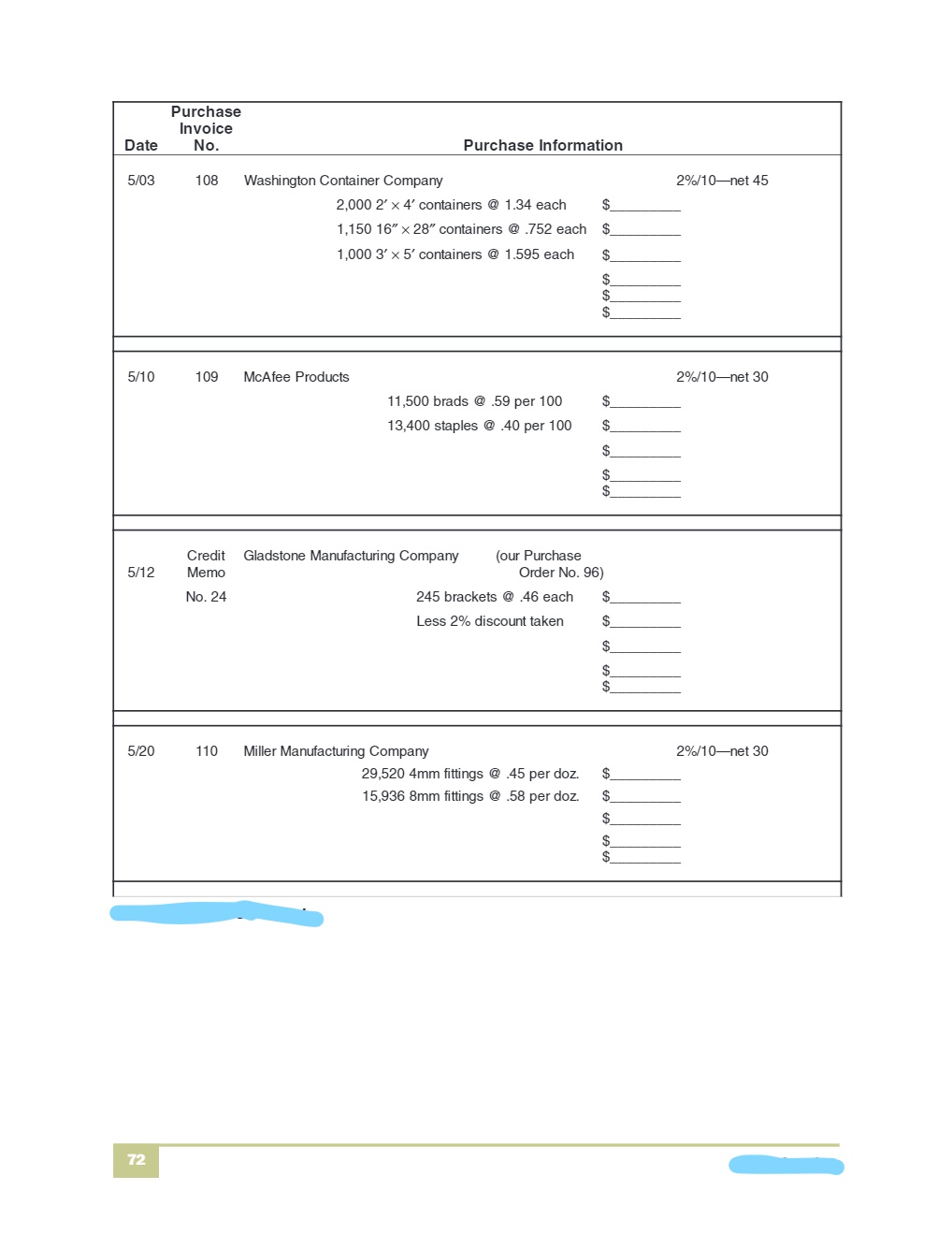

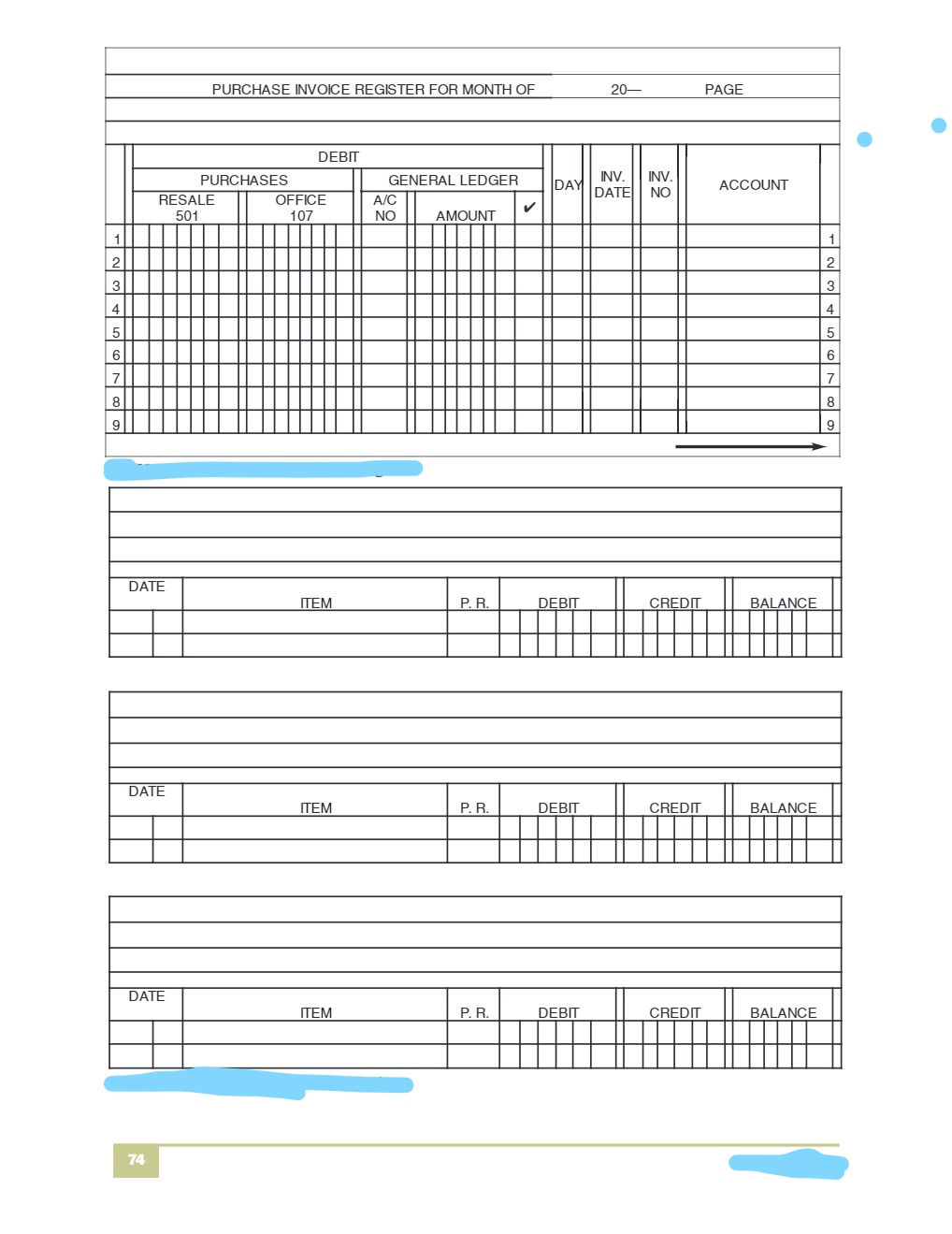

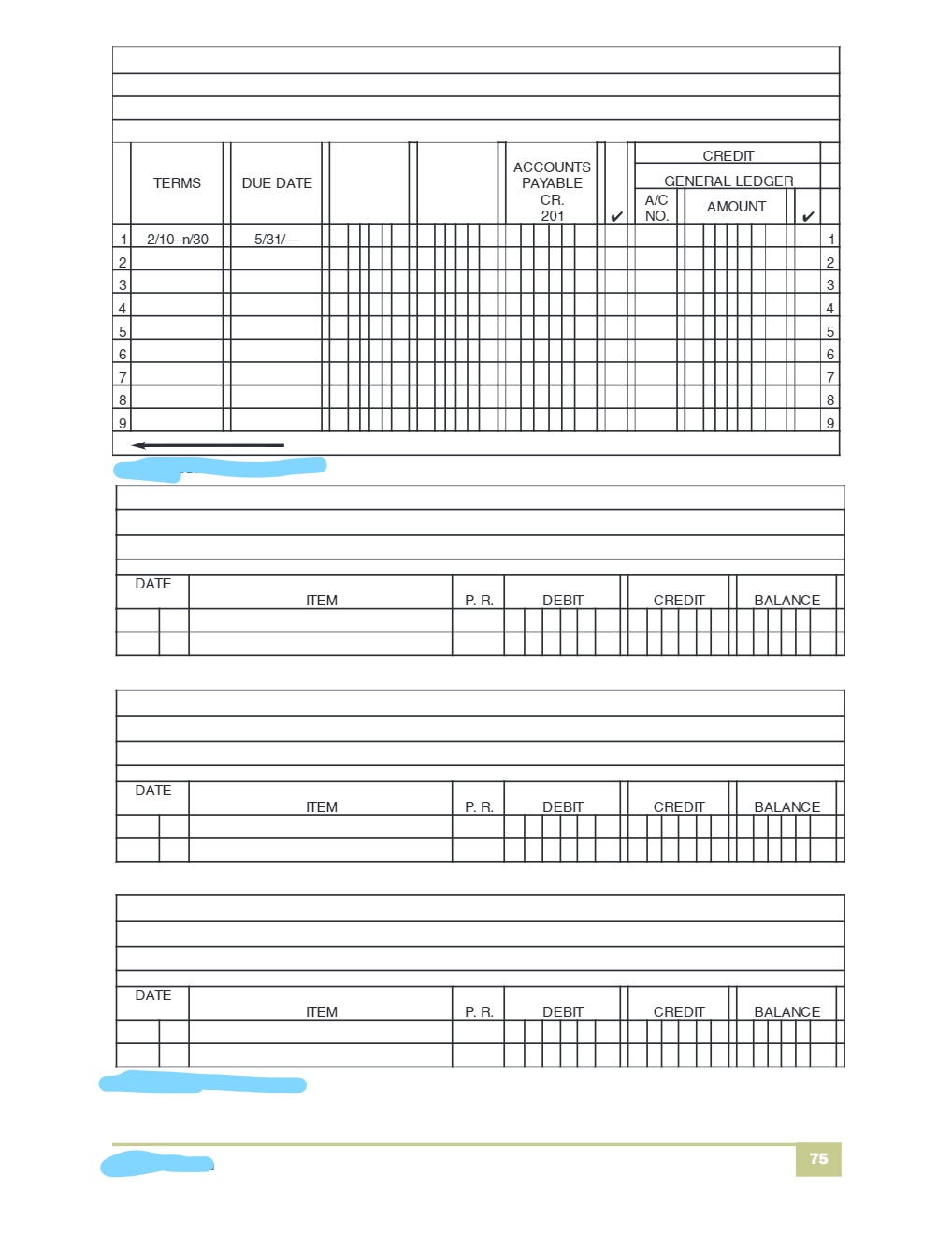

Compute the balances on each of the forms starting below. Enter the transactions in the purchases invoice register and the accounts payable ledger. Prove the accounts payable ledger balance. Use 05011 as the account number for purchases discount and 05012 for purchases returns and allowances. The items in invoice 112 are not for resale. All purchases listed are for manufacturing use except those on purchase invoice 112

Please give me 100 percent correct answer without making mistakes. And please check the work once submitted to me. And also please give me step by step solution. for example like adding, subtracting, dividing and multiplying. What to add, what to multiply stuff like that.

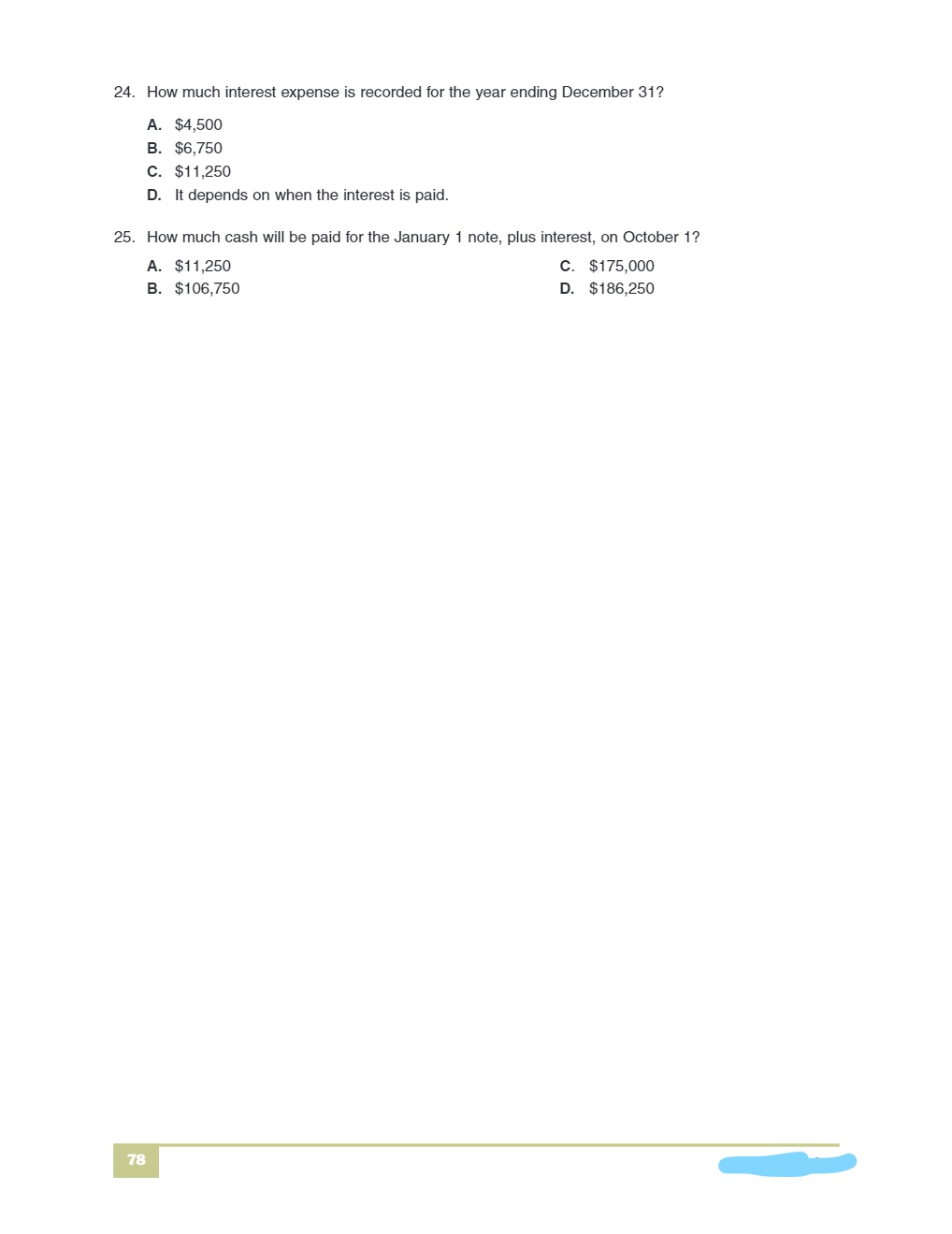

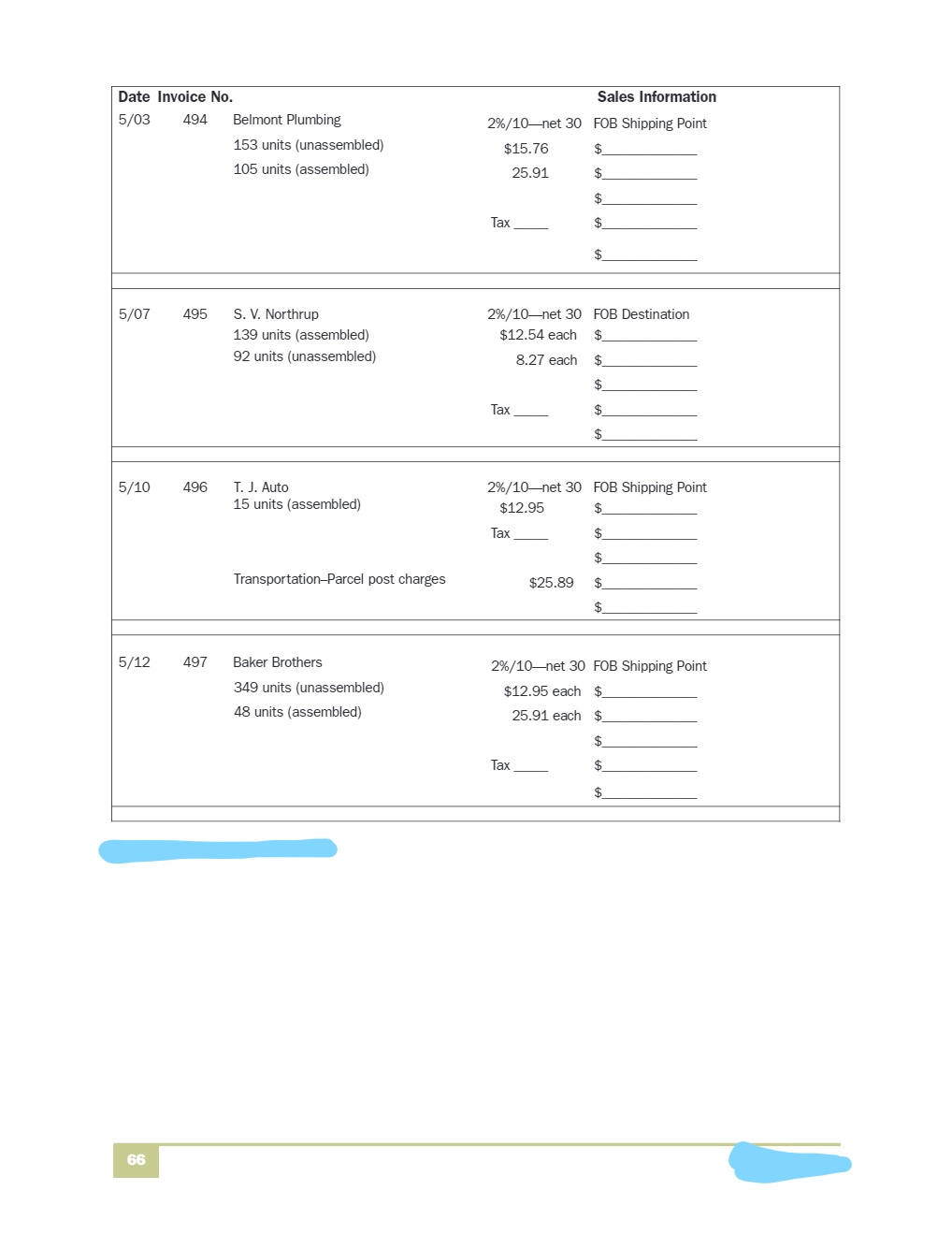

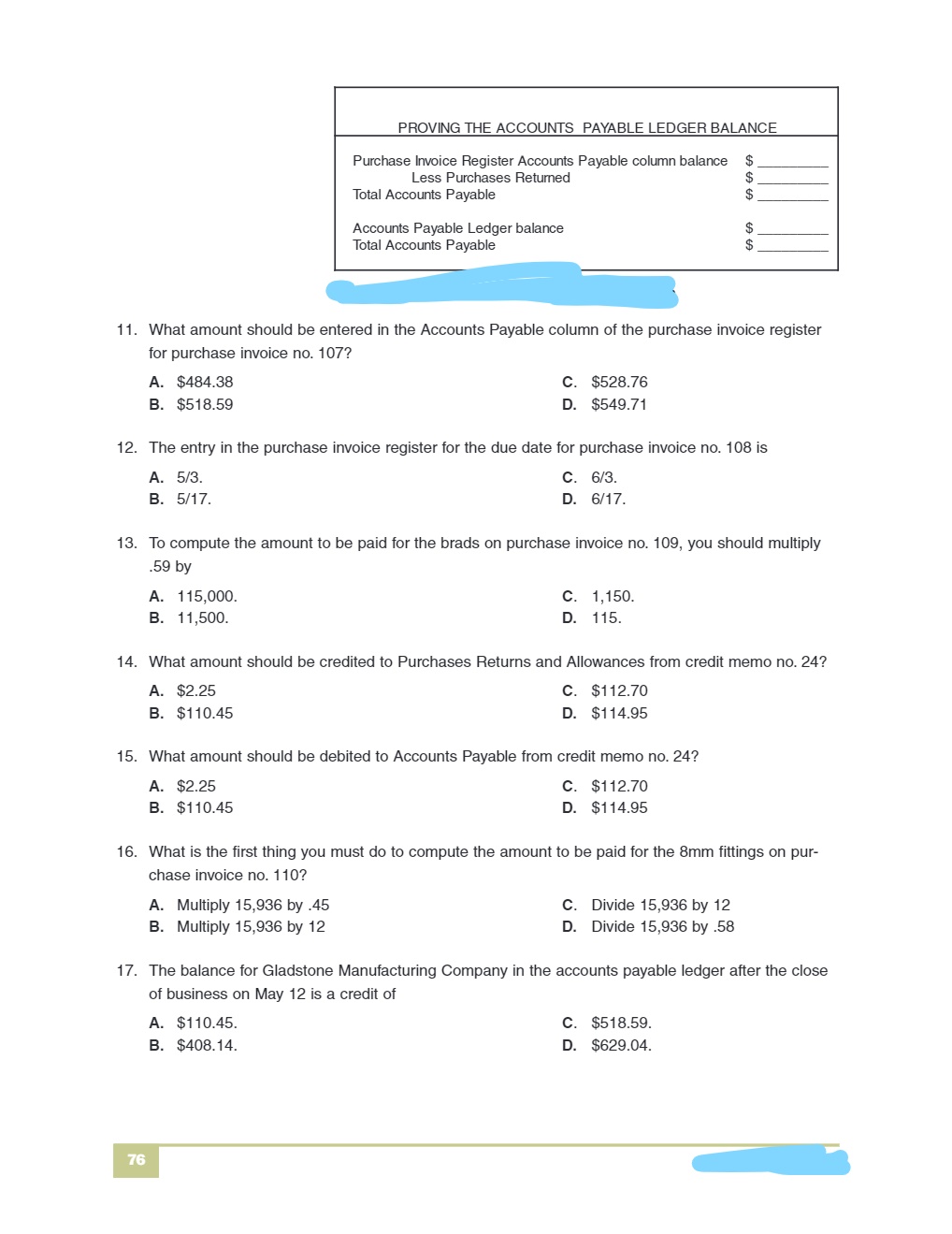

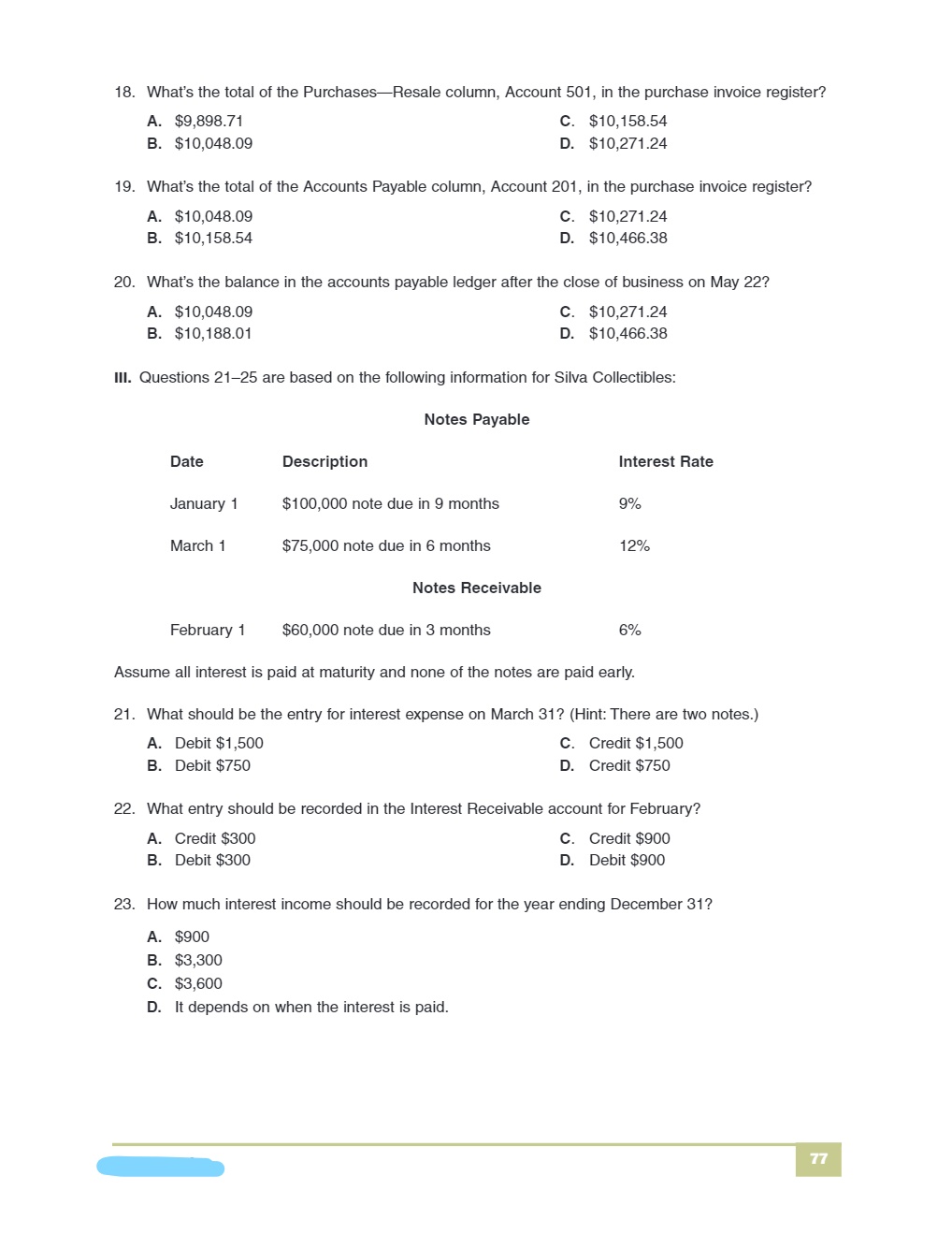

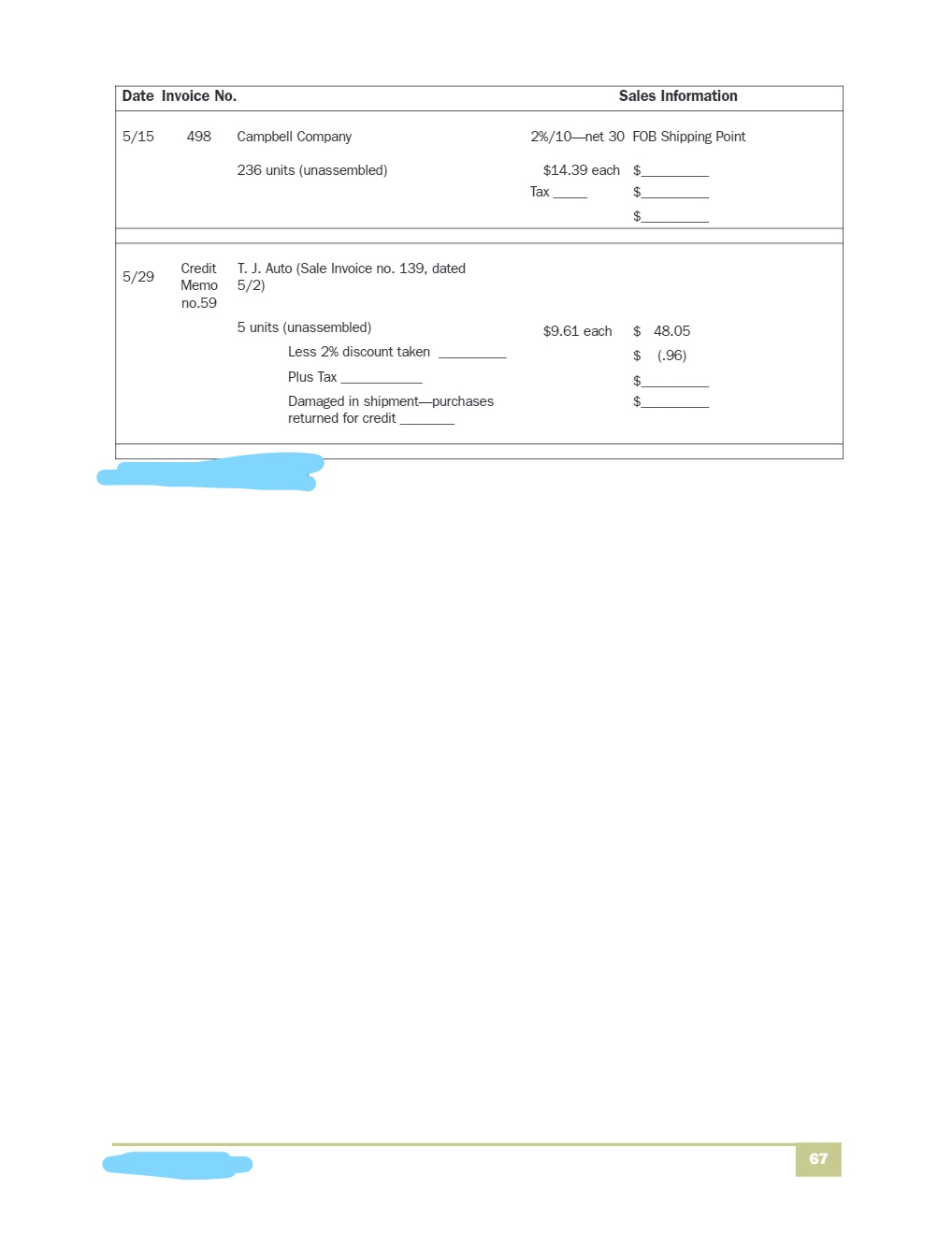

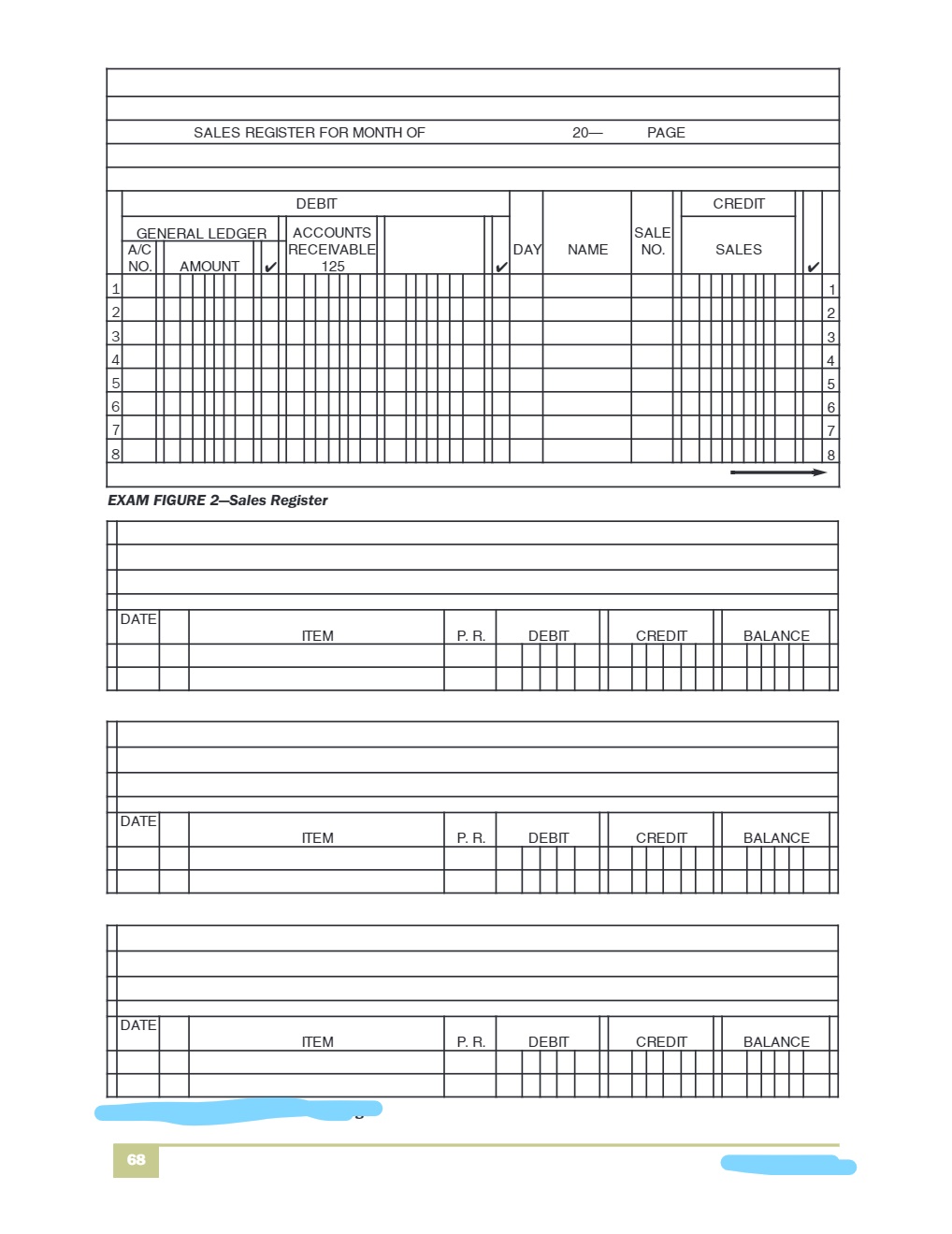

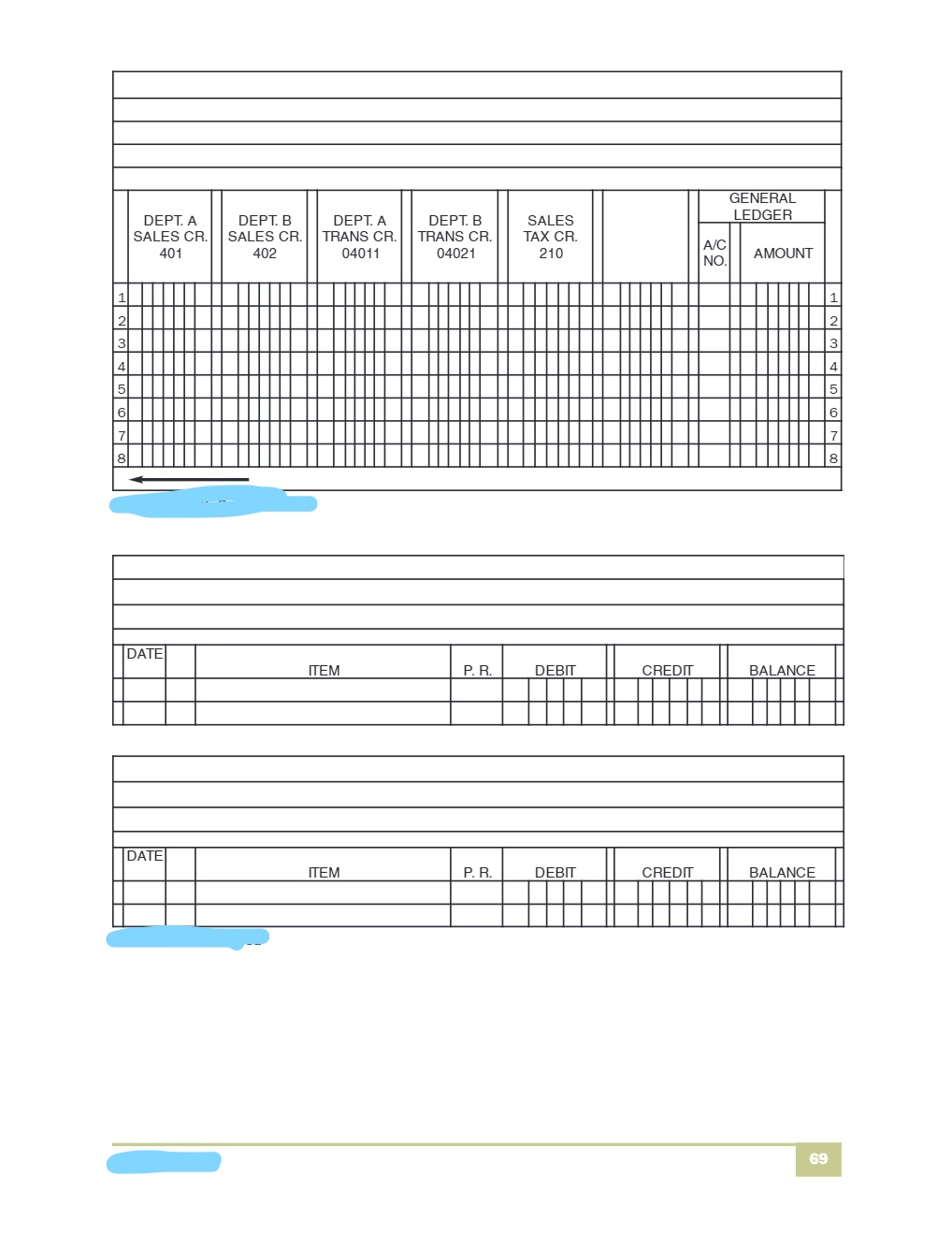

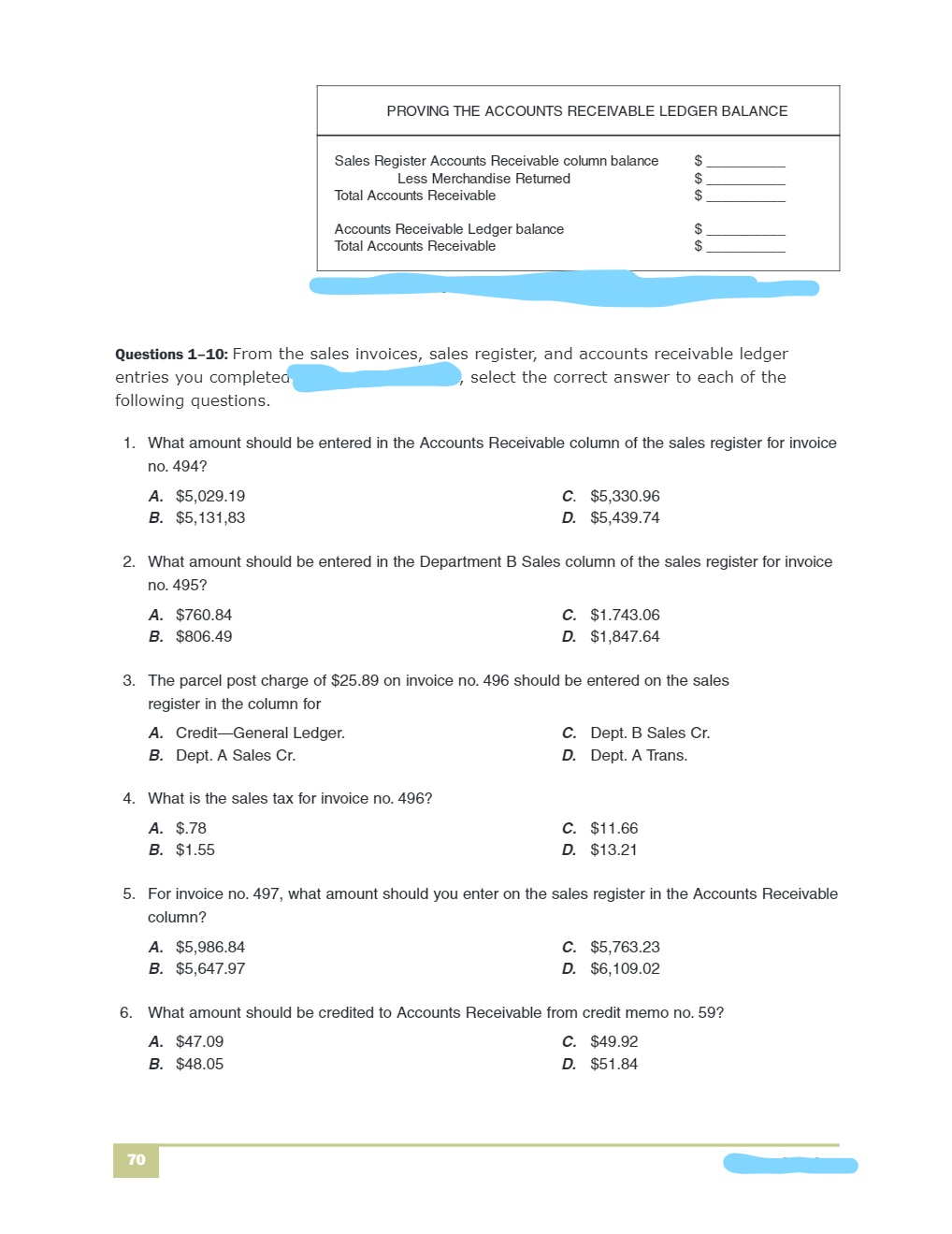

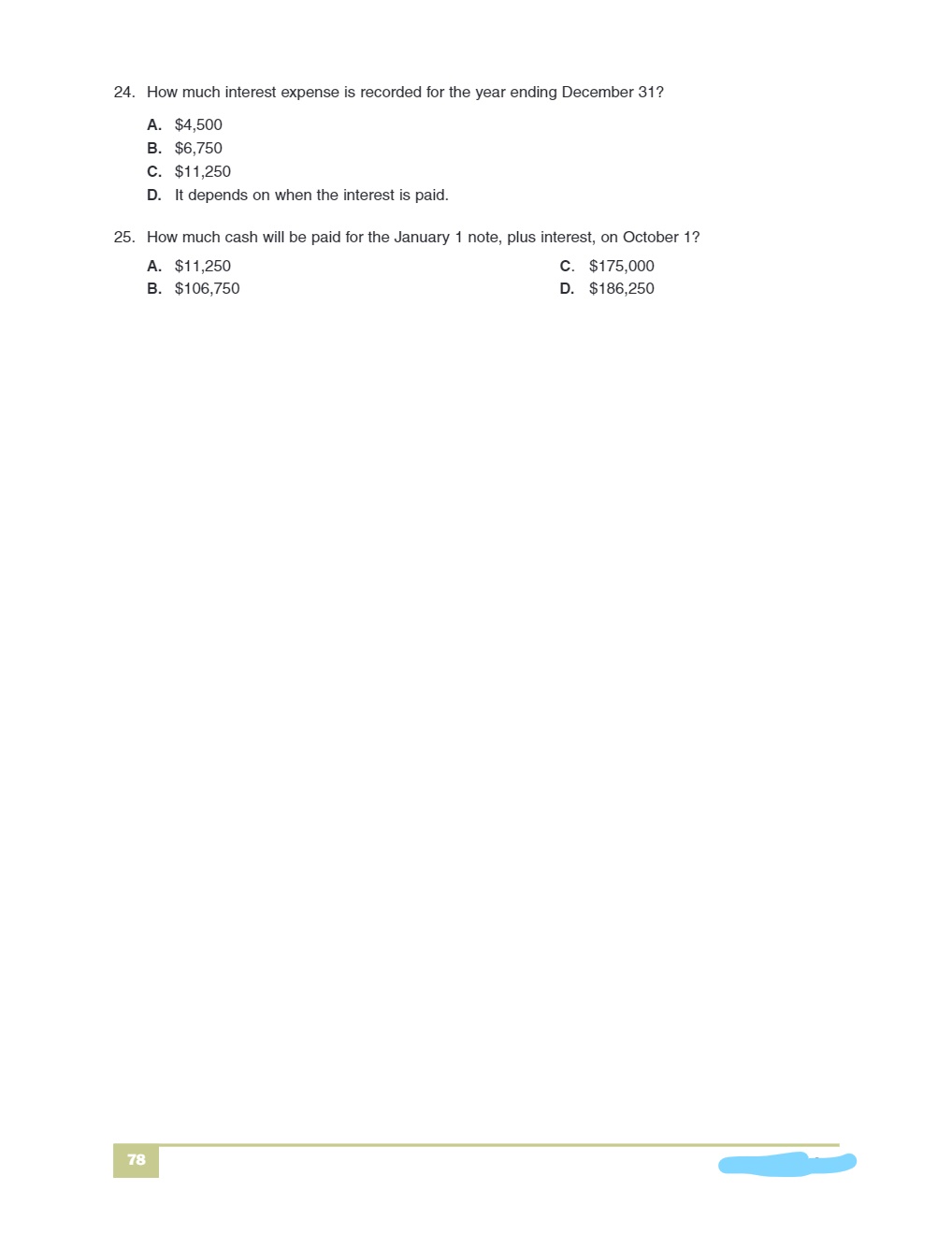

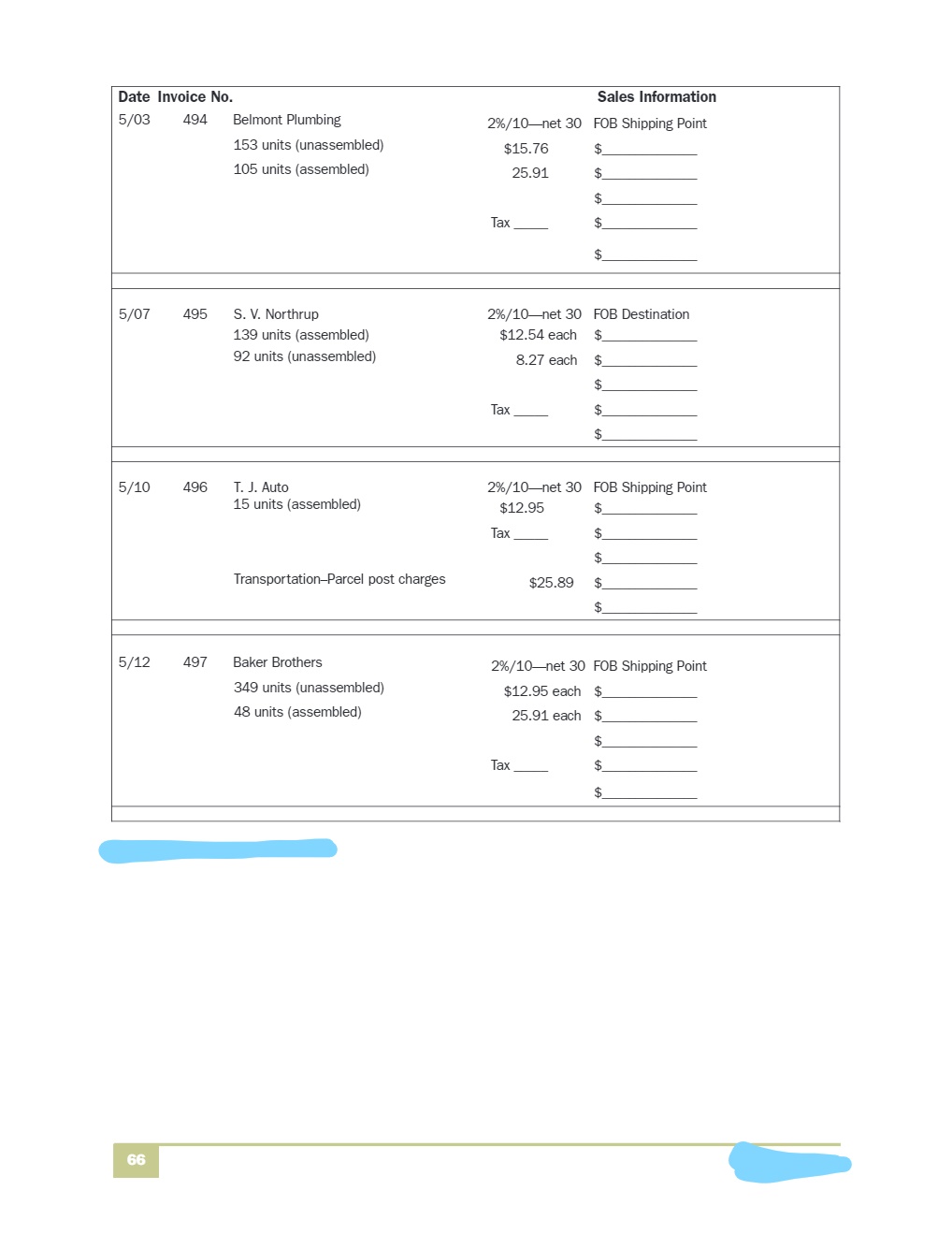

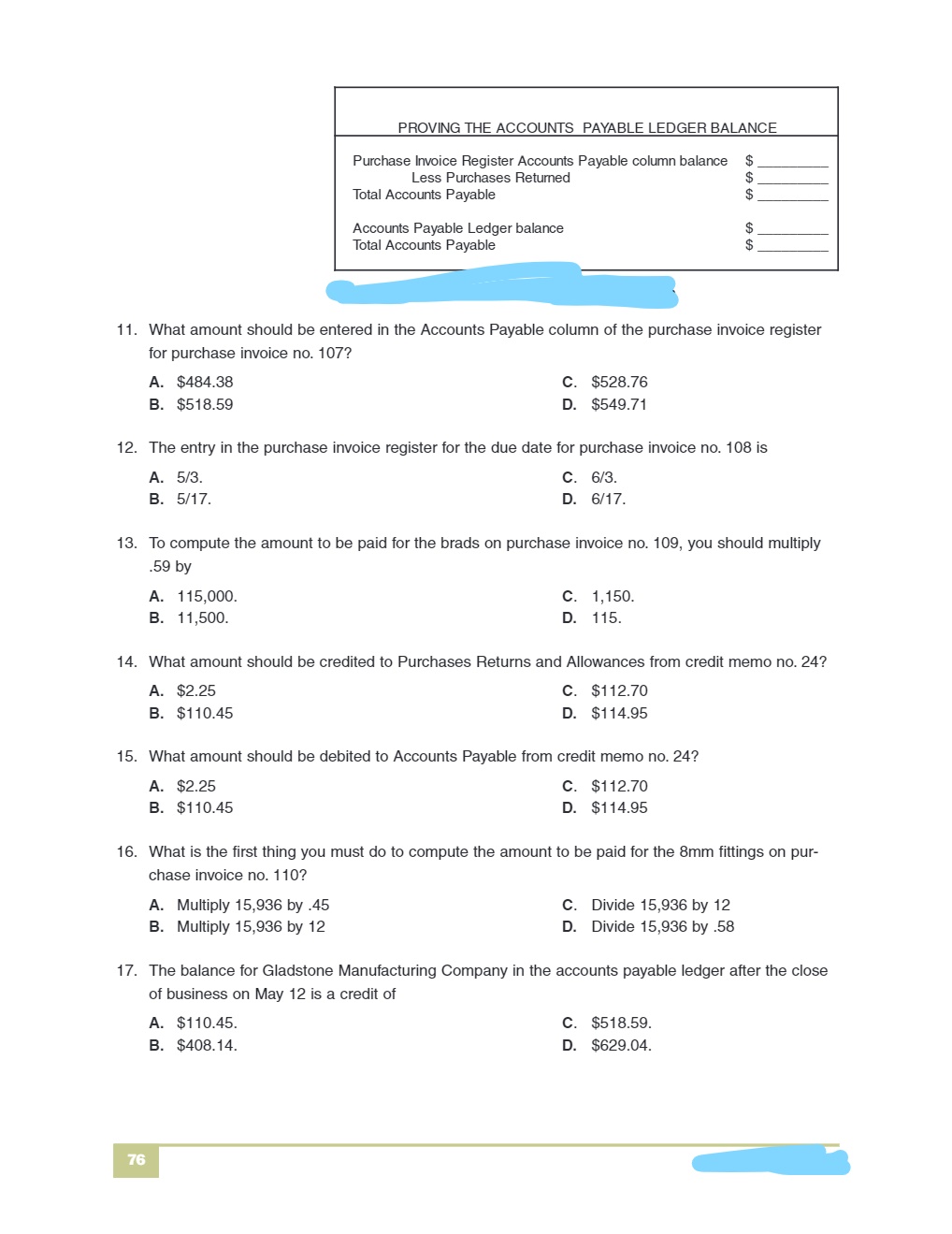

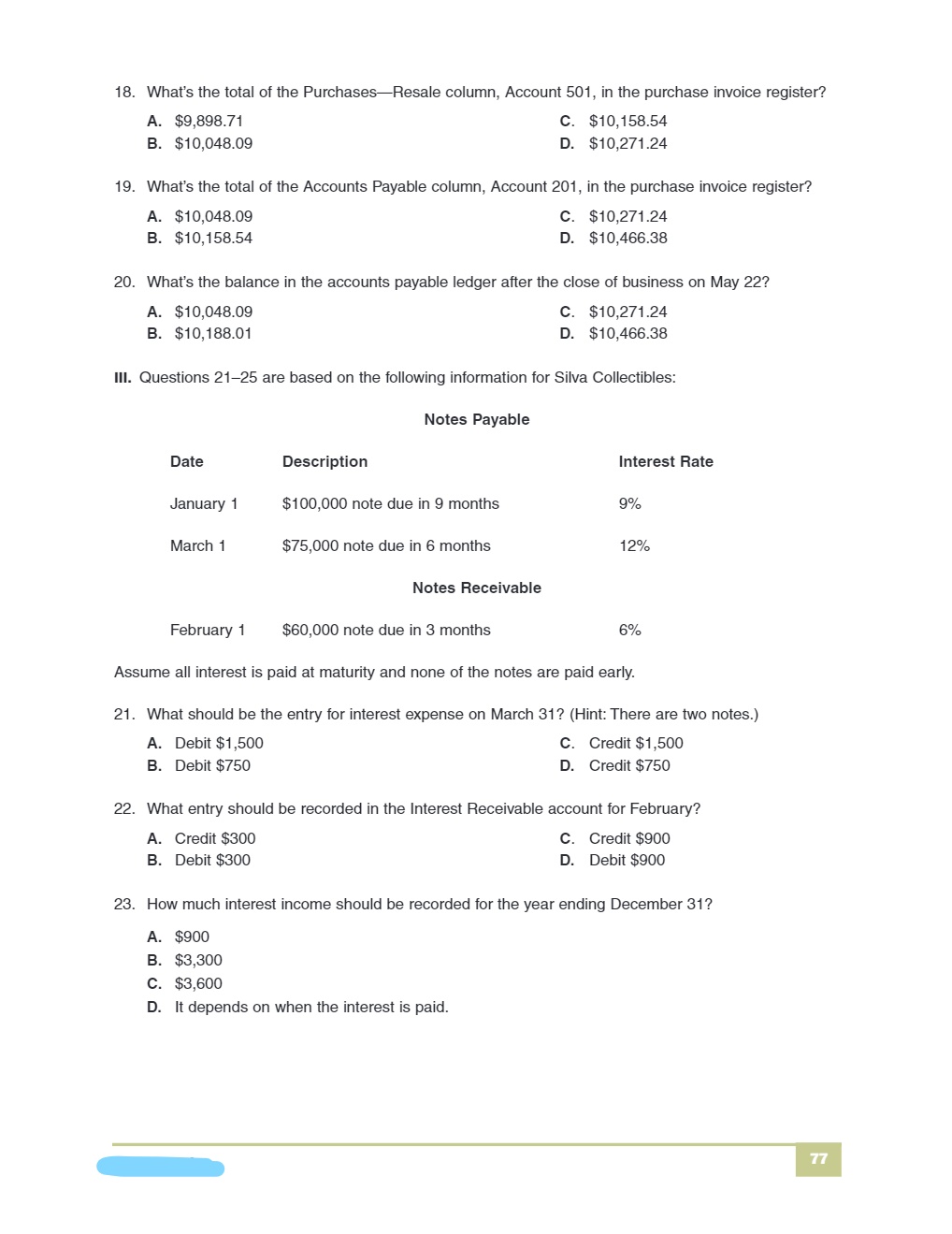

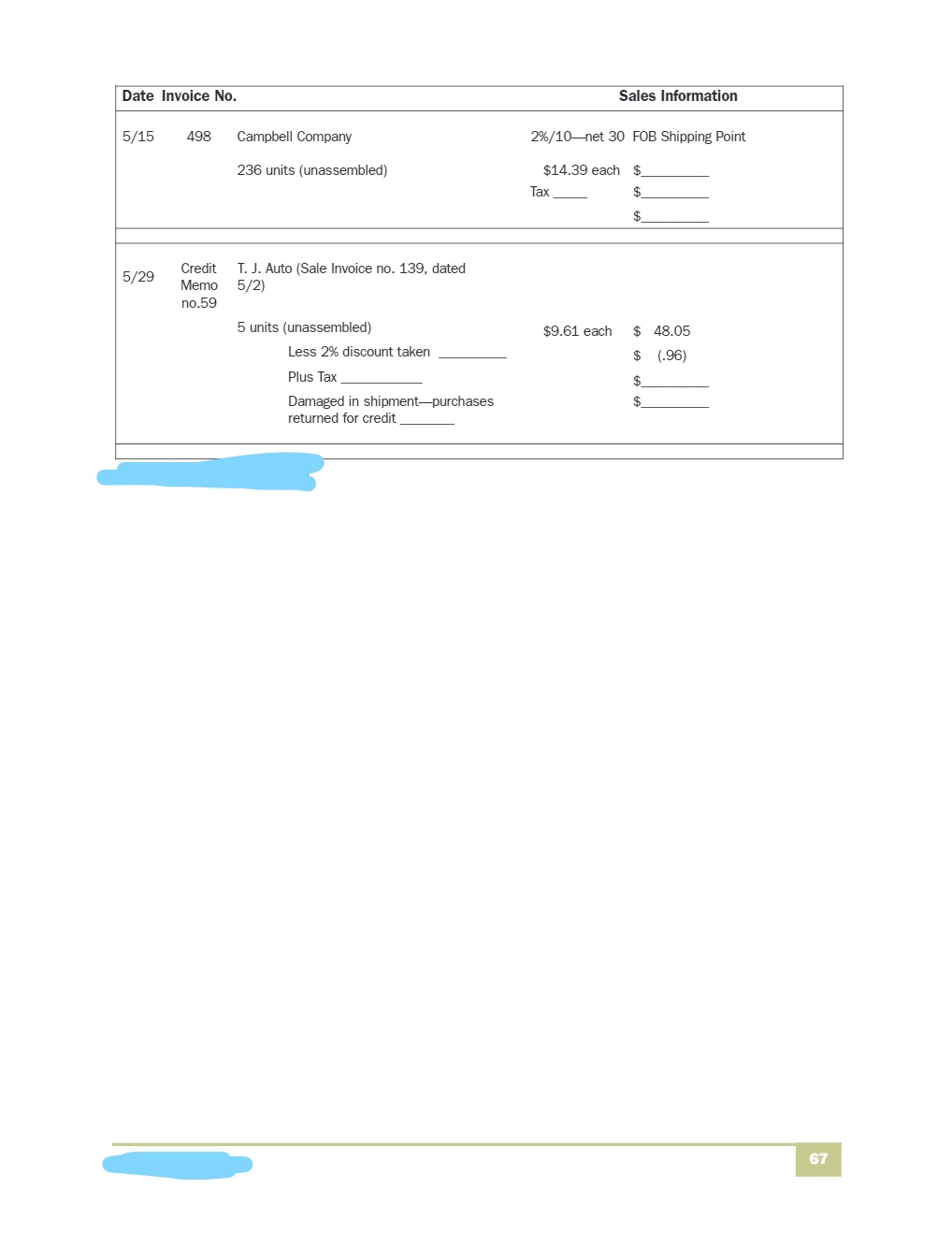

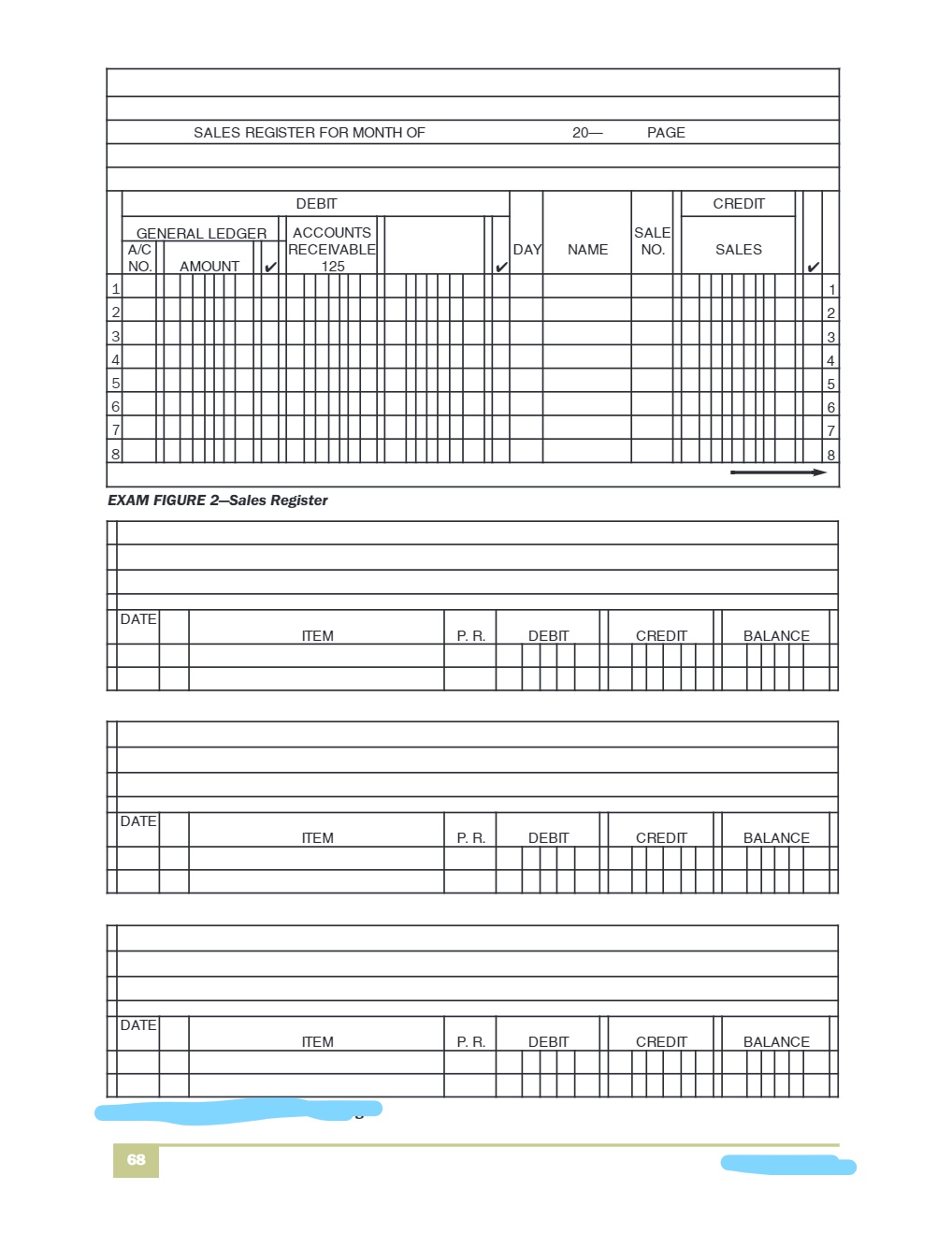

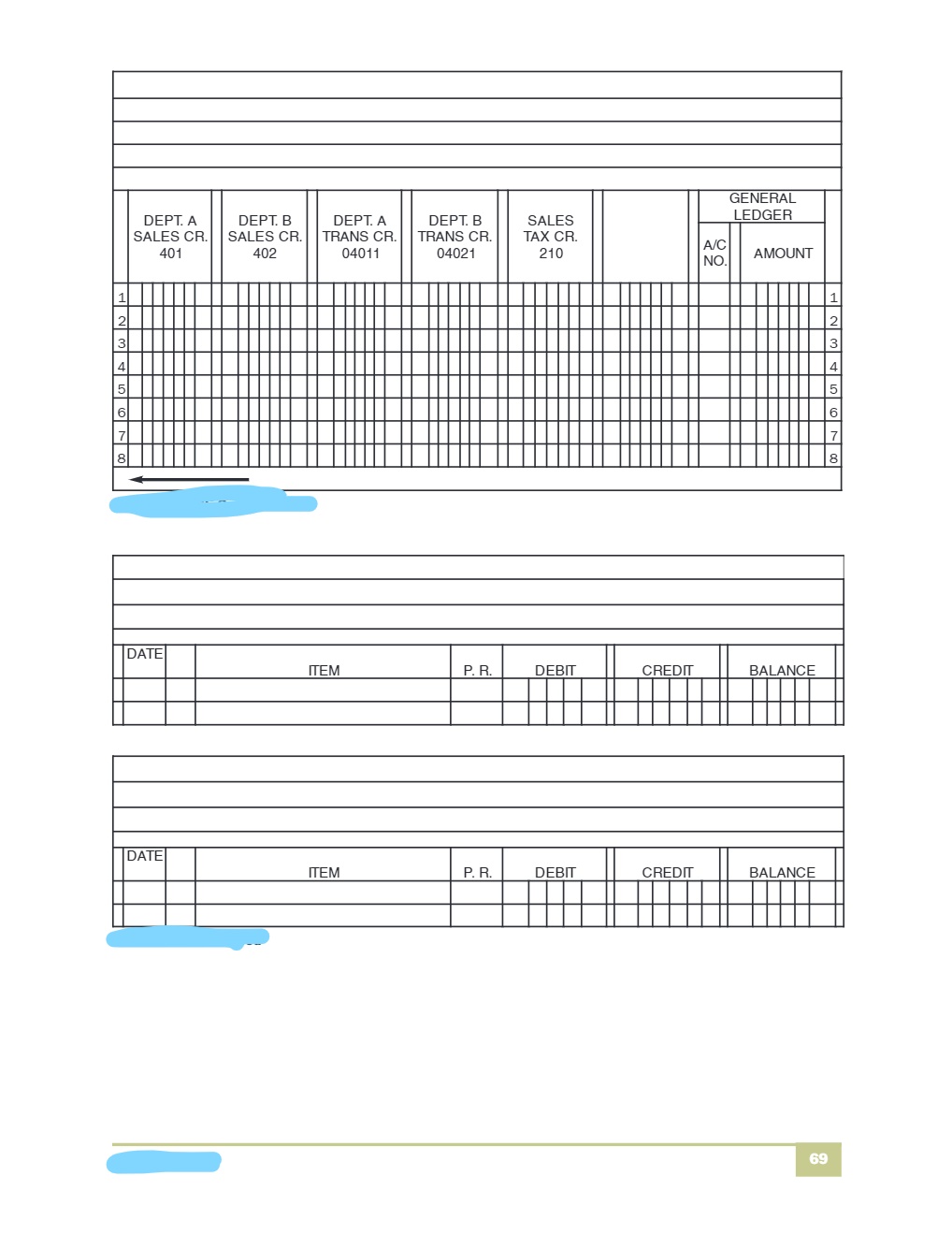

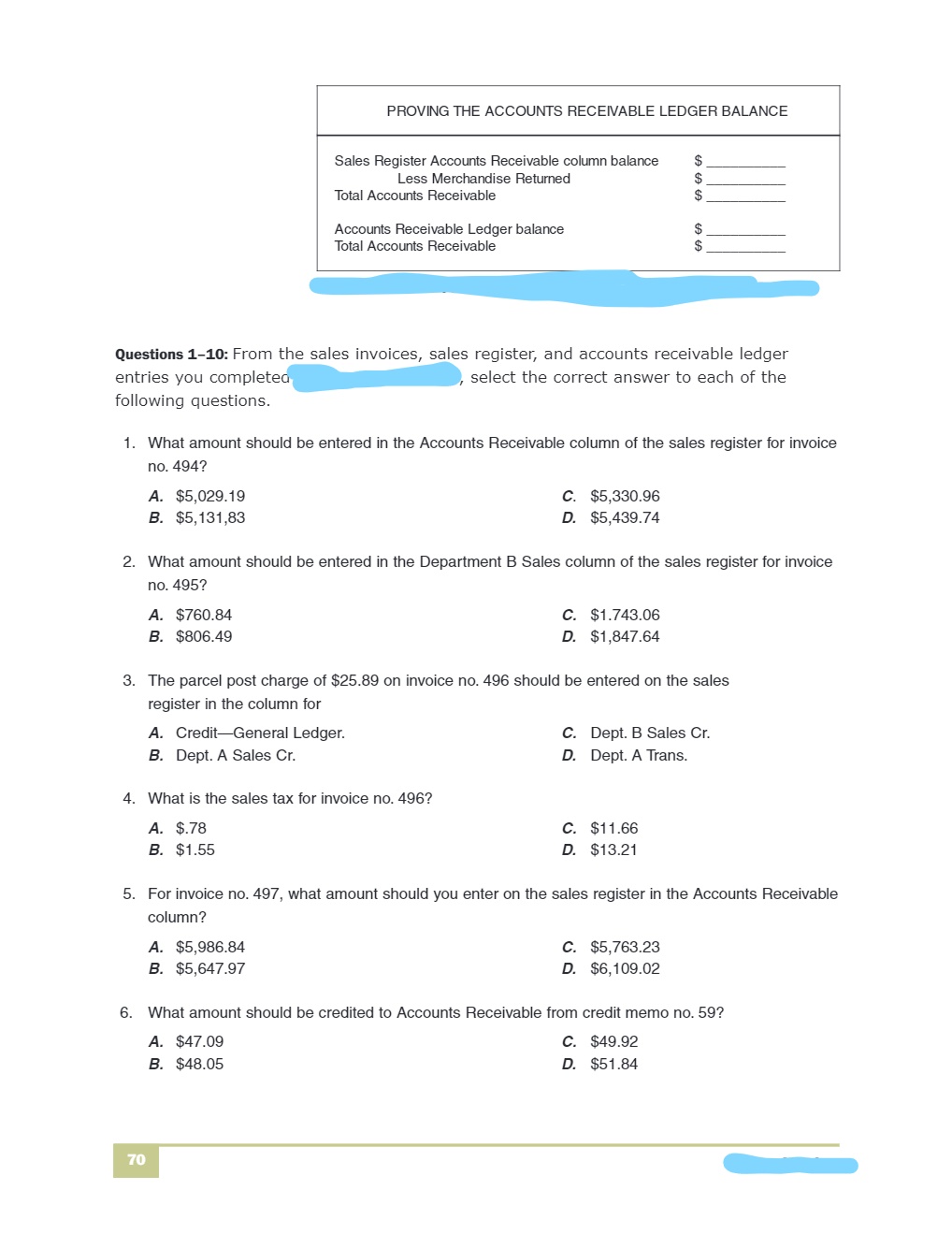

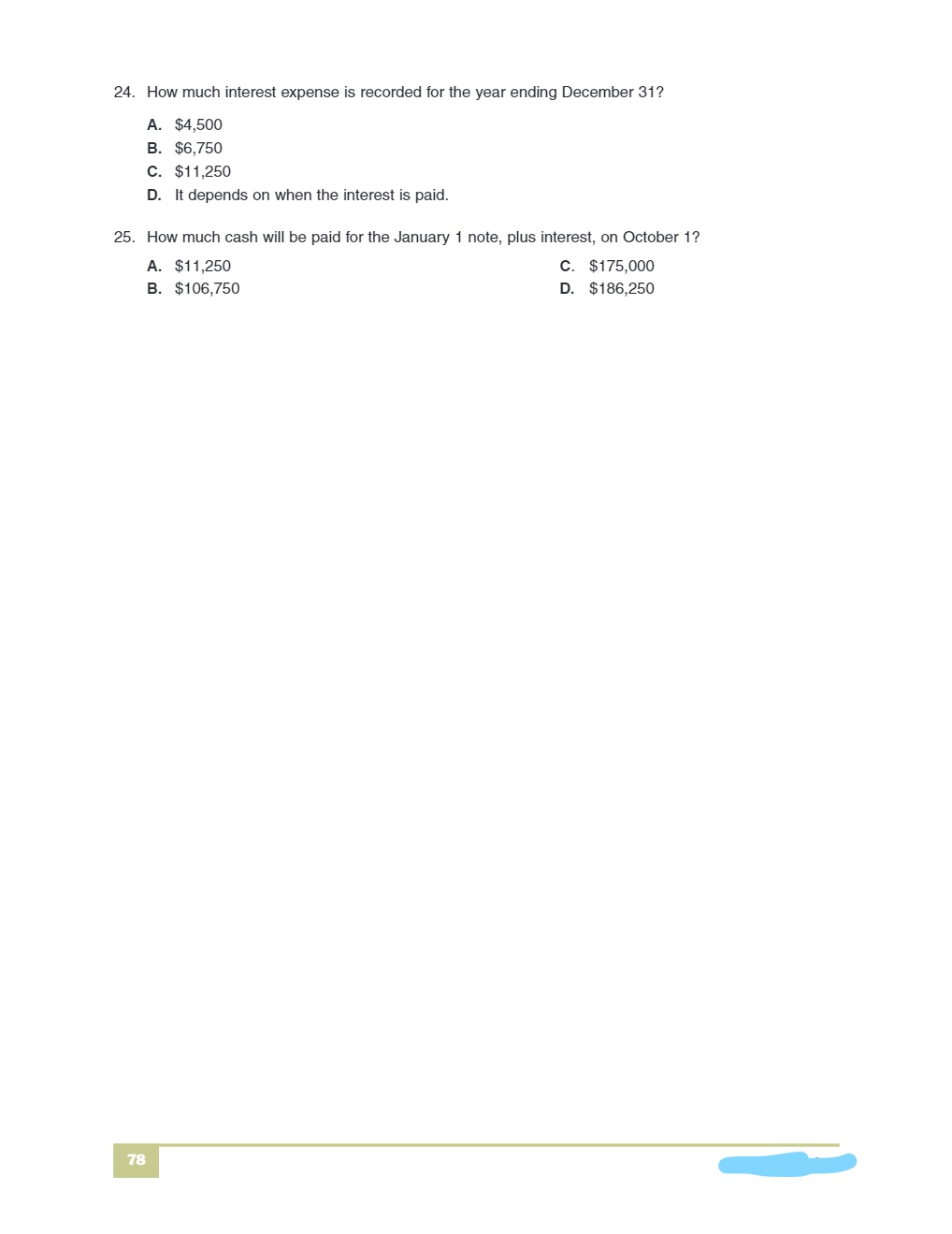

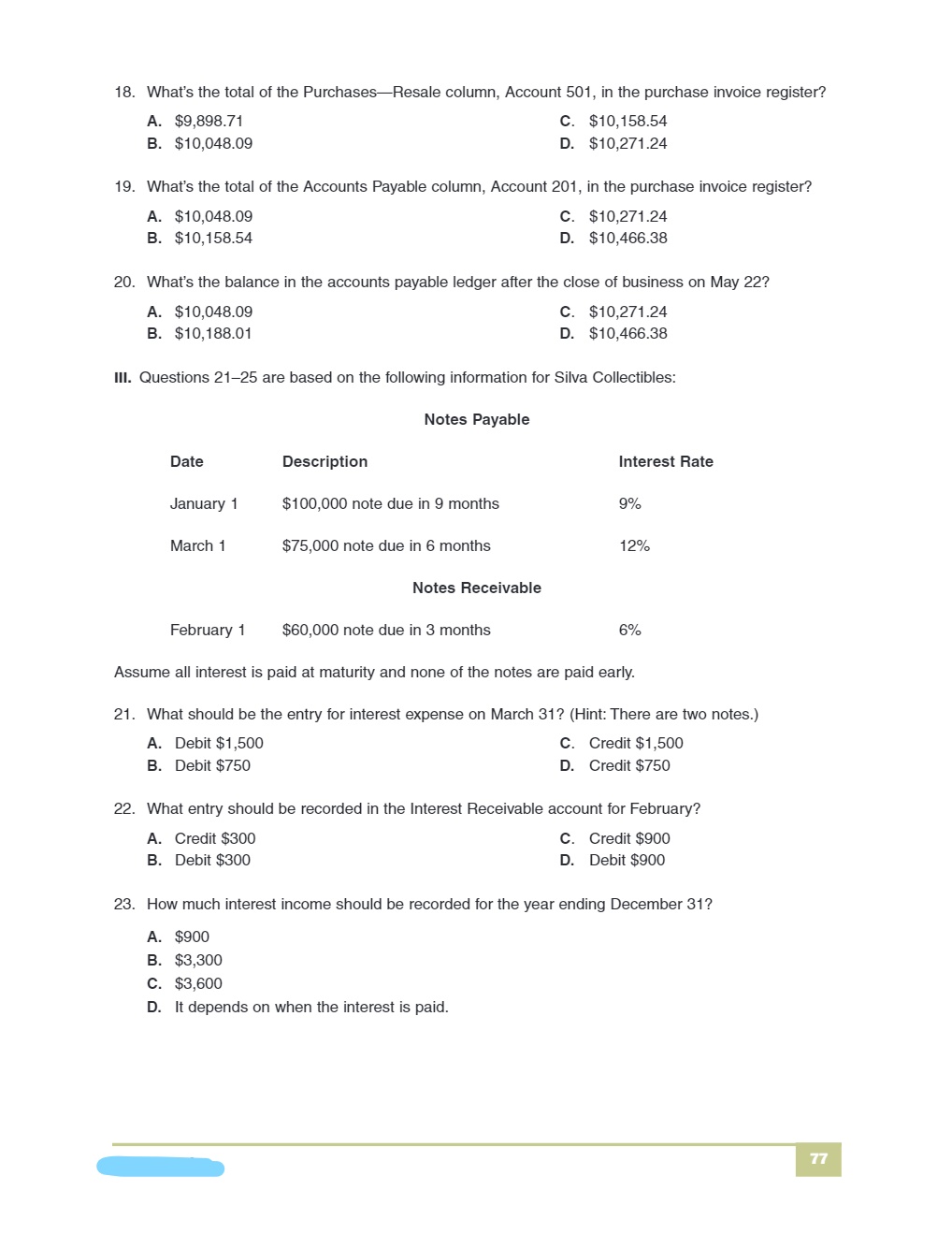

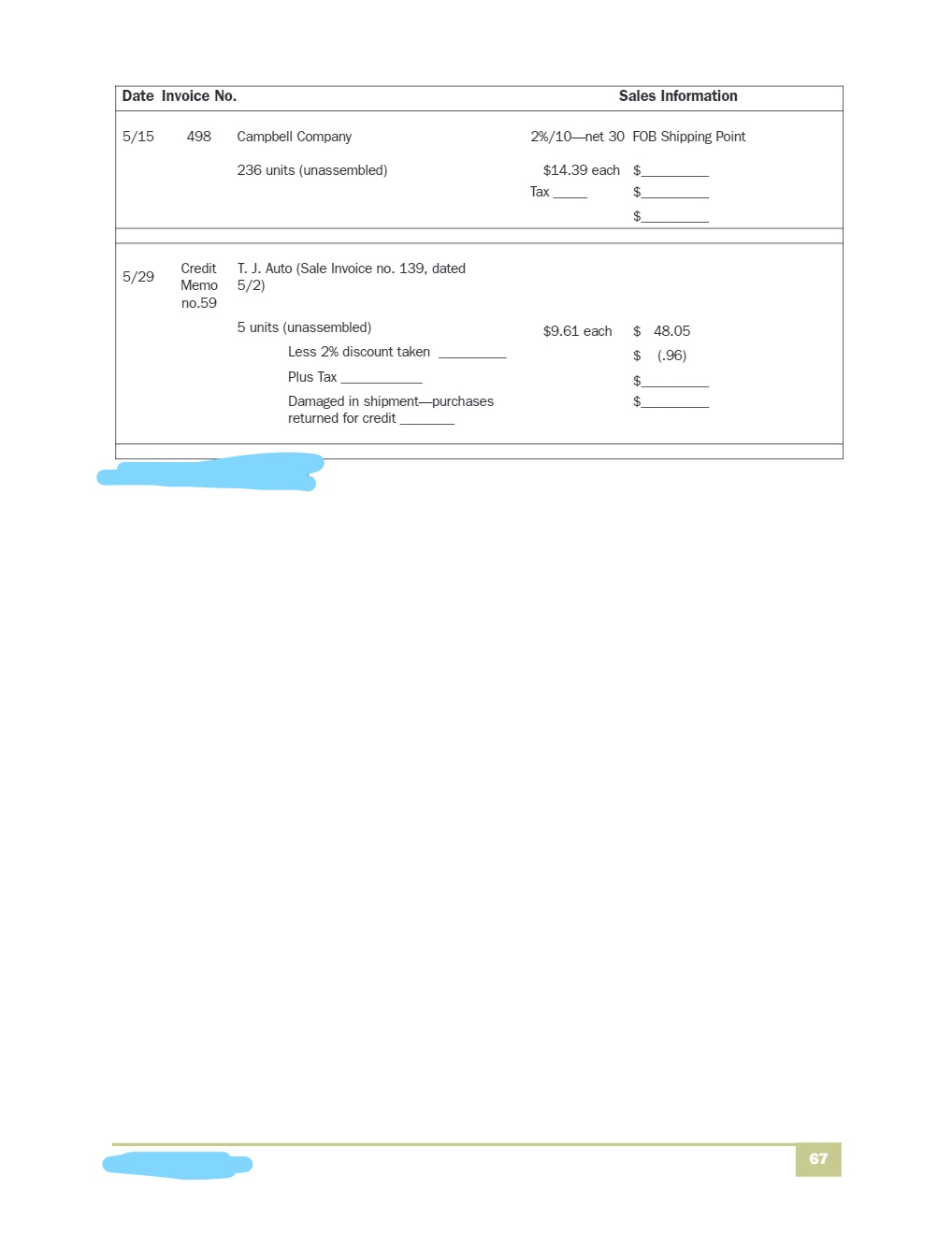

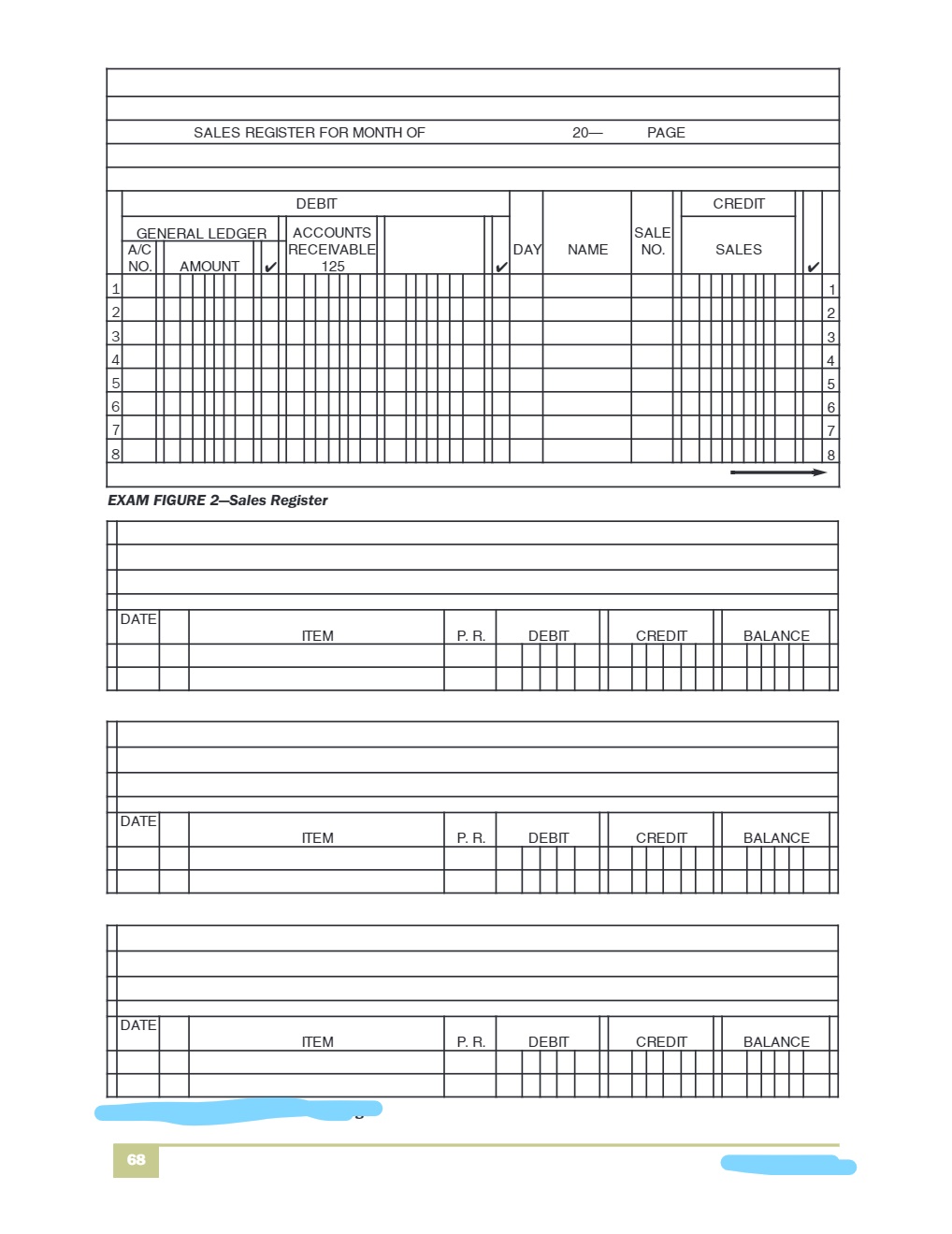

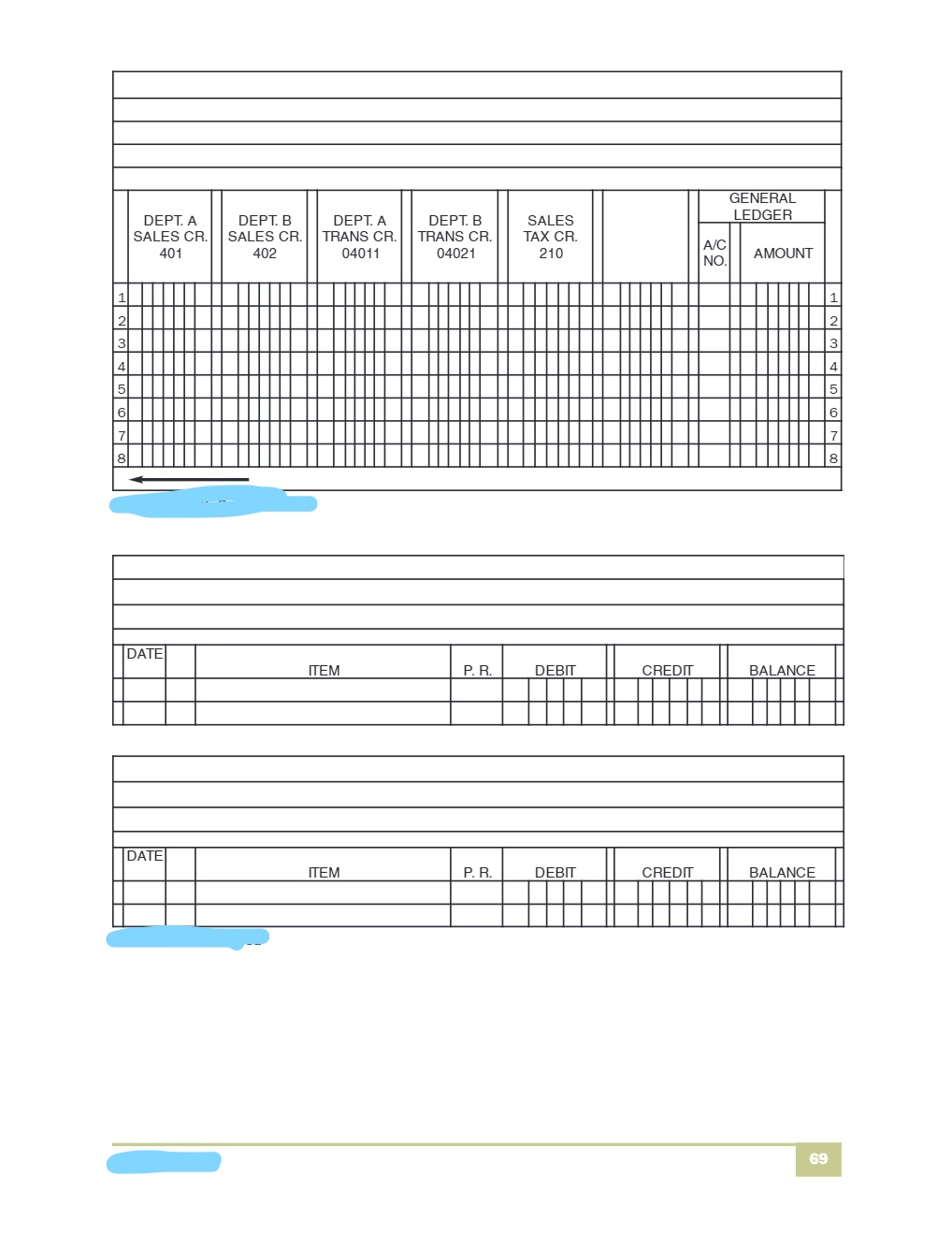

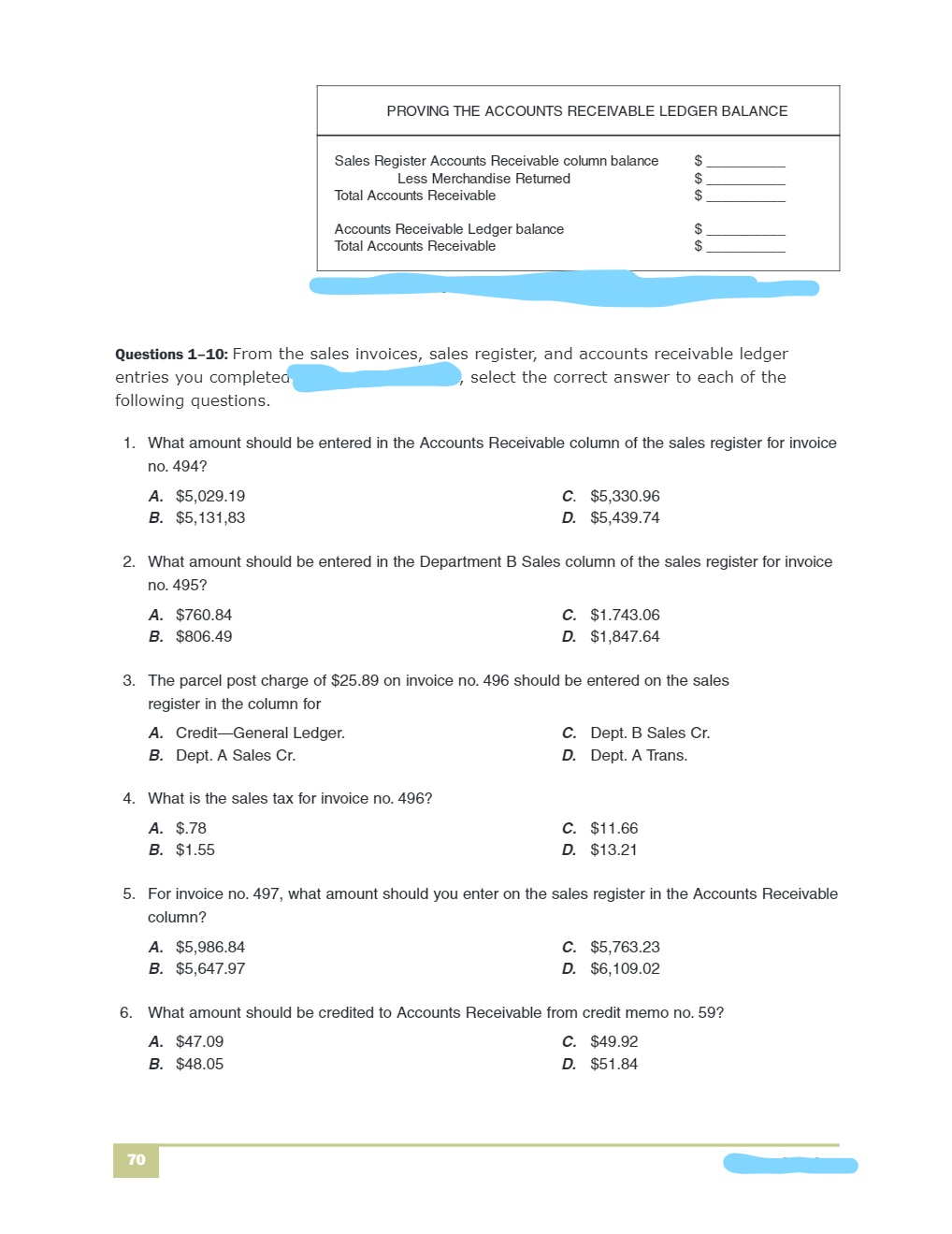

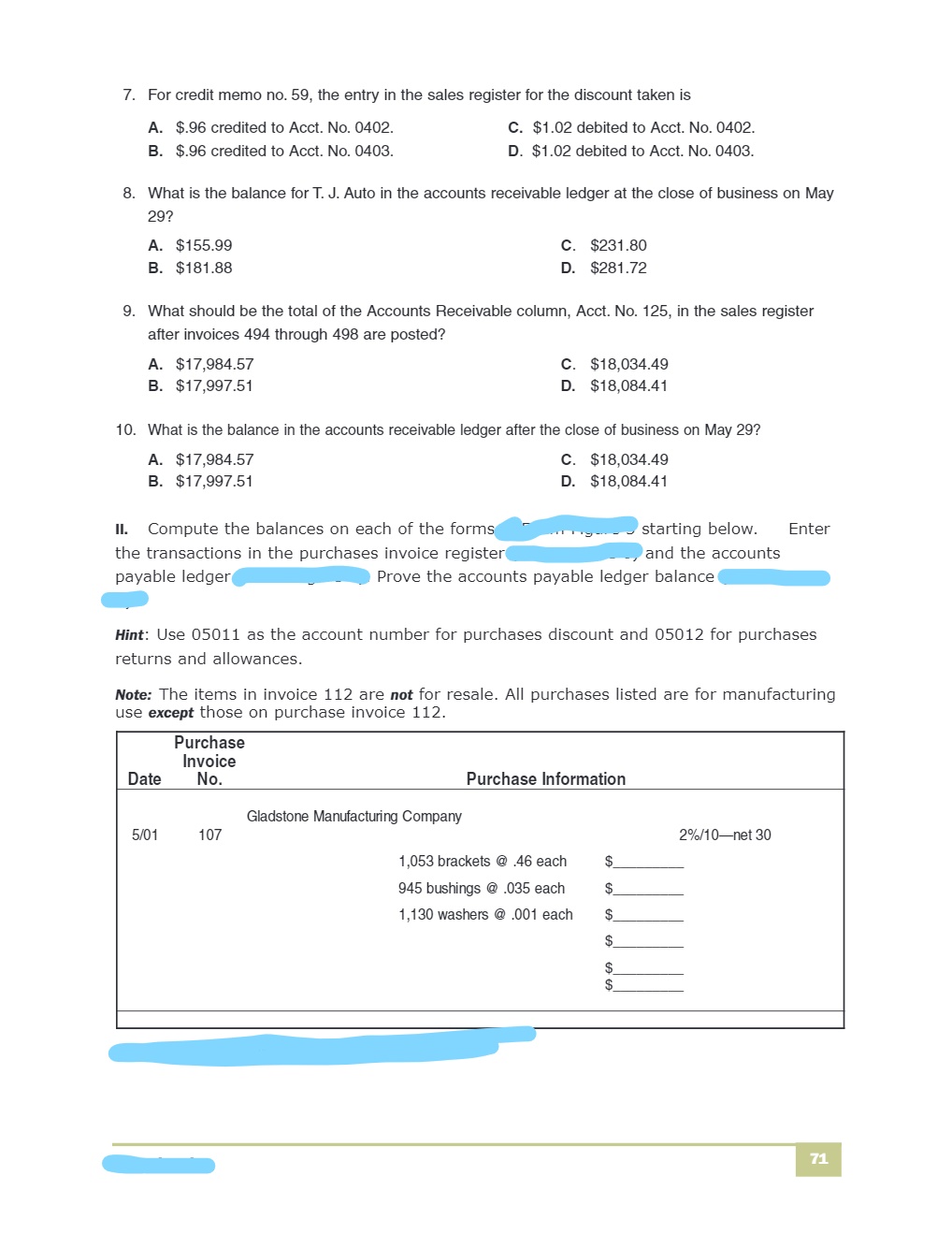

24. How much interest expense is recorded for the year ending December 31? A. $4,500 B. $6,750 C. $11,250 D. It depends on when the interest is paid. 25. How much cash will be paid tor the January 1 note, plus interest, on October 1? A. 511,250 C. $175,000 B. $106,750 D. $186,250 Date Invoice No. Sales Information 5/03 194 Belmont Plumbing 2%/10-net 30 FOB Shipping Point 153 units (unassembled) $15.76 105 units (assembled) 25.91 Tax 5/07 495 S. V. Northrup 2%/10-net 30 FOB Destination 139 units (assembled) $12.54 each 92 units (unassembled) 8.27 each $ Tax 5/10 496 T. J. Auto 2%/10-net 30 FOB Shipping Point 15 units (assembled) $12.95 Tax Transportation-Parcel post charges $25.89 5/12 497 Baker Brothers 2%/10-net 30 FOB Shipping Point 349 units (unassembled) $12.95 each $ 48 units (assembled) 25.91 each $ Tax 66PROVING THE ACCOUNTS PAYABLE LEDGER BALANCE Purchase Invoice Register Accounts Payable column balance Less Purchases Returned Total Accounts Payable Accounts Payable Ledger balance Total Accounts Payable 11. What amount should be entered in the Accounts Payable column of the purchase invoice register for purchase invoice no. 107? A. $484.38 C. $528.76 B. $518.59 D. $549.71 12. The entry in the purchase invoice register for the due date for purchase invoice no. 108 is A. 5/3. C. 6/3. B. 5/17. D. 6/17. 13. To compute the amount to be paid for the brads on purchase invoice no. 109, you should multiply .59 by A. 115,000. C. 1,150. B. 11,500. D. 115. 14. What amount should be credited to Purchases Returns and Allowances from credit memo no. 24? A. $2.25 C. $112.70 B. $110.45 D. $114.95 15. What amount should be debited to Accounts Payable from credit memo no. 24? A. $2.25 C. $112.70 B. $110.45 D. $114.95 16. What is the first thing you must do to compute the amount to be paid for the 8mm fittings on pur- chase invoice no. 110? A. Multiply 15,936 by .45 C. Divide 15,936 by 12 B. Multiply 15,936 by 12 D. Divide 15,936 by .58 17. The balance for Gladstone Manufacturing Company in the accounts payable ledger after the close of business on May 12 is a credit of A. $110.45. C. $518.59. B. $408.14. D. $629.04. 7618. 1What's the total 01 the PurchasesResale column, Account 501, in the purchase invoice register? A. $9,898.71 0. $10,150.54 B. $10,048.09 D. $10,271.24 19. What's the total 01 the Accounts Payable column, Account 201 , in the purchase invoice register? A. $10,048.09 C. $10,271.24 B. $10,158.54 D. $10,466.38 20. What's the balance in the accounts payable ledger after the close of business on May 22? A. $10,048.09 c. $10,271.24 B. $10,188.01 D. $10,490.39 III. Questions 2125 are based on the tollowing information for Silva Collectibles: Notes Payable Date Description Interest Rate January 1 $100,000 note due in 9 months 9% March 1 $75,000 note due in 6 months 12% Notes Receivable February 1 $80,000 note due in 3 months 6% Assume all interest is paid at maturity and none ot the notes are paid early. 21. What should be the entry for interest expense on March 31? (Hint: There are two notes.) A. Debit $1,500 C. Credit $1,500 B. Debit $750 D. Credit $750 22. What entry should be recorded in the Interest Receivable account for Febmary? A. Credit$300 C. Credit$900 B. Debit $300 D. Debit $900 23. How much interest income should be recorded for the year ending December 31 ? A. $900 $3.300 $3.600 It depends on when the interest is paid. 9.09 Date Invoice No. Sales Information 5/15 498 Campbell Company 2%/10-net 30 FOB Shipping Point 236 units (unassembled) $14.39 each $ Tax $ 5/29 Credit T. J. Auto (Sale Invoice no. 139, dated Memo 5/2) no.59 5 units (unassembled) $9.61 each $ 48.05 Less 2% discount taken $ (.96) Plus Tax $ Damaged in shipment-purchases $ returned for credit 67SALES REGISTER FOR MONTH OF 20- PAGE DEBIT CREDIT GENERAL LEDGER ACCOUNTS SALE A/C RECEIVABLE DAY NAME NO. SALES NO AMOUNT 125 NO G A W CO EXAM FIGURE 2-Sales Register DATE TEM P. R. DEBIT CREDIT BALANCE DATE ITEM P. R. DEBIT CREDIT BALANCE DATE ITEM P. R. DEBIT CREDIT BALANCE 68GENERAL DEPT. A DEPT. B DEPT. A DEPT. B SALES LEDGER SALES CR. SALES CR. TRANS CR. TRANS CR. TAX CR. 401 04011 04021 210 A/C 402 NO AMOUNT W N 8 DATE ITEM P. R. DEBIT CREDIT BALANCE DATE ITEM P. R. DEBIT CREDIT BALANCE 69PROVING THE ACCOUNTS RECEIVABLE LEDGER BALANCE Sales Register Accounts Receivable column balance Less Merchandise Returned Total Accounts Receivable Accounts Receivable Ledger balance Total Accounts Receivable Questions 1-10: From the sales invoices, sales register, and accounts receivable ledger entries you completed , select the correct answer to each of the following questions. 1. What amount should be entered in the Accounts Receivable column of the sales register for invoice no. 494? A. $5,029.19 C. $5,330.96 B. $5, 131,83 D. $5,439.74 2. What amount should be entered in the Department B Sales column of the sales register for invoice no. 495? A. $760.84 C. $1.743.06 B. $806.49 D. $1,847.64 3. The parcel post charge of $25.89 on invoice no. 496 should be entered on the sales register in the column for A. Credit-General Ledger. C. Dept. B Sales Cr. B. Dept. A Sales Cr. D. Dept. A Trans. 4. What is the sales tax for invoice no. 496? A. $.78 C. $11.66 B. $1.55 D. $13.21 5. For invoice no. 497, what amount should you enter on the sales register in the Accounts Receivable column? A. $5,986.84 C. $5,763.23 B. $5,647.97 D. $6, 109.02 6. What amount should be credited to Accounts Receivable from credit memo no. 59? A. $47.09 C. $49.92 B. $48.05 D. $51.84 707. For credit memo no. 59, the entry in the sales register for the discount taken is A. $.96 credited to Acct. No. 0402. C. $1.02 debited to Acct. No. 0402. B. $.96 credited to Acct. No. 0403. D. $1.02 debited to Acct. No. 0406. 8. What is the balance for'l'. J. Auto in the accounts receivable ledger at the close of business on May 29'? A. $155.99 C. $231.80 El. $181.88 D. $281.72 9. What should be the total of the Accounts Receivable column, Acct. No. 125, in the sales register after invoices 494 through 498 are posted? A. $17,984.57 C. $18,034.49 B. $17,997.51 D. $18,084.41 10. What is the balance in the accounts receivable ledger after the close of business on May 29? A. $17,994.57 c. $19,934.49 9. $17,997.51 D. $18,084.41 II. Compute the balances on each of the forms\" starting below. Enter the transactions in the purchases invoice register'and the accounts payable ledger Prove the accounts payable ledger balance - Hint: Use 05011 as the account number for purchases discount and 05012 for purchases returns and allowances. Note: The items in invoice 112 are not for resale. All purchases listed are for manufacturing use except those on purchase invoice 112. Purchase Information Gladstone Maniactuing llicmpanjlr 2W1 net 30 1,053 brackets e .46 each 945 bustings 0' .035 each 1,130 washers 6 .001 each Purchase Invoice Date No Purchase Information 5/03 108 Washington Container Company 2%/10-net 45 2,000 2' x 4' containers @ 1.34 each 1,150 16" x 28" containers @ .752 each $ 1,000 3' x 5' containers @ 1.595 each 5/10 109 McAfee Products 2%/10-net 30 11,500 brads @ .59 per 100 13,400 staples @ .40 per 100 CACA CA CA CA Credit Gladstone Manufacturing Company (our Purchase 5/12 Memo Order No. 96) No. 24 245 brackets @ .46 each Less 2% discount taken 5/20 110 Miller Manufacturing Company 2%/10-net 30 29,520 4mm fittings @ .45 per doz. 15,936 8mm fittings @ .58 per doz. 72PURCHASE INVOICE REGISTER FOR MONTH OF 20- PAGE DEBIT PURCHASES GENERAL LEDGER DAY INV. INV. A/C DATE NO ACCOUNT RESALE OFFICE 501 107 NO AMOUNT (D CO V O UT A W N - KD CO V O UT A W N - DATE ITEM P. R. DEBIT CREDIT BALANCE DATE ITEM P. R. DEBIT CREDIT BALANCE DATE ITEM P. R. DEBIT CREDIT BALANCE 74CREDIT ACCOUNTS TERMS DUE DATE PAYABLE GENERAL LEDGER CR. A/C NO. AMOUNT 201 2/10-n/30 5/31/- DATE ITEM P. R. DEBIT CREDIT BALANCE DATE ITEM P. R. DEBIT CREDIT BALANCE DATE ITEM P . R . DEBIT CREDIT BALANCE 75