Hello, I posted this assignment earlier but got now respone, can someone please help me make a cash budget, income statement and a balance sheet from these information? I tried but i can not make it right :(

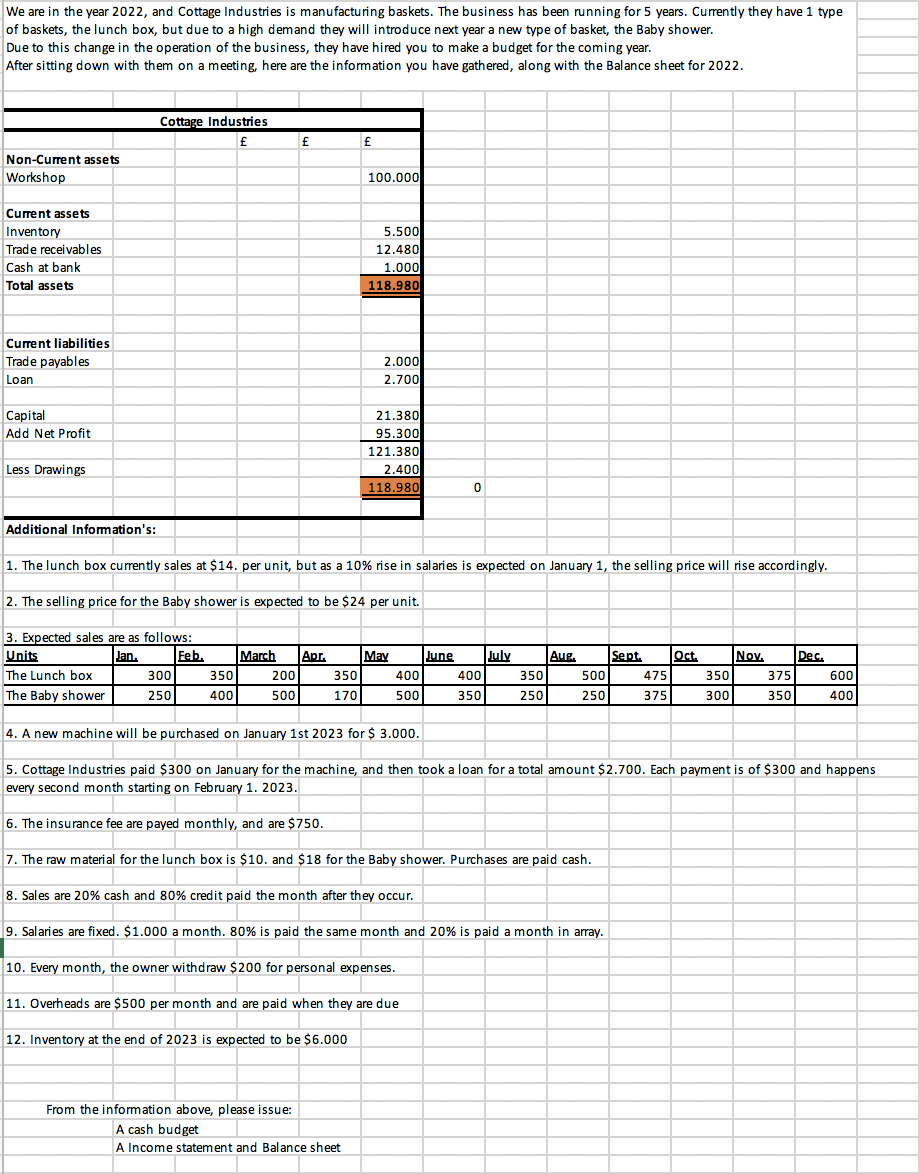

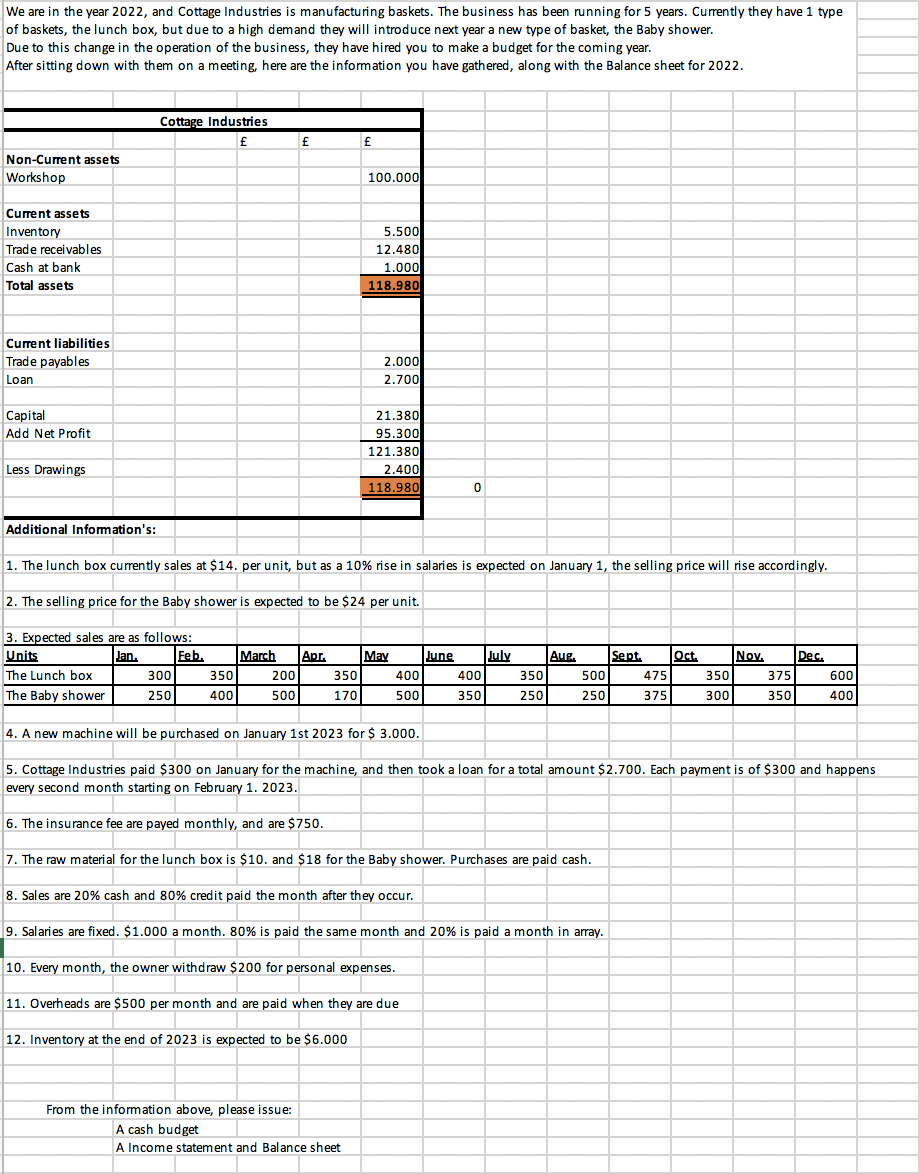

We are in the year 2022 , and Cottage Industries is manufacturing baskets. The business has been running for 5 years. Currently they have 1 type of baskets, the lunch box, but due to a high demand they will introduce next year a new type of basket, the Baby shower. Due to this change in the operation of the business, they have hired you to make a budget for the coming year. After sitting down with them on a meeting, here are the information you have gathered, along with the Balance sheet for 2022 . 4. A new machine will be purchased on January 1 st 2023 for $3.000. 5. Cottage Industries paid $300 on January for the machine, and then took a loan for a total amount $2.700. Each payment is of $300 and happens every second month starting on February 1. 2023. 6. The insurance fee are payed monthly, and are $750. 7. The raw material for the lunch box is $10. and $18 for the Baby shower. Purchases are paid cash. 8. Sales are 20% cash and 80% credit paid the month after they occur. 9. Salaries are fixed. $1.000 a month. 80% is paid the same month and 20% is paid a month in array. 10. Every month, the owner withdraw $200 for personal expenses. 11. Overheads are $500 per month and are paid when they are due 12. Inventory at the end of 2023 is expected to be $6.000 From the information above, please issue: A cash budget A Income statement and Balance sheet We are in the year 2022 , and Cottage Industries is manufacturing baskets. The business has been running for 5 years. Currently they have 1 type of baskets, the lunch box, but due to a high demand they will introduce next year a new type of basket, the Baby shower. Due to this change in the operation of the business, they have hired you to make a budget for the coming year. After sitting down with them on a meeting, here are the information you have gathered, along with the Balance sheet for 2022 . 4. A new machine will be purchased on January 1 st 2023 for $3.000. 5. Cottage Industries paid $300 on January for the machine, and then took a loan for a total amount $2.700. Each payment is of $300 and happens every second month starting on February 1. 2023. 6. The insurance fee are payed monthly, and are $750. 7. The raw material for the lunch box is $10. and $18 for the Baby shower. Purchases are paid cash. 8. Sales are 20% cash and 80% credit paid the month after they occur. 9. Salaries are fixed. $1.000 a month. 80% is paid the same month and 20% is paid a month in array. 10. Every month, the owner withdraw $200 for personal expenses. 11. Overheads are $500 per month and are paid when they are due 12. Inventory at the end of 2023 is expected to be $6.000 From the information above, please issue: A cash budget A Income statement and Balance sheet