Hello, I want soln for the following question. But before that please read my requirement carefully. I am posting everything related to the question so do not follow any other method and solutions form Chegg. I want answer in the table format which is given below. Do not use excel or scan paper posting. Just fill the table as it is by following the given hints to do the question. Also, save the image if u cant see clearly and zoom in the image. Dont comments like image is not clear etc etc or other info. I have provided every detail. If you did not follow the requirements I straightly downvote the answer and report you. We are not paying for wrong answers.

Life Insurance Needs for a Young Married Couple. Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retirement plan valued at approximately $20,000. They recently received an offer in the mail from their mortgage lender for a mortgage life insurance policy of $190,000. Their only life insurance currently is a $20,000 cash-value survivorship joint life policy. They each would like to provide the other with support for at least five years if one of them should die.

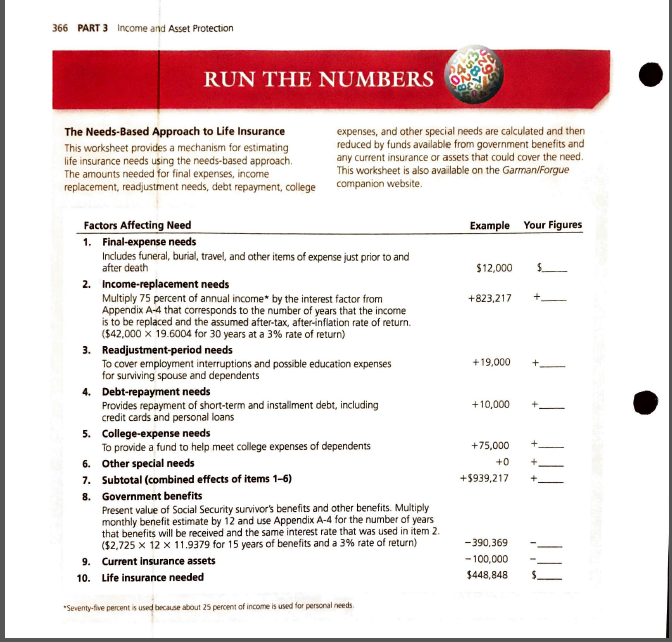

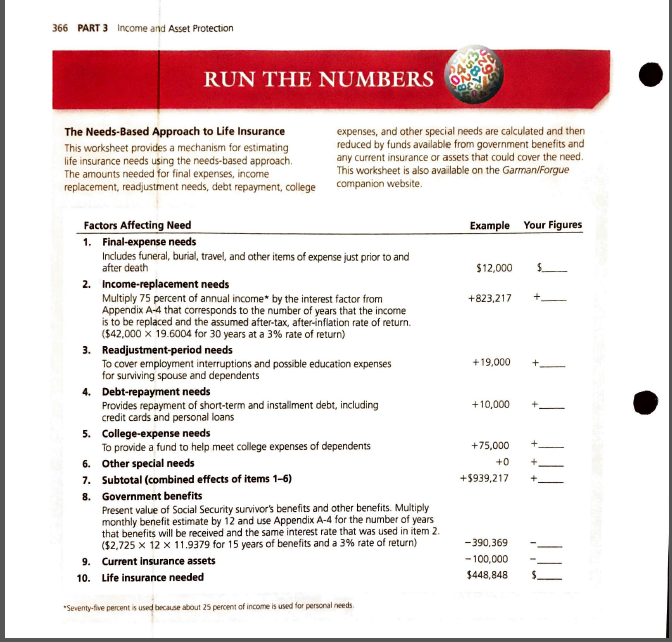

(a) Assuming $15,000 in final expenses and $20,000 allocated to help make mortgage payments, calculate the amount of life insurance they should purchase using the needs-based approach.

| Needs-Based Approach to Life Insurance | | |

| Factors Affecting Need | | |

| | Amy | Mack |

| Final-expense needs | | |

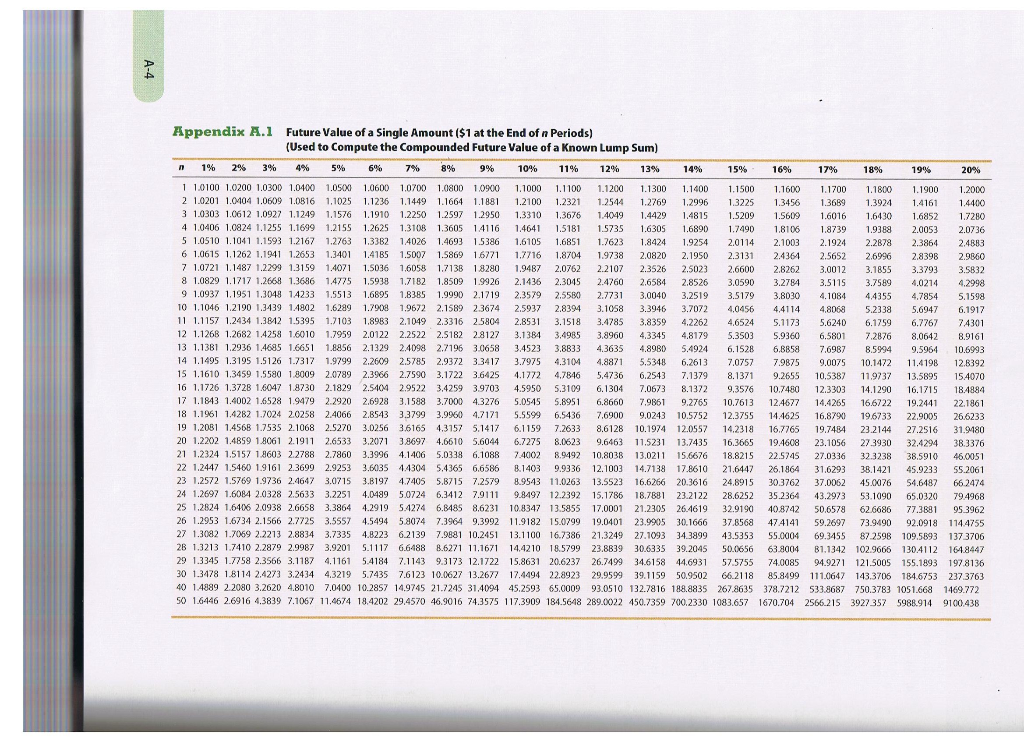

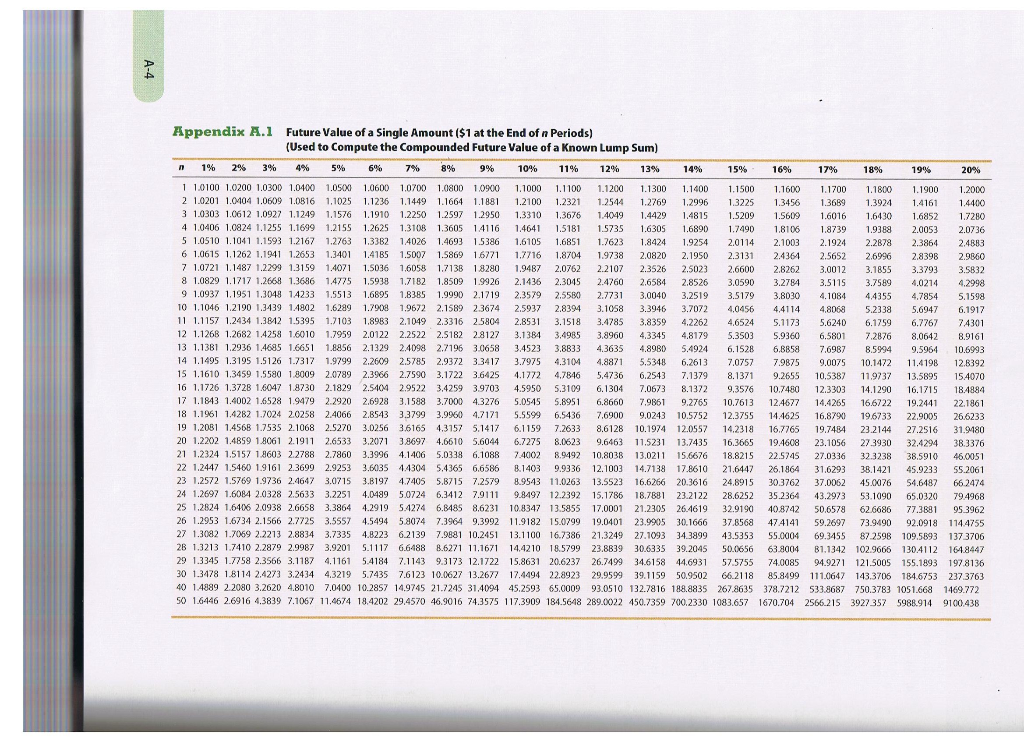

| Income-replacement needs | N = 5 I/Y = 3 PV = CPT PMT = 71,000 x 0.75 FV = 0 | N = 5 I/Y = 3 PV = CPT PMT = 62,000 x 0.75 FV = 0 |

| Readjustment period needs | | |

| Debt-repayment needs | | |

| College-expense needs | | |

| Other special needs: Mortgage payments | | |

| Subtotal: | | |

| Government benefits | | |

| Current insurance assets: Home Life insurance cash value Retirement plan | | |

| Subtotal: | | |

| Life insurance needed: | | |

366 PART 3 Income and Asset Protection RUN THE NUMBERS The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college expenses, and other special needs are calculated and then reduced by funds available from government benefits and any current insurance or assets that could cover the need. This worksheet is also available on the Garman/Forgue companion website. Example Your Figures $12,000 +823,217 +19,000 + Factors Affecting Need 1. Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death 2. Income-replacement needs Multiply 75 percent of annual income by the interest factor from Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return. ($42.000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans 5. College-expense needs To provide a fund to help meet college expenses of dependents 6. Other special needs 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. ($2,725 X 12 X 11.9379 for 15 years of benefits and a 3% rate of return) 9. Current Insurance assets 10. Life insurance needed +10,000 +75,000 +5939,217 -390,369 - 100,000 $448,848 $ Seventy-five percent is used because about 25 percent of income is used for personal needs A-4 Appendix A.1 Future Value of a Single Amount ($1 at the End of n Periods) (Used to Compute the Compounded Future Value of a Known Lump Sum) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 1.0100 1.0200 1.0300 1.0400 1.050X) 1.0600 10700 1.0800 1.090 1.1000 1.11001.1200 1.1300 1.14001.1500 1.1600 1.1700 1.1800 1.1900 1.2000 2 1.0201 1.0104 1.0609 1.0816 1,1025 1.1236 1.1449 1.1664 1.1881 1.2100 1.2321 1.2544 1.2769 1.2996 1 .3225 1.3456 1.3689 1.3924 1.4161 1.4400 3 1.0303 1.0612 1.0927 1.1249 1.1576 1.1910 1.2250 1.25971.2950 1,3310 1.3676 1.4049 1.4429 1.48151.5209 1.5609 1 6016 1.6430 1.6852 1.7280 4 1.0406 1.0824 1.1255 1.1699 1.2155 1.2625 1.3108 1.3605 14116 1.4641 1.51811.5735 1.6305 1.6890 1 .7490 1,8106 1.8739 1.9388 2.0053 2.0736 5 1.0510 1.1041 1.1593 1.2167 1.2763 1.33B2 1.4026 1.4693 1.5386 1.6105 1.68511.7623 1.8424 1.9254 2 .0114 2.1003 2.1924 2.2878 2.3864 2.4883 6 1.0615 1.1262 1.1941 1.2653 1.3401 1.41B5 1.5007 1.5869 16771 1.7716 1.87041.9738 2.0820 2.1950 2 .3131 2.4364 2.5652 2.6996 2.8398 2.9860 7 1.0721 1.1487 1.2299 1.3159 1.4071 1.5036 1.6058 1.7138 1.8280 1.9487 2.07622.2107 2.3526 2.5023 2 .6600 2.8262 3.0012 3.1855 3.3793 3.5832 8 1.0829 1.1717 1.2668 1.3686 1.4775 1.5938 1.7182 1.8509 1.9926 2.1436 2.3045 2.4760 26584 2.8526 3.0590 3.2784 3.5115 3.7589 4 ,0214 4.2998 9 1.0937 1.1951 1,3048 14233 1.5513 1.6895 1.8385 1.9990 2.1719 2.3579 2.5580 2.7731 3.0040 3.2519 3.5179 3.8030 4.1084 4.4355 4.7854 5.1598 10 1.1046 1.2190 1.3439 14802 1.6299 1.7908 1.9672 2.1589 2.3674 2.5937 2.8394 3.10583.3946 3.7072 4 0456 4.4114 4,8068 5.2338 5.6947 6.1917 11 1.1157 1.2434 1.3812 1.5395 1.7103 1.8983 2.1049 2.3316 25804 2.8531 3.1518 3.4785 3.83594.2262 4,6524 5.1173 5.6240 6.1759 6.7767 7.4301 12 1.126B 1.2682 14258 1.6010 1.7959 2.0122 2.2522 2.5182 2.8127 3.1384 3.4985 3.8960 4.33454.81795.3503 5.9360 6,5801 7.2876 8.06428.9161 13 1.1381 1.2936 1.4695 16651 1.8856 2.1329 2.4098 2.7196 3.0658 3.4523 3.8833 4.3635 4.8980 5.4924 6.1528 6 ,8858 7.6987 8.5994 9.5964 10.6993 14 1.1495 1.3195 1.5126 1.7317 1.9799 2.2609 2.5785 2.9372 33417 3.79754,31041,8871 5.5348 6.2613 7.07577.9875 9.0075 10.1472 11.4198 12.8392 15 1.1610 1,3459 1.5580 1.8009 2.0789 2.3966 2.7590 3.1722 3.6425 4.1772 4.7846 5.4736 6.25437.13798.13719.2655 10,538711.9737 13.5895154070 16 1.1726 1.3728 1.6047 1.8730 2.1829 2.5404 2.9522 3.4259 3.9703 4.5950 5.31096.1304 7.0673 8.1372 9 ,3576 10.7480 12.3303 14.1290 16,1715 18.4884 17 1.1843 1.4002 1.6528 1.9479 2.2920 2.6928 3.1588 3.7000 4.3276 5.0545 5.8951 6,8660 7.9861 9.2765 10.7613124677 14.4265 16,6722 19.2441 22.1861 18 1.1961 1.4282 1.7024 20258 2.4066 2.8543 3.37993.9960 4.7171 5.5599 6,5436 7.6900 9.0243 10.5752 12.3755 144625 16,87% 19.6733 22.9005 26,6233 19 1.2081 1.456B 1.7535 2.1068 2.5270 3.0256 3.6165 4.3157 5.1417 6.1159 7.2633 8.6128 10.1974 12.055714.2318 16.7765 19.7484 23.2144 27.2516 31.9480 20 1.2202 1,4859 18061 2.1911 2.6533 3.207138697 4,6610 5.6044 6.72758.0623 9.6463 11.5231 13.7435 16,3665 194608 23.1056 27.3930 32.4294 38.3376 21 1.2324 1.5157 1.8603 2.2788 2.7860 3.3996 4.1406 5.0338 6.1088 7.40028.9492 10,8038 13.0211 15.6676 18.8215 22.5745 27.0336 32.3238 38.5910 46.0051 22 1.2447 1.5460 1.9161 2.3699 2.9253 3.6035 44304 5.4365 6.6586 8.1403 9.9336 12.1003 14.7138 17.861021.6447 26.1864 31.629338.142145.9233 55.2061 23 1.2572 1.5769 1.9736 2.4647 3.0715 3.8197 4.7405 5.6715 7.2579 8.9543 11.0263 13.5523 16.6266 20.3616 24.8915 30.3762 37,0062 45.0076 54.6187 66.2474 24 1.2697 1.6084 2.0328 2.5633 3.2251 4.0489 5.0724 6.3412 7.9111 9.8497 12.2392 15.1786 18.7881 23.212228.6252 35.2364 43.2973 53.1090 65.0320 79.4968 25 1.2824 1.6406 2.0938 2.6658 3.3864 4.291954274 6,6185 8.6231 10.8347 13.5855 17.0001 21.230526461932.9190 40.8742 50.6578 62.6686 77.3881 95.3962 26 1.2953 1.6734 2.1566 2.7725 3.5557 4.5494 5.8074 7.3964 9.3992 11.9182 15.0799 19,0401 23.9905 30.1666 37.8568 474141 59.269773.9490 92.0918 1144755 27 1.3082 1.7069 2.2213 2.8834 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 21.3249 27.1093 34.389943.535355.0004 69.3455 87.2598 109.5893 137 3706 26 1.3213 1.7410 2.2879 2.9987 3.9201 5.1117 6.6488 8.6271 11.1671 14.4210 18.5799 23.8839 30.6335 39.204550.0/656 63.8004 B1.1342 102.9666 130.4112 164.8447 29 1.3345 1.7758 2.3566 3.1187 4.1161 5.4184 7.1143 9.3173 12.1722 15.8631 20.6237 26.7499 34.6158 44.6931 57.575574.0085 94.9271 121.5005 155.1893 197 8136 30 1.3178 1.8114 2.4273 3.2434 4,3219 5.7435 7.6123 10.0627 13.2677 17.4494 22.8923 29.9599 39.1159 50.950266-2118 85.8499 111.0647 143.3706 184.6753 237.3763 40 1.4889 2.2080 3.2620 4.8010 7.0400 10.2857 14.9745 21.7245 31.4094 45.2593 65.000 93.0510 132.7816 188.8835267.8635 378.7212 533.8687 750.3783 1051.668 1469.772 50 1.6446 2.6916 4.3839 7.1067 11,4674 18.4202 29.4570 46.9016 74.3575 117.3909 184.5618 289.0022 450.7359 700.2330 1083.657 1670.704 2566.215 3927 357 5988.914 9100.438 366 PART 3 Income and Asset Protection RUN THE NUMBERS The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college expenses, and other special needs are calculated and then reduced by funds available from government benefits and any current insurance or assets that could cover the need. This worksheet is also available on the Garman/Forgue companion website. Example Your Figures $12,000 +823,217 +19,000 + Factors Affecting Need 1. Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death 2. Income-replacement needs Multiply 75 percent of annual income by the interest factor from Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return. ($42.000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans 5. College-expense needs To provide a fund to help meet college expenses of dependents 6. Other special needs 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. ($2,725 X 12 X 11.9379 for 15 years of benefits and a 3% rate of return) 9. Current Insurance assets 10. Life insurance needed +10,000 +75,000 +5939,217 -390,369 - 100,000 $448,848 $ Seventy-five percent is used because about 25 percent of income is used for personal needs A-4 Appendix A.1 Future Value of a Single Amount ($1 at the End of n Periods) (Used to Compute the Compounded Future Value of a Known Lump Sum) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 1.0100 1.0200 1.0300 1.0400 1.050X) 1.0600 10700 1.0800 1.090 1.1000 1.11001.1200 1.1300 1.14001.1500 1.1600 1.1700 1.1800 1.1900 1.2000 2 1.0201 1.0104 1.0609 1.0816 1,1025 1.1236 1.1449 1.1664 1.1881 1.2100 1.2321 1.2544 1.2769 1.2996 1 .3225 1.3456 1.3689 1.3924 1.4161 1.4400 3 1.0303 1.0612 1.0927 1.1249 1.1576 1.1910 1.2250 1.25971.2950 1,3310 1.3676 1.4049 1.4429 1.48151.5209 1.5609 1 6016 1.6430 1.6852 1.7280 4 1.0406 1.0824 1.1255 1.1699 1.2155 1.2625 1.3108 1.3605 14116 1.4641 1.51811.5735 1.6305 1.6890 1 .7490 1,8106 1.8739 1.9388 2.0053 2.0736 5 1.0510 1.1041 1.1593 1.2167 1.2763 1.33B2 1.4026 1.4693 1.5386 1.6105 1.68511.7623 1.8424 1.9254 2 .0114 2.1003 2.1924 2.2878 2.3864 2.4883 6 1.0615 1.1262 1.1941 1.2653 1.3401 1.41B5 1.5007 1.5869 16771 1.7716 1.87041.9738 2.0820 2.1950 2 .3131 2.4364 2.5652 2.6996 2.8398 2.9860 7 1.0721 1.1487 1.2299 1.3159 1.4071 1.5036 1.6058 1.7138 1.8280 1.9487 2.07622.2107 2.3526 2.5023 2 .6600 2.8262 3.0012 3.1855 3.3793 3.5832 8 1.0829 1.1717 1.2668 1.3686 1.4775 1.5938 1.7182 1.8509 1.9926 2.1436 2.3045 2.4760 26584 2.8526 3.0590 3.2784 3.5115 3.7589 4 ,0214 4.2998 9 1.0937 1.1951 1,3048 14233 1.5513 1.6895 1.8385 1.9990 2.1719 2.3579 2.5580 2.7731 3.0040 3.2519 3.5179 3.8030 4.1084 4.4355 4.7854 5.1598 10 1.1046 1.2190 1.3439 14802 1.6299 1.7908 1.9672 2.1589 2.3674 2.5937 2.8394 3.10583.3946 3.7072 4 0456 4.4114 4,8068 5.2338 5.6947 6.1917 11 1.1157 1.2434 1.3812 1.5395 1.7103 1.8983 2.1049 2.3316 25804 2.8531 3.1518 3.4785 3.83594.2262 4,6524 5.1173 5.6240 6.1759 6.7767 7.4301 12 1.126B 1.2682 14258 1.6010 1.7959 2.0122 2.2522 2.5182 2.8127 3.1384 3.4985 3.8960 4.33454.81795.3503 5.9360 6,5801 7.2876 8.06428.9161 13 1.1381 1.2936 1.4695 16651 1.8856 2.1329 2.4098 2.7196 3.0658 3.4523 3.8833 4.3635 4.8980 5.4924 6.1528 6 ,8858 7.6987 8.5994 9.5964 10.6993 14 1.1495 1.3195 1.5126 1.7317 1.9799 2.2609 2.5785 2.9372 33417 3.79754,31041,8871 5.5348 6.2613 7.07577.9875 9.0075 10.1472 11.4198 12.8392 15 1.1610 1,3459 1.5580 1.8009 2.0789 2.3966 2.7590 3.1722 3.6425 4.1772 4.7846 5.4736 6.25437.13798.13719.2655 10,538711.9737 13.5895154070 16 1.1726 1.3728 1.6047 1.8730 2.1829 2.5404 2.9522 3.4259 3.9703 4.5950 5.31096.1304 7.0673 8.1372 9 ,3576 10.7480 12.3303 14.1290 16,1715 18.4884 17 1.1843 1.4002 1.6528 1.9479 2.2920 2.6928 3.1588 3.7000 4.3276 5.0545 5.8951 6,8660 7.9861 9.2765 10.7613124677 14.4265 16,6722 19.2441 22.1861 18 1.1961 1.4282 1.7024 20258 2.4066 2.8543 3.37993.9960 4.7171 5.5599 6,5436 7.6900 9.0243 10.5752 12.3755 144625 16,87% 19.6733 22.9005 26,6233 19 1.2081 1.456B 1.7535 2.1068 2.5270 3.0256 3.6165 4.3157 5.1417 6.1159 7.2633 8.6128 10.1974 12.055714.2318 16.7765 19.7484 23.2144 27.2516 31.9480 20 1.2202 1,4859 18061 2.1911 2.6533 3.207138697 4,6610 5.6044 6.72758.0623 9.6463 11.5231 13.7435 16,3665 194608 23.1056 27.3930 32.4294 38.3376 21 1.2324 1.5157 1.8603 2.2788 2.7860 3.3996 4.1406 5.0338 6.1088 7.40028.9492 10,8038 13.0211 15.6676 18.8215 22.5745 27.0336 32.3238 38.5910 46.0051 22 1.2447 1.5460 1.9161 2.3699 2.9253 3.6035 44304 5.4365 6.6586 8.1403 9.9336 12.1003 14.7138 17.861021.6447 26.1864 31.629338.142145.9233 55.2061 23 1.2572 1.5769 1.9736 2.4647 3.0715 3.8197 4.7405 5.6715 7.2579 8.9543 11.0263 13.5523 16.6266 20.3616 24.8915 30.3762 37,0062 45.0076 54.6187 66.2474 24 1.2697 1.6084 2.0328 2.5633 3.2251 4.0489 5.0724 6.3412 7.9111 9.8497 12.2392 15.1786 18.7881 23.212228.6252 35.2364 43.2973 53.1090 65.0320 79.4968 25 1.2824 1.6406 2.0938 2.6658 3.3864 4.291954274 6,6185 8.6231 10.8347 13.5855 17.0001 21.230526461932.9190 40.8742 50.6578 62.6686 77.3881 95.3962 26 1.2953 1.6734 2.1566 2.7725 3.5557 4.5494 5.8074 7.3964 9.3992 11.9182 15.0799 19,0401 23.9905 30.1666 37.8568 474141 59.269773.9490 92.0918 1144755 27 1.3082 1.7069 2.2213 2.8834 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 21.3249 27.1093 34.389943.535355.0004 69.3455 87.2598 109.5893 137 3706 26 1.3213 1.7410 2.2879 2.9987 3.9201 5.1117 6.6488 8.6271 11.1671 14.4210 18.5799 23.8839 30.6335 39.204550.0/656 63.8004 B1.1342 102.9666 130.4112 164.8447 29 1.3345 1.7758 2.3566 3.1187 4.1161 5.4184 7.1143 9.3173 12.1722 15.8631 20.6237 26.7499 34.6158 44.6931 57.575574.0085 94.9271 121.5005 155.1893 197 8136 30 1.3178 1.8114 2.4273 3.2434 4,3219 5.7435 7.6123 10.0627 13.2677 17.4494 22.8923 29.9599 39.1159 50.950266-2118 85.8499 111.0647 143.3706 184.6753 237.3763 40 1.4889 2.2080 3.2620 4.8010 7.0400 10.2857 14.9745 21.7245 31.4094 45.2593 65.000 93.0510 132.7816 188.8835267.8635 378.7212 533.8687 750.3783 1051.668 1469.772 50 1.6446 2.6916 4.3839 7.1067 11,4674 18.4202 29.4570 46.9016 74.3575 117.3909 184.5618 289.0022 450.7359 700.2330 1083.657 1670.704 2566.215 3927 357 5988.914 9100.438