Hello, I was missing info from my last attempt to get help here is everything. I need help with this assignment.

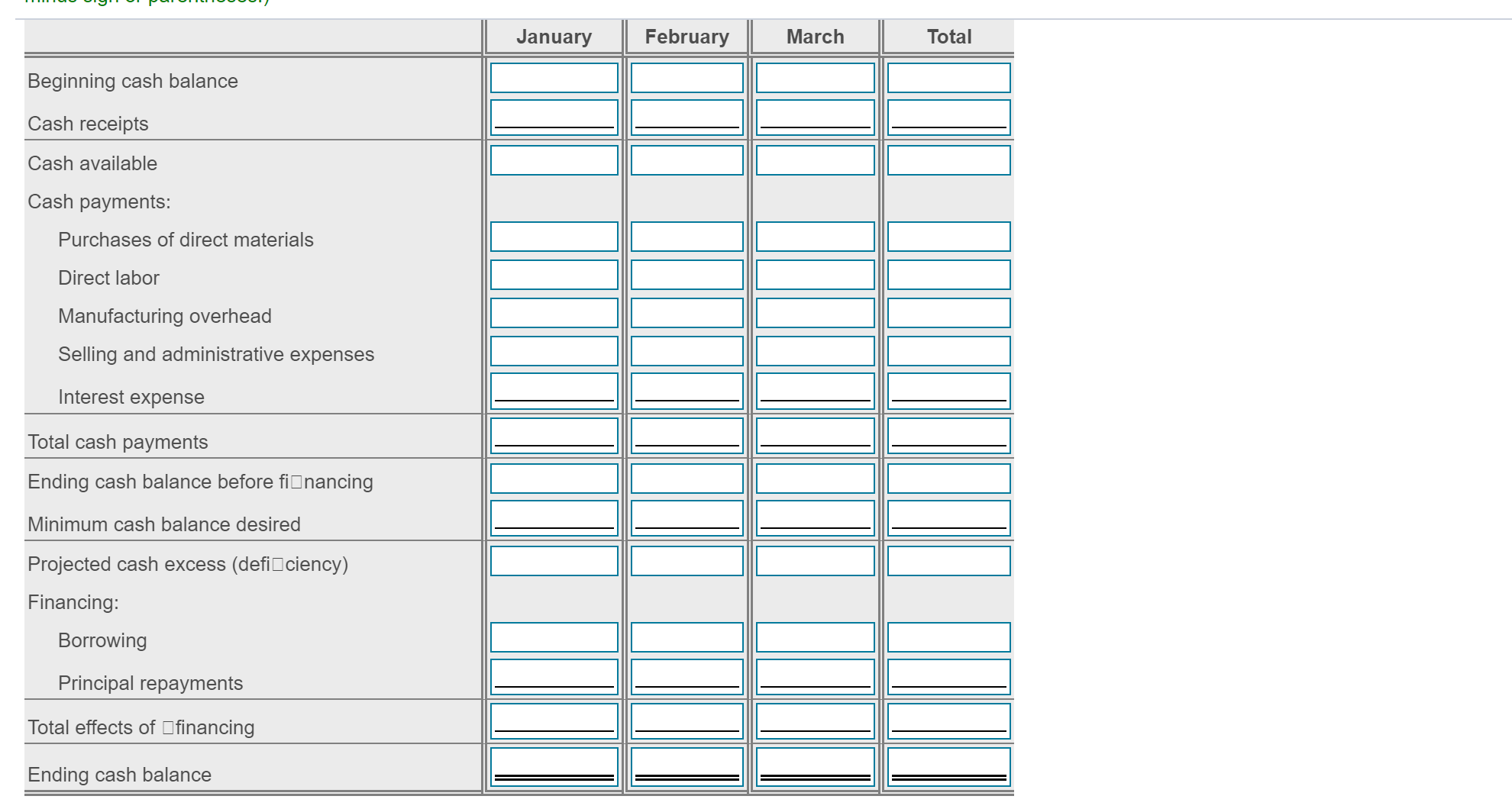

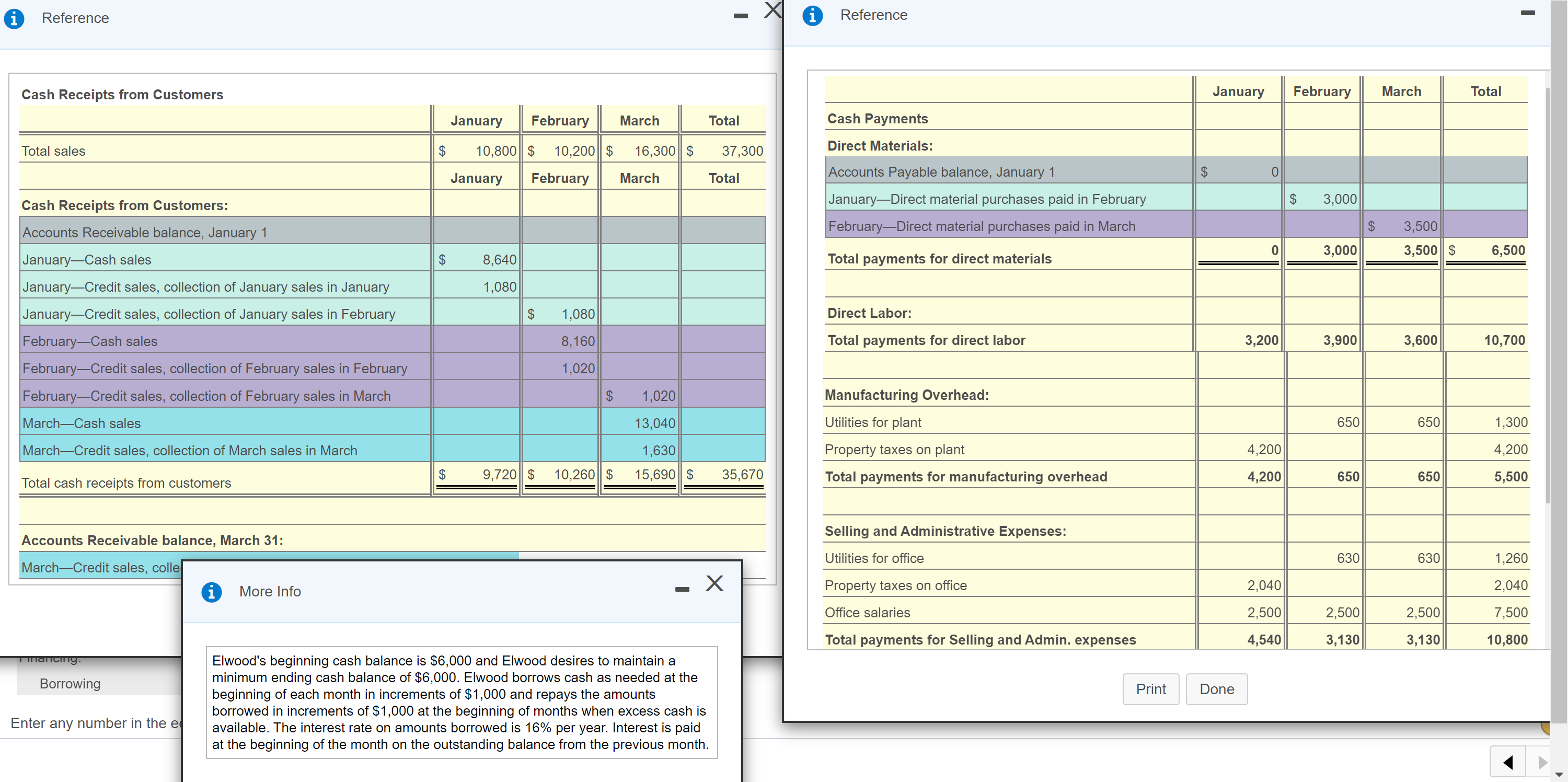

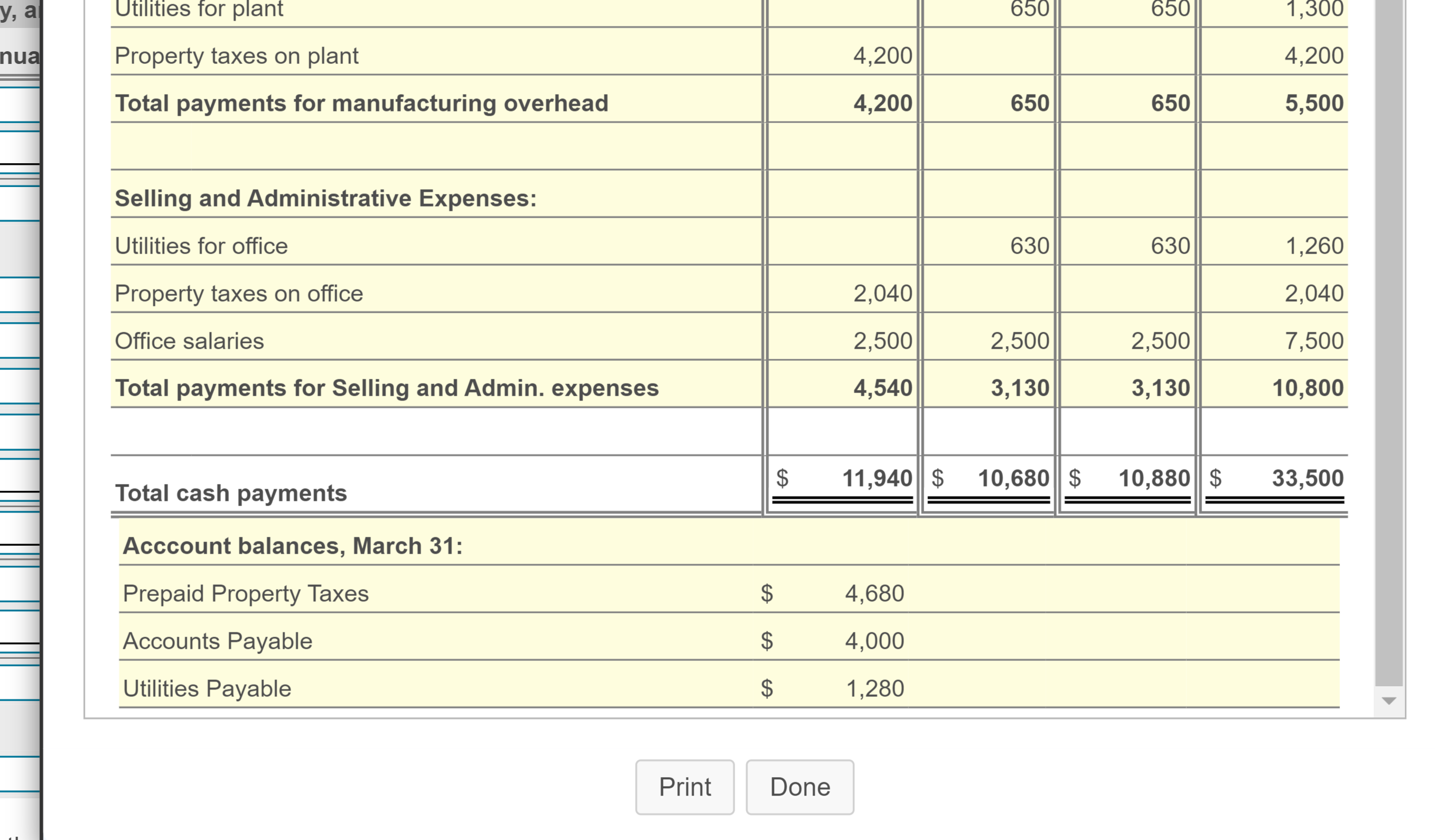

.m- \"3.. c. I._........c_._.-., Beginning cash balance Cash receipts Cash available Cash payments: Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Interest expense Total cash payments Ending cash balance before IZInancing Minimum cash balance desired Projected cash excess (defiElciency) Financing: Borrowing Principal repayments Total effects of Dnancing Ending cash balance 0 Reference - Cash Receipts from Customers January February March Total Total sales $ 10,800 $ 10,200 $ 16,300 $ 37,300 January February I March Total Cash Receipt from Customers: JanuaryCash sales $ 8,640 JanuaryCredit sales, collection of January sales in January 1,080 JanuaryCredit sales, collection of January sales in February $ 1,080 Total cash receipts from customers w w m $ 35'6\") Account Receivable balance, March 31: _ X o More Info Elwood's beginning cash balance is $6.000 and Elwood desires to maintain a minimum ending cash balance of $6,000. Elwood borrows cash as needed at the beginning of each month In Increments of$1.000 and repays the amounts borrowed in increments of $1 ,000 at the beginning of months when excess cash is available The interest rate on amount borrowed is 16% per year. Interest is paid Borrowlng Enter any number in the 0 Reference - January February March Total Cash Payment Direct Materials: JanuaryDirect material purchases paid in Febmary $ 3,000 Tohl payment for direct materials 0 3'000 3'500 $ 6'50\" Direct Labor: Total payment for direct labor 3,200 3,900 3,600 10,100 Manufacturing Overhead: Utilities for plant 650 650 1,300 Property taxes on plant 4,200 4,200 Total payment for manufacturing overhead 4,200 650 650 5,500 Selling and Administrative Expenses: Utilities for ofce 630 630 1,260 Property taxes on ofce 2,040 2,040 Ofce salaries 2,500 2,500 2,500 7,500 Total payment for Selling and Admin. expenses 4.540 3.130 3.130 10.800 at the beginning of the month on the outstanding balance from the previous month. y, a Utilities for plant 650 650 1,300 nua Property taxes on plant 4,200 4,200 Total payments for manufacturing overhead 4,200 650 650 5,500 Selling and Administrative Expenses: Utilities for office 630 630 1,260 Property taxes on office 2,040 2,040 Office salaries 2,500 2,500 2,500 7,500 Total payments for Selling and Admin. expenses 4,540 3,130 3,130 10,800 Total cash payments $ 11,940 $ 10,680 $ 10,880 $ 33,500 Account balances, March 31: Prepaid Property Taxes 4,680 Accounts Payable 4,000 Utilities Payable $ 1,280 Print Done