Hello, If you can help with the blank red problems, and if you have suggestions or corrections on my work, A and B, feel free to suggest corrections. My work is at the bottom.

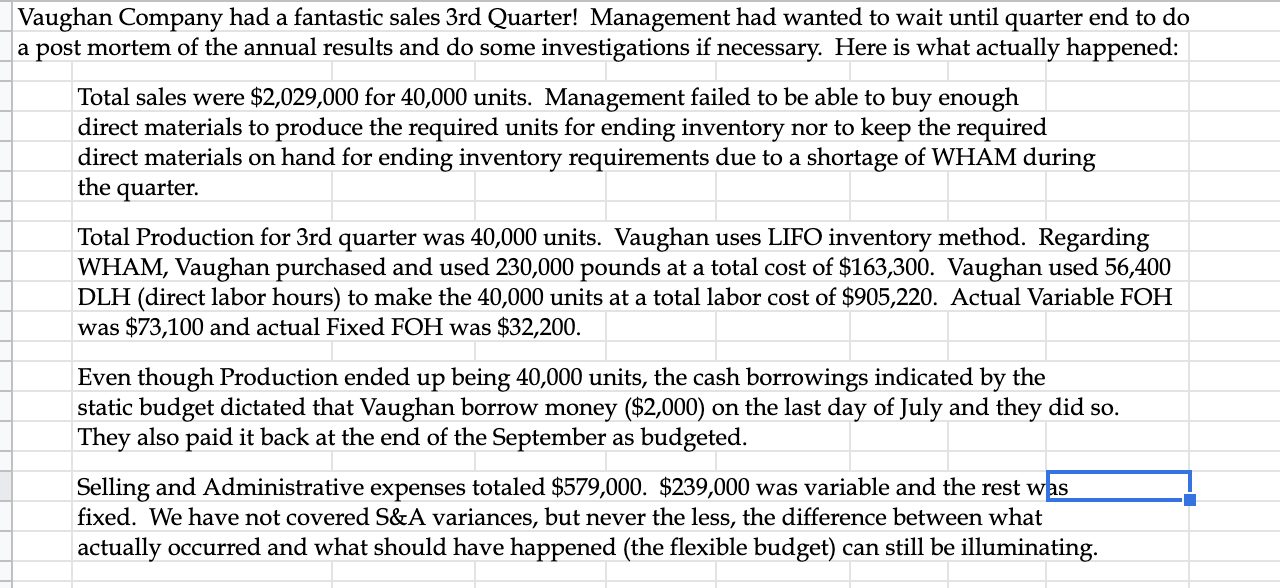

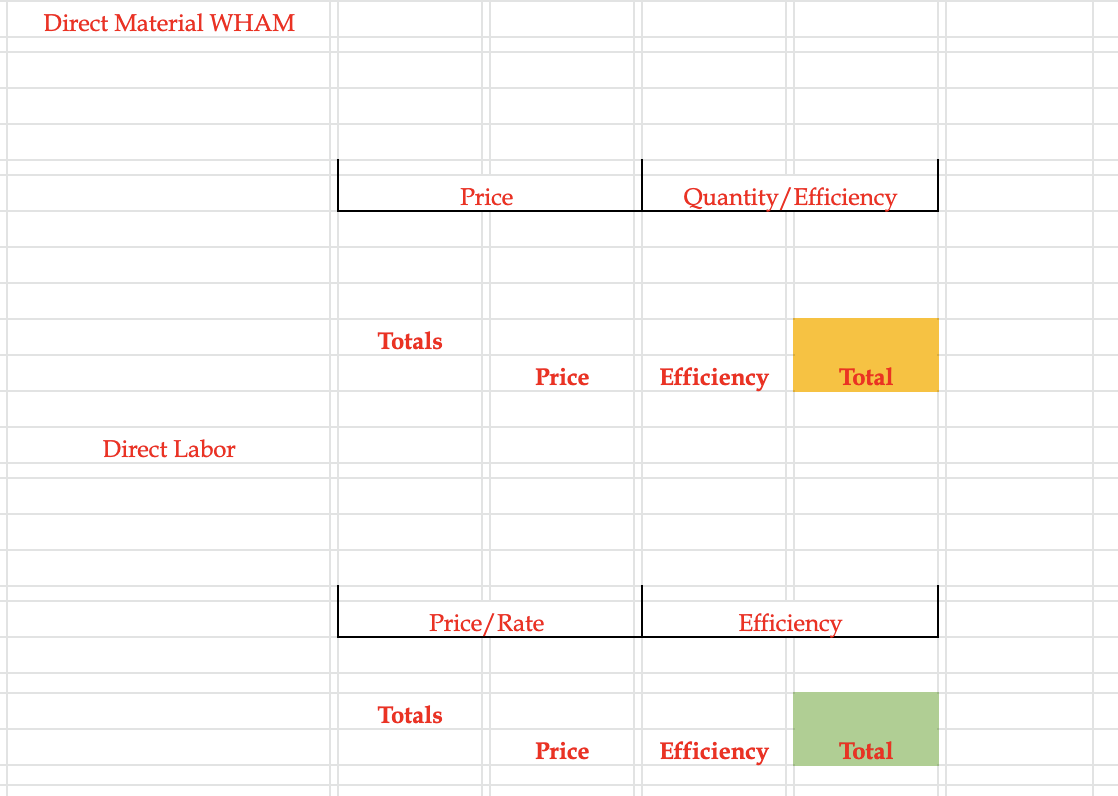

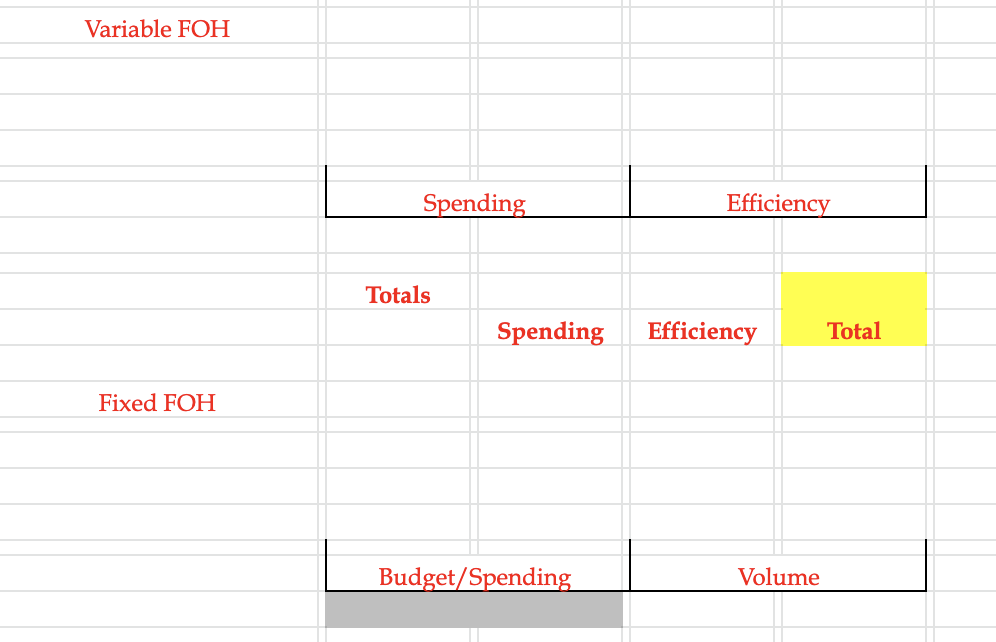

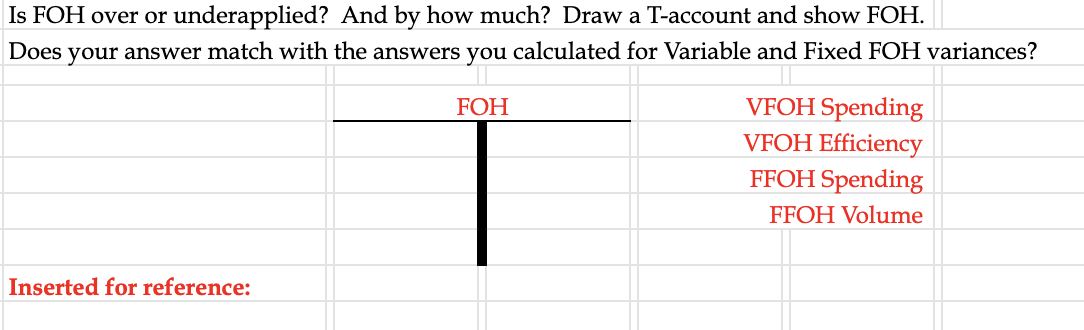

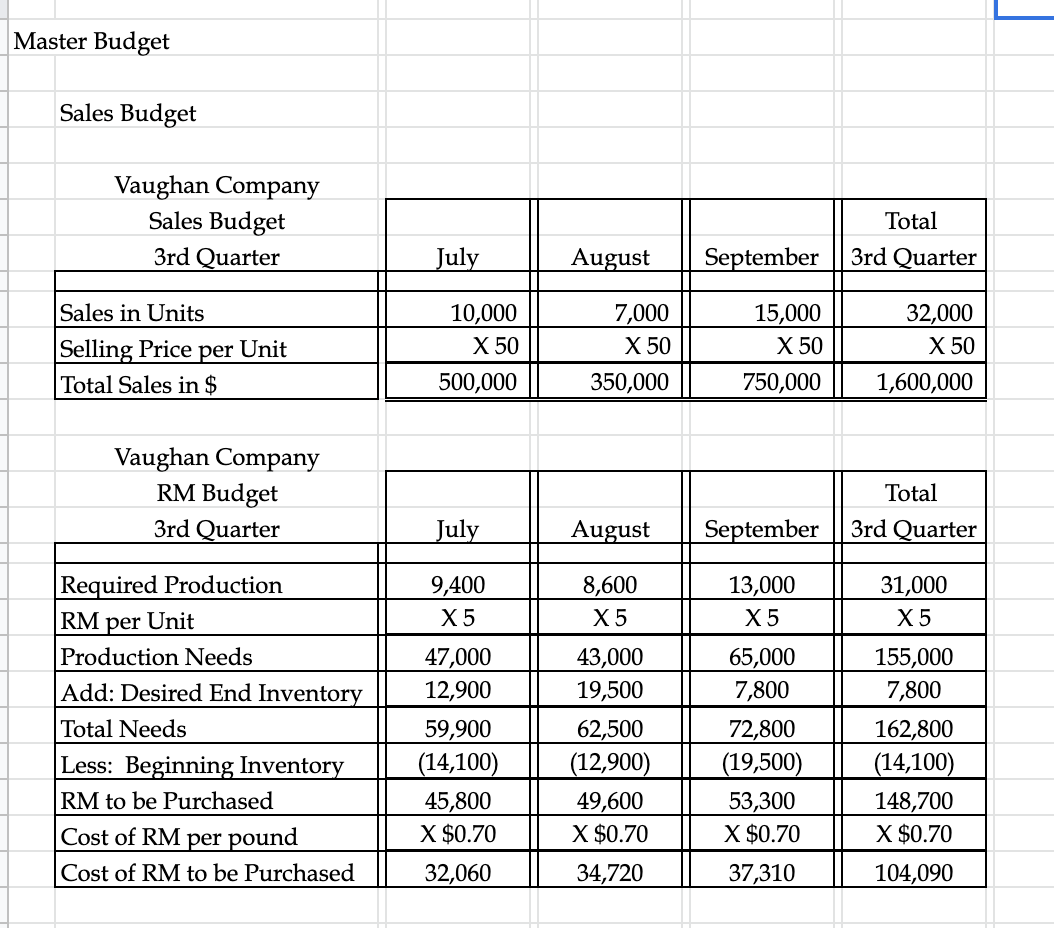

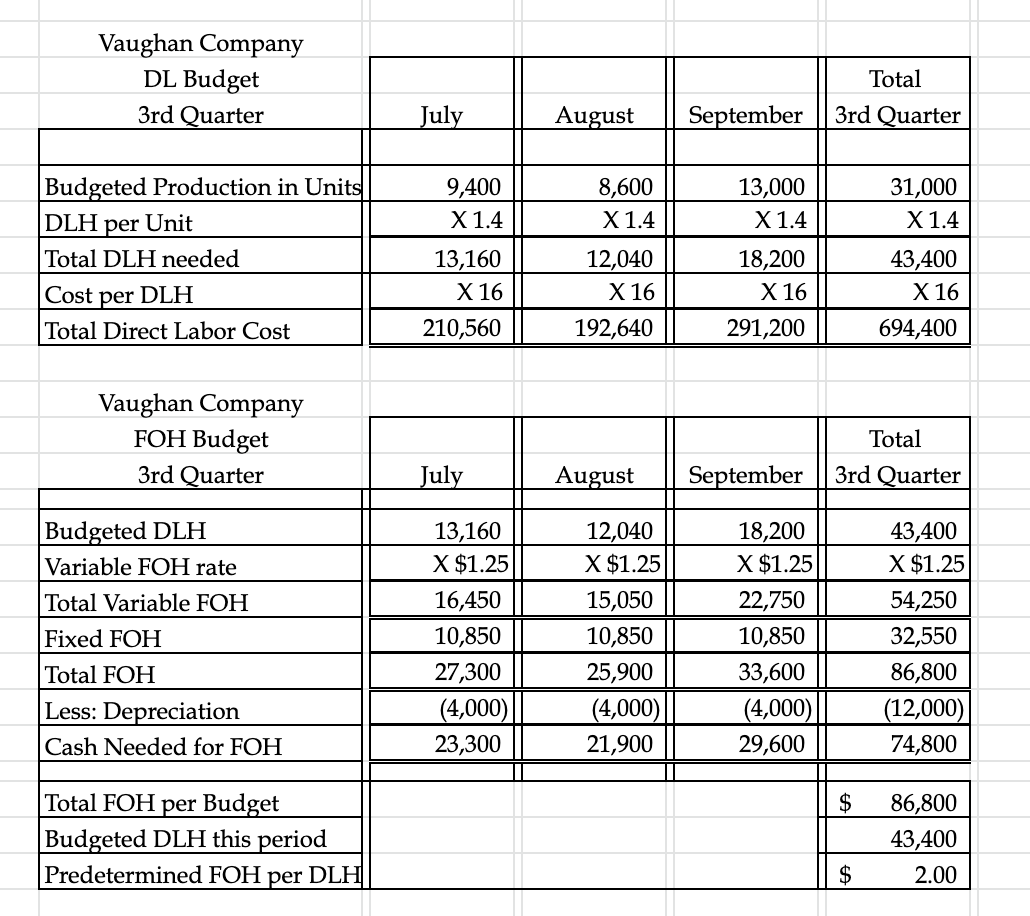

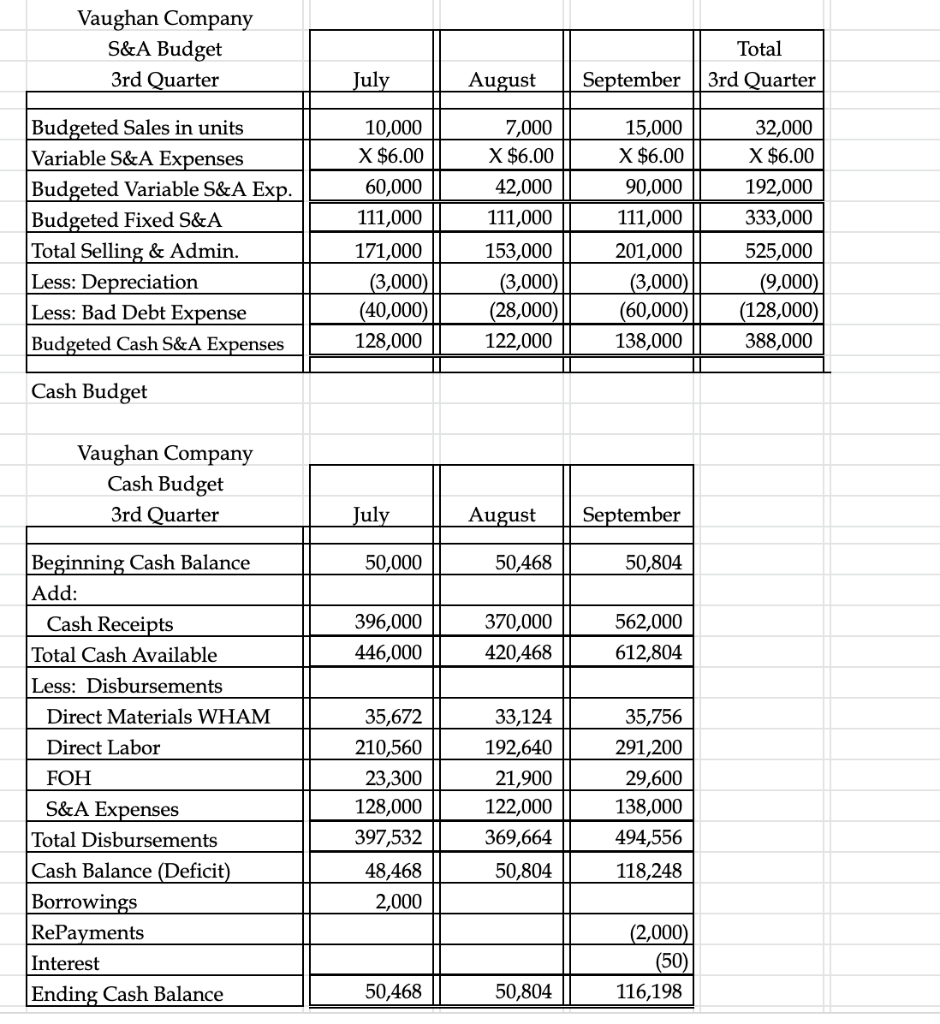

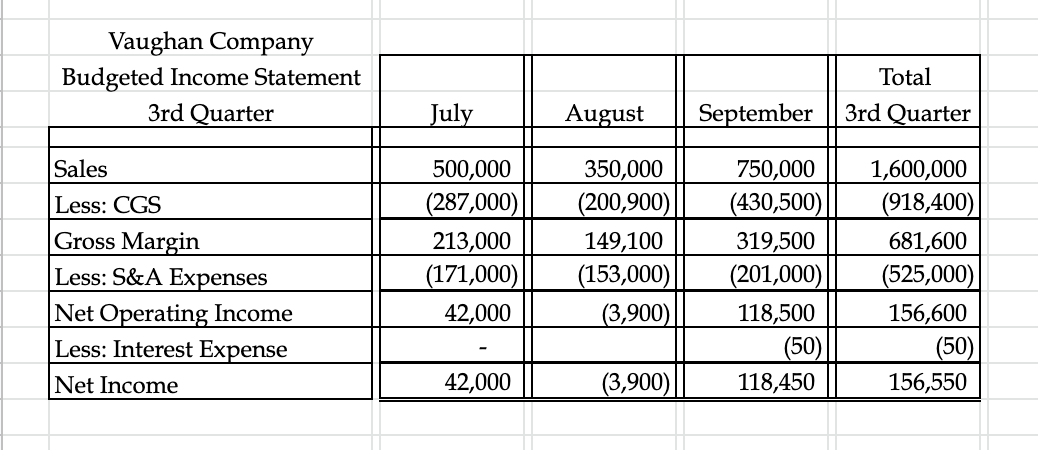

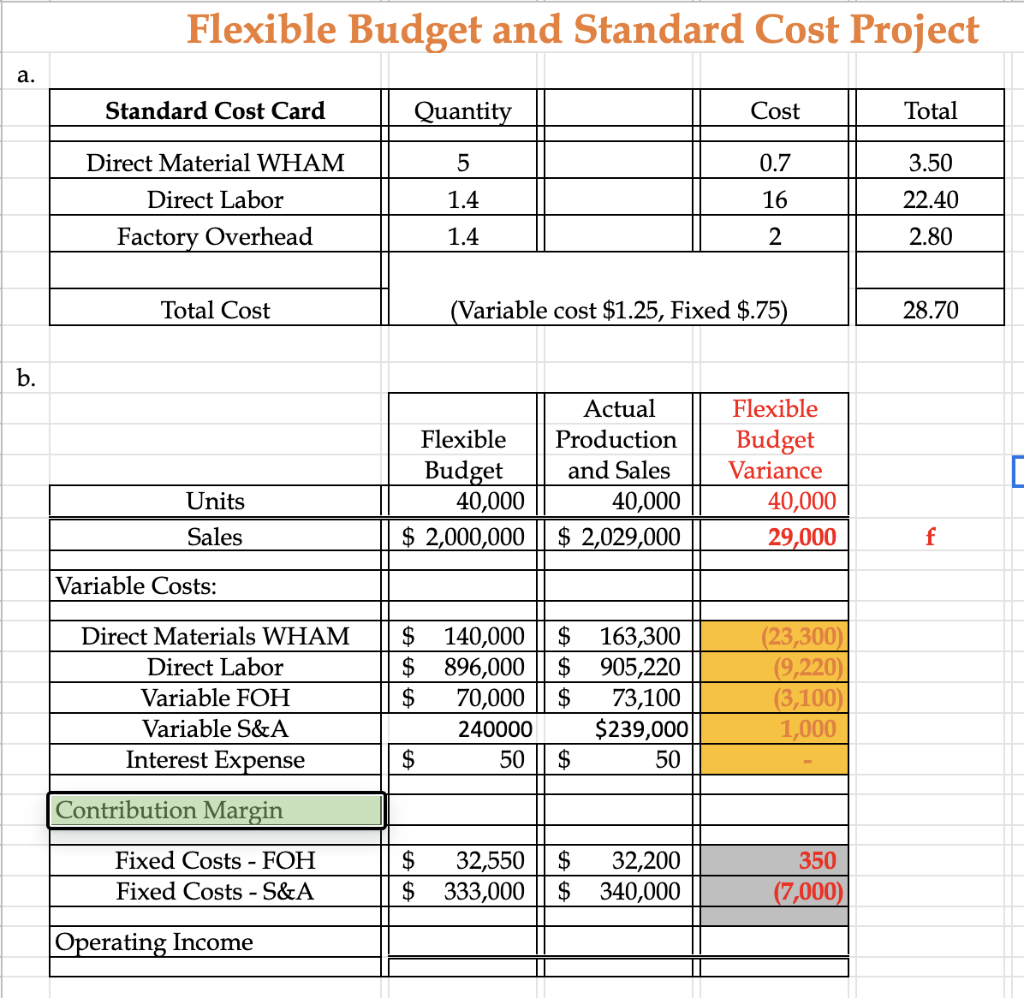

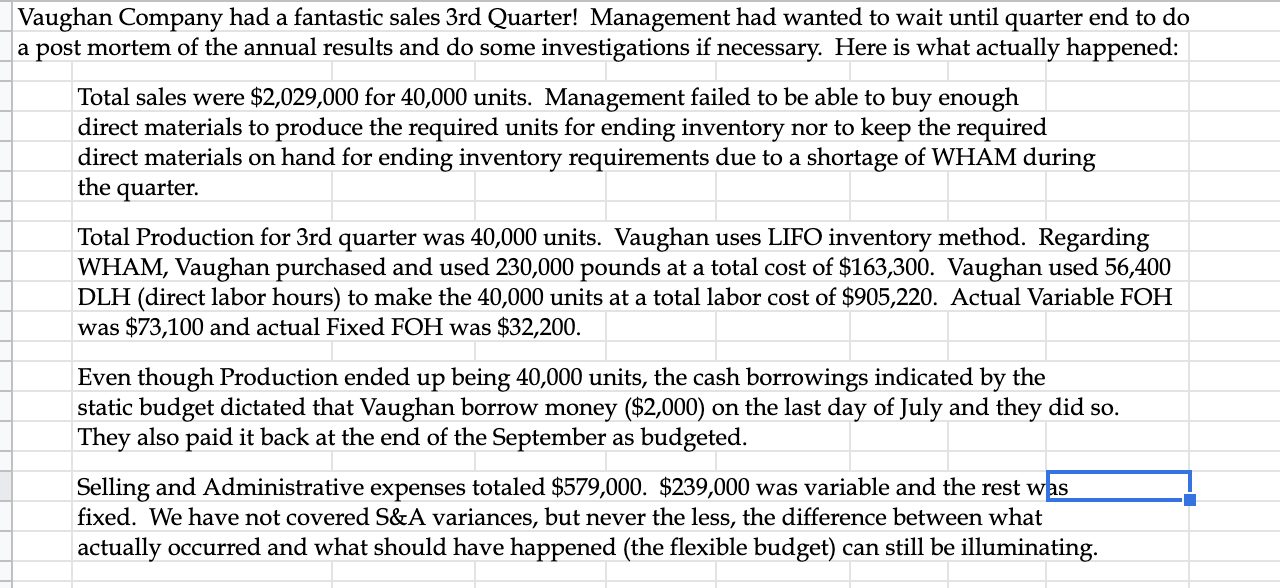

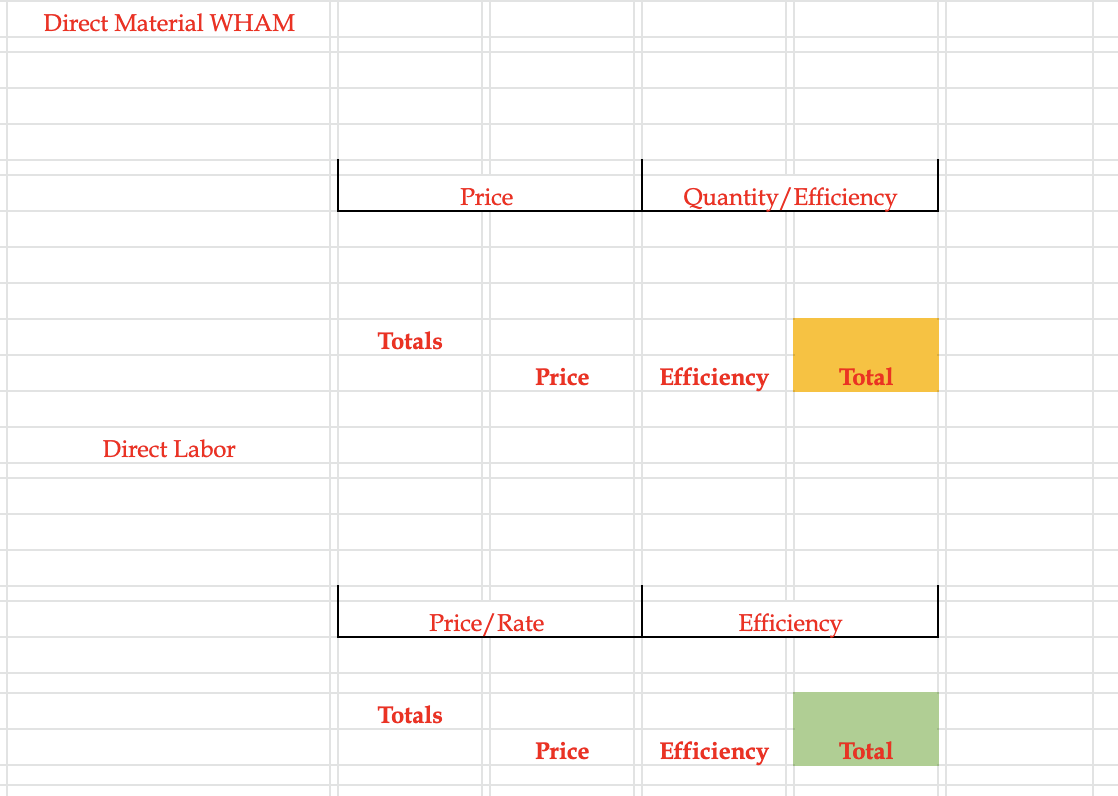

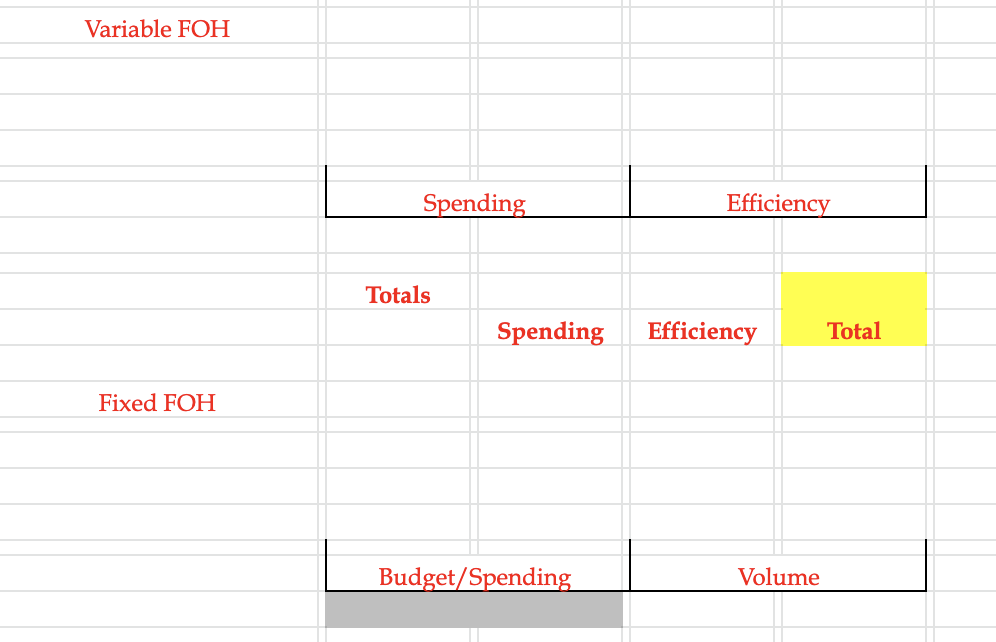

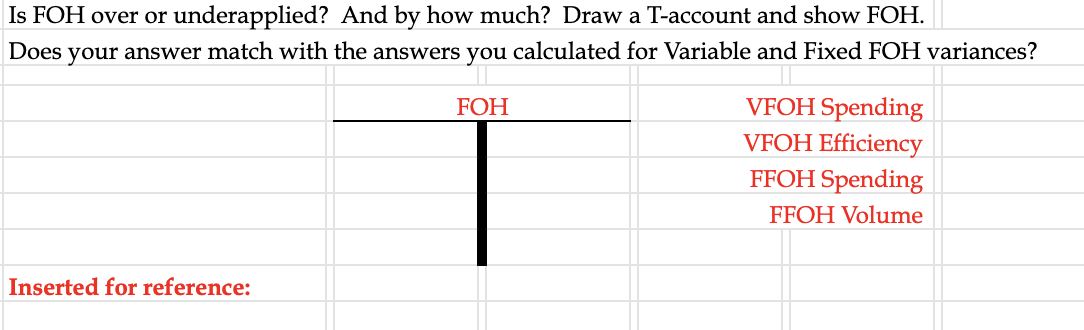

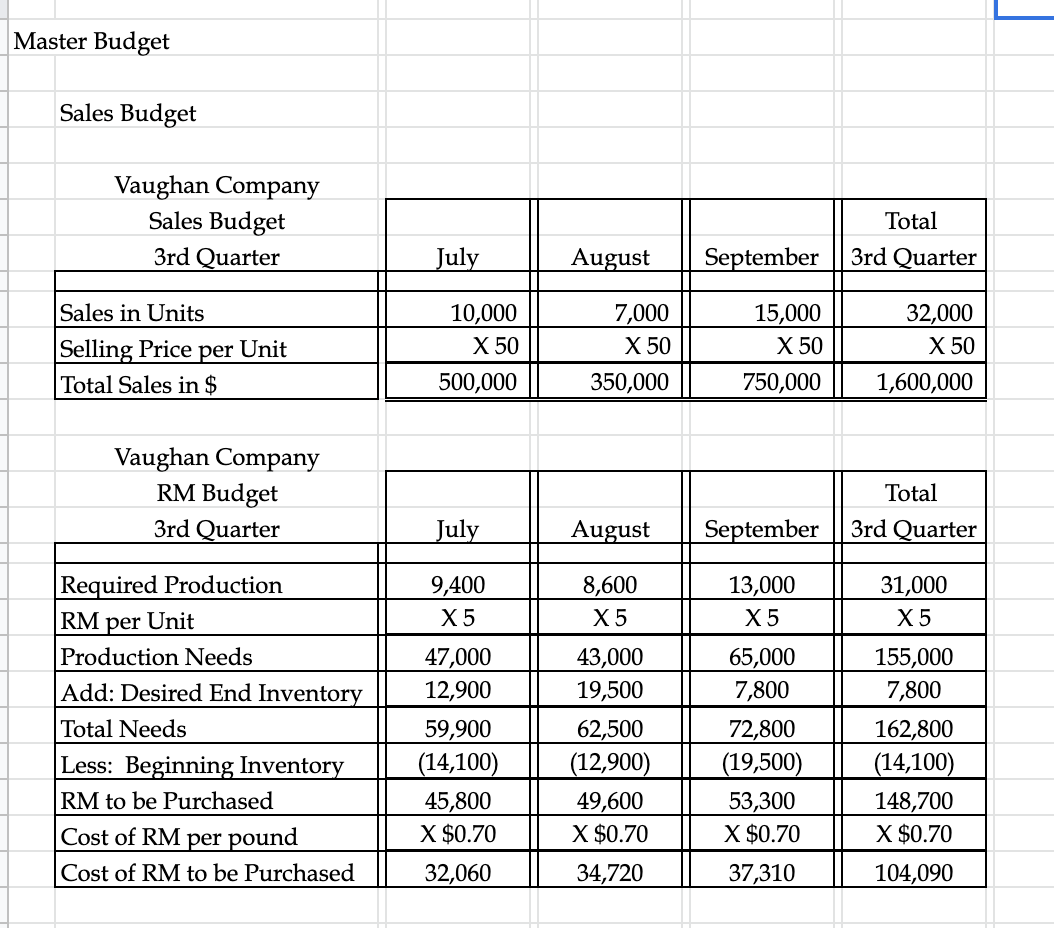

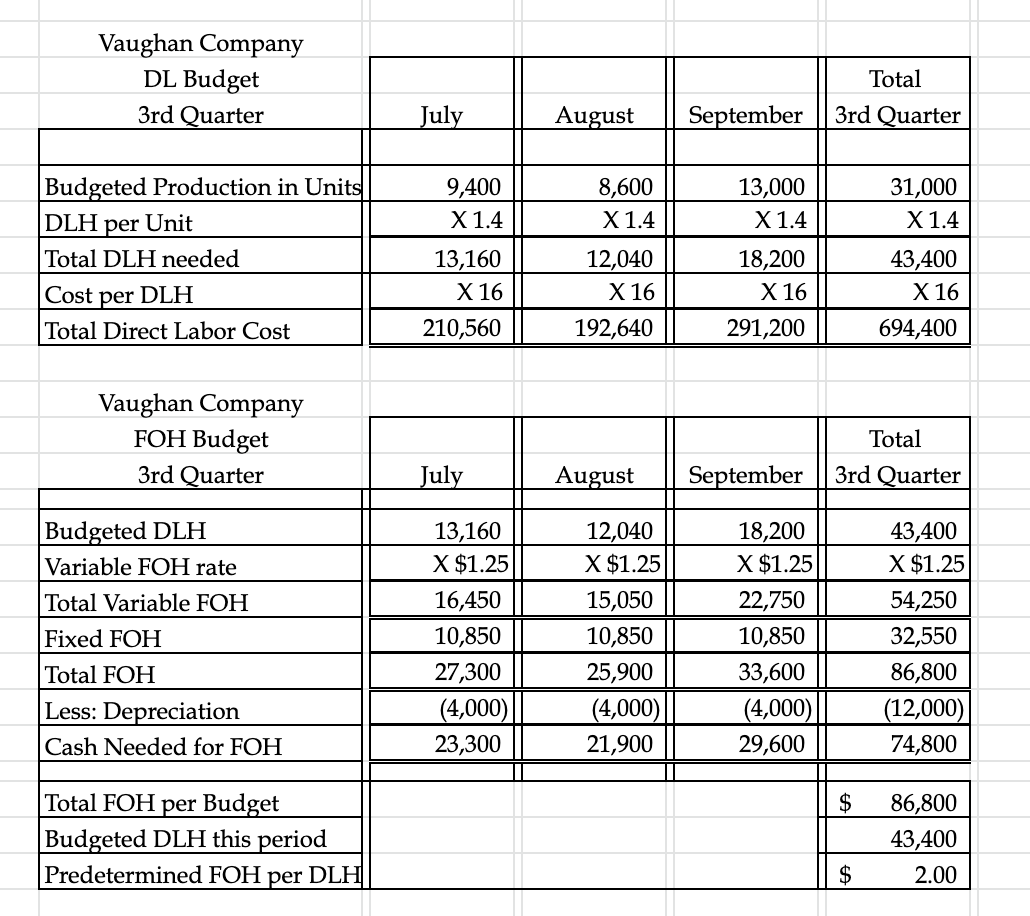

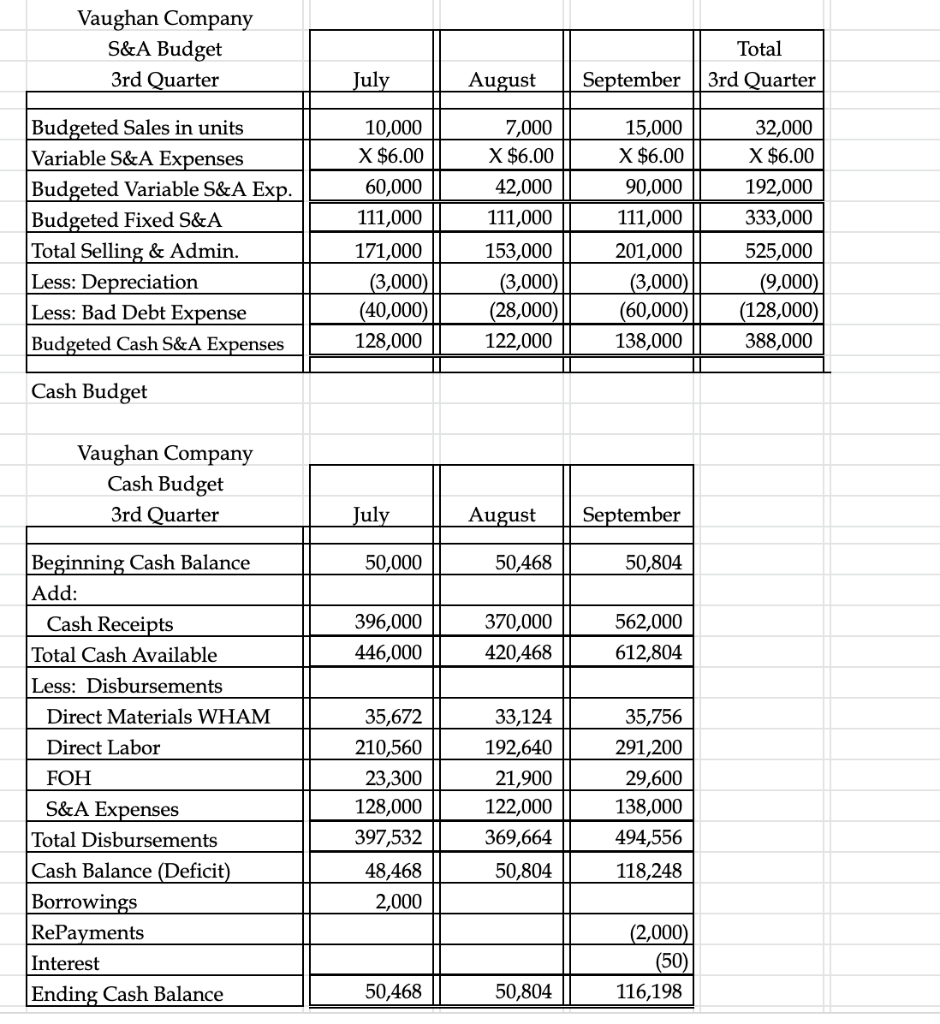

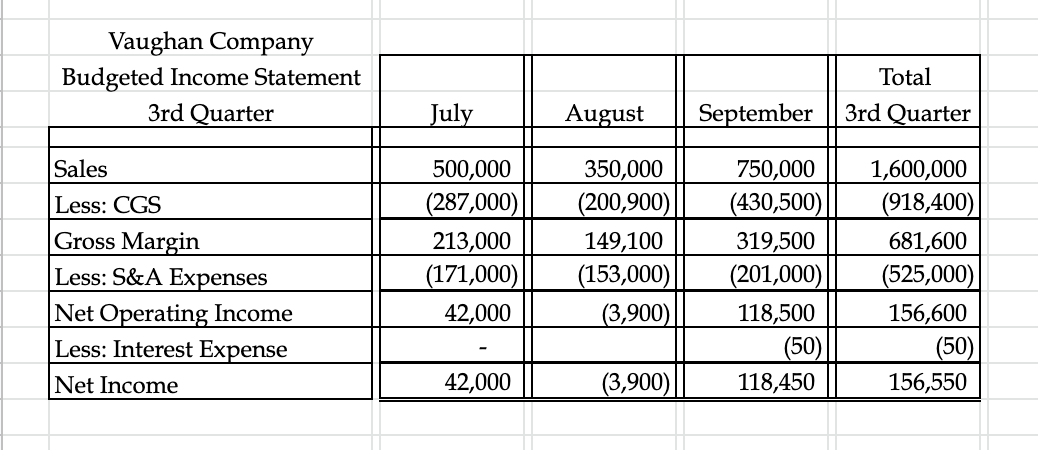

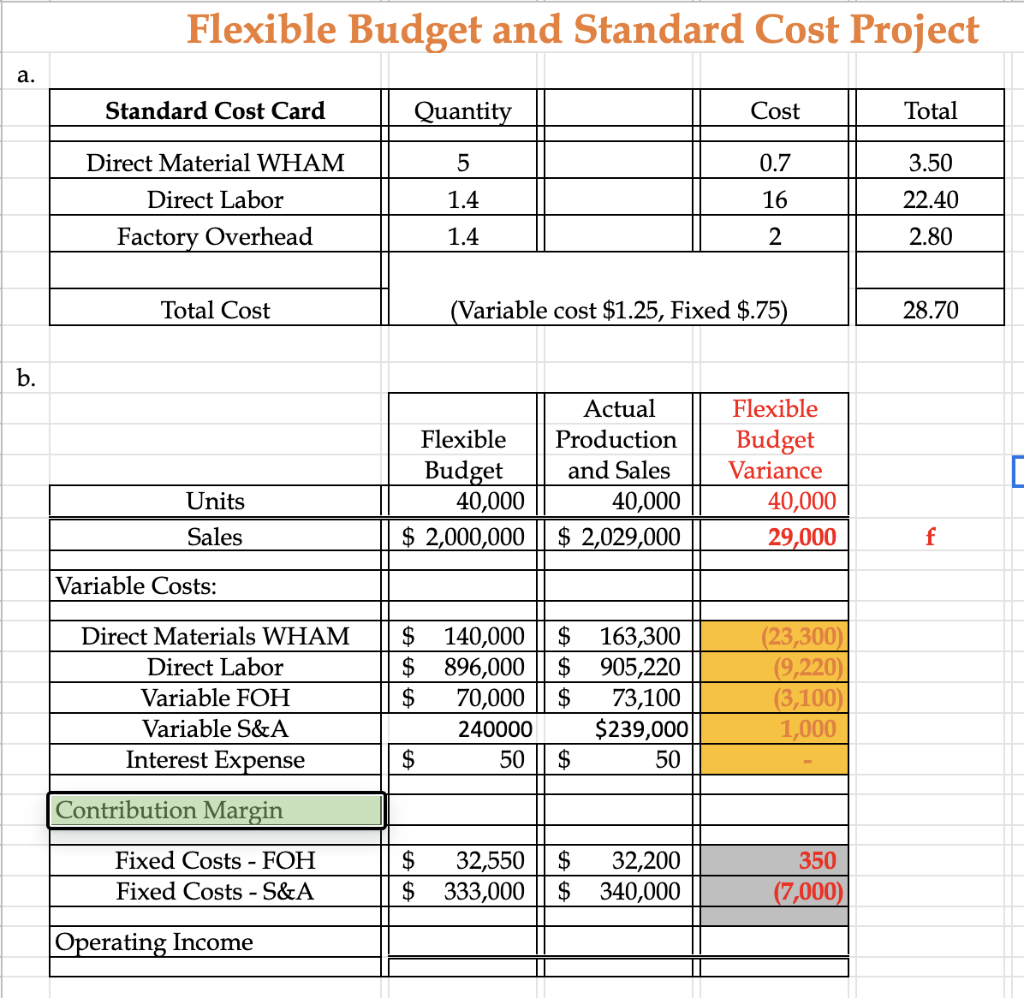

Vaughan Company had a fantastic sales 3rd Quarter! Management had wanted to wait until quarter end to do a post mortem of the annual results and do some investigations if necessary. Here is what actually happened: Total sales were $2,029,000 for 40,000 units. Management failed to be able to buy enough direct materials to produce the required units for ending inventory nor to keep the required direct materials on hand for ending inventory requirements due to a shortage of WHAM during the quarter. Total Production for 3rd quarter was 40,000 units. Vaughan uses LIFO inventory method. Regarding WHAM, Vaughan purchased and used 230,000 pounds at a total cost of $163,300. Vaughan used 56,400 DLH (direct labor hours) to make the 40,000 units at a total labor cost of $905,220. Actual Variable FOH was $73,100 and actual Fixed FOH was $32,200. Even though Production ended up being 40,000 units, the cash borrowings indicated by the static budget dictated that Vaughan borrow money ($2,000) on the last day of July and they did so. They also paid it back at the end of the September as budgeted. Selling and Administrative expenses totaled $579,000. $239,000 was variable and the rest was fixed. We have not covered S&A variances, but never the less, the difference between what actually occurred and what should have happened (the flexible budget) can still be illuminating. Direct Material WHAM Price Quantity/Efficiency Totals Price Efficiency Total Direct Labor Price/Rate Efficiency Totals Price Efficiency Total Variable FOH Spending Efficiency Totals Spending Efficiency Total Fixed FOH Budget/Spending Volume Is FOH over or underapplied? And by how much? Draw a T-account and show FOH. Does your answer match with the answers you calculated for Variable and Fixed FOH variances? FOH 1 VFOH Spending VFOH Efficiency FFOH Spending FFOH Volume Inserted for reference: Master Budget Sales Budget Vaughan Company Sales Budget 3rd Quarter Total July August September 3rd Quarter Sales in Units Selling Price per Unit Total Sales in $ 10,000 X 50 500,000 7,000 X 50 15,000 X 50 750,000 32,000 X 50 1,600,000 350,000 Vaughan Company RM Budget 3rd Quarter Total 3rd Quarter July August September 9,400 X 5 8,600 X 5 13,000 X 5 31,000 X 5 43,000 19,500 65,000 7,800 Required Production RM per Unit Production Needs Add: Desired End Inventory Total Needs Less: Beginning Inventory RM to be purchased Cost of RM per pound Cost of RM to be Purchased 47,000 12,900 59,900 (14,100) 45,800 X $0.70 32,060 62,500 (12,900) 49,600 X $0.70 72,800 (19,500) 53,300 X $0.70 155,000 7,800 162,800 (14,100) 148,700 X $0.70 34,720 37,310 104,090 Vaughan Company DL Budget 3rd Quarter Total July August September 3rd Quarter 9,400 X 1.4 8,600 X 1.4 13,000 X 1.4 31,000 X 1.4 Budgeted Production in Units DLH per Unit Total DLH needed Cost per DLH Total Direct Labor Cost 13,160 X 16 210,560 12,040 X 16 192,640 18,200 X 16 291,200 43,400 X 16 694,400 Vaughan Company FOH Budget 3rd Quarter Total July August September 3rd Quarter 18,200 X $1.25 Budgeted DLH Variable FOH rate Total Variable FOH Fixed FOH Total FOH Less: Depreciation Cash Needed for FOH 13,160 X $1.25 16,450 10,850 27,300 (4,000) 23,300 12,040 X $1.25 15,050 10,850 25,900 (4,000) 21,900 22,750 10,850 33,600 (4,000) 29,600 43,400 X $1.25 54,250 32,550 86,800 (12,000) 74,800 $ Total FOH per Budget Budgeted DLH this period Predetermined FOH per DLH 86,800 43,400 2.00 $ Vaughan Company S&A Budget 3rd Quarter Total 3rd Quarter July August September 15,000 X $6.00 90,000 111,000 Budgeted Sales in units Variable S&A Expenses Budgeted Variable S&A Exp. Budgeted Fixed S&A Total Selling & Admin. Less: Depreciation Less: Bad Debt Expense Budgeted Cash S&A Expenses 10,000 X $6.00 60,000 111,000 171,000 (3,000) (40,000) 128,000 7,000 X $6.00 42,000 111,000 153,000 (3,000) (28,000) 122,000 32,000 X $6.00 192,000 333,000 525,000 (9,000) (128,000)| 388,000 201,000 (3,000) (60,000) 138,000 Cash Budget Vaughan Company Cash Budget 3rd Quarter July August September 50,000 50,468 50,804 396,000 446,000 370,000 420,468 562,000 612,804 Beginning Cash Balance Add: Cash Receipts Total Cash Available Less: Disbursements Direct Materials WHAM Direct Labor FOH S&A Expenses Total Disbursements Cash Balance (Deficit) Borrowings RePayments Interest Ending Cash Balance 35,672 210,560 23,300 128,000 397,532 48,468 2,000 33,124 192,640 21,900 122,000 369,664 50,804 35,756 291,200 29,600 138,000 494,556 118,248 (2,000 (50) 116,198 50,468 50,804 Vaughan Company Budgeted Income Statement 3rd Quarter Total July August September 3rd Quarter Sales Less: CGS Gross Margin Less: S&A Expenses Net Operating Income Less: Interest Expense Net Income 500,000 (287,000)| 213,000 (171,000) 42,000 350,000 (200,900) 149,100 (153,000) (3,900 750,000 (430,500) 319,500 (201,000) 118,500 (50) 118,450 1,600,000 (918,400) 681,600 (525,000) 156,600 (50) 156,550 42,000 (3,900) Flexible Budget and Standard Cost Project a. Standard Cost Card Quantity Cost Total 5 0.7 3.50 Direct Material WHAM Direct Labor Factory Overhead 1.4 16 22.40 1.4 2 2.80 Total Cost (Variable cost $1.25, Fixed $.75) 28.70 b. Actual Production and Sales 40,000 $ 2,029,000 Flexible Budget 40,000 $ 2,000,000 Flexible Budget Variance 40,000 29,000 Units Sales f Variable Costs: Direct Materials WHAM Direct Labor Variable FOH Variable S&A Interest Expense $ 140,000 $ 163,300 $ 896,000 || $ 905,220 $ 70,000 $ 73,100 240000 $239,000 $ 50 $ 50 (23,300) (9,220) (3,100) 1,000 Contribution Margin Fixed Costs - FOH Fixed Costs - S&A $ 32,550 $ 333,000 $ 32,200 $ 340,000 350 (7,000) Operating Income Vaughan Company had a fantastic sales 3rd Quarter! Management had wanted to wait until quarter end to do a post mortem of the annual results and do some investigations if necessary. Here is what actually happened: Total sales were $2,029,000 for 40,000 units. Management failed to be able to buy enough direct materials to produce the required units for ending inventory nor to keep the required direct materials on hand for ending inventory requirements due to a shortage of WHAM during the quarter. Total Production for 3rd quarter was 40,000 units. Vaughan uses LIFO inventory method. Regarding WHAM, Vaughan purchased and used 230,000 pounds at a total cost of $163,300. Vaughan used 56,400 DLH (direct labor hours) to make the 40,000 units at a total labor cost of $905,220. Actual Variable FOH was $73,100 and actual Fixed FOH was $32,200. Even though Production ended up being 40,000 units, the cash borrowings indicated by the static budget dictated that Vaughan borrow money ($2,000) on the last day of July and they did so. They also paid it back at the end of the September as budgeted. Selling and Administrative expenses totaled $579,000. $239,000 was variable and the rest was fixed. We have not covered S&A variances, but never the less, the difference between what actually occurred and what should have happened (the flexible budget) can still be illuminating. Direct Material WHAM Price Quantity/Efficiency Totals Price Efficiency Total Direct Labor Price/Rate Efficiency Totals Price Efficiency Total Variable FOH Spending Efficiency Totals Spending Efficiency Total Fixed FOH Budget/Spending Volume Is FOH over or underapplied? And by how much? Draw a T-account and show FOH. Does your answer match with the answers you calculated for Variable and Fixed FOH variances? FOH 1 VFOH Spending VFOH Efficiency FFOH Spending FFOH Volume Inserted for reference: Master Budget Sales Budget Vaughan Company Sales Budget 3rd Quarter Total July August September 3rd Quarter Sales in Units Selling Price per Unit Total Sales in $ 10,000 X 50 500,000 7,000 X 50 15,000 X 50 750,000 32,000 X 50 1,600,000 350,000 Vaughan Company RM Budget 3rd Quarter Total 3rd Quarter July August September 9,400 X 5 8,600 X 5 13,000 X 5 31,000 X 5 43,000 19,500 65,000 7,800 Required Production RM per Unit Production Needs Add: Desired End Inventory Total Needs Less: Beginning Inventory RM to be purchased Cost of RM per pound Cost of RM to be Purchased 47,000 12,900 59,900 (14,100) 45,800 X $0.70 32,060 62,500 (12,900) 49,600 X $0.70 72,800 (19,500) 53,300 X $0.70 155,000 7,800 162,800 (14,100) 148,700 X $0.70 34,720 37,310 104,090 Vaughan Company DL Budget 3rd Quarter Total July August September 3rd Quarter 9,400 X 1.4 8,600 X 1.4 13,000 X 1.4 31,000 X 1.4 Budgeted Production in Units DLH per Unit Total DLH needed Cost per DLH Total Direct Labor Cost 13,160 X 16 210,560 12,040 X 16 192,640 18,200 X 16 291,200 43,400 X 16 694,400 Vaughan Company FOH Budget 3rd Quarter Total July August September 3rd Quarter 18,200 X $1.25 Budgeted DLH Variable FOH rate Total Variable FOH Fixed FOH Total FOH Less: Depreciation Cash Needed for FOH 13,160 X $1.25 16,450 10,850 27,300 (4,000) 23,300 12,040 X $1.25 15,050 10,850 25,900 (4,000) 21,900 22,750 10,850 33,600 (4,000) 29,600 43,400 X $1.25 54,250 32,550 86,800 (12,000) 74,800 $ Total FOH per Budget Budgeted DLH this period Predetermined FOH per DLH 86,800 43,400 2.00 $ Vaughan Company S&A Budget 3rd Quarter Total 3rd Quarter July August September 15,000 X $6.00 90,000 111,000 Budgeted Sales in units Variable S&A Expenses Budgeted Variable S&A Exp. Budgeted Fixed S&A Total Selling & Admin. Less: Depreciation Less: Bad Debt Expense Budgeted Cash S&A Expenses 10,000 X $6.00 60,000 111,000 171,000 (3,000) (40,000) 128,000 7,000 X $6.00 42,000 111,000 153,000 (3,000) (28,000) 122,000 32,000 X $6.00 192,000 333,000 525,000 (9,000) (128,000)| 388,000 201,000 (3,000) (60,000) 138,000 Cash Budget Vaughan Company Cash Budget 3rd Quarter July August September 50,000 50,468 50,804 396,000 446,000 370,000 420,468 562,000 612,804 Beginning Cash Balance Add: Cash Receipts Total Cash Available Less: Disbursements Direct Materials WHAM Direct Labor FOH S&A Expenses Total Disbursements Cash Balance (Deficit) Borrowings RePayments Interest Ending Cash Balance 35,672 210,560 23,300 128,000 397,532 48,468 2,000 33,124 192,640 21,900 122,000 369,664 50,804 35,756 291,200 29,600 138,000 494,556 118,248 (2,000 (50) 116,198 50,468 50,804 Vaughan Company Budgeted Income Statement 3rd Quarter Total July August September 3rd Quarter Sales Less: CGS Gross Margin Less: S&A Expenses Net Operating Income Less: Interest Expense Net Income 500,000 (287,000)| 213,000 (171,000) 42,000 350,000 (200,900) 149,100 (153,000) (3,900 750,000 (430,500) 319,500 (201,000) 118,500 (50) 118,450 1,600,000 (918,400) 681,600 (525,000) 156,600 (50) 156,550 42,000 (3,900) Flexible Budget and Standard Cost Project a. Standard Cost Card Quantity Cost Total 5 0.7 3.50 Direct Material WHAM Direct Labor Factory Overhead 1.4 16 22.40 1.4 2 2.80 Total Cost (Variable cost $1.25, Fixed $.75) 28.70 b. Actual Production and Sales 40,000 $ 2,029,000 Flexible Budget 40,000 $ 2,000,000 Flexible Budget Variance 40,000 29,000 Units Sales f Variable Costs: Direct Materials WHAM Direct Labor Variable FOH Variable S&A Interest Expense $ 140,000 $ 163,300 $ 896,000 || $ 905,220 $ 70,000 $ 73,100 240000 $239,000 $ 50 $ 50 (23,300) (9,220) (3,100) 1,000 Contribution Margin Fixed Costs - FOH Fixed Costs - S&A $ 32,550 $ 333,000 $ 32,200 $ 340,000 350 (7,000) Operating Income