Hello,

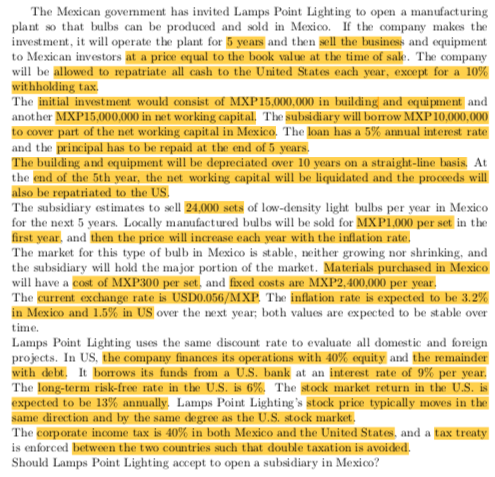

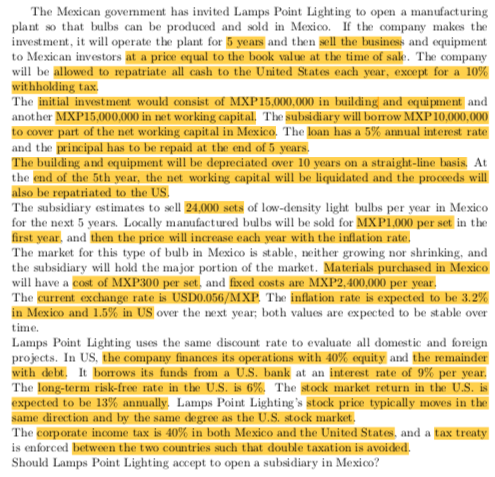

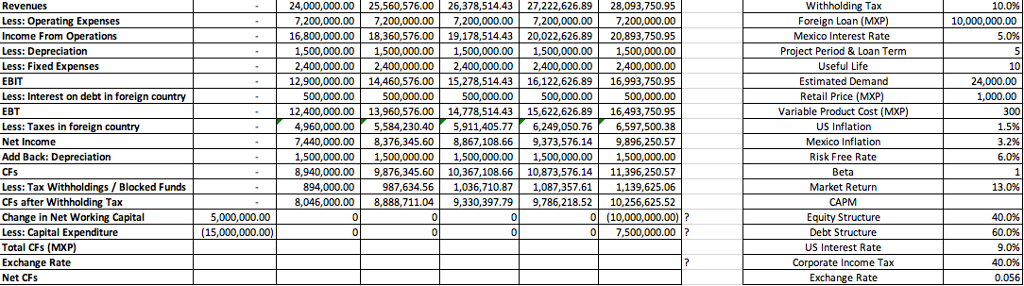

If you could please check my work using the following template I used and paying particularly close attention to the rows with the question marks by them, that would be much appreciated.

Thank you in advance for your help!

The Mexican govemment has invited Lamps Point Lighting to open a manufacturing plant so that bulbs can be produced and sold in Mexo. the company makes the investment, it will operate the plant for 5 years and then sell the business and equipment to Mexican investors at a price equal to the book value at the time of sale. The company will be allowed to repatriate all cash to the United States each year, except for a 10% wit hholding tax. The initial investment would consist of MXP15.000,000 in building and equipment and another MXP15,000,000 in net working capital The subsidiary will borrow MXP10,000,000 to cover part of the net working capital in Mexico The loan has a 5% annual interest rate and the principal has to be repaid at the end of 5 years. The building and equipment will be depreciated over 10 years on a straight-line basis At the end of the 5th year, the net working capital will be liquidated and the proceeds will also be repatriated to the US The subsidiary estimates to sell 24,000 sets of low-density light bulbs per year in Mexico for the next 5 years. Locally manufactured bulbs will be sold for MX.P1,000 per set in the first year., and then the price will increase each year with the inflation rate, The market for this type of bulb in Mexioo is stable, nergrowing nor shrinking, and the subsidiary will hold the major portion of the market. Materials purchased in Mexico will have a cost of MXP300 per set, and fixed costs are MXP2,400,000 per year The current exchange rate is USD0.056/MXP. The inflation rate is expected to be 3.2% in Mexico and 1.5% in US over the next year: both values are expected to be stable over time Lamps Point Lighting uses the same disoount rate to evaluate all domestic and foreign projects. In US the company finances its operations with 40% equity and the remainder with debt. It borrows its funds from a U.S. bank at an interest rate of 9% per year. The long-term risk-free rate in the US, is 6%. The stock market return in the US, is expected to be 13% annually, Lamps Point Lighting stock price typically moves in the same direction and by the same degree as the U.S. stock market. The corporate inonne tax is 40% in both Mexico and the United States, and a tax treaty is enforced between the two countries such that double taxation is avoided Should Lamps Point Lighting accept to open a subsidiary in Mexico