Answered step by step

Verified Expert Solution

Question

1 Approved Answer

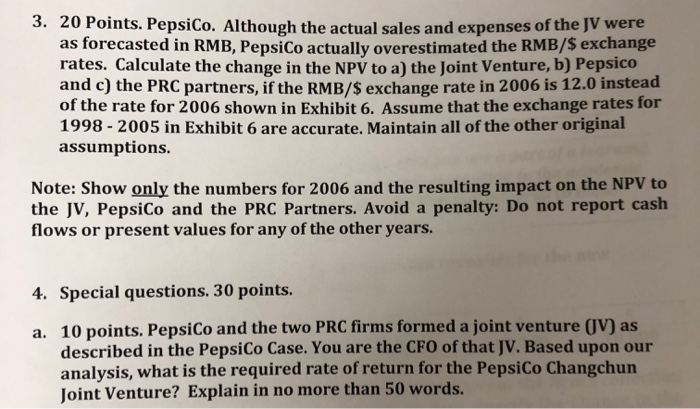

Hello, If you could please help me answer Question 3 Question 4 part a, that would be much appreciated. The homework assignment is due within

Hello,

If you could please help me answer Question 3 Question 4 part a, that would be much appreciated. The homework assignment is due within the next hour, so your help would be a life-saver. No additional information other than what is provided below was given. Thank you in advance, and I promise to give a great review!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started