Question

Hello. I'm a bit confused as to the non-controlling interest, pre-acquisitioon consolidated journal entry for a question I have. Eno paid $1,200,000 for the 70

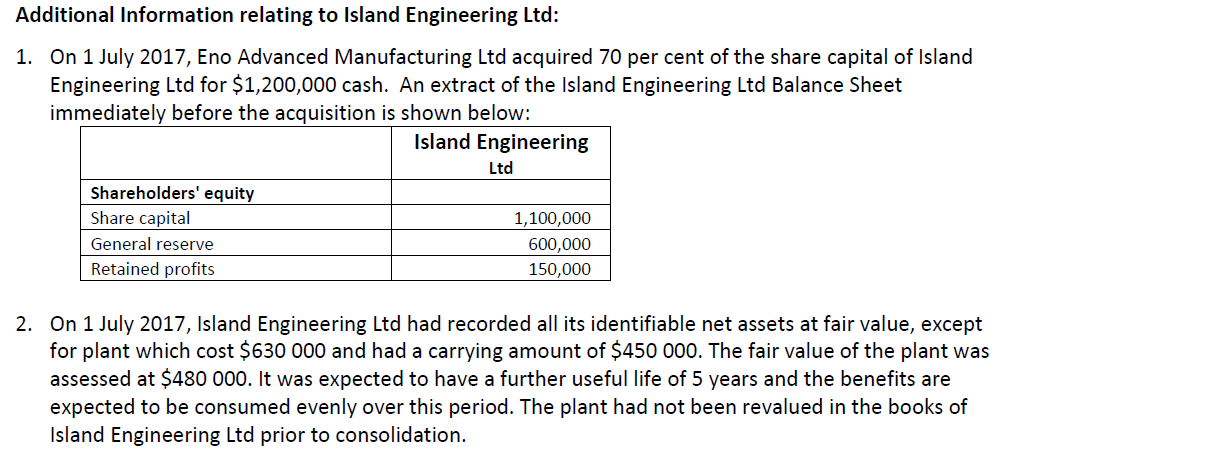

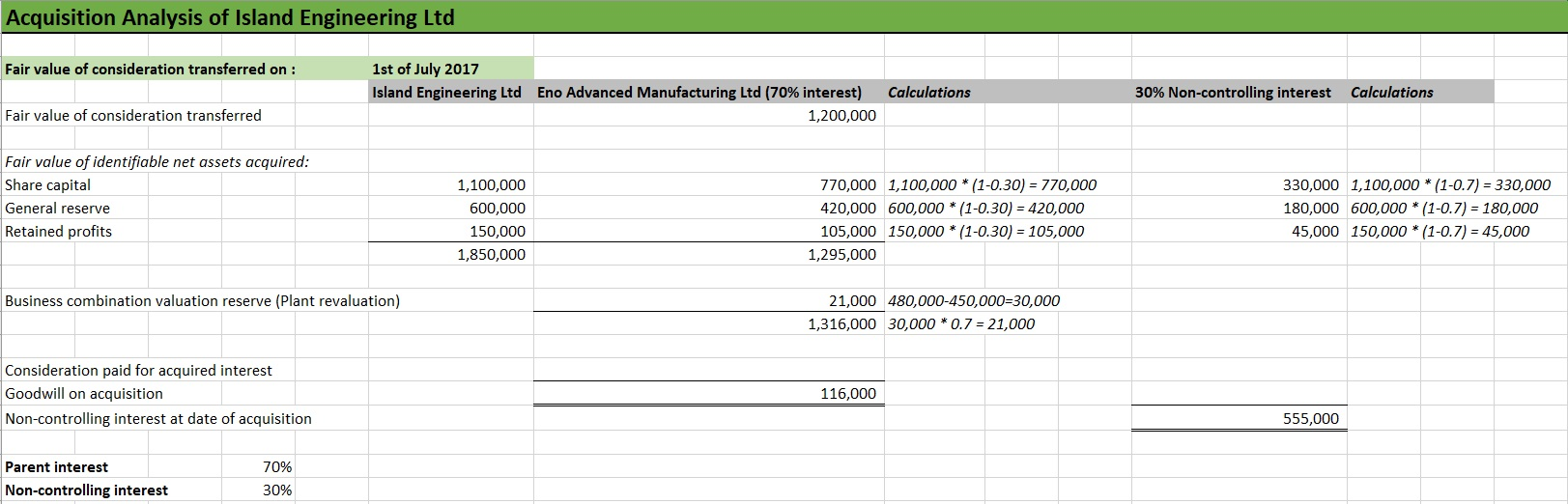

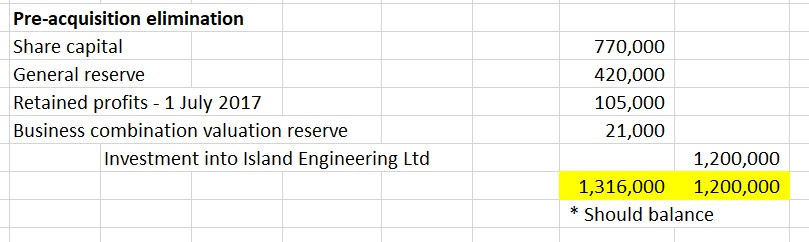

Hello. I'm a bit confused as to the non-controlling interest, pre-acquisitioon consolidated journal entry for a question I have. Eno paid $1,200,000 for the 70 per cent stake in Island Engineering but after cacluating the equity accounts and revaluation of the plant asset I can't get the accounts to balance in the journal entires to the $1,200,000 that was originally paid. Not sure what I'm doing wrong? I've attached images of the question and my workings thus far. I haven't done the change in depreciation expense as I'll do that in another journal entry once I've finished the pre-acquisition entry  Calculations:

Calculations:  And here is my journal entry this far:

And here is my journal entry this far:

It's probably something silly but I'm very stumped as to how to get it to balance to the $1,200,000 invested.

Additional Information relating to Island Engineering Ltd: 1. On 1 July 2017, Eno Advanced Manufacturing Ltd acquired 70 per cent of the share capital of Island Engineering Ltd for $1,200,000 cash. An extract of the Island Engineering Ltd Balance Sheet immediately before the acquisition is shown below: Island Engineering Ltd Shareholders' equity Share capital 1,100,000 General reserve 600,000 Retained profits 150,000 2. On 1 July 2017, Island Engineering Ltd had recorded all its identifiable net assets at fair value, except for plant which cost $630 000 and had a carrying amount of $450 000. The fair value of the plant was assessed at $480 000. It was expected to have a further useful life of 5 years and the benefits are expected to be consumed evenly over this period. The plant had not been revalued in the books of Island Engineering Ltd prior to consolidation. Acquisition Analysis of Island Engineering Ltd Fair value of consideration transferred on: 1st of July 2017 Island Engineering Ltd Eno Advanced Manufacturing Ltd (70% interest) 1,200,000 Calculations 30% Non-controlling interest Calculations Fair value of consideration transferred Fair value of identifiable net assets acquired: Share capital General reserve Retained profits 1,100,000 600,000 150,000 1,850,000 770,000 1,100,000 * (1-0.30) = 770,000 420,000 600,000 * (1-0.30) = 420,000 105,000 150,000 * (1-0.30) = 105,000 1,295,000 330,000 1,100,000 * (1-0.7) = 330,000 180,000 600,000 *(1-0.7) = 180,000 45,000 150,000 *(1-0.7) = 45,000 Business combination valuation reserve (Plant revaluation) 21,000 480,000-450,000=30,000 1,316,000 30,000 * 0.7 = 21,000 Consideration paid for acquired interest Goodwill on acquisition Non-controlling interest at date of acquisition 116,000 555,000 Parent interest Non-controlling interest 70% 30% Pre-acquisition elimination Share capital General reserve Retained profits - 1 July 2017 Business combination valuation reserve Investment into Island Engineering Ltd 770,000 420,000 105,000 21,000 1,200,000 1,316,000 1,200,000 * Should balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started