Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello! I've been stuck with my Financial Management homework for a while now and just don't know how to calculate this problem. Please help me

Hello! I've been stuck with my Financial Management homework for a while now and just don't know how to calculate this problem.

Please help me so that I can understand this!

Thanks for your answer in advance!

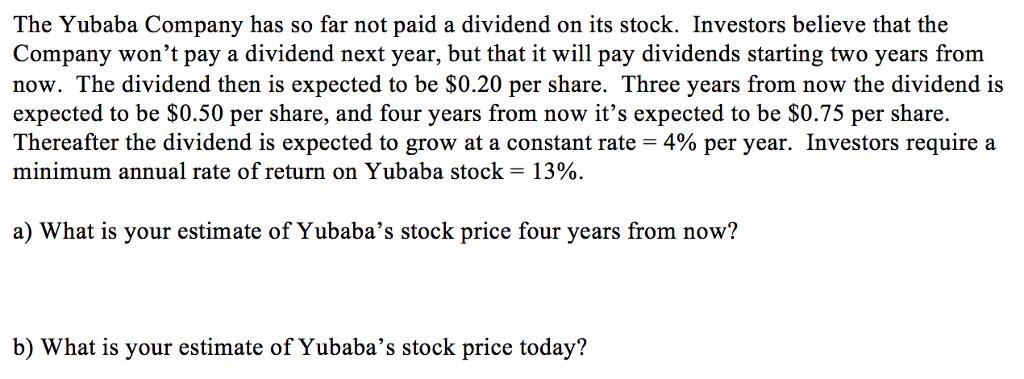

The Yubaba Company has so far not paid a dividend on its stock. Investors believe that the Company won't pay a dividend next year, but that it will pay dividends starting two years from now. The dividend then is expected to be S0.20 per share. Three years from now the dividend i:s expected to be $0.50 per share, and four years from now it's expected to be $0.75 per share. Thereafter the dividend is expected to grow at a constant rate 4% per year. Investors require a minimum annual rate of return on Yubaba stock-13%. a) What is your estimate of Yubaba's stock price four years from now? b) What is your estimate of Yubaba's sook price today? b) What is your estimate of Yubaba's stock price todayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started