Hello :) May I please have help on this question

no Multiple questions just the first part the rest is information :) please let me know if you need more information

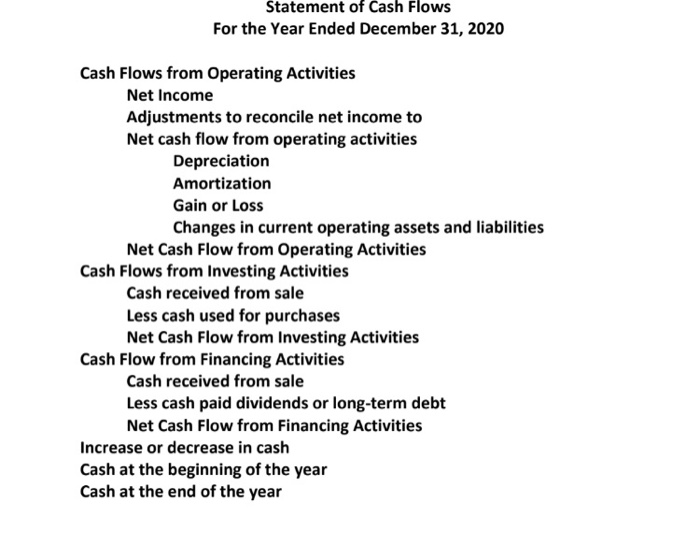

my Apologies I have attached the statement of cash flow's I prepared thank you :)

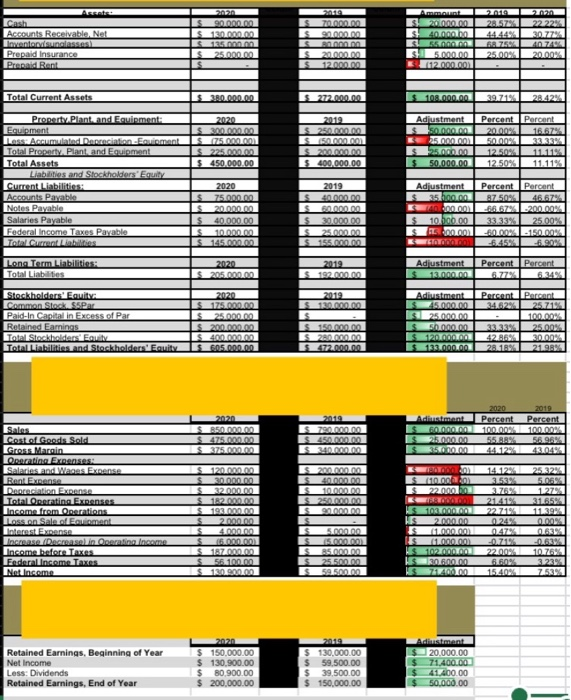

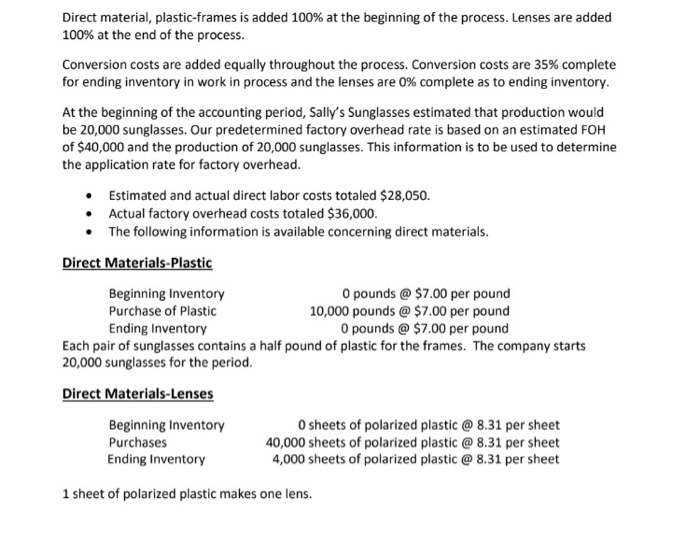

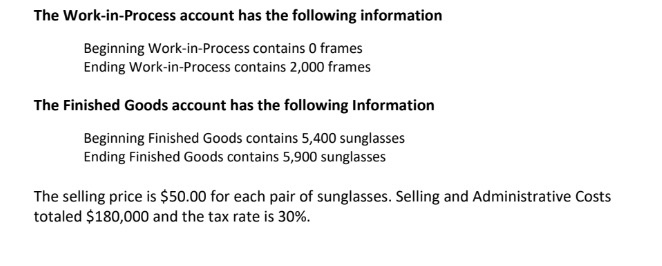

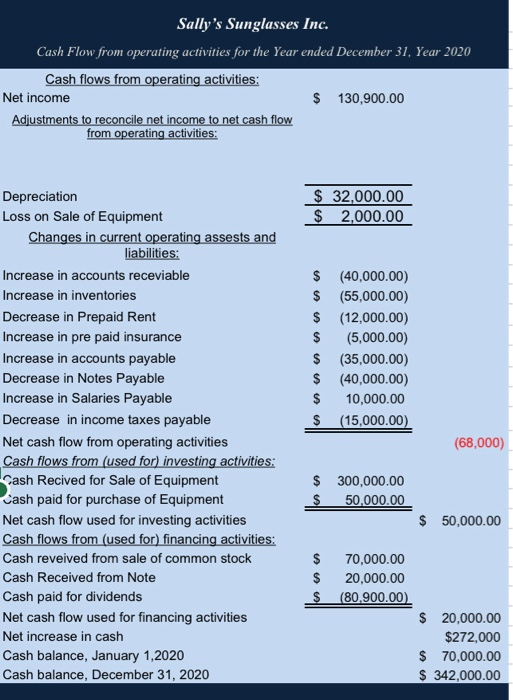

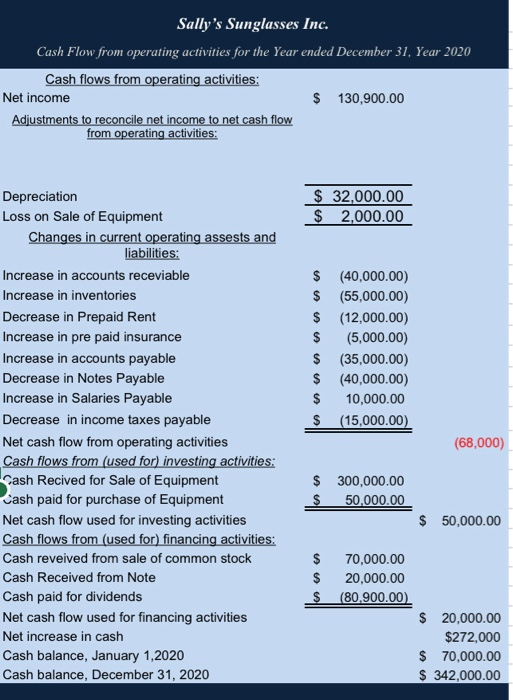

Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to Net cash flow from operating activities Depreciation Amortization Gain or Loss Changes in current operating assets and liabilities Net Cash Flow from Operating Activities Cash Flows from Investing Activities Cash received from sale Less cash used for purchases Net Cash Flow from Investing Activities Cash Flow from Financing Activities Cash received from sale Less cash paid dividends or long-term debt Net Cash Flow from Financing Activities Increase or decrease in cash Cash at the beginning of the year Cash at the end of the year 2020 2020 2222 30.72 Cash Accounts Receivable Net JORDAN Prepaid Insurance Prepaid Rent $180 Sonnen S_25.000.00 S 70.000.00 S92.000.00 s 30.000 s 20.000 12.000.00 4000 BONAME 5.000.00 (112.000.000 28.57% 44.449 GAZED 25.00% 20.00% Total Current Assets $_300.000.00 $_272.000.00 $_108.000.00 39.71% 28.02 2020 $300 S25000 Adjustment $50.000 E 25.000.000 Percent Percent 20.000 16.67 50.000 3232 12.50 12.50% $225. $ 450,000.00 $ 200,000.00 S400.000.00 $ 50,000.00 Property Plant and Equipment: Equipment Lass: Accumulated Depreciation - Equipment Total Property. Plant, and Equipment Total Assets Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Notes Payable Salaries Payable Federal Income Taxes Payable Total Qualnis 2020 $ 75.000.00 20.00 $ 40.000.00 12 145.000.00 2019 4000 SBOR. $ 30,000.00 S_25.000,00 155.00 Adjustment $ 35.hann 0.001 $ 10,500.00 IS200.00 Percent Percent 87.5096 46.67% 16.67 1.200.00 33,33% 25.00% 60.00.150.00 -6.90 Long Term Liabilities: Total Liabilities 2020 205.00 2019 Adjustment 1.000.00 Percent Percent Percent Parent 34.629 25.719 Stockholders' Equity Common Stock Par Paid-In Cantalin ENGASS of Par Retained Eamings Total Stockholders En Total Liabilities and Stockholders' Emily 2020 S_175.000,00 $ 25.000.00 $20.00 S400,000.00 S_605.000.00 2012 IS RADIO ES S150R S 2.000.00 S472.000.00 Adiustment 25.000.00 $25.000 Chan. 120.00 $132.000.000 33.33% 25.00% 42.86% 30.00% 28.10% 21.9% 2020 850.000.00 S475.0 2020 2019 Adinstment Percent Percent FO.000.000 100.00% 100.00% 25.000.00 55. SERRA 44.12 S450.000.00 400RR ELAN nonaco $22.000 Sales Cost of Goods Sold Gross Marin Operating Expenses Salaries and Wages Expo Rent Expense Depreciation Expanse Total Operating Expenses Income from pertines Loss on Sales Equipment InterestExpanse Increase mense in romanian Income Income before Taxes Federal Income Taxes Net Income $ 120 3.RARA S32.000.00 $132.00 S_1920 2.000.0 4.000.00 $ ORDER S1A7.000.00 $ 55.100.00 S 250.000.00 is 9000.00 $ ES 5.000 S_15.000.000 S85.000.00 25.500 $59.500.00 10A HS 2.000.00 301.000.00 1.000.00 102.00 SOBRAN 14.128 25.32% 3153% 5.05 1.27% 21.41% 31.65% 22.71% 0.24% 0.00 RE 2018 22.00% 10.76 6.60 1229 15.40% Retained Earnings, Beginning of Year Net Income Less: Dividends Retained Earnings, End of Year 2020 $ 150,000.00 $ 130,900.00 $ 80.900.00 $ 200,000.00 $ 130,000.00 $ 59,500.00 $ 39,500.00 $ 150,000.00 Adistant 20,000.00 71.400.00 41.400.00 50.000.00 Direct material, plastic-frames is added 100% at the beginning of the process. Lenses are added 100% at the end of the process. Conversion costs are added equally throughout the process. Conversion costs are 35% complete for ending inventory in work in process and the lenses are 0% complete as to ending inventory. At the beginning of the accounting period, Sally's Sunglasses estimated that production would be 20,000 sunglasses. Our predetermined factory overhead rate is based on an estimated FOH of $40,000 and the production of 20,000 sunglasses. This information is to be used to determine the application rate for factory overhead. Estimated and actual direct labor costs totaled $28,050. Actual factory overhead costs totaled $36,000 The following information is available concerning direct materials. Direct Materials-Plastic Beginning Inventory O pounds @ $7.00 per pound Purchase of Plastic 10,000 pounds @ $7.00 per pound Ending Inventory 0 pounds @ $7.00 per pound Each pair of sunglasses contains a half pound of plastic for the frames. The company starts 20,000 sunglasses for the period. Direct Materials-Lenses Beginning Inventory O sheets of polarized plastic @ 8.31 per sheet Purchases 40,000 sheets of polarized plastic @ 8.31 per sheet Ending Inventory 4,000 sheets of polarized plastic @ 8.31 per sheet 1 sheet of polarized plastic makes one lens. The Work-in-Process account has the following information Beginning Work-in-Process contains 0 frames Ending Work-in-Process contains 2,000 frames The Finished Goods account has the following Information Beginning Finished Goods contains 5,400 sunglasses Ending Finished Goods contains 5,900 sunglasses The selling price is $50.00 for each pair of sunglasses. Selling and Administrative Costs totaled $180,000 and the tax rate is 30%. Sally's Sunglasses Inc. Cash Flow from operating activities for the Year ended December 31, Year 2020 Cash flows from operating activities: Net income $ 130,900.00 Adjustments to reconcile net income to net cash flow from operating activities: $ 32,000.00 $ 2,000.00 $ (40,000.00) $ (55,000.00) $ 12,000.00) $ (5,000.00) $ (35,000.00) $ (40,000.00) $ 10,000.00 $ (15,000.00 Depreciation Loss on Sale of Equipment Changes in current operating assests and liabilities: Increase in accounts receviable Increase in inventories Decrease in Prepaid Rent Increase in pre paid insurance Increase in accounts payable Decrease in Notes Payable Increase in Salaries Payable Decrease in income taxes payable Net cash flow from operating activities Cash flows from (used for) investing activities: Cash Recived for Sale of Equipment Cash paid for purchase of Equipment Net cash flow used for investing activities Cash flows from (used for) financing activities: Cash reveived from sale of common stock Cash Received from Note Cash paid for dividends Net cash flow used for financing activities Net increase in cash Cash balance, January 1, 2020 Cash balance, December 31, 2020 (68,000) $ 300,000.00 $ 50,000.00 $ 50,000.00 $ 70,000.00 $ 20,000.00 $ (80.900.00) $ 20,000.00 $272,000 $ 70,000.00 S 342,000.00