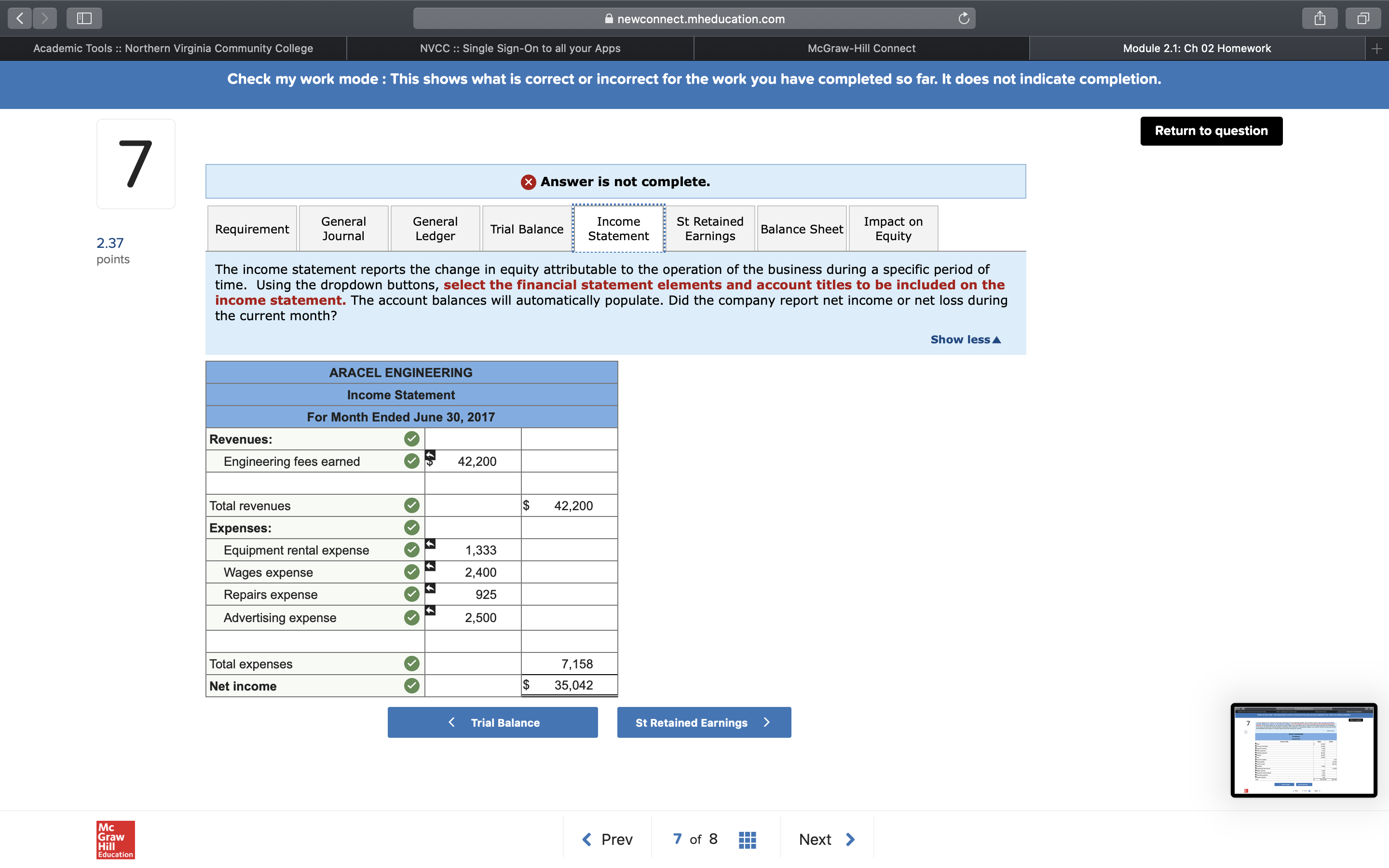

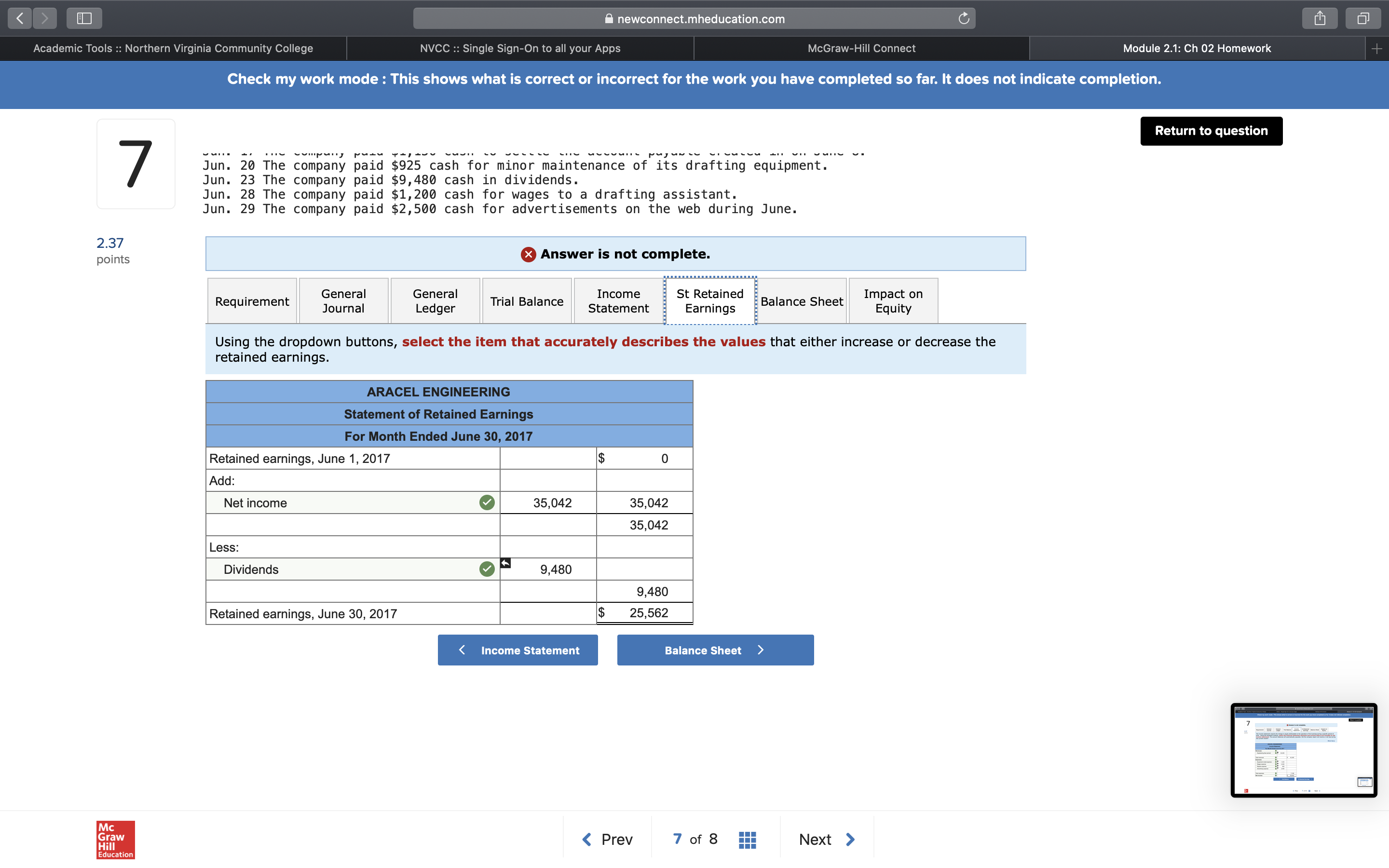

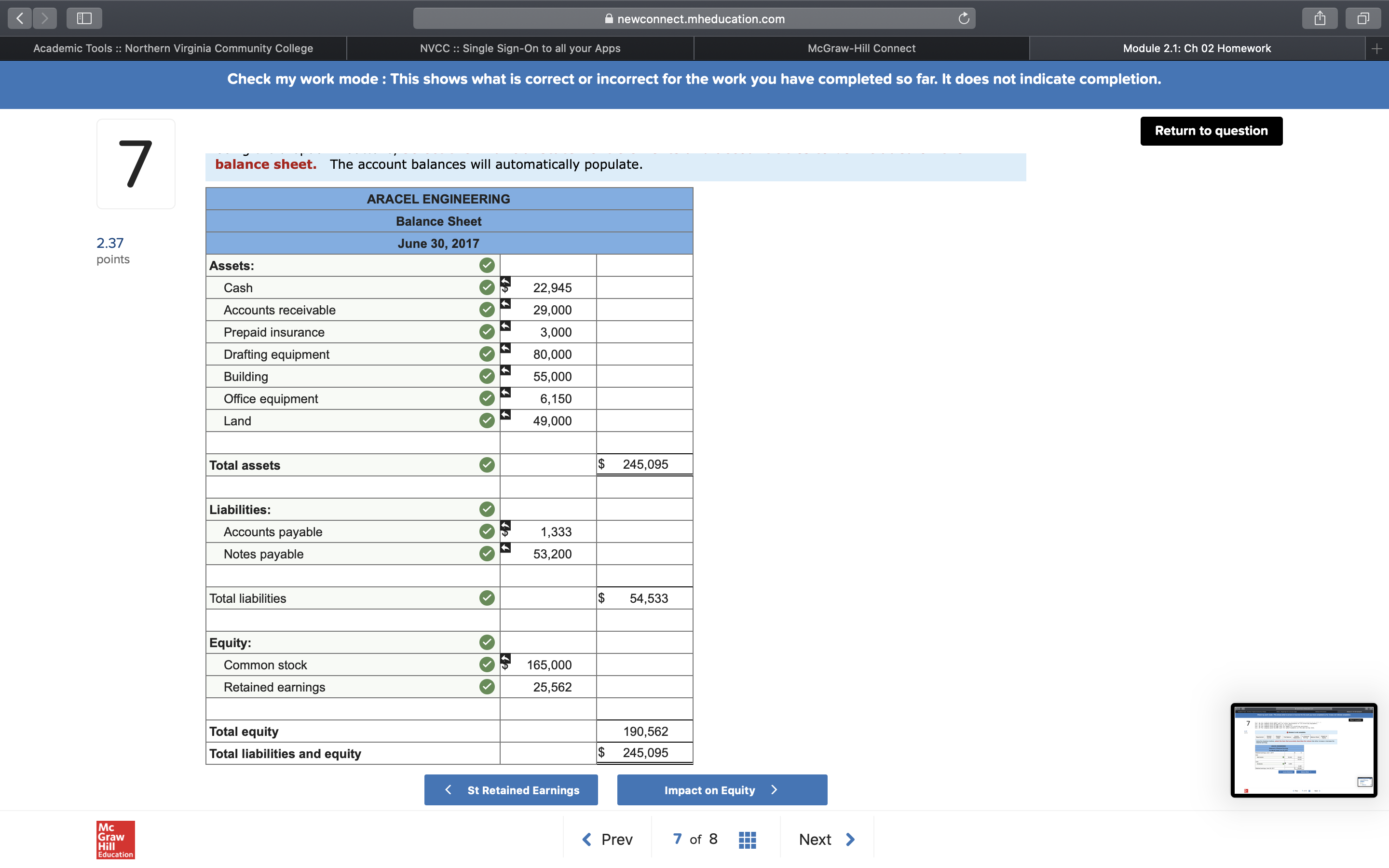

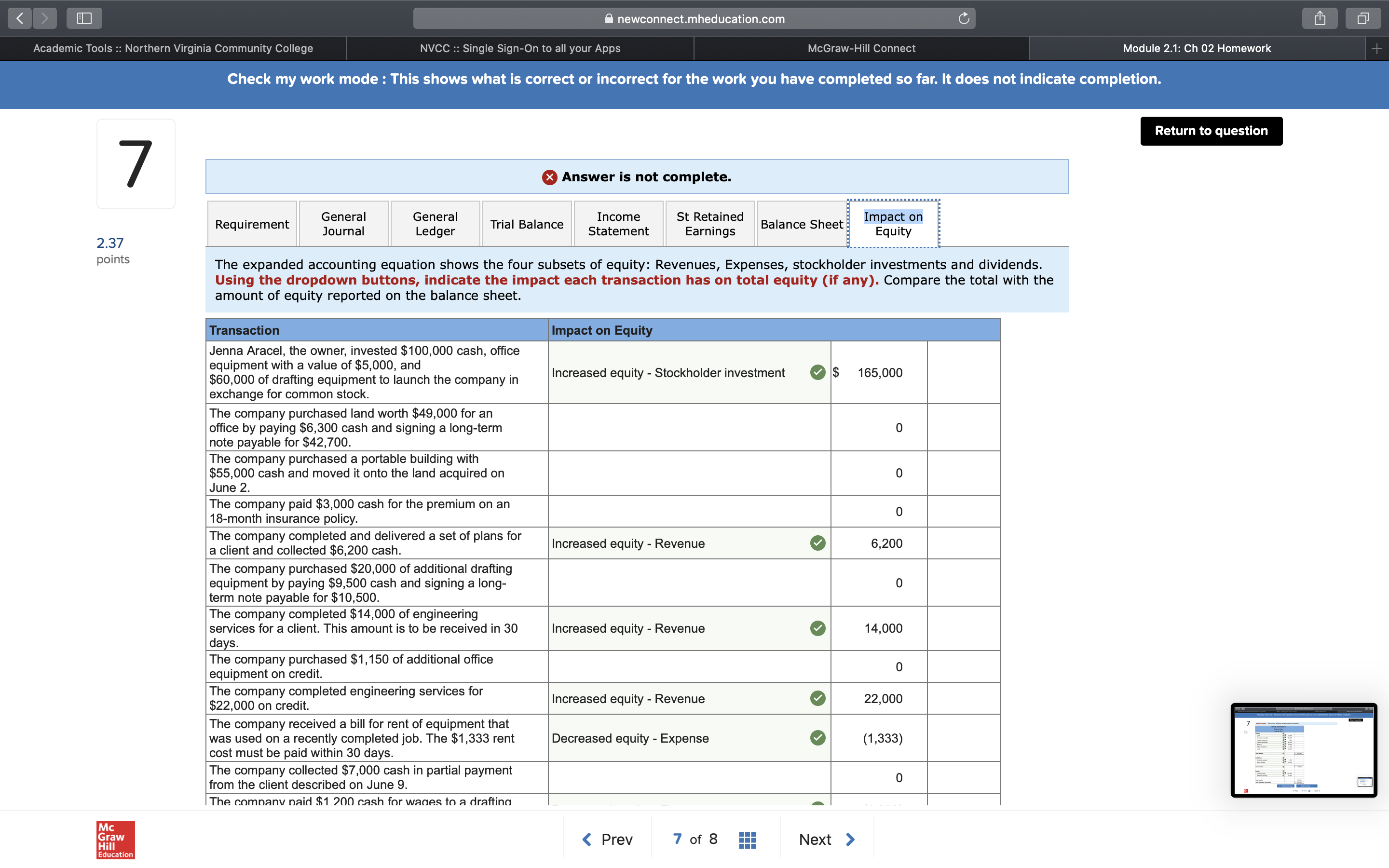

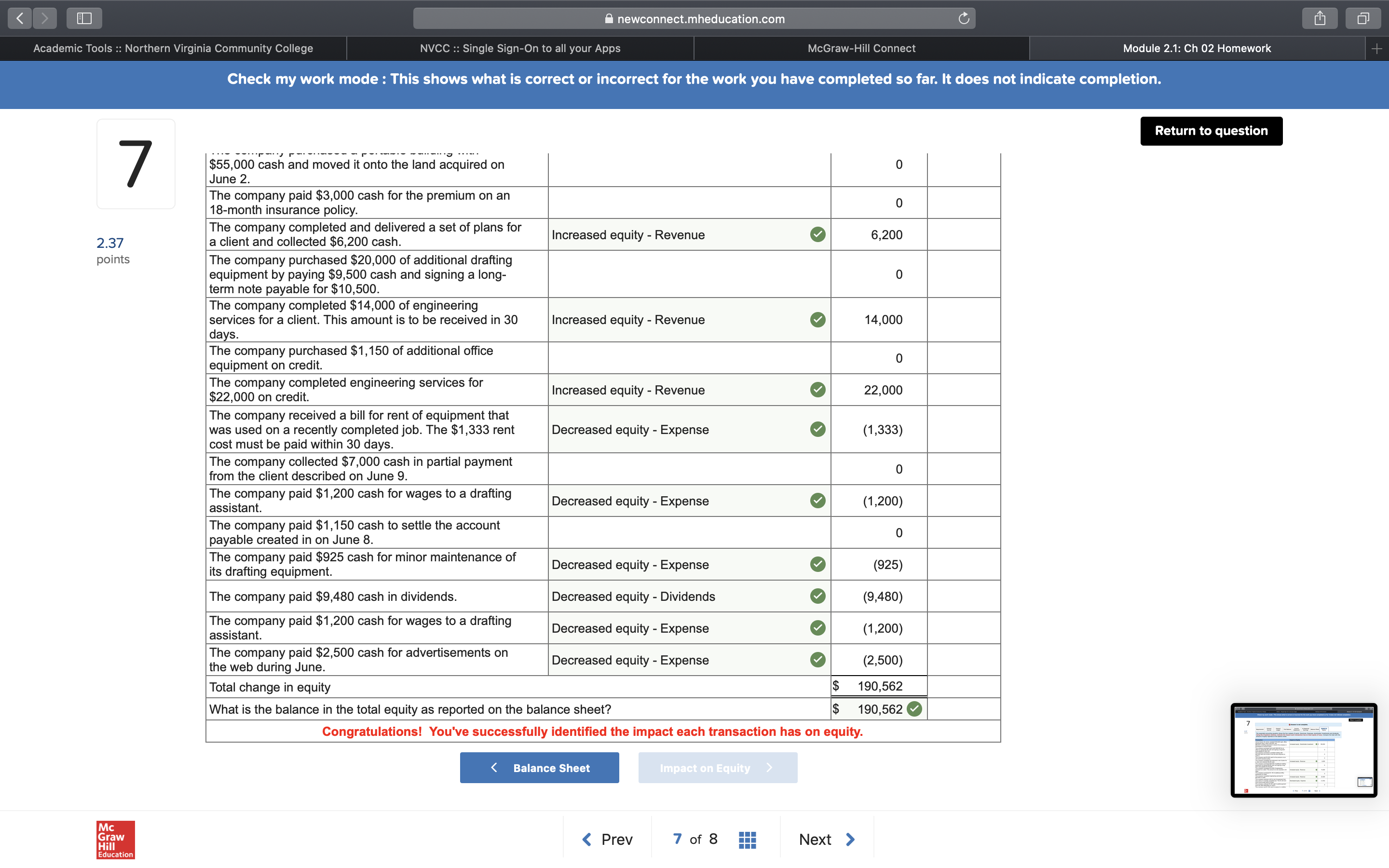

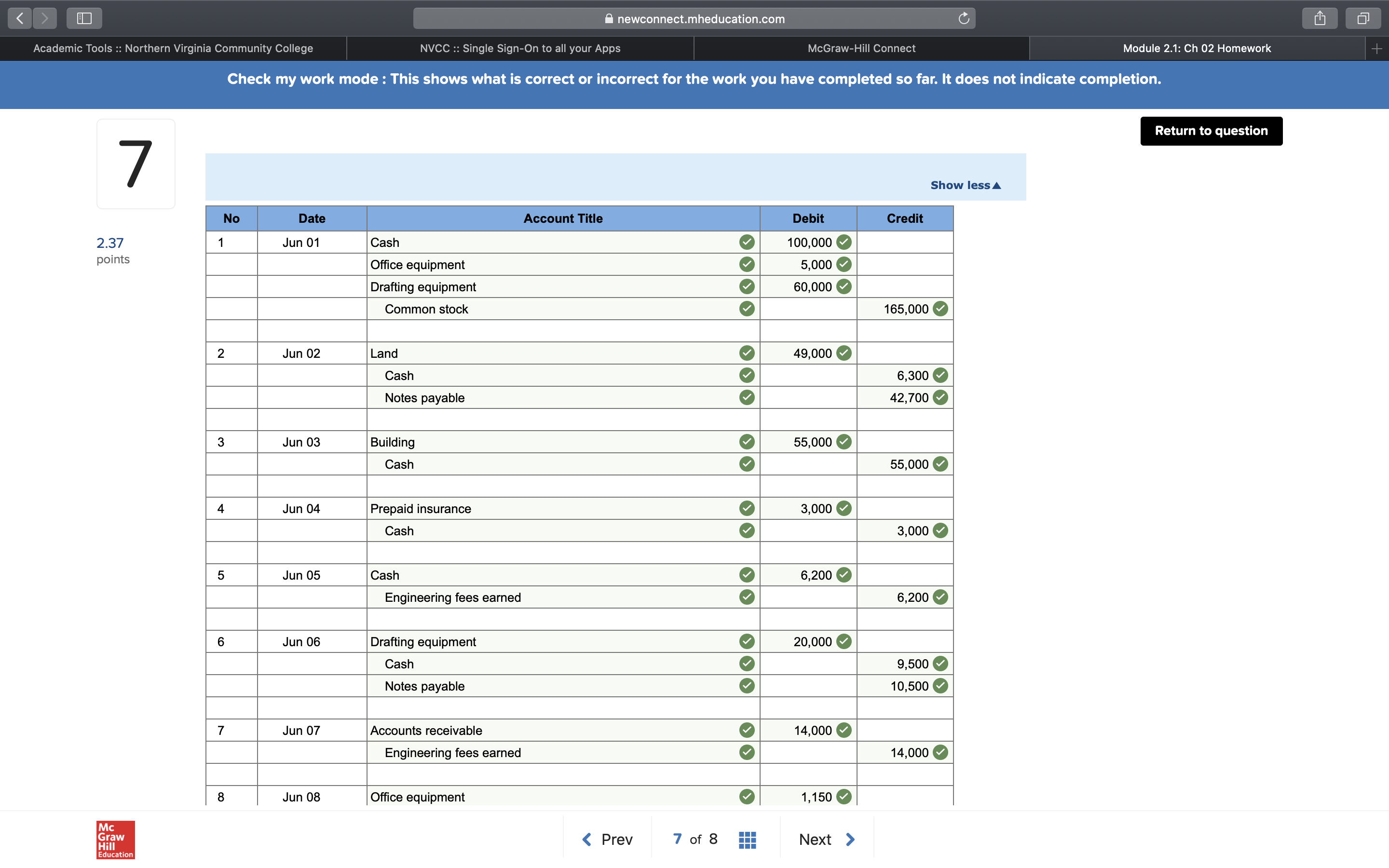

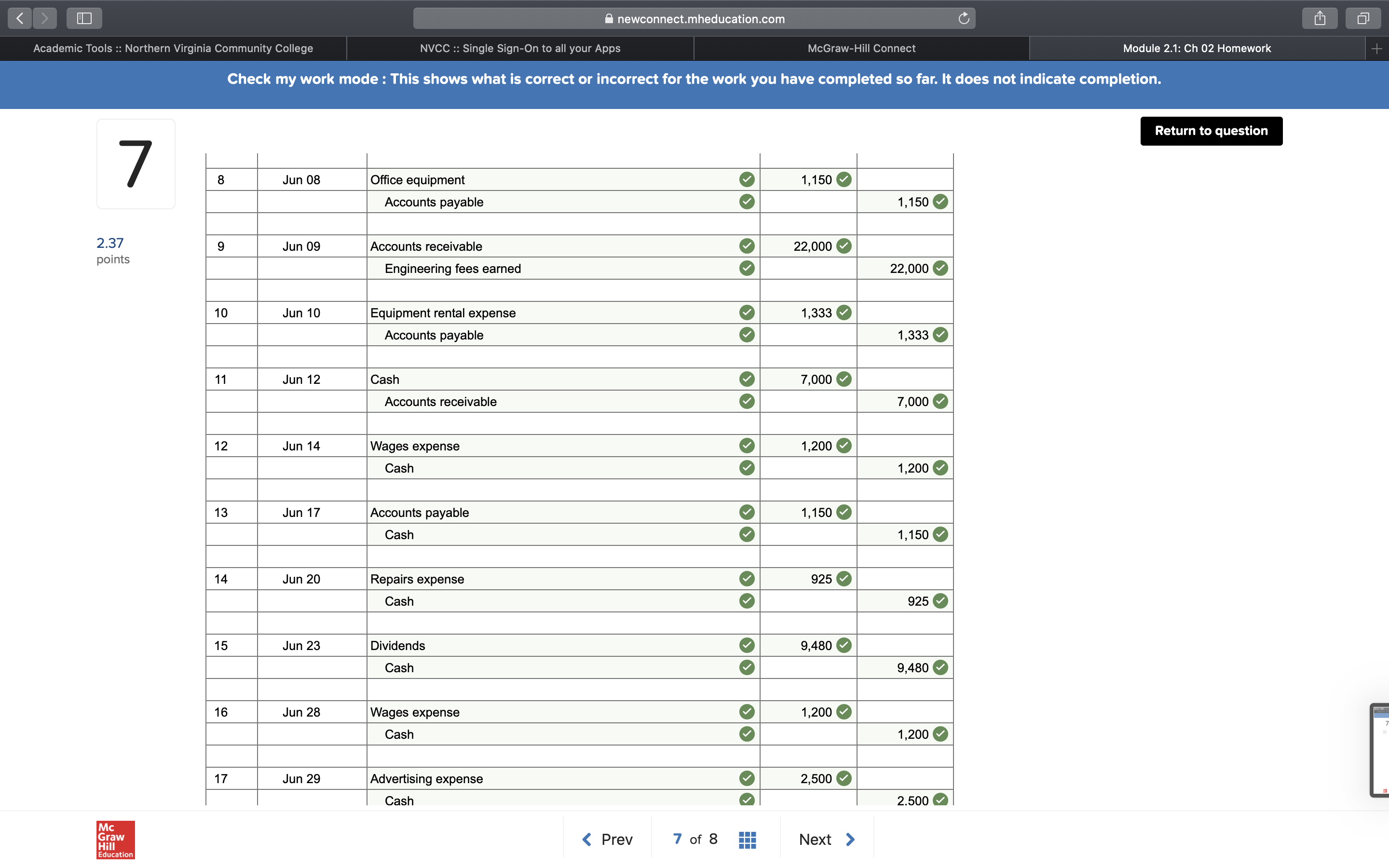

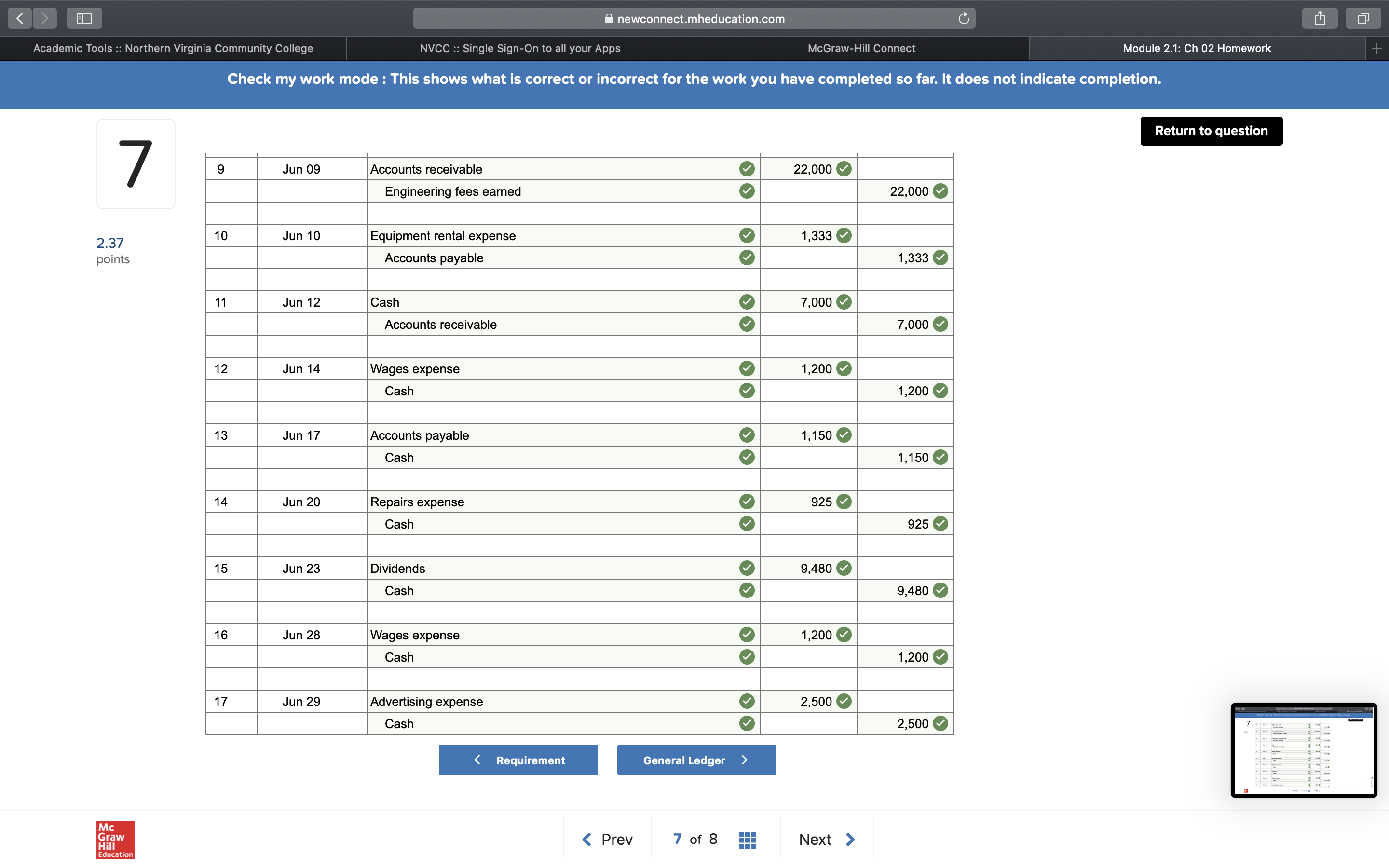

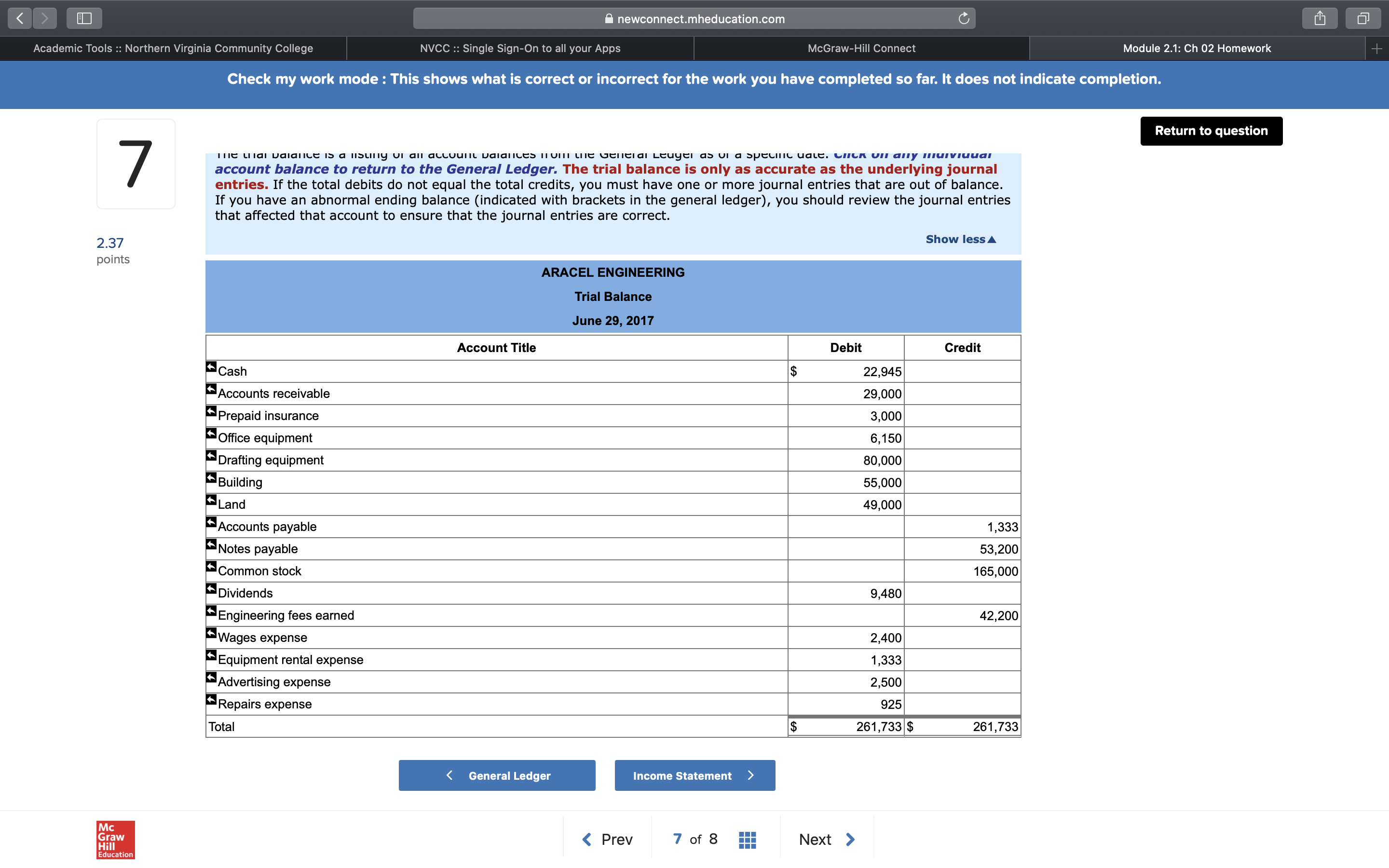

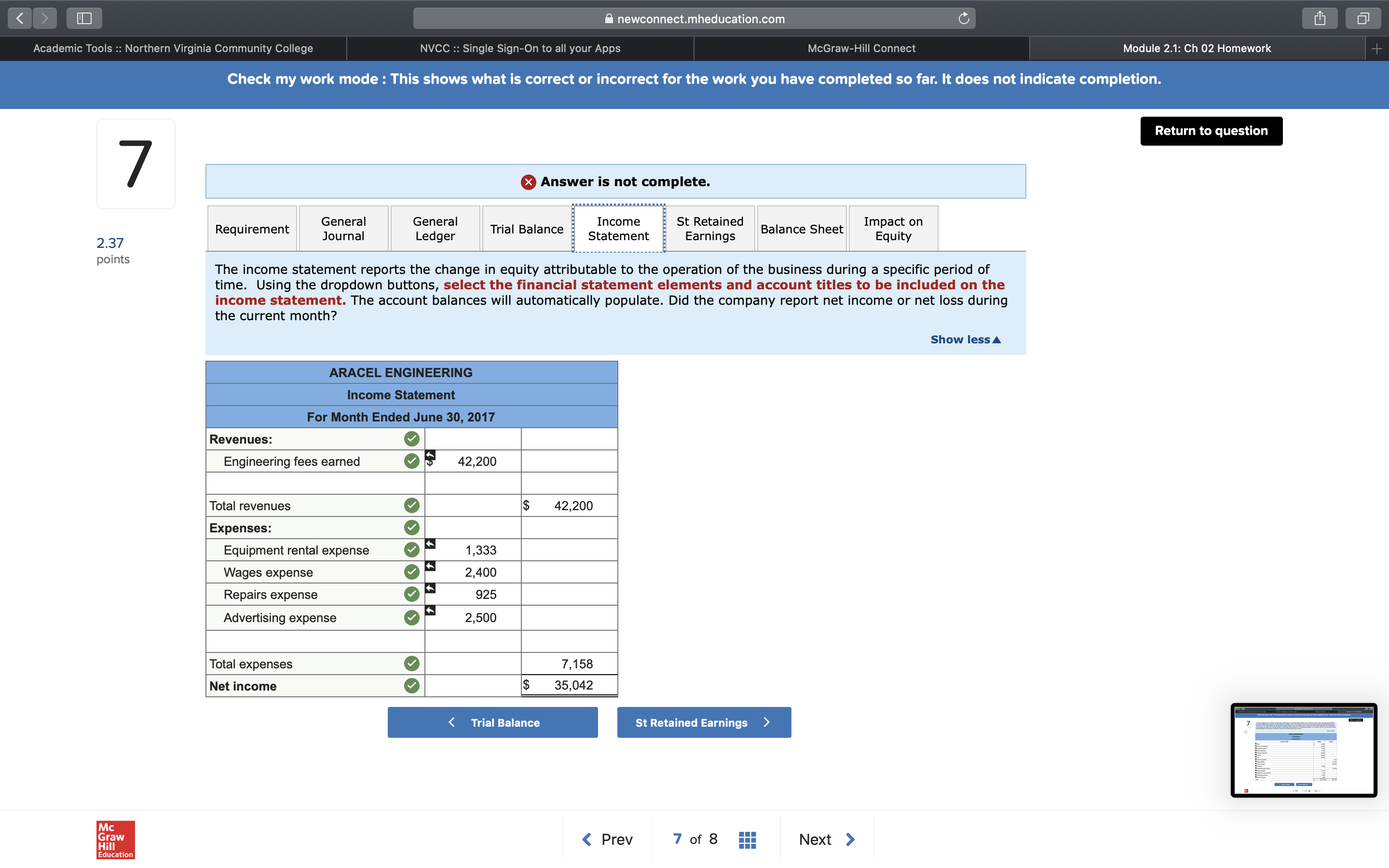

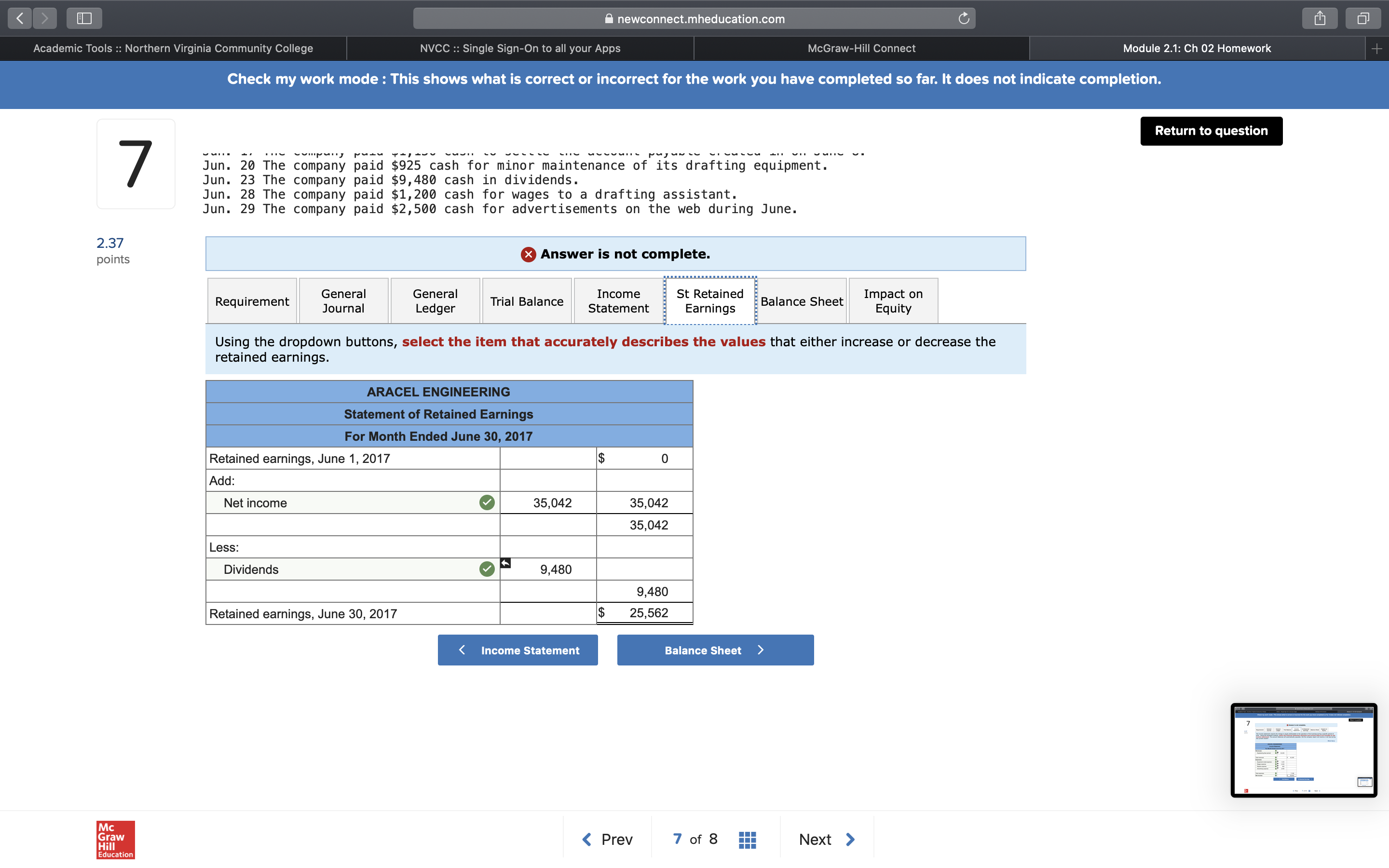

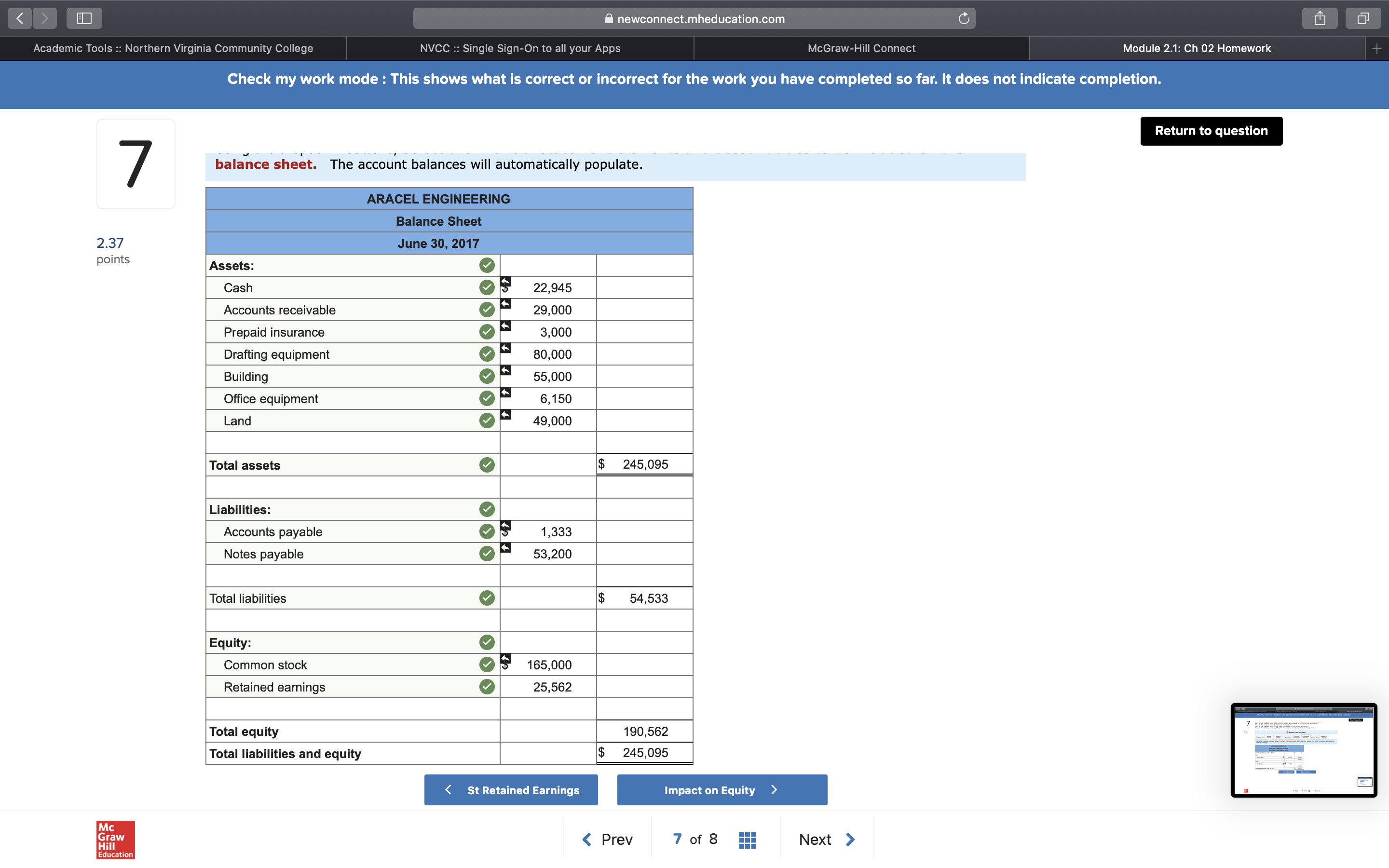

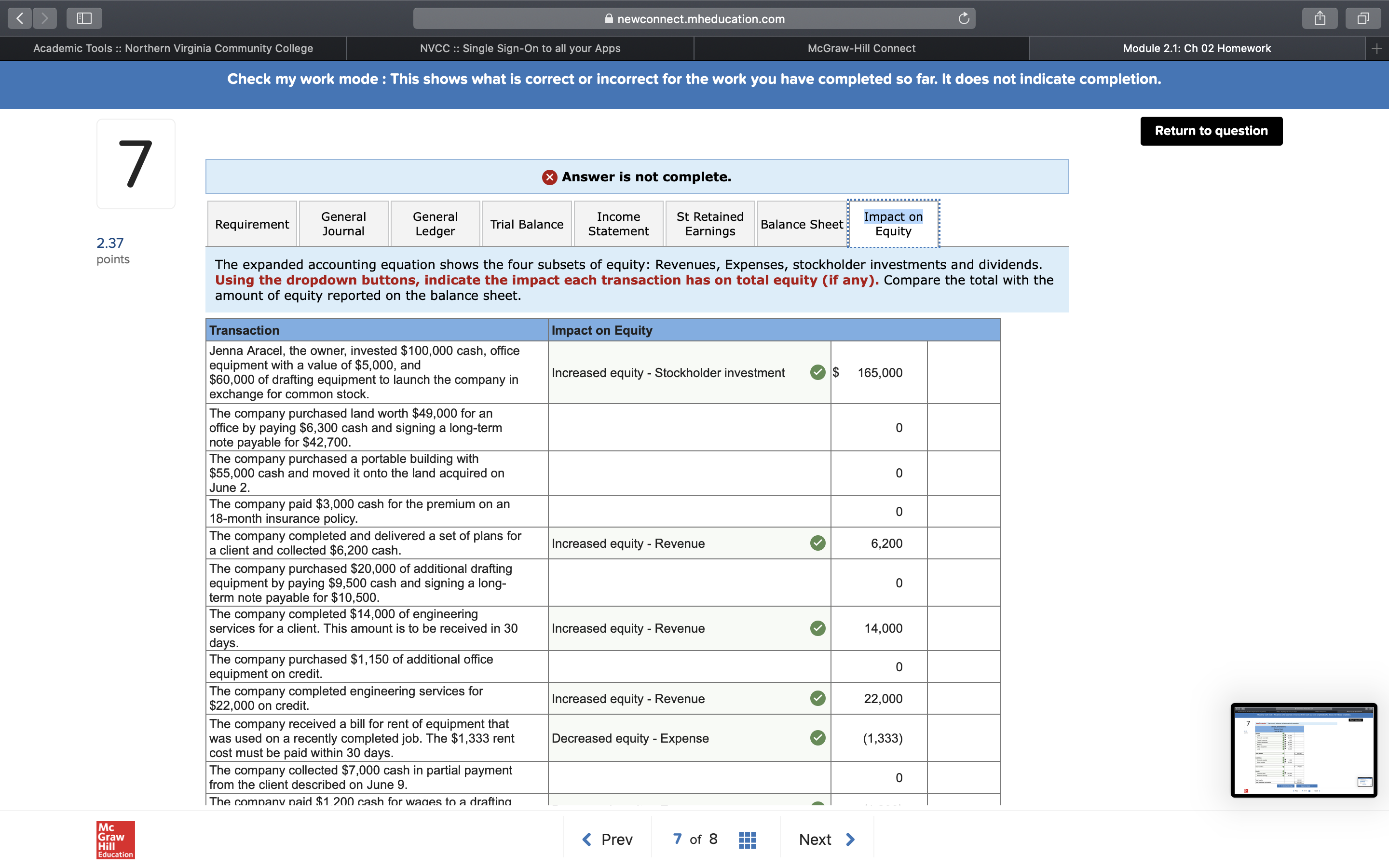

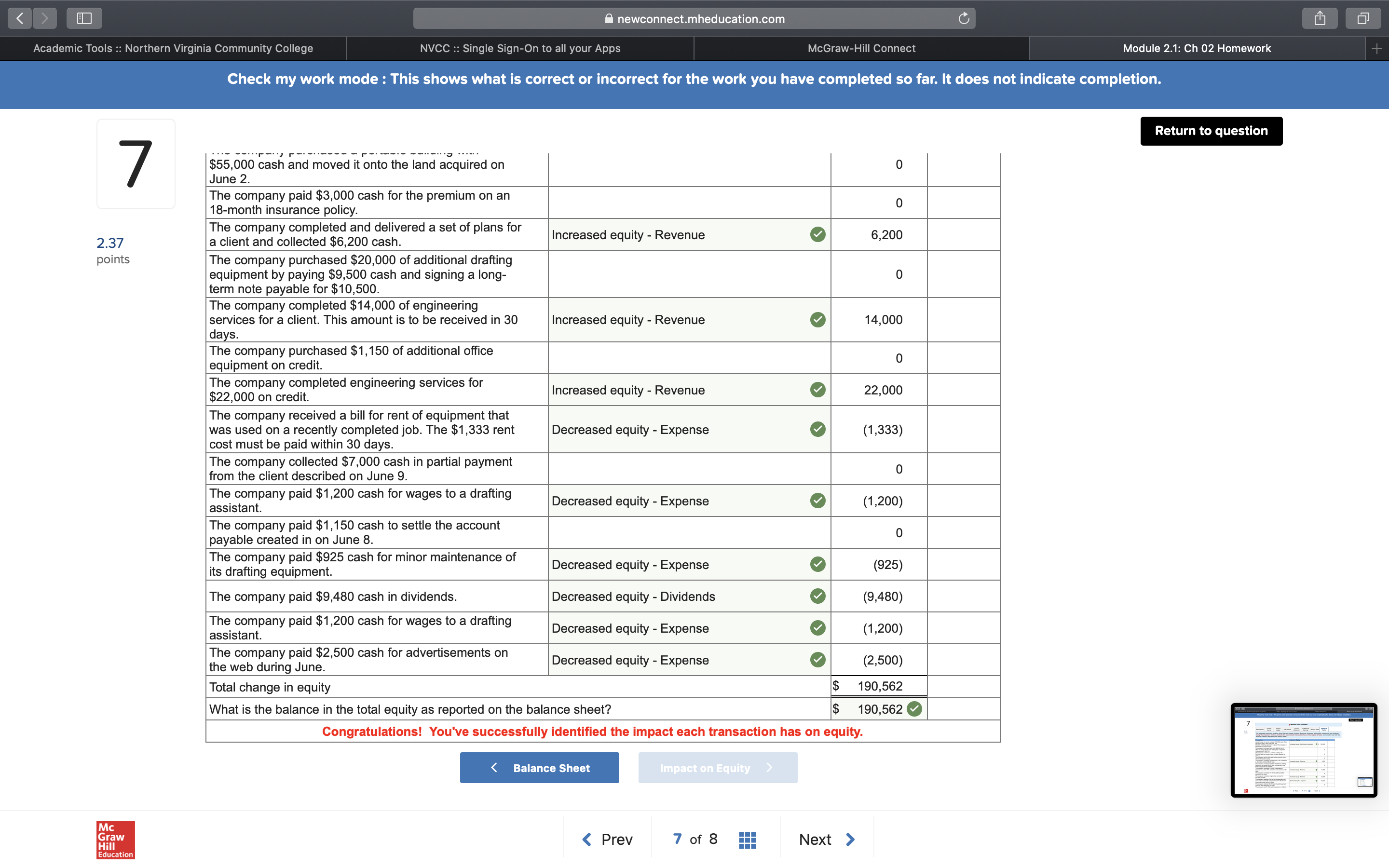

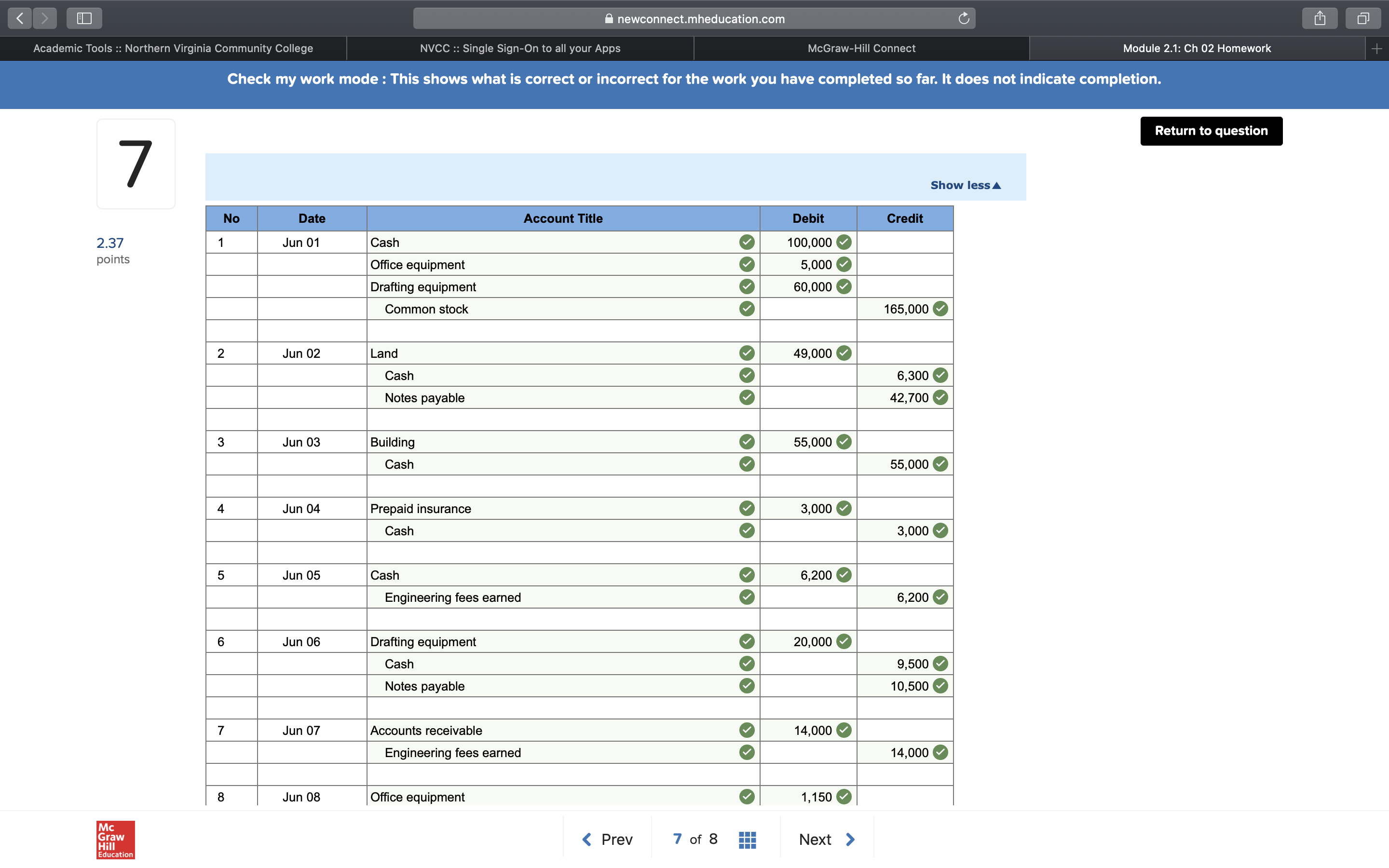

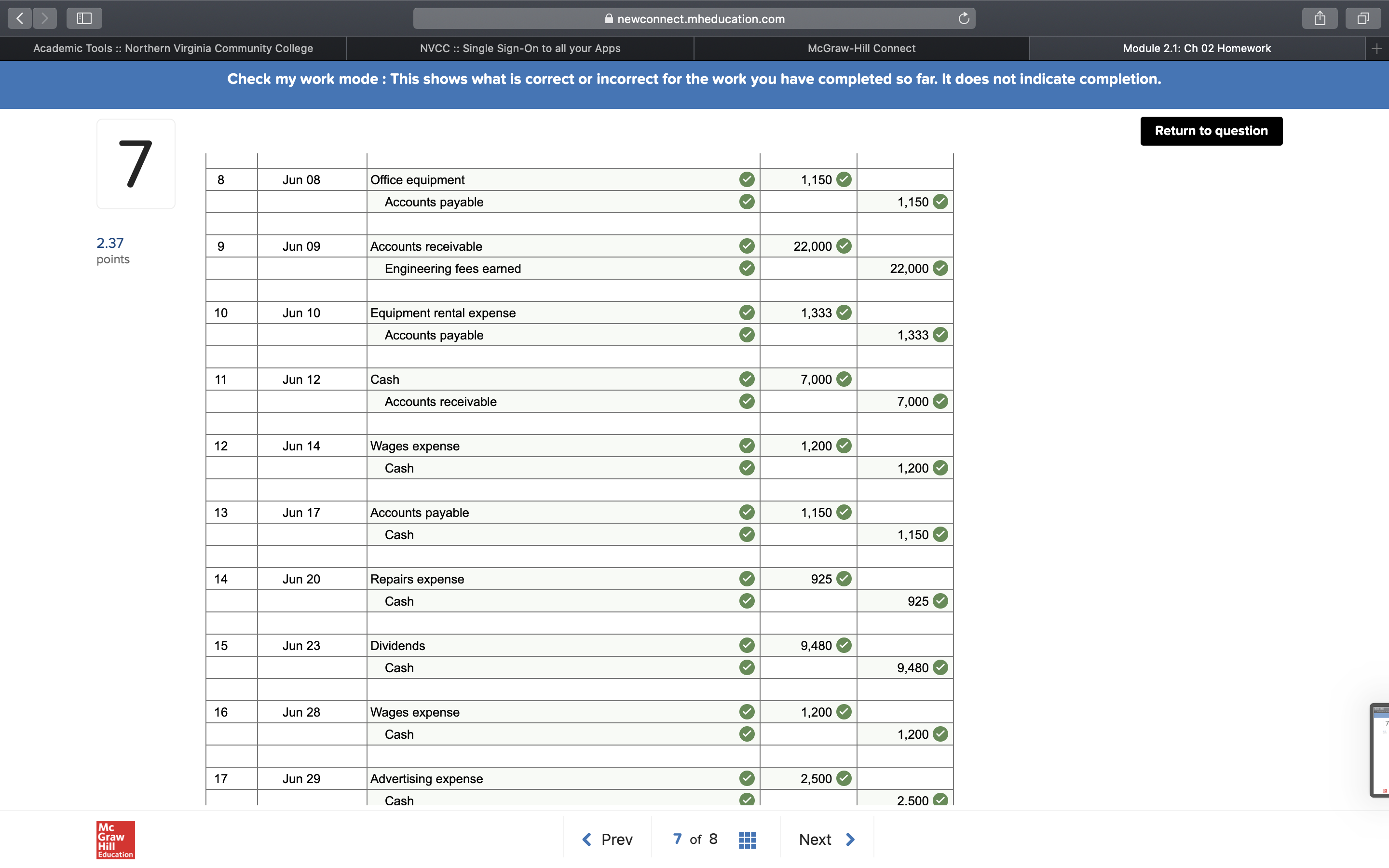

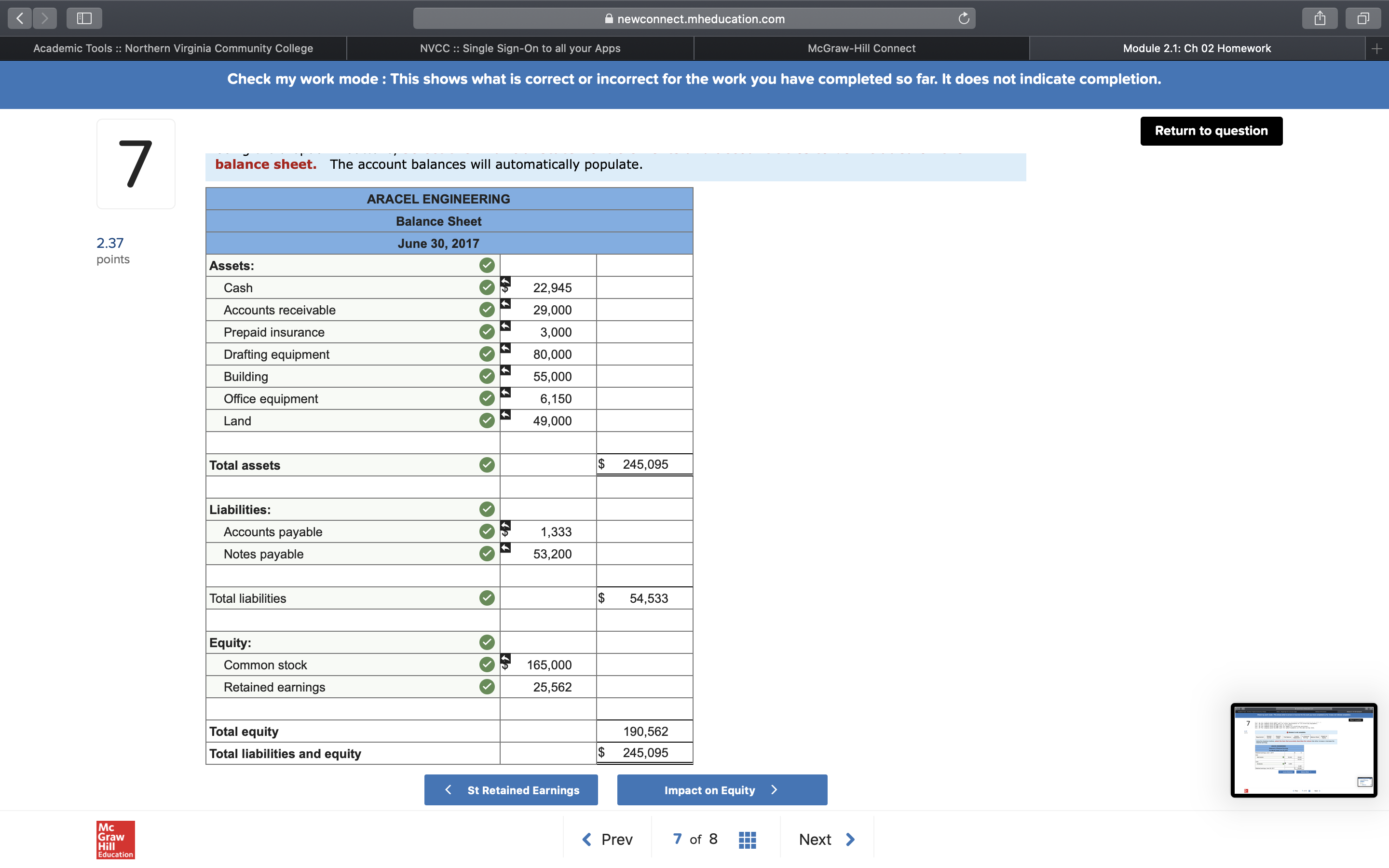

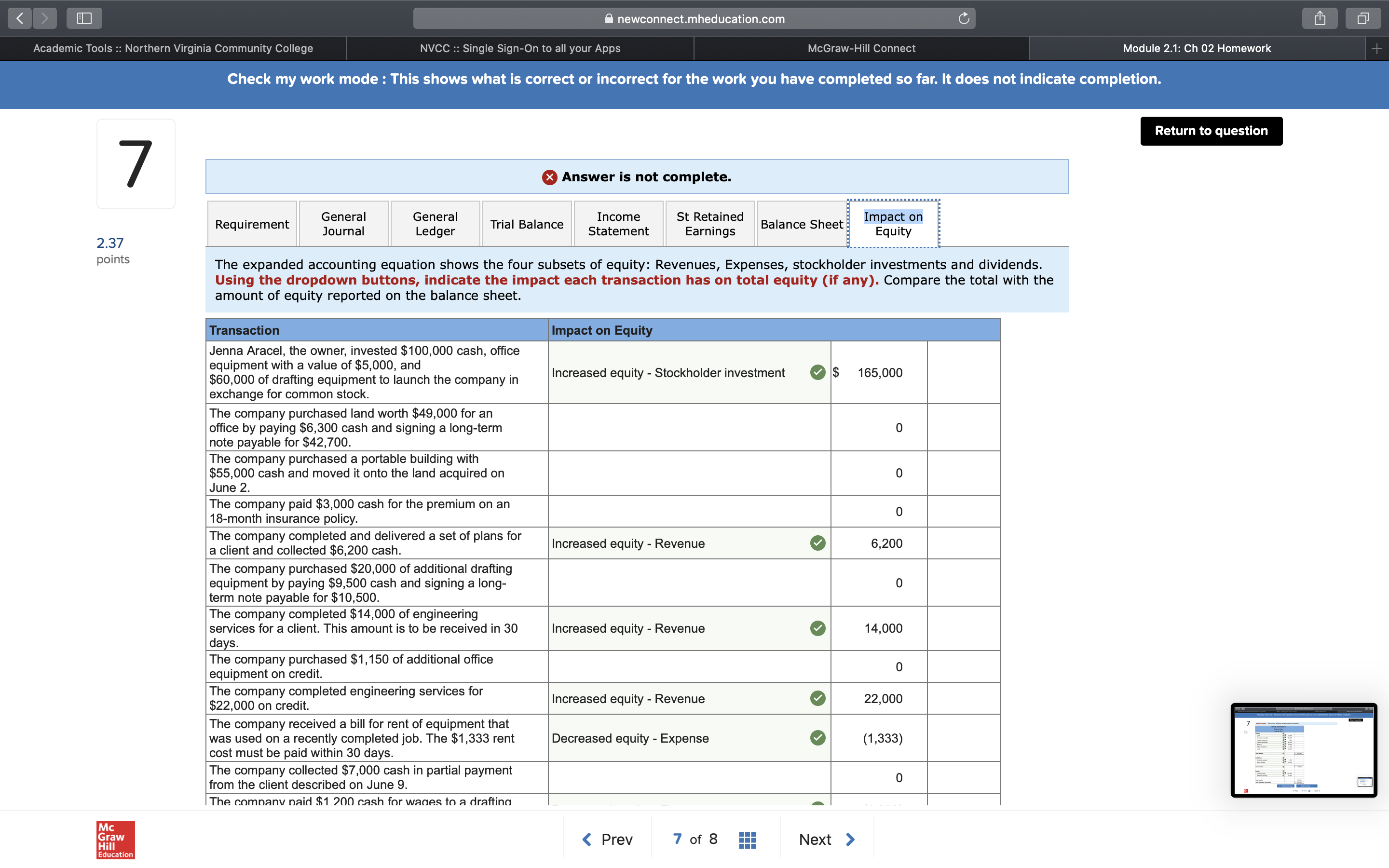

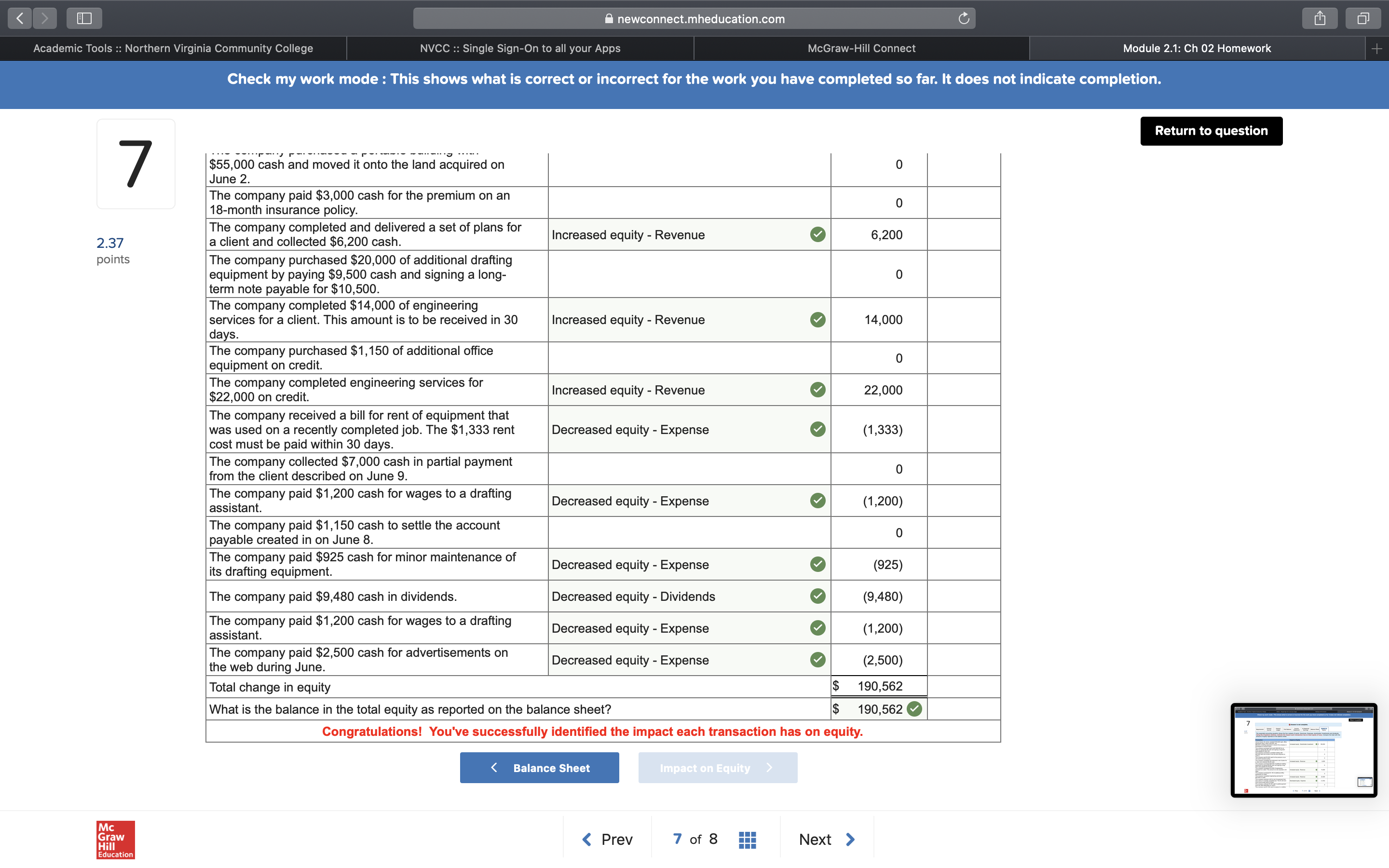

Hello, my homework says I am missing information for the answer to be completed and I don't know whats missing. (Below is the information they have given me, and the screenshots are my work)

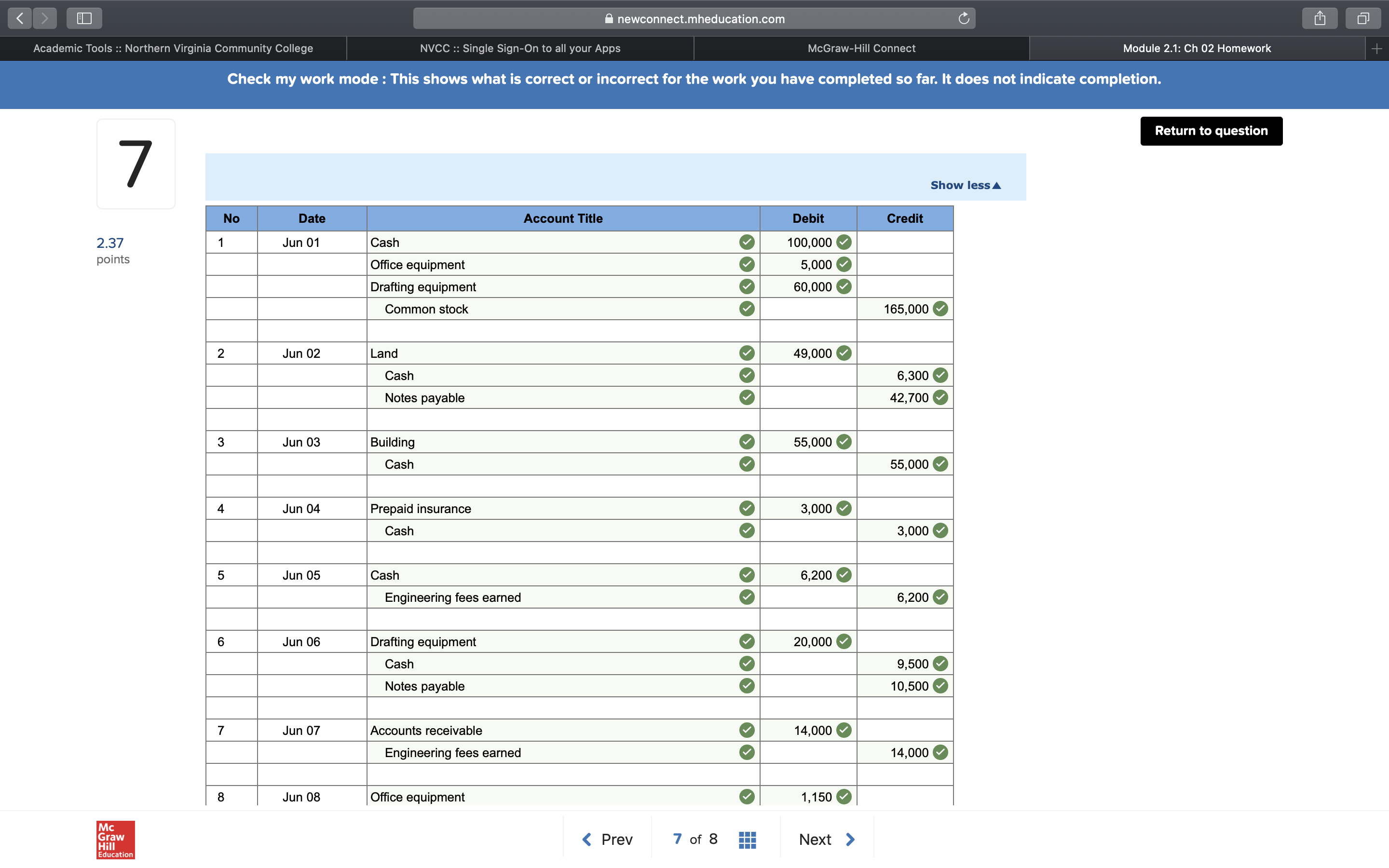

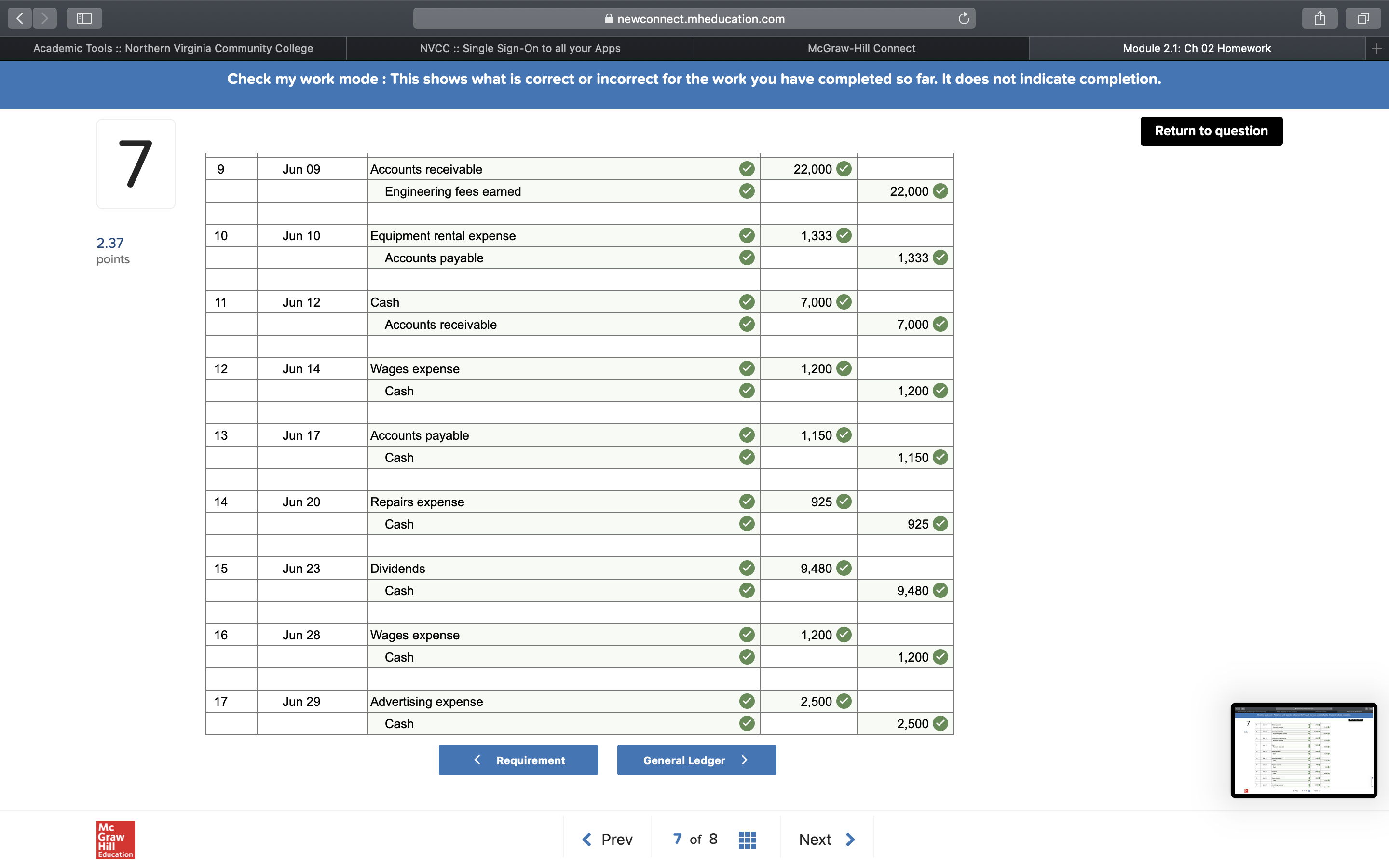

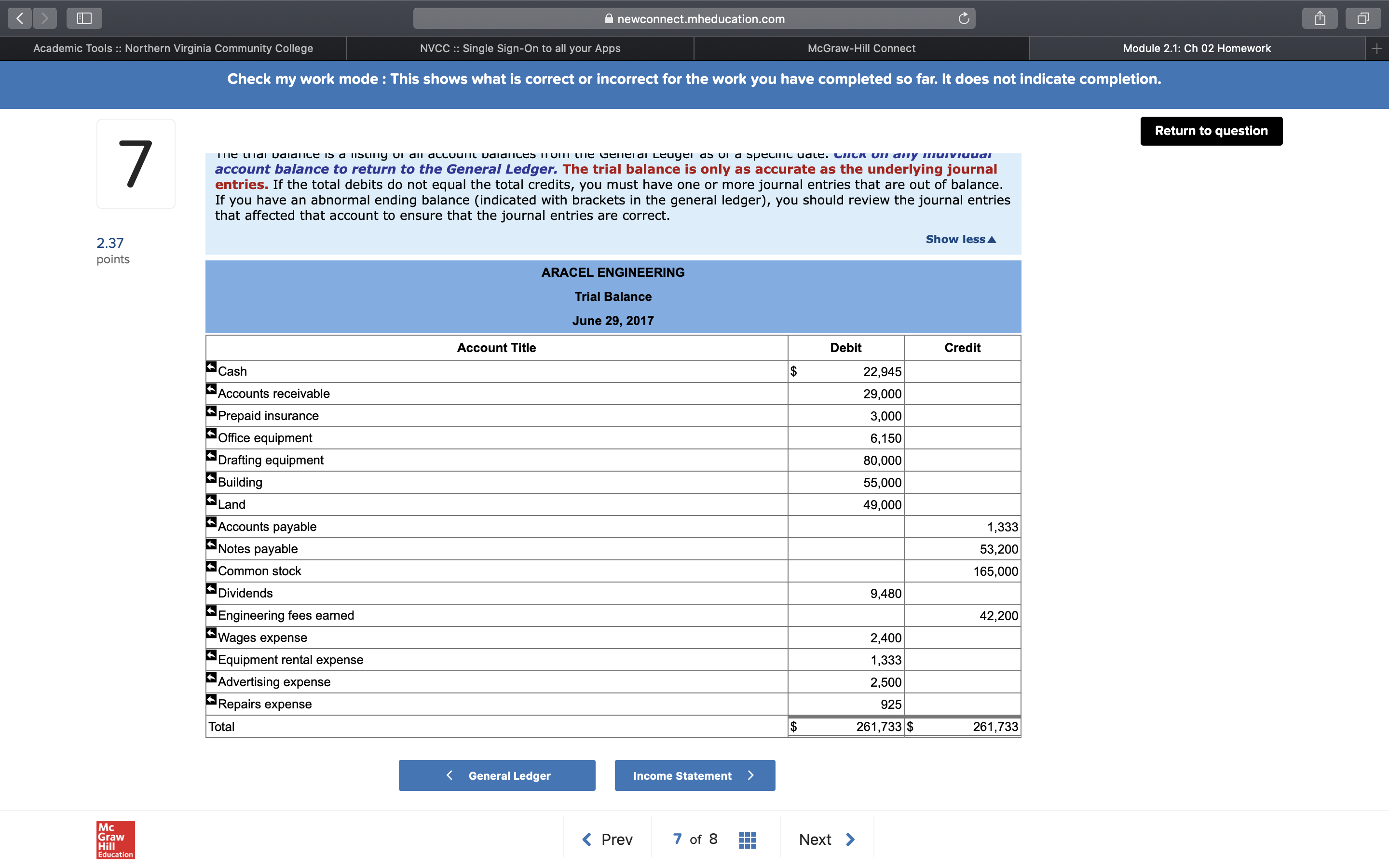

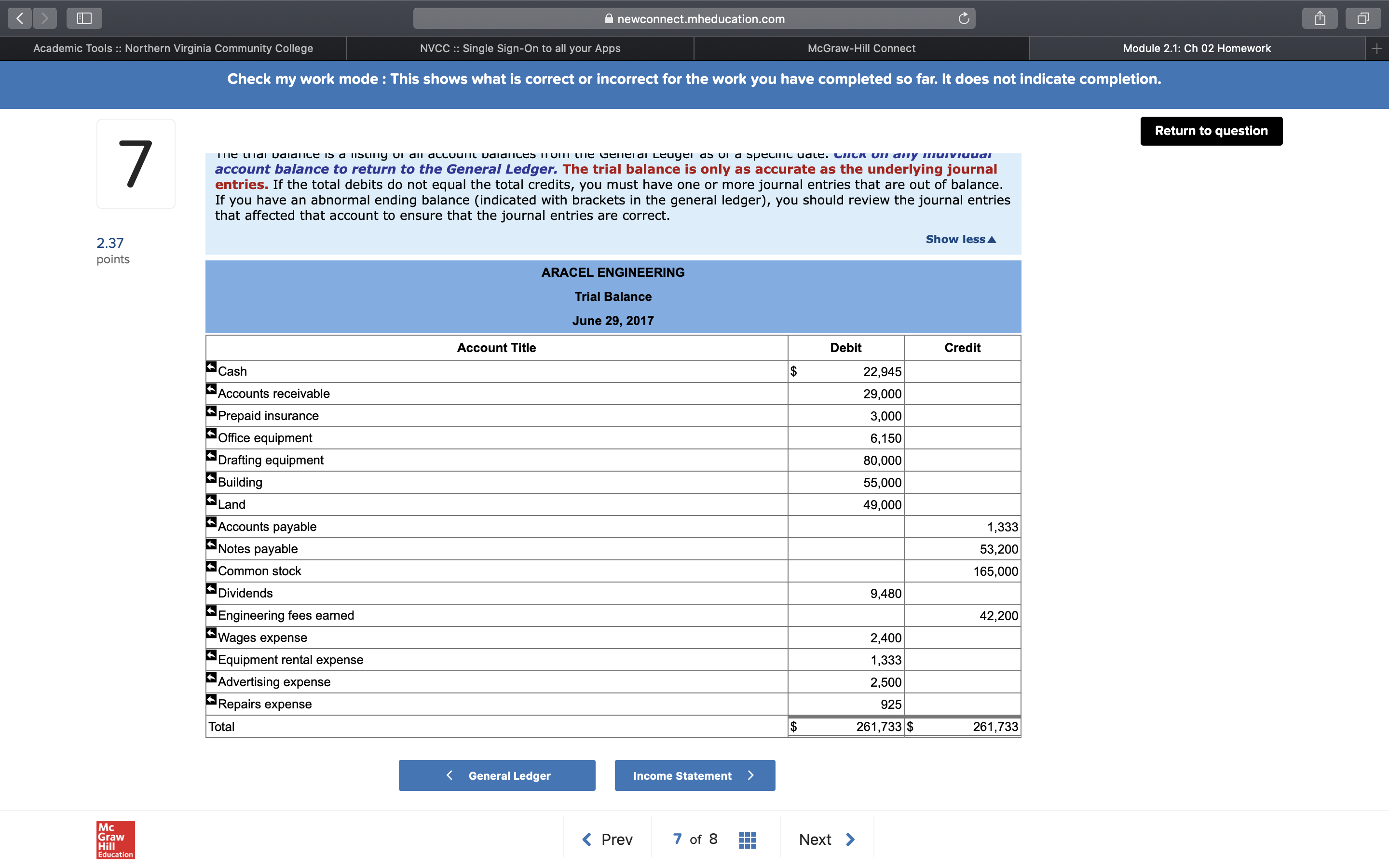

Jun.1Jenna Aracel, the owner, invested $100,000 cash, office equipment with a value of $5,000, and $60,000 of drafting equipment to launch the company in exchange for common stock.

Jun.2The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term note payable for $42,700.

Jun.3The company purchased a portable building with $55,000 cash and moved it onto the land acquired on June 2.

Jun.4The company paid $3,000 cash for the premium on an 18-month insurance policy.

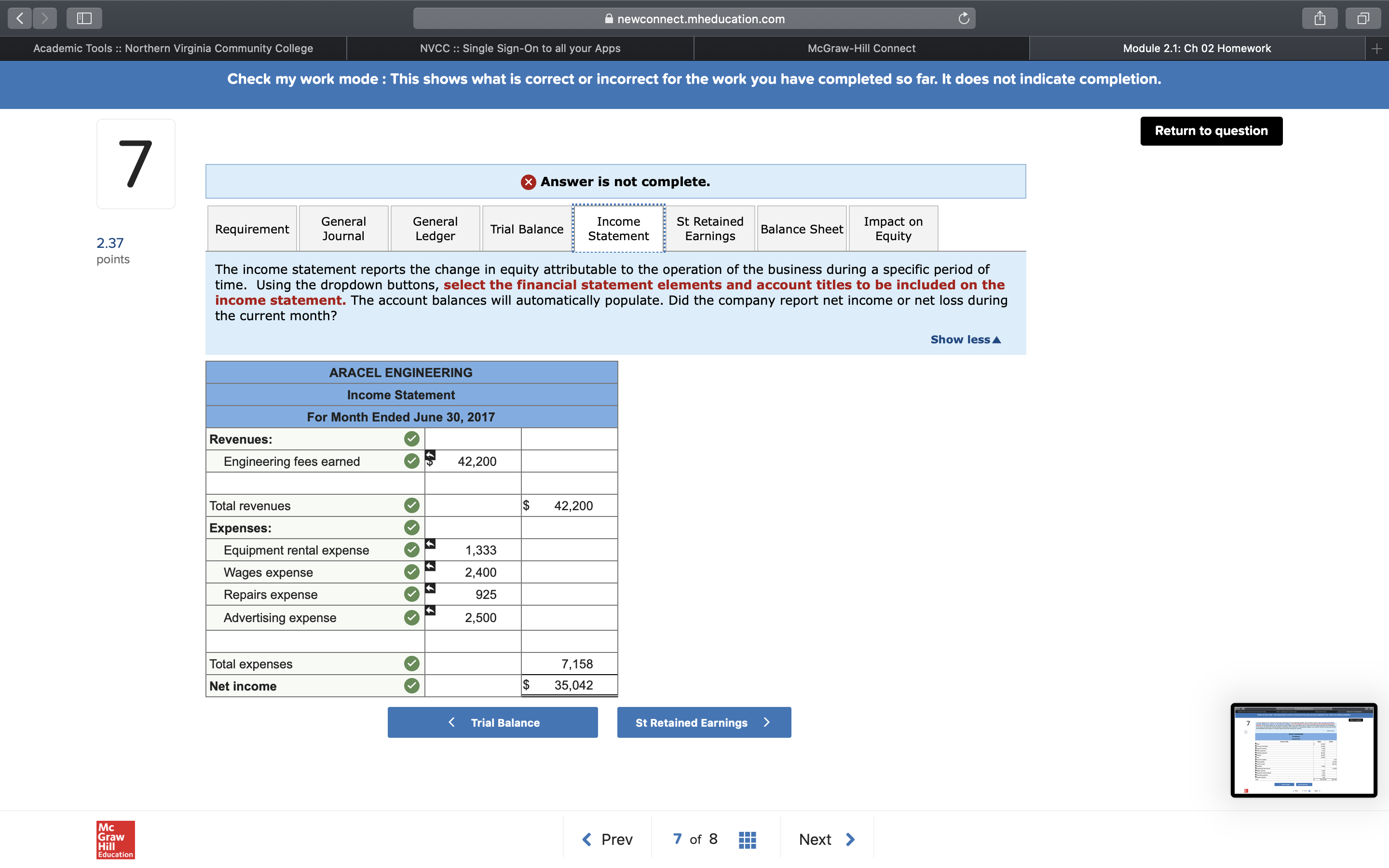

Jun.5The company completed and delivered a set of plans for a client and collected $6,200 cash.

Jun.6The company purchased $20,000 of additional drafting equipment by paying $9,500 cash and signing a long-term note payable for $10,500.

Jun.7The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days.

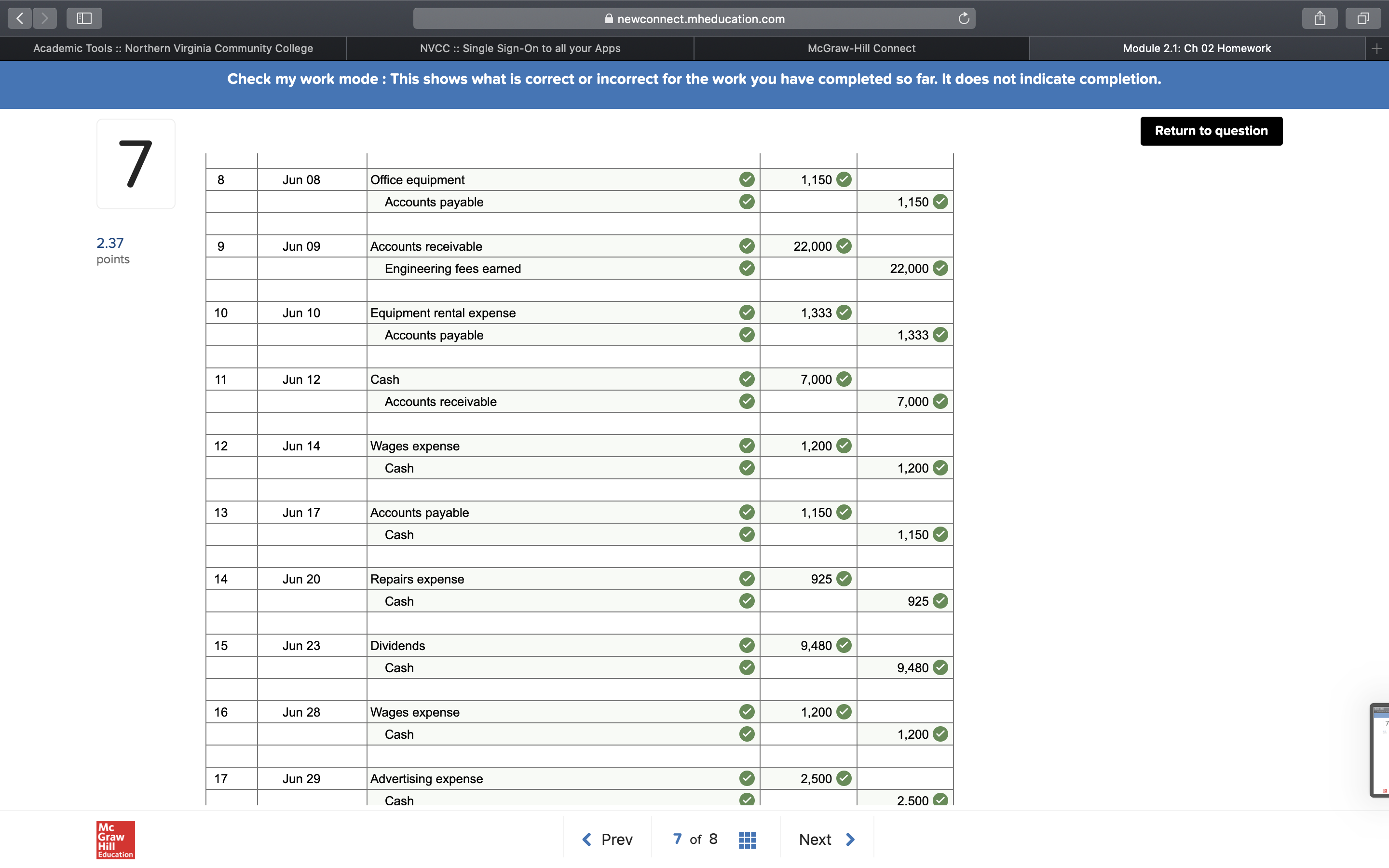

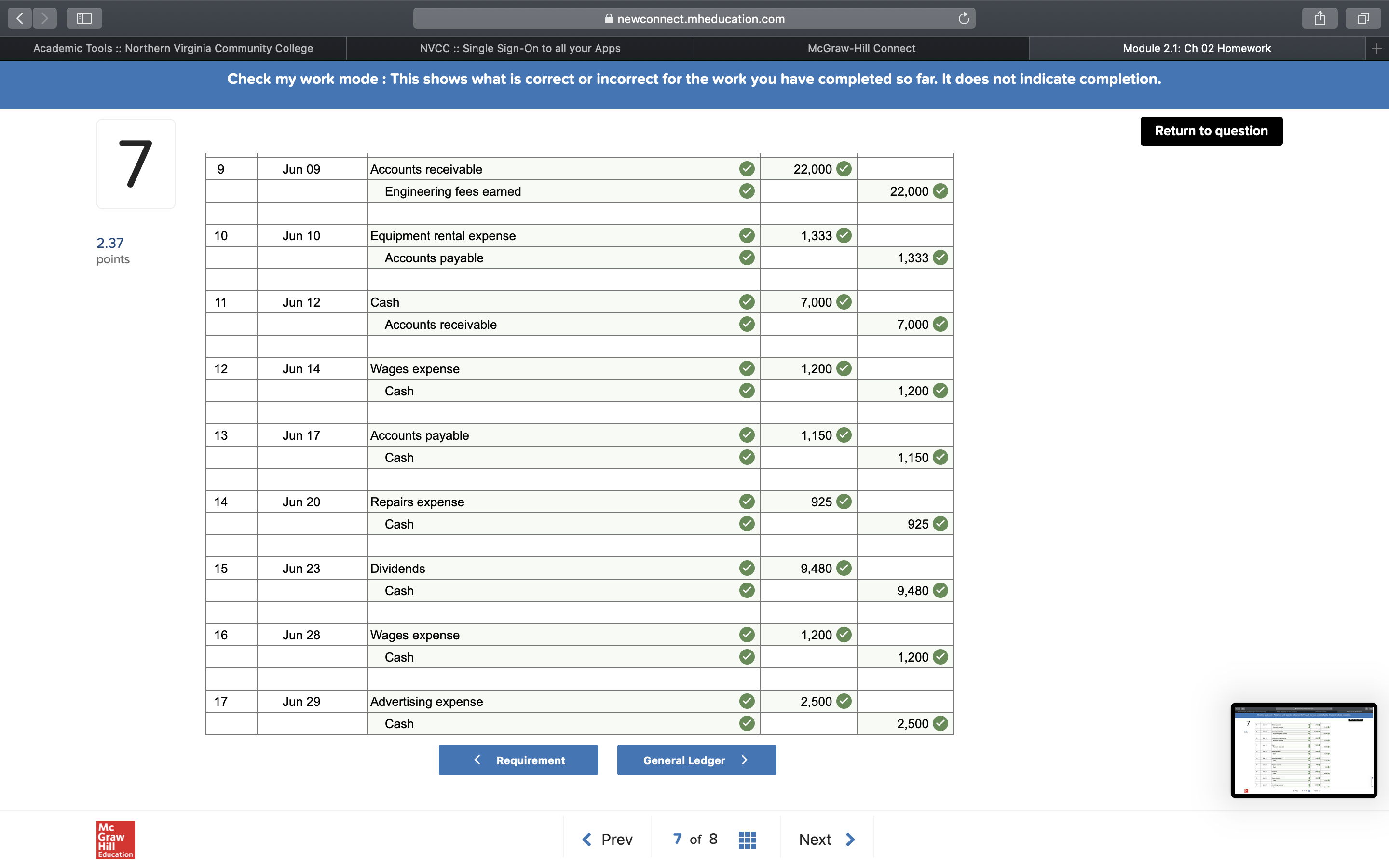

Jun.8The company purchased $1,150 of additional office equipment on credit.

Jun.9The company completed engineering services for $22,000 on credit.

Jun.10The company received a bill for rent of equipment that was used on a recently completed job. The $1,333 rent cost must be paid within 30 days.

Jun.12The company collected $7,000 cash in partial payment from the client described billed on June 9.

Jun.14The company paid $1,200 cash for wages to a drafting assistant.

Jun.17The company paid $1,150 cash to settle the account payable created in on June 8.Jun.20The company paid $925 cash for minor maintenance of its drafting equipment.

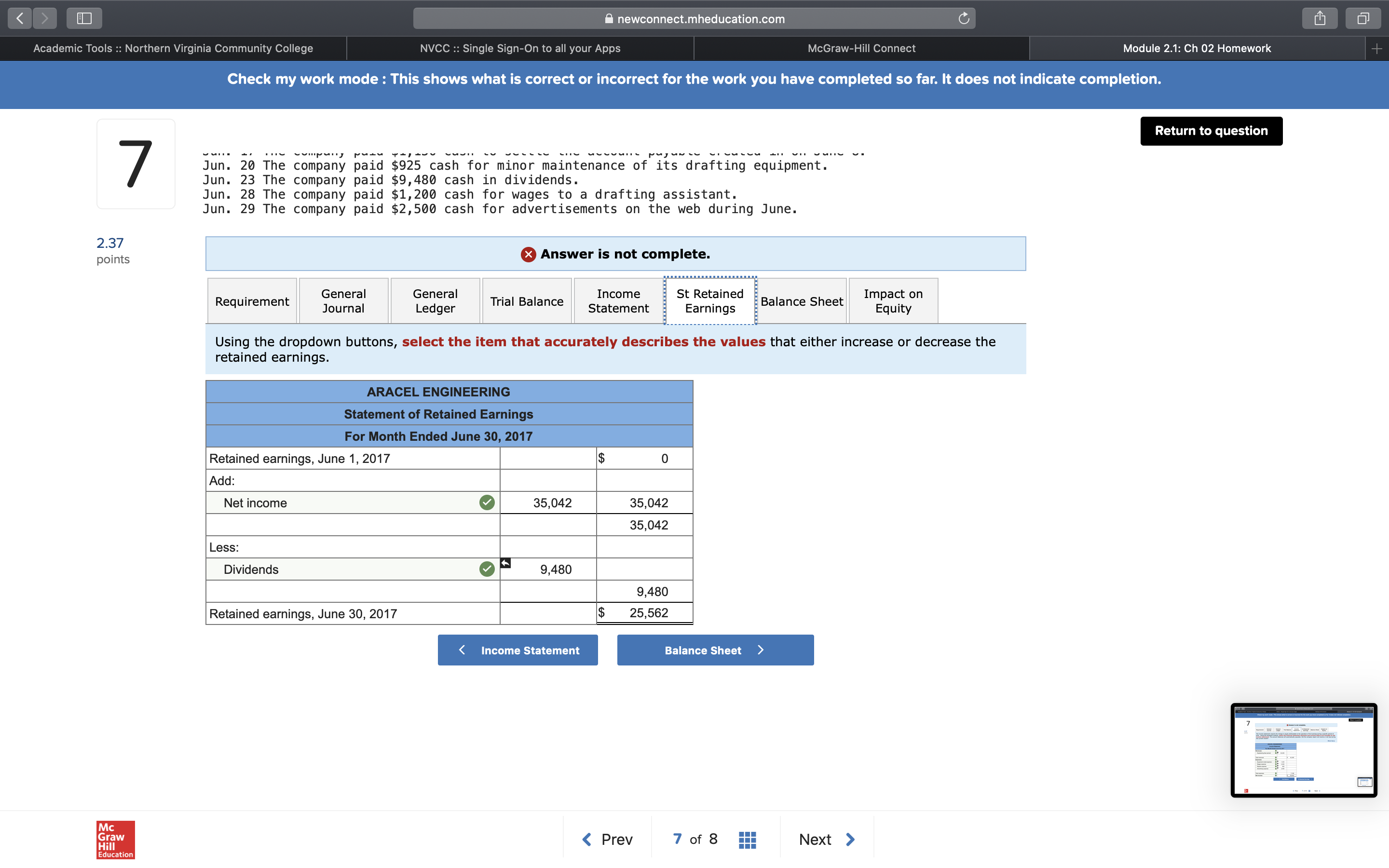

Jun.23The company paid $9,480 cash in dividends.Jun.28The company paid $1,200 cash for wages to a drafting assistant.

Jun.29The company paid $2,500 cash for advertisements on the web during June.

newconnect.mheducation.com C Academic Tools :: Northern Virginia Community College NVCC :: Single Sign-On to all your Apps McGraw-Hill Connect Module 2.1: Ch 02 Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 7 Show less No Date Account Title Debit Credit 2.37 Jun 01 Cash 100,000 points Office equipment 5,000 Drafting equipment 60,000 Common stock 165,000 2 Jun 02 Land 49,000 Cash 6,300 Notes payable 42,700 3 Jun 03 Building 65,000 Cash 55,000 4 Jun 04 Prepaid insurance O 3,000 Cash 3,000 5 Jun 05 Cash 6,200 Engineering fees earned 6,200 6 Jun 06 Drafting equipment 20,000 Cash 9,500 Notes payable 10,500 7 Jun 07 Accounts receivable 14,000 Engineering fees earned 14,000 8 Jun 08 Office equipment 1, 150 Mc Graw Hill Education newconnectmheducationcom 111111 1:1 ,: :: : V, :7 :1 ~11 m a: :1 111311111" Module2.1:Ch02Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to q ue n ; 3 Jun 03 Ofce equipment 9 1,150 9 Accounts payable 9 1,150 9 2-37 9 Jun 09 Accounts receivable 9 22,000 0 points Engineering fees earned 9 22,000 a 10 Jun 10 Equipment rental expense 9 1,333 9 Accounts payable 9 1,333 9 11 Jun 12 Cash 9 7,000 0 Accounts receivable 9 7,000 Q 12 Jun 14 Wages expense 9 1,200 9 Cash 9 1,200 9 13 Jun 17 Aoooune payable 9 1,150 0 Cash 9 1,150 0 14 Jun 20 Repairs expense 9 925 9 Cash 9 925 9 15 Jun 23 Dividends 9 9,480 0 Cash 9 9,480 0 16 Jun 28 Wages expense 9 1,200 9 I 7 Cash 9 1,200 9 17 Jun 29 Advertising expense 9 2,500 0 Cash 9 2.500 a MC Graw ( Prev 7 of 8 Next ) Hill Education newconnecimheducationcom 111111 1:1 ,: :: : 7' :7 :1 1'11 m a: :1 1H:'iiiii" Module2.1:Ch02Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to q ue n 7 9 Jun 09 Aeoounis receivable 9 22,000 9 Engineering fees eamed 9 22,000 9 2 37 10 Jun 10 Equipment rental expense 9 1,333 0 points Accounts payable 9 1,333 a 11 Jun 12 Cash 9 7,000 9 Accounts receivable 9 7,000 9 12 Jun 14 Wages expense 9 1,200 0 Cash 9 1,200 a 13 Jun 17 Accounts payable 9 1,150 0 Cash 9 1,150 9 14 Jun 20 Repairs expense 9 925 0 Cash 9 925 a 15 Jun 23 Dividends 9 9,480 9 Cash 9 9,450 o 16 Jun 28 Wages expense 9 1,200 0 Cash 9 1,200 a 17 Jun 29 Advertising expense 9 2,500 9 Cash 9 2,500 9 MC Graw ( Prev 7 of 8 Next ) Hill Education newconnectmheducationcom Ml C , C: :l 3' :7 i , 'll \"1 ,; l i l H : Hm Module 2.1:Ch 02 Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to q ue n account balance to return to the General Ledger. The trial balance is only as accurate as the under y ng journal entries. If the total debits do not equal the total credits, you must have one or more journal entries that are out of balance. If you have an abnormal ending balance (indicated with brackets in the general ledger), you should review the journal entries that affected that account to ensure that the journal entries are correct. 7 me u in: valance ID a nanny u: an awuullk Ucllcllchb nun: we ueuemi Longer a: m :- apuulil. uaw. mum un any nlulvluual 237 Show lessA points Account Title Debit Credit :Cash $ 22,945 Aooounls receivable 29,000 Prepaid insurance 3,000 Ofce equipment 6,150 Drafting equipment 80,000 Building 55,000 Land 49,000 leoounis payable 1,333 Notes payable 53,200 Common stock 165,000 Dividends 9,480 :Engineering fees earned 42,200 Wages expense 2,400 IEquipment rental expense 1,333 Advertising expense 2,500 Repairs expense 925 Total m M: a'i'iw ( Prev 7 of 8 Education Next ) E newconnectmheducationcom w a g :: : , :7 :' mii m i: :' liliiiiii\" Module2.i:Ch02Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to ques on J 0 Answer Is not complete. General General Joumal Ledger Income St Retained Impact on Requirement Statement Earnings Balance Sheet Equity ' Trial Balance 2.37 ' points The income statement reports the change in equity attributable to the operation of the business during a specic period of time. Using the dropdown buttons, select the financial statement elements and account titles to be included on the income statement. The account balances will automatically populate. Did the company report net income or net loss during the current month? Show lessA Revenues: 9 Engineering fees earned 9 42,200 Total revenues o $ 42,200 Expenses: 0 Equipment rental expense a 1,333 Wages expense 9 2,400 Repairs expense 9 925 Advertising expense 9 I! 2,500 Total expenses 9 7,158 Net Income 0 $ 35,042 ( Prev 7 of 8 Next ) Education newconnectmheducationcom Hui Ci , i: i , :7 :. i'll nu .; i ' :ilw ' ModuleZ.'l:Ch02Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to q ue n Jun. 20 The company paid $925 cash for minor maintenance of its drafting equipment. Jun. 23 The company paid $9,480 cash in dividends. Jun. 28 The company paid $1,200 cash for wages to a drafting assistant. Jun. 29 The company paid $2,500 cash for advertisements on the web during June. 2.37 _ points 0 Answer Is not complete. . General General . Income St Retained Impact on Requirement Journal Ledger TrIal Balance Statement Earnings Balance Sheet Equity Using the dropdown buttons, select the item that accurately descr hes the values that either increase or decrease the retained earnings. Relained earnings, June 1, 2017 $ 0 Add: Net income 9 35.042 35.042 35.042 Less: . , DIVIdends 0 9,480 9,480 Retained earnings, June 30, 2017 $ 25.562 M: Graw ( Prev 7 of 8 Next ) Hill 54mm" newconnect.mheducation.com C Academic Tools :: Northern Virginia Community College NVCC :: Single Sign-On to all your Apps McGraw-Hill Connect Module 2.1: Ch 02 Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 7 balance sheet. The account balances will automatically populate. ARACEL ENGINEERING Balance Sheet 2.37 June 30, 2017 points Assets: Cash 22,945 Accounts receivable 29,000 Prepaid insurance 3,000 Drafting equipment 80,000 Building 65,000 Office equipment 6, 150 Land 49,000 Total assets $ 245,095 Liabilities: Accounts payable 1,333 Notes payable 53,200 Total liabilities $ 54,533 Equity: Common stock 165,000 Retained earnings 25,562 Total equity 90,562 Total liabilities and equity $ 245,095 Mc Graw Hill Educationnewconnect.mheducation.com C Academic Tools :: Northern Virginia Community College NVCC :: Single Sign-On to all your Apps McGraw-Hill Connect Module 2.1: Ch 02 Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 7 & Answer is not complete. Requirement General General Income St Retained Impact on 2.37 Journal Ledger Trial Balance Statement Earnings Balance Sheet Equity points The expanded accounting equation shows the four subsets of equity: Revenues, Expenses, stockholder investments and dividends. Using the dropdown buttons, indicate the impact each transaction has on total equity (if any). Compare the total with the amount of equity reported on the balance sheet. Transaction Impact on Equity Jenna Aracel, the owner, invested $100,000 cash, office equipment with a value of $5,000, and $60,000 of drafting equipment to launch the company in Increased equity - Stockholder investment $ 165,000 exchange for common stock The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term 0 note payable for $42,700. The company purchased a portable building with $55,000 cash and moved it onto the land acquired on 0 June 2 The company paid $3,000 cash for the premium on an 18-month insurance policy. 0 The company completed and delivered a set of plans for a client and collected $6,200 cash. Increased equity - Revenue 6,200 The company purchased $20,000 of additional drafting equipment by paying $9,500 cash and signing a long- 0 term note payable for $10,500. The company completed $14,000 of engineering services for a client. This amount is to be received in 30 Increased equity - Revenue V 14,000 days. The company purchased $1,150 of additional office equipment on credit The company completed engineering services for $22,000 on credit. Increased equity - Revenue 22,000 The company received a bill for rent of equipment that was used on a recently completed job. The $1,333 rent Decreased equity - Expense V (1,333) cost must be paid within 30 days The company collected $7,000 cash in partial payment from the client described on June 9 0 The company paid $1.200 cash for wades to a draftina . - - - Mc Graw Hill Education newconnectmheducation.ccm .w c. ,: :: : 7' :7 :i wii m a: :w iiii'iiiii\" Module2.i:Ch02Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to ques on $55,666'Ea' Sa'iB'vaiiBiEii; ii'qlliie'd on 0 June 2. The company paid $3,000 cash for the premium on an 0 18-month insurance policy, The company completed and delivered a set of plans for . 237 a client and collected $6,200 cash. Increased equity ' Revenue 9 6'200 points The company purchased $20,000 of additional dratting equipment by paying $9,500 cash and signing a long 0 term note payable for $10,500, The company completed $14.000 of engineering services for a client. This amount is to be received in 30 Increased equity Revenue 9 14.000 days. The company purchased $1.150 of additional oice 0 equipment on credit. The company completed engineering services for I d . R v o 22 000 $22,000 on credit. ncrease equity - e enue . The company received a bill for rent of equipment that was used on a recently completed job. The $1.333 rent Decreased equity - Expense 0 (1,333) cost must be paid within 30 days. The company collected $7,000 cash in partial payment 0 from the client described on June 9. :2; 52:11pm), paid $1,200 cash for wages to a drafting Decreased equity _ Expense o (1.200) The company paid $1,150 cash to settie the account 0 payable created in on June 8. The corn an aid $925 cash for minor maintenance of . its drafting equipment. Decreased equity - Expense o (925) The company paid $9,480 cash in dividends, Decreased equity - Dividends 0 (9,480) 2:52:1'9\"), paid $1,200 cash for wages to a drafting Decreased equity _ Expense 9 (1,200) The company paid $2,500 cash for advertisements on . the web during June. Decreased equity - Expense 9 (2.500) Total change in equity $ 190.562 What is the balance in the total equity as reported on the balance sheet? $ 190,562 0 Congratulations! You've successlully identied the impact each transaction has on equity.