Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. My question relates to book 978 1 61853 122 3 Taking pages 109, 110 into account, what is average accounts receivable? Begin year and

Hello. My question relates to book 978 1 61853 122 3

Taking pages 109, 110 into account, what is average accounts receivable? Begin year and end year I know are a factor, but will any other part of this data become a facto?r

? If so, please explain.

Thank you

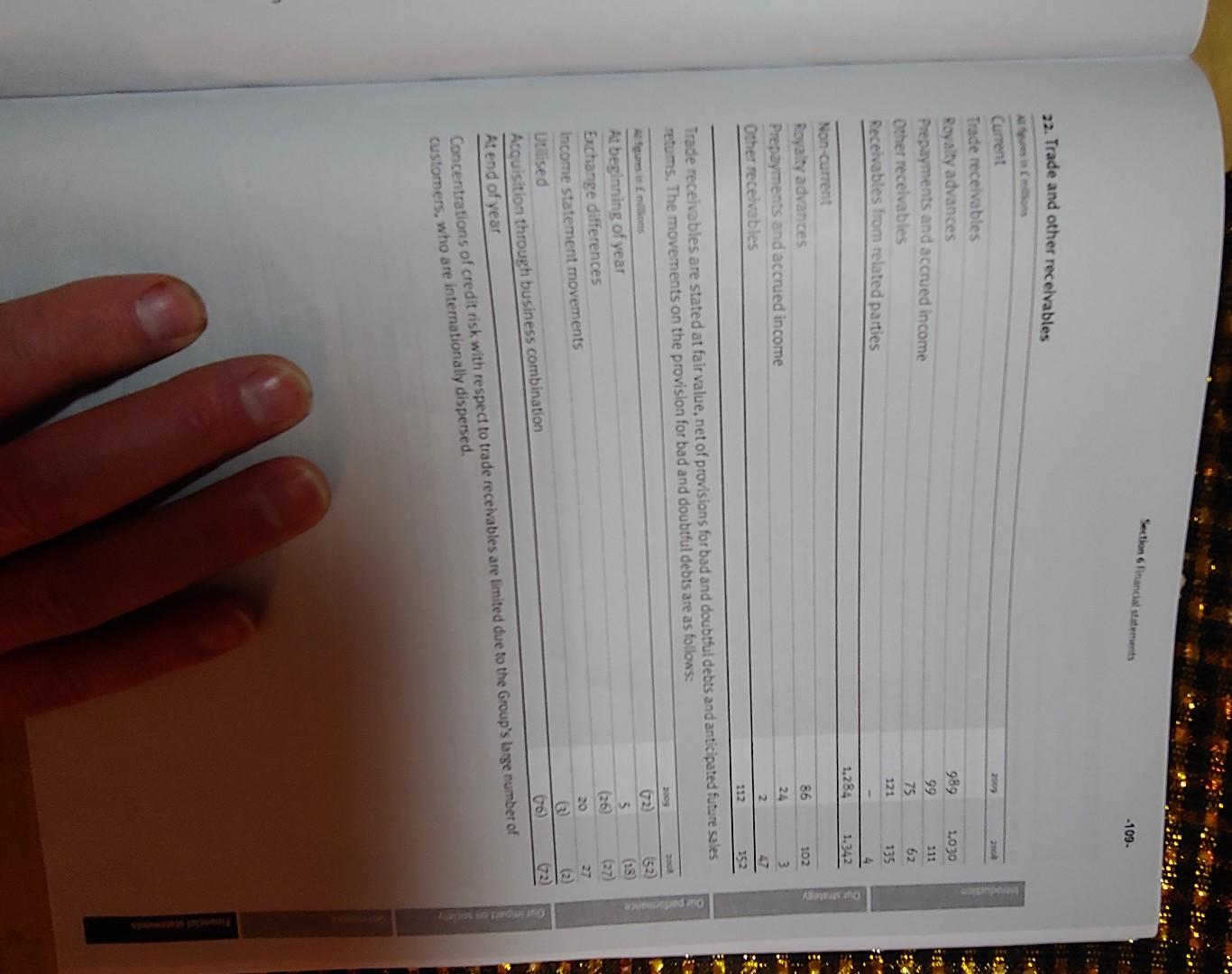

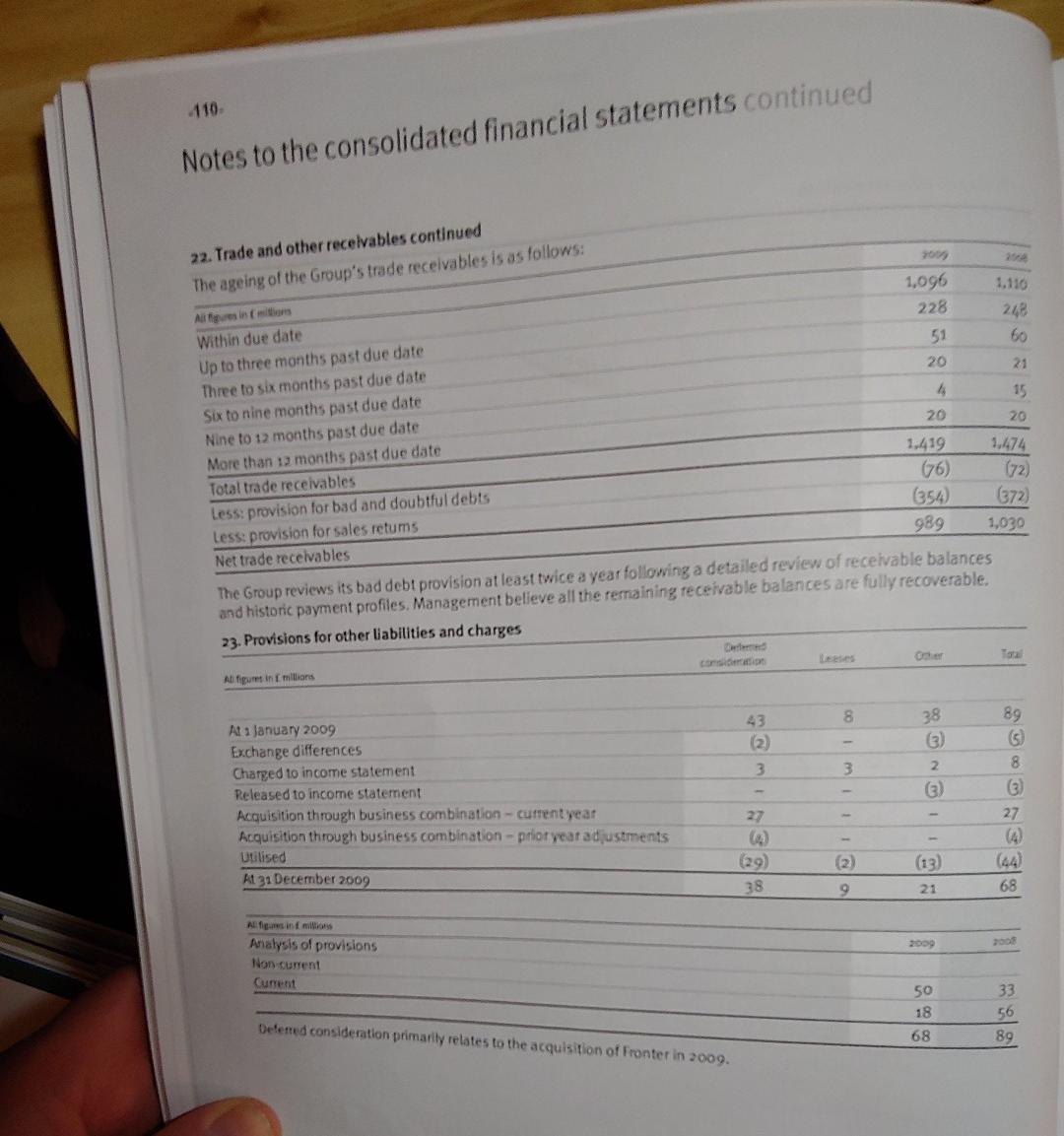

Section Financial statements -109 22. Trade and other receivables Current Trade receivables Royalty advances Prepayments and accrued income Other receivables Receivables from related parties 989 99 75 121 1,030 111 62 135 1,284 1.342 86 Non-current Royalty advances Prepayments and accrued income Other receivables 102 3 24 2 152 Trade receivables are stated at fair value, net of provisions for bad and doubthul debts and anticipated future sales retums. The movements on the provision for bad and doubtful debts are as follows: 2009 (27) 20 (2) At beginning of year Exchange differences 5 Income statement movements (26 Utilised Acquisition through business combination At end of year Concentrations of credit risk with respect to trade receivables are limited due to the Group's large number of customers, who are internationally dispersed. 110 Notes to the consolidated financial statements continued 1,096 228 248 60 20 21 4 22. Trade and other receivables continued The ageing of the Group's trade receivables is as follows: Ai fini Within due date Up to three months past due date Three to six months past due date Six to nine months past due date Nine to 12 months past due date More than 12 months past due date Total trade receivables Less: provision for bad and doubtful debts Less: provision for sales retums Net trade receivables 20 15 20 1.419 1,474 (6) (72) (354) (372) 989 1,030 The Group reviews its bad debt provision at least twice a year following a detailed review of receivable balances and historic payment profiles, Management believe all the remaining receivable balances are fully recoverable. 23. Provisions for other abilities and charges como All figures in millions 8 38 89 3 3 2 6) At : January 2009 Exchange differences Charged to income statement Released to income statement Acquisition through business combination - current year Acquisition through business combination-prior year adjustments Utilised At 31 December 2009 8 (3) 27 27 (2) (13) (29) 38 9 21 68 Alguns in Emilio Analysis of provisions Non current Current 50 18 33 56 89 Detened consideration primarily relates to the acquisition of Fronter in 2009. 68Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started