Answered step by step

Verified Expert Solution

Question

1 Approved Answer

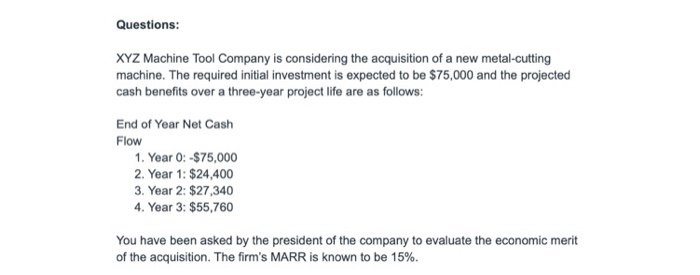

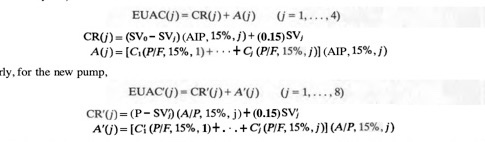

Hello, need help solving this question using the formulas as shown in the second picture. please show work, will rate. Thank you. second picture is

Hello, need help solving this question using the formulas as shown in the second picture. please show work, will rate. Thank you.

second picture is example of the process needed, but doesnt have to be same exact formula

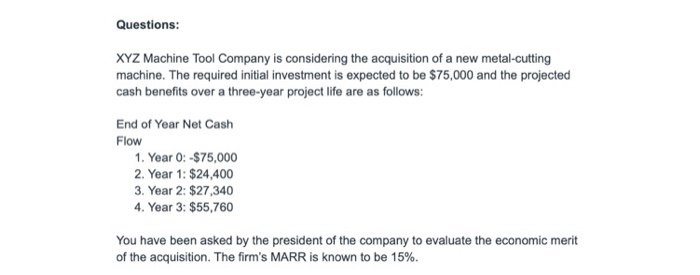

Questions: XYZ Machine Tool Company is considering the acquisition of a new metal-cutting machine. The required initial investment is expected to be $75,000 and the projected cash benefits over a three-year project life are as follows: End of Year Net Cash Flow 1. Year 0:-$75,000 2. Year 1: $24.400 3. Year 2: $27,340 4. Year 3: $55,760 You have been asked by the president of the company to evaluate the economic merit of the acquisition. The firm's MARR is known to be 15%. EUACU) - CR(1) + A() (-1,...,4) CRC)-(SV - SV) (AIP, 15%,])+ (0.15) SV, A()= [C(P/F, 15%, 1)+...+ (P/F, 15%./) (AIP, 15%, j) mly, for the new pump. EUACU) - CR'() + A'U') (-1,..., 8) CRO)=(P-SV) (A/P, 15%, j)+ (0.15)SV) A'C)=[C(P/F, 15%,1)+...+ C(P/F, 15%.;)] (A/P, 15%.;) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started