Hello pleas complete answer

best regards

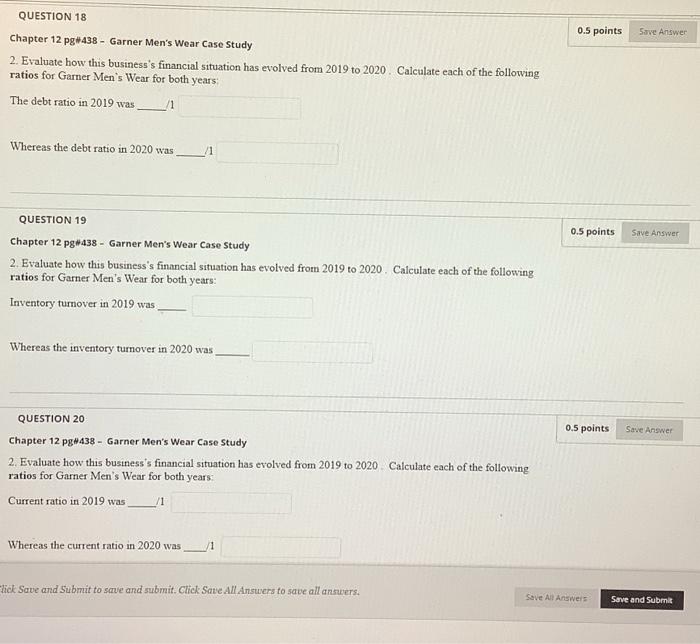

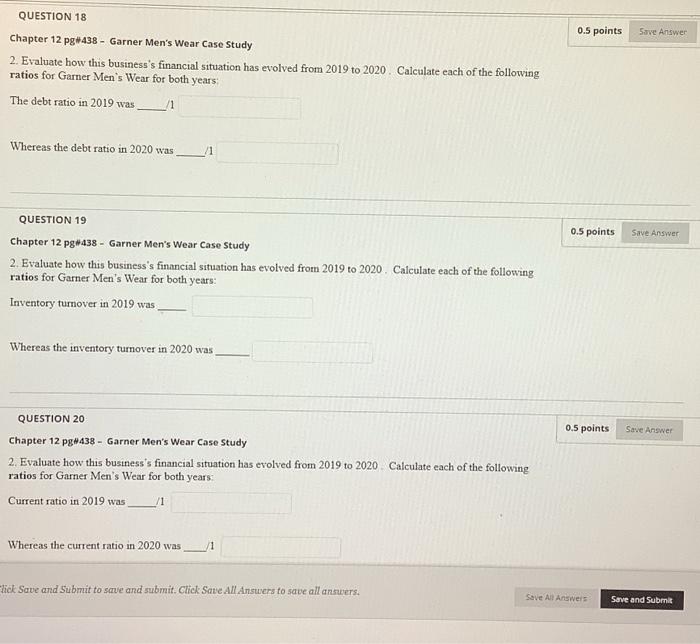

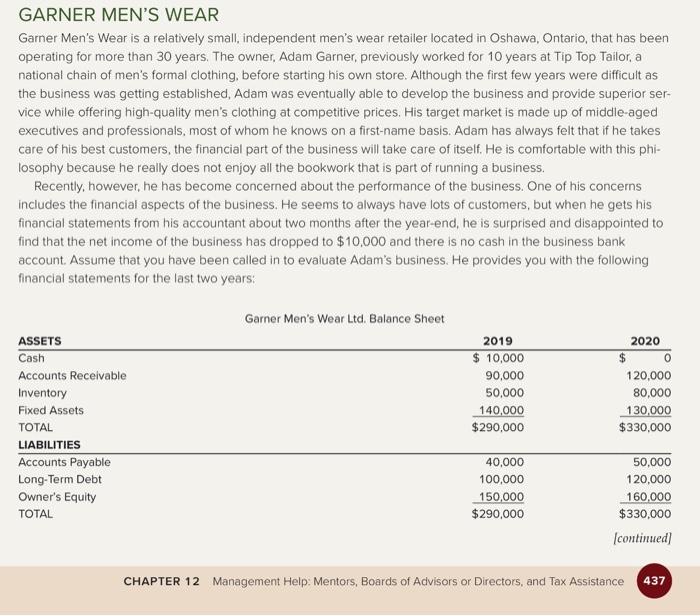

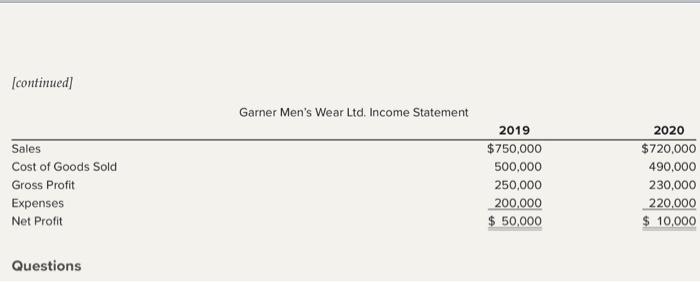

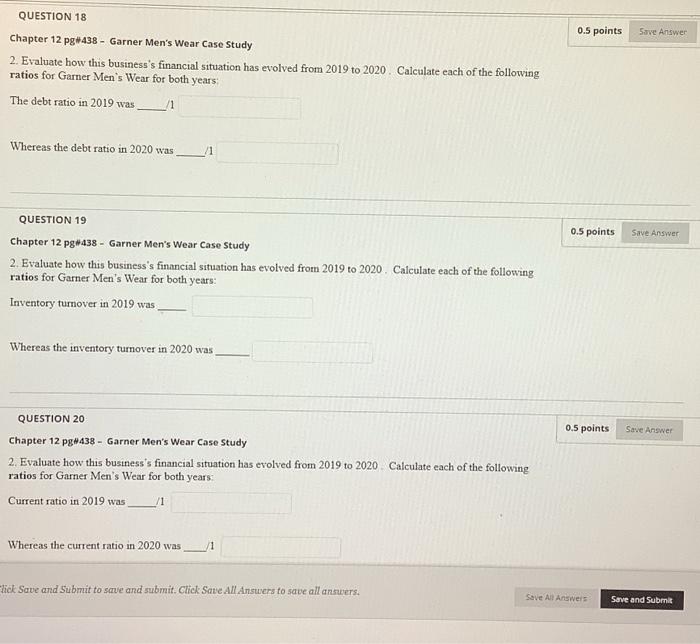

QUESTION 18 0.5 points Save Answer Chapter 12 pg#438 - Garner Men's Wear Case Study 2. Evaluate how this business's financial situation has evolved from 2019 to 2020. Calculate each of the following ratios for Garner Men's Wear for both years The debt ratio in 2019 was 11 Whereas the debt ratio in 2020 was 0.5 points Save Answer QUESTION 19 Chapter 12 pg#438 - Garner Men's Wear Case Study 2. Evaluate how this business's financial situation has evolved from 2019 to 2020. Calculate each of the following ratios for Garner Men's Wear for both years: Inventory turnover in 2019 was Whereas the inventory turnover in 2020 was 0.5 points Save Answer QUESTION 20 Chapter 12 pg438 - Garner Men's Wear Case Study 2. Evaluate how this business's financial situation has evolved from 2019 to 2020 Calculate each of the following ratios for Garner Men's Wear for both years Current ratio in 2019 was Whereas the current ratio in 2020 was /1 lick Save and submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit GARNER MEN'S WEAR Garner Men's Wear is a relatively small, independent men's wear retailer located in Oshawa, Ontario, that has been operating for more than 30 years. The owner. Adam Garner, previously worked for 10 years at Tip Top Tailor, a national chain of men's formal clothing, before starting his own store. Although the first few years were difficult as the business was getting established, Adam was eventually able to develop the business and provide superior ser- vice while offering high-quality men's clothing at competitive prices. His target market is made up of middle-aged executives and professionals, most of whom he knows on a first-name basis. Adam has always felt that if he takes care of his best customers, the financial part of the business will take care of itself. He is comfortable with this phi- losophy because he really does not enjoy all the bookwork that is part of running a business. Recently, however, he has become concerned about the performance of the business. One of his concerns includes the financial aspects of the business. He seems to always have lots of customers, but when he gets his financial statements from his accountant about two months after the year-end, he is surprised and disappointed to find that the net income of the business has dropped to $10,000 and there is no cash in the business bank account. Assume that you have been called in to evaluate Adam's business. He provides you with the following financial statements for the last two years: Garner Men's Wear Ltd. Balance Sheet ASSETS Cash Accounts Receivable Inventory Fixed Assets TOTAL LIABILITIES Accounts Payable Long-Term Debt Owner's Equity TOTAL 2019 $ 10,000 90,000 50,000 140,000 $ 290,000 2020 $ 0 120,000 80,000 130,000 $330,000 40,000 100,000 150,000 $ 290,000 50,000 120,000 160,000 $330,000 (continued) CHAPTER 12 Management Help: Mentors, Boards of Advisors or Directors, and Tax Assistance 437 [continued Garner Men's Wear Ltd. Income Statement Sales Cost of Goods Sold Gross Profit Expenses Net Profit 2019 $750,000 500.000 250,000 200,000 $ 50,000 2020 $720,000 490,000 230,000 220,000 $ 10,000 Questions