Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello! Please help me pick the right answer for questions A to E, only one answer on each is correct. also, motivate your answer in

hello!

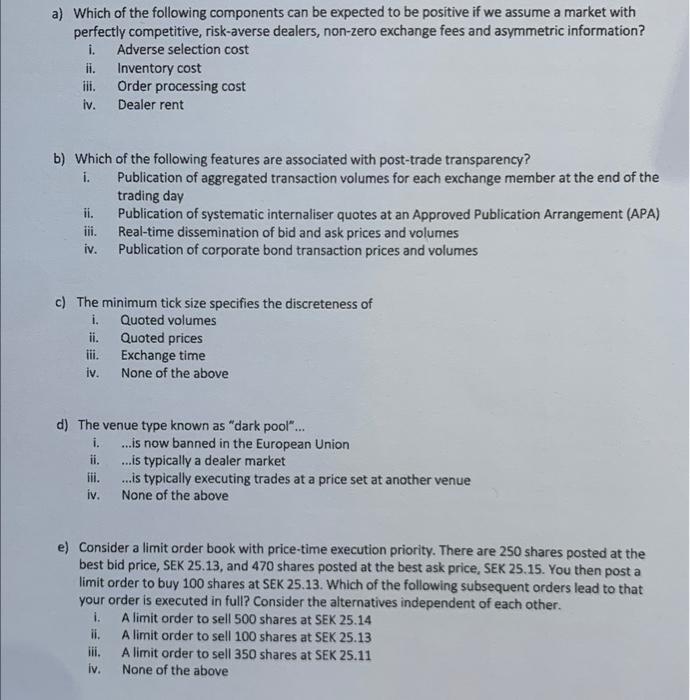

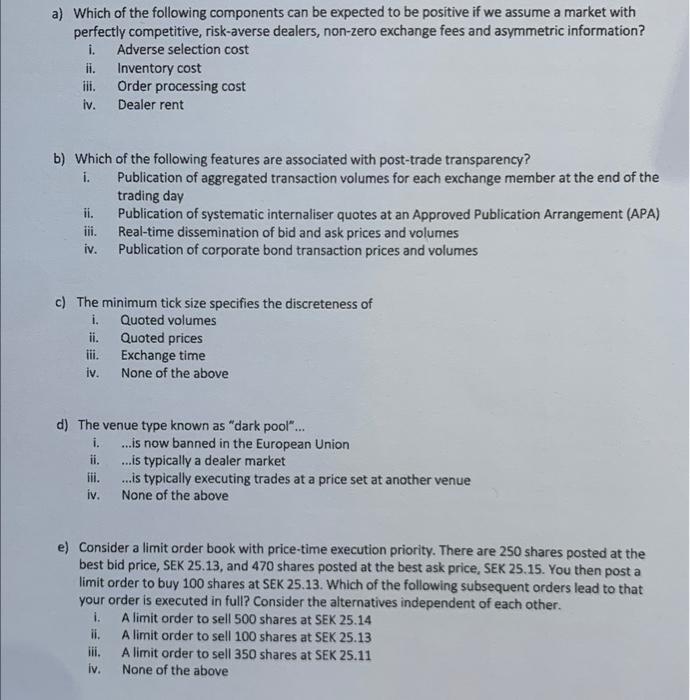

a) Which of the following components can be expected to be positive if we assume a market with perfectly competitive, risk-averse dealers, non-zero exchange fees and asymmetric information? i. Adverse selection cost ii. Inventory cost iii. Order processing cost iv. Dealer rent b) Which of the following features are associated with post-trade transparency? i. Publication of aggregated transaction volumes for each exchange member at the end of the trading day ii. Publication of systematic internaliser quotes at an Approved Publication Arrangement (APA) iii. Real-time dissemination of bid and ask prices and volumes iv. Publication of corporate bond transaction prices and volumes c) The minimum tick size specifies the discreteness of i. Quoted volumes ii. Quoted prices iii. Exchange time iv. None of the above d) The venue type known as "dark pool"... i. ...is now banned in the European Union ii. ...is typically a dealer market iii. ...is typically executing trades at a price set at another venue iv. None of the above e) Consider a limit order book with price-time execution priority. There are 250 shares posted at the best bid price, SEK 25.13, and 470 shares posted at the best ask price, SEK 25.15. You then post a limit order to buy 100 shares at SEK 25.13. Which of the following subsequent orders lead to that your order is executed in full? Consider the alternatives independent of each other. i. A limit order to sell 500 shares at SEK 25.14 ii. A limit order to sell 100 shares at SEK 25.13 iii. A limit order to sell 350 shares at SEK 25.11 iv. None of the above Please help me pick the right answer for questions A to E, only one answer on each is correct.

also, motivate your answer in short.

thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started