Question: Hello. Please help me with this assignment if you understand how to do it. Appreciate it! Q-2-10: What is the over or under applied manufacturing

Hello. Please help me with this assignment if you understand how to do it. Appreciate it!

Q-2-10: What is the over or under applied manufacturing overhead for 2019?

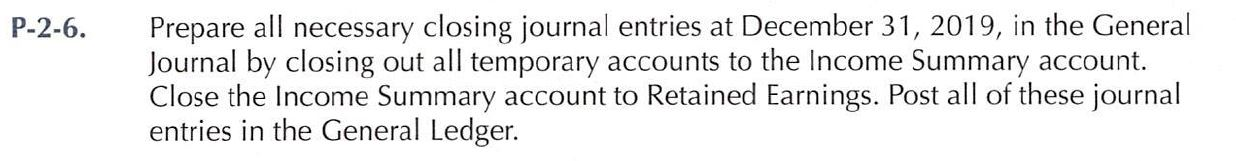

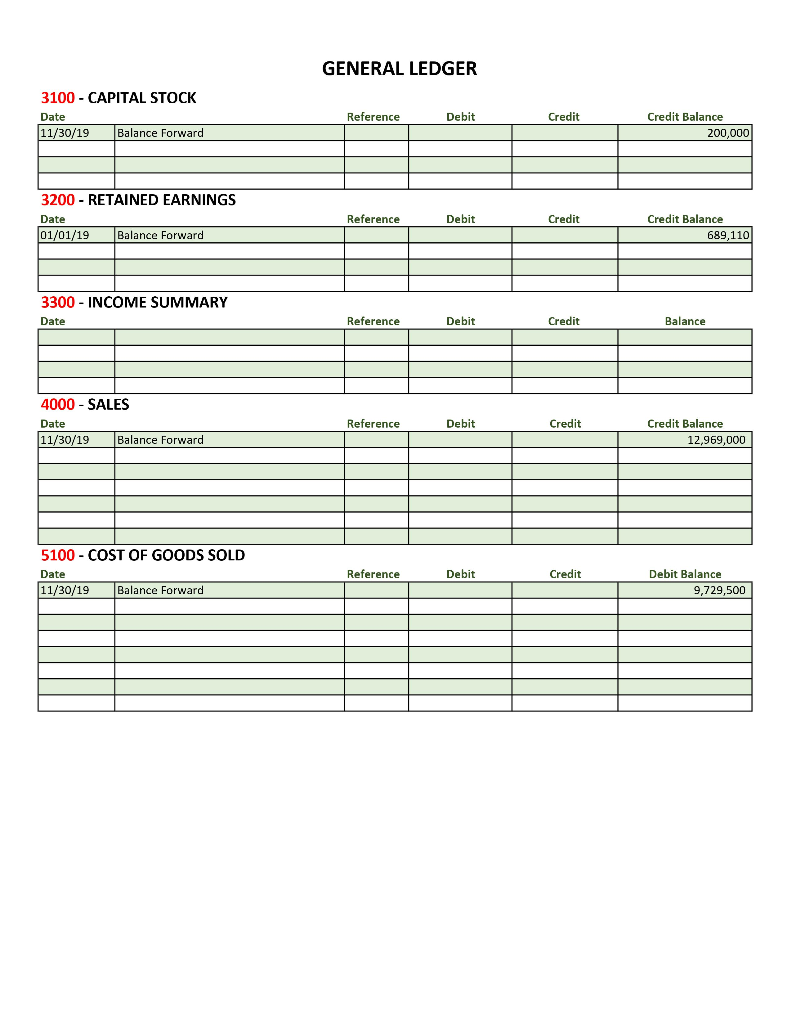

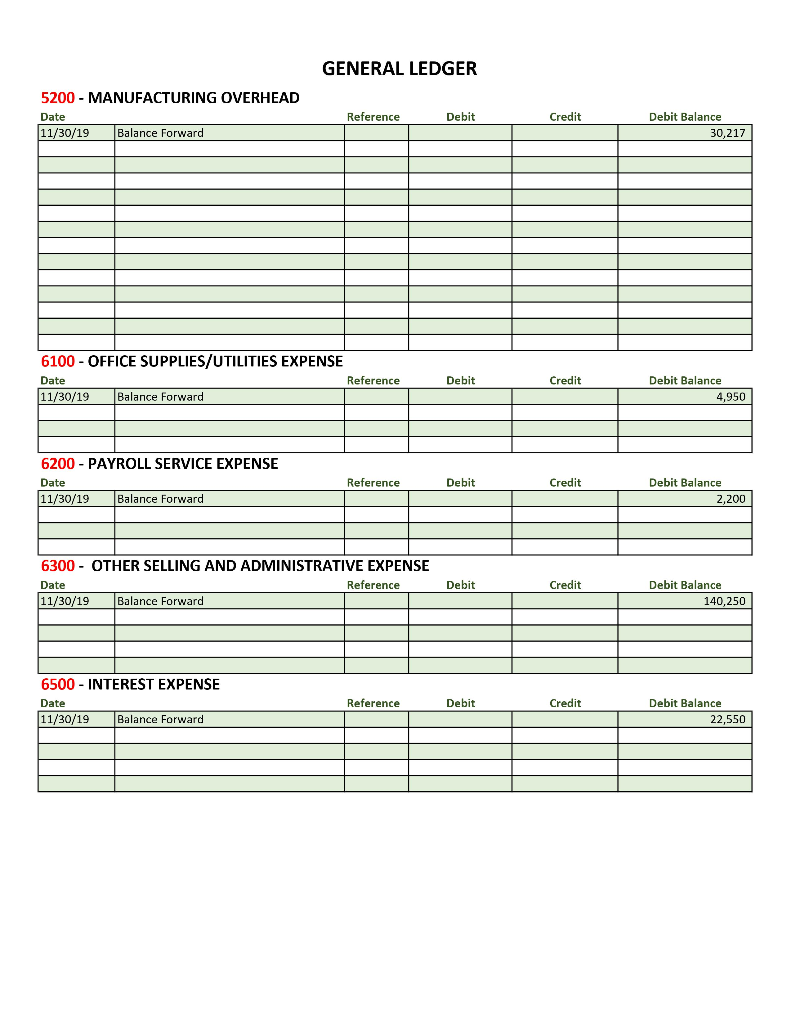

P-2-6: Prepare all necessary closing journal entries at December 31, 2019 in the General Journal by closing out all temporary accounts to the Income Summary account. Close the Income Summary account to retained Earnings. Post all of these journal entries to the General Ledger.

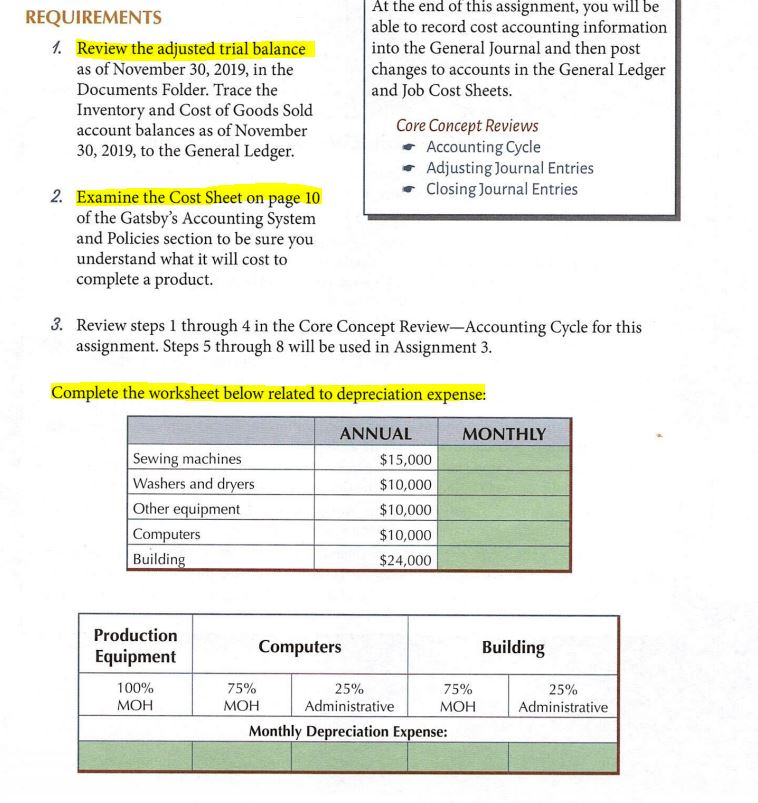

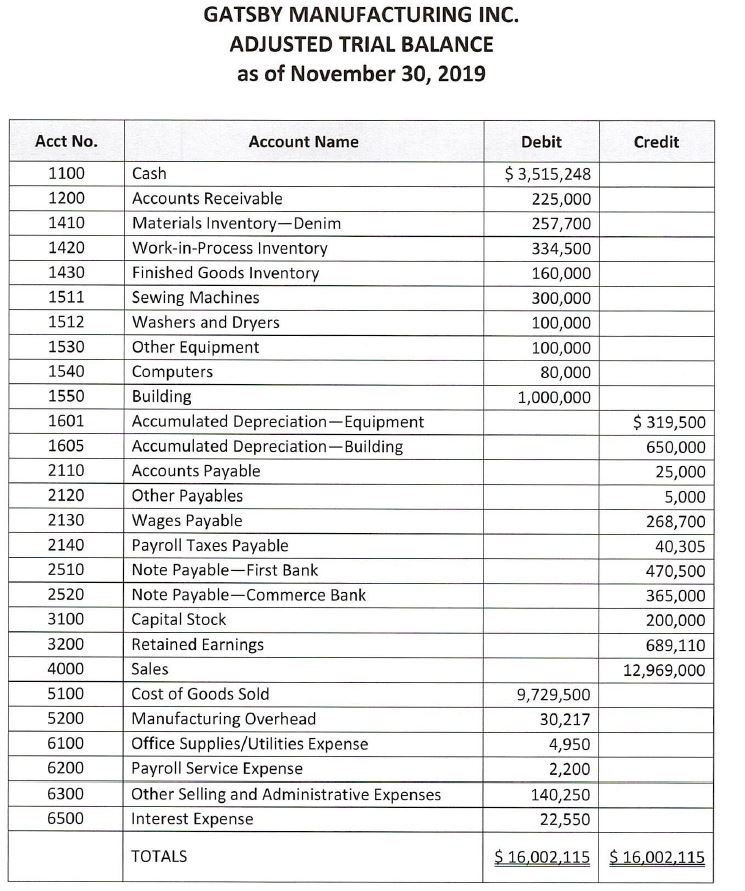

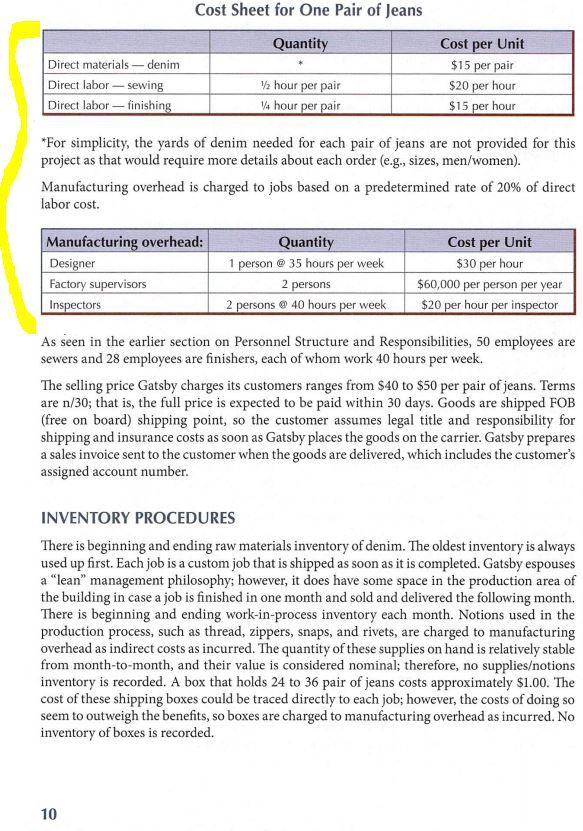

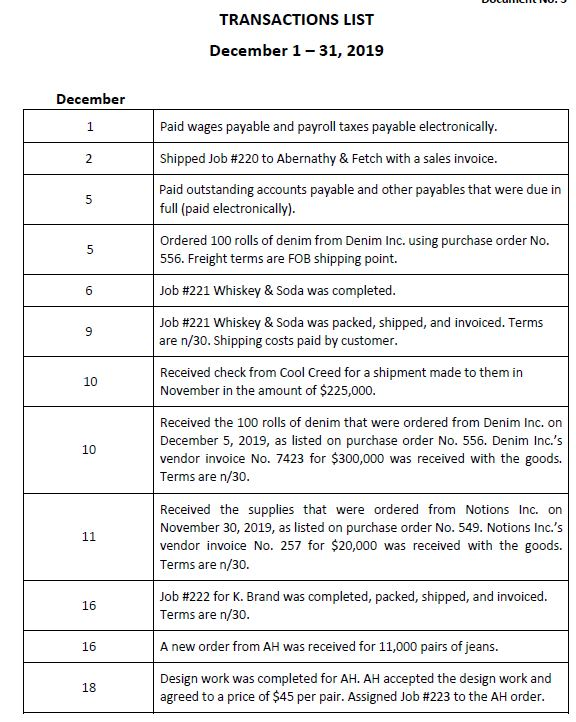

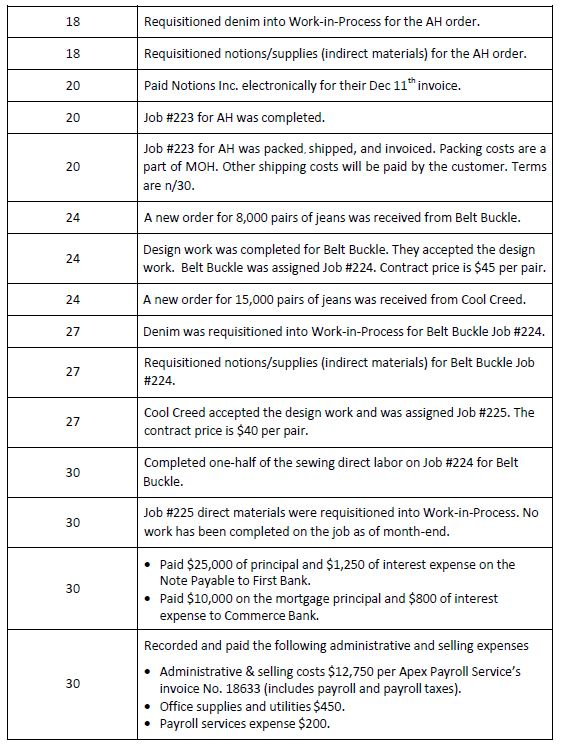

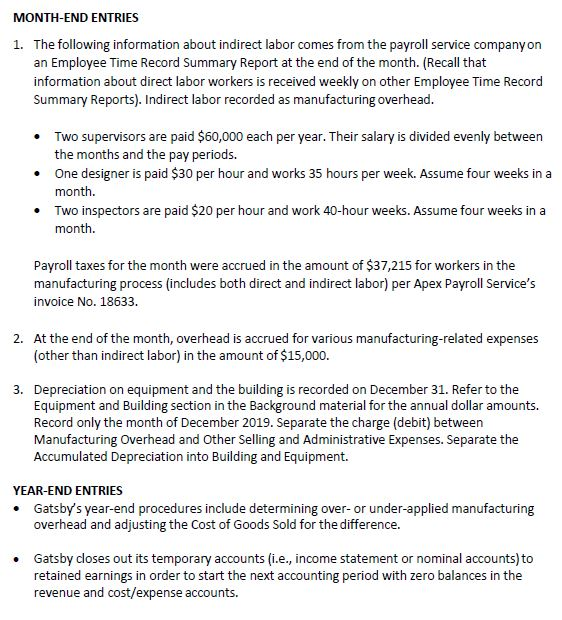

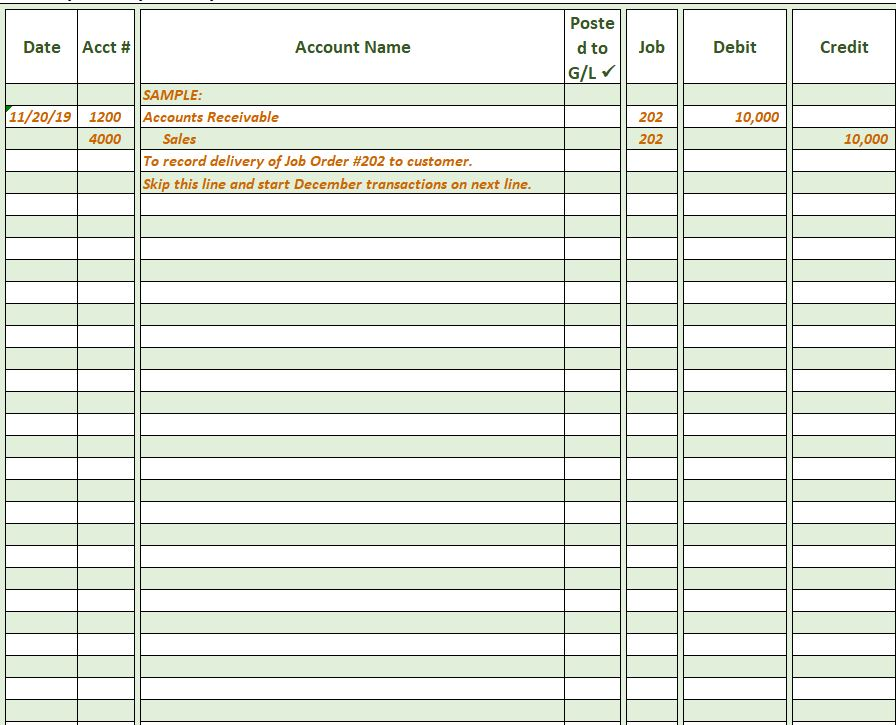

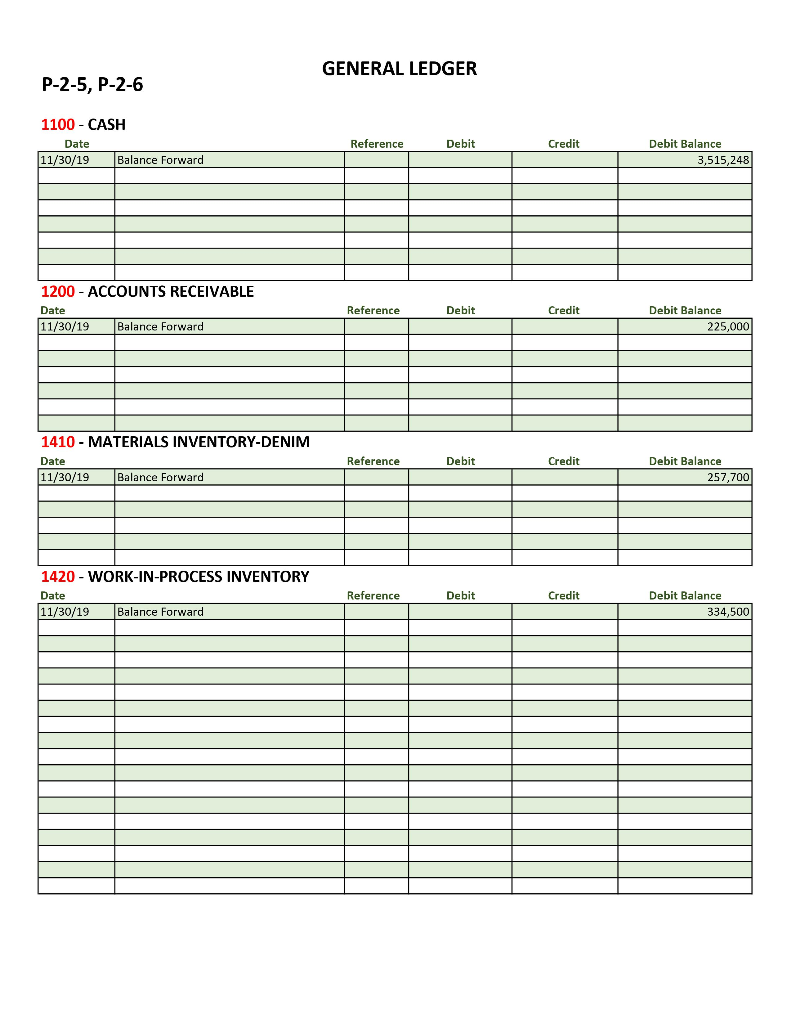

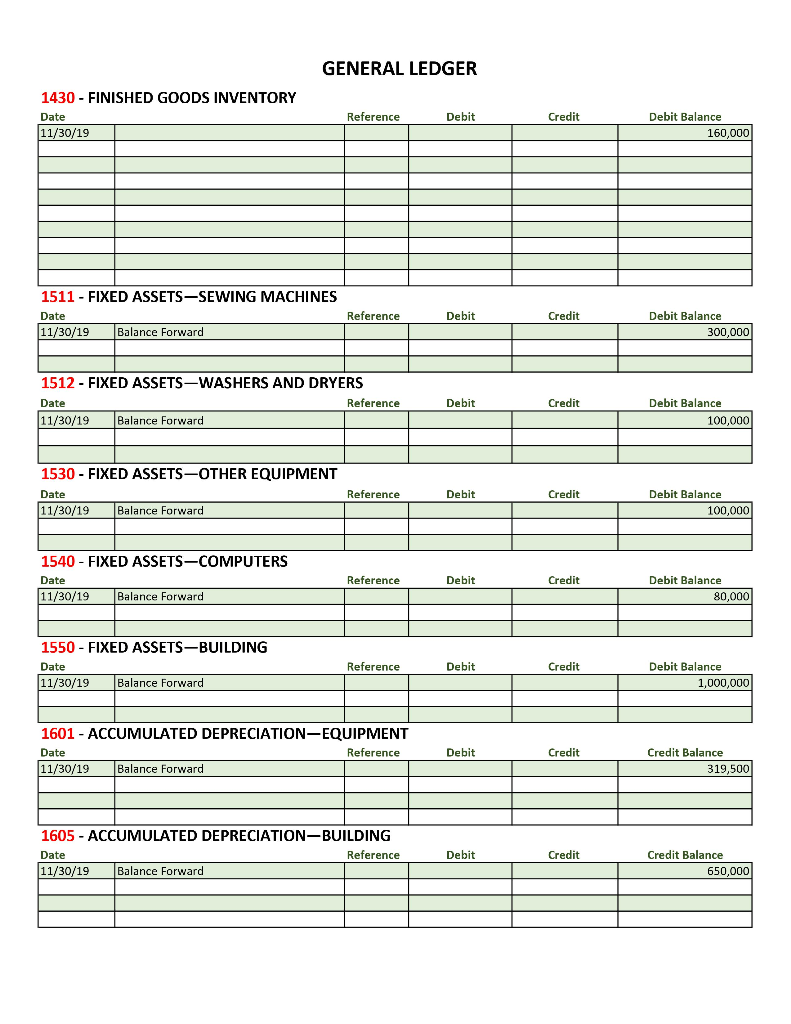

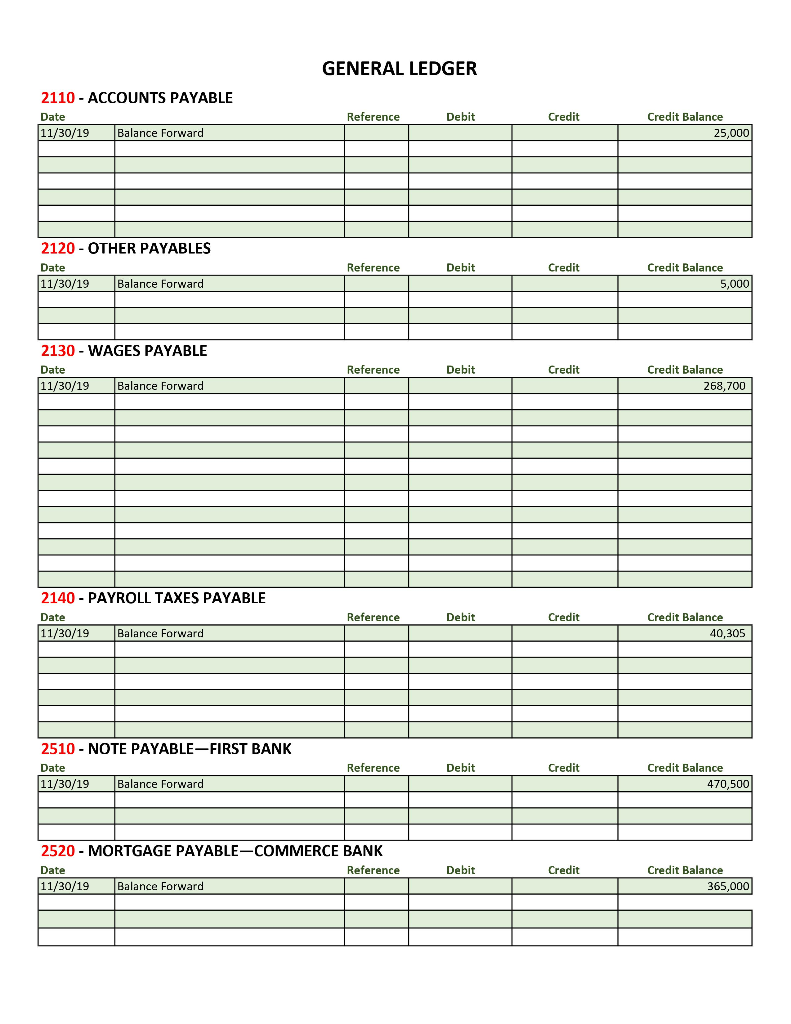

REQUIREMENTS 1. Review the adjusted trial balance as of November 30, 2019, in the Documents Folder. Trace the Inventory and Cost of Goods Sold account balances as of November 30, 2019, to the General Ledger. At the end of this assignment, you will be able to record cost accounting information into the General Journal and then post changes to accounts in the General Ledger and Job Cost Sheets. Core Concept Reviews Accounting Cycle Adjusting Journal Entries Closing Journal Entries Examine the Cost Sheet on page 10 of the Gatsby's Accounting System and Policies section to be sure you understand what it will cost to complete a product. 3. Review steps 1 through 4 in the Core Concept Review-Accounting Cycle for this assignment. Steps 5 through 8 will be used in Assignment 3. Complete the worksheet below related to depreciation expense: MONTHLY Sewing machines Washers and dryers Other equipment Computers Building ANNUAL $15,000 $10,000 $10,000 $10,000 $24,000 Computers Building Production Equipment 100% MOH 75% 25% 75% MOH Administrative MOH Monthly Depreciation Expense: 25% Administrative GATSBY MANUFACTURING INC. ADJUSTED TRIAL BALANCE as of November 30, 2019 Acct No. Account Name Debit Credit 1100 1200 1410 1420 1430 $ 3,515,248 225,000 257,700 334,500 160,000 300,000 100,000 100,000 80,000 1,000,000 1511 1512 1530 1540 1550 1601 1605 2110 2120 2130 2140 2510 2520 3100 3200 4000 Cash Accounts Receivable Materials Inventory-Denim Work-in-Process Inventory Finished Goods Inventory Sewing Machines Washers and Dryers Other Equipment Computers Building Accumulated Depreciation Equipment Accumulated Depreciation - Building Accounts Payable Other Payables Wages Payable Payroll Taxes Payable Note Payable-First Bank Note Payable-Commerce Bank Capital Stock Retained Earnings Sales Cost of Goods Sold Manufacturing Overhead Office Supplies/Utilities Expense Payroll Service Expense Other Selling and Administrative Expenses Interest Expense $ 319,500 650,000 25,000 5,000 268,700 40,305 470,500 365,000 200,000 689,110 12,969,000 5100 5200 6100 6200 6300 6500 9,729,500 30,217 4,950 2,200 140,250 22,550 TOTALS $ 16,002,115 $ 16,002,115 Cost Sheet for One Pair of Jeans Quantity Direct materials - denim Direct labor-sewing Direct labor - finishing Cost per Unit $15 per pair $20 per hour $15 per hour 12 hour per pair V4 hour per pair *For simplicity, the yards of denim needed for each pair of jeans are not provided for this project as that would require more details about each order (e.g., sizes, men/women). Manufacturing overhead is charged to jobs based on a predetermined rate of 20% of direct labor cost. Manufacturing overhead: Designer Factory supervisors Inspectors Quantity 1 person @35 hours per week 2 persons 2 persons @ 40 hours per week Cost per Unit $30 per hour $60,000 per person per year $20 per hour per inspector As seen in the earlier section on Personnel Structure and Responsibilities, 50 employees are sewers and 28 employees are finishers, each of whom work 40 hours per week. The selling price Gatsby charges its customers ranges from $40 to $50 per pair of jeans. Terms are n/30; that is, the full price is expected to be paid within 30 days. Goods are shipped FOB (free on board) shipping point, so the customer assumes legal title and responsibility for shipping and insurance costs as soon as Gatsby places the goods on the carrier. Gatsby prepares a sales invoice sent to the customer when the goods are delivered, which includes the customer's assigned account number. INVENTORY PROCEDURES There is beginning and ending raw materials inventory of denim. The oldest inventory is always used up first. Each job is a custom job that is shipped as soon as it is completed. Gatsby espouses a "lean" management philosophy; however, it does have some space in the production area of the building in case a job is finished in one month and sold and delivered the following month. There is beginning and ending work-in-process inventory each month. Notions used in the production process, such as thread, zippers, snaps, and rivets, are charged to manufacturing overhead as indirect costs as incurred. The quantity of these supplies on hand is relatively stable from month-to-month, and their value is considered nominal; therefore, no suppliesotions inventory is recorded. A box that holds 24 to 36 pair of jeans costs approximately $1.00. The cost of these shipping boxes could be traced directly to each job; however, the costs of doing so seem to outweigh the benefits, so boxes are charged to manufacturing overhead as incurred. No inventory of boxes is recorded. 10 TRANSACTIONS LIST December 1 - 31, 2019 December Paid wages payable and payroll taxes payable electronically. Shipped Job #220 to Abernathy & Fetch with a sales invoice. Paid outstanding accounts payable and other payables that were due in full (paid electronically). Ordered 100 rolls of denim from Denim Inc. using purchase order No. 556. Freight terms are FOB shipping point. Job #221 Whiskey & Soda was completed. Job #221 Whiskey & Soda was packed, shipped, and invoiced. Terms are n/30. Shipping costs paid by customer. Received check from Cool Creed for a shipment made to them in November in the amount of $225,000. Received the 100 rolls of denim that were ordered from Denim Inc. on December 5, 2019, as listed on purchase order No. 556. Denim Inc.'s vendor invoice No. 7423 for $300,000 was received with the goods. Terms are n/30. Received the supplies that were ordered from Notions Inc. on November 30, 2019, as listed on purchase order No. 549. Notions Inc.'s vendor invoice No. 257 for $20,000 was received with the goods. Terms are n/30. Job #222 for K. Brand was completed, packed, shipped, and invoiced. Terms are n/30. A new order from AH was received for 11,000 pairs of jeans. Design work was completed for AH. AH accepted the design work and agreed to a price of $45 per pair. Assigned Job #223 to the AH order. Requisitioned denim into Work-in-Process for the AH order. Requisitioned notions/supplies (indirect materials) for the AH order. Paid Notions Inc. electronically for their Dec 11th invoice. Job #223 for AH was completed. Job #223 for AH was packed, shipped, and invoiced. Packing costs are a part of MOH. Other shipping costs will be paid by the customer. Terms are n/30. A new order for 8,000 pairs of jeans was received from Belt Buckle. Design work was completed for Belt Buckle. They accepted the design work. Belt Buckle was assigned Job #224. Contract price is $45 per pair. A new order for 15,000 pairs of jeans was received from Cool Creed. Denim was requisitioned into Work-in-Process for Belt Buckle Job #224. Requisitioned notions/supplies (indirect materials) for Belt Buckle Job #224. Cool Creed accepted the design work and was assigned Job #225. The contract price is $40 per pair. Completed one-half of the sewing direct labor on Job #224 for Belt Buckle. Job #225 direct materials were requisitioned into Work-in-process. No work has been completed on the iob as of month-end. Paid $25,000 of principal and $1,250 of interest expense on the Note Payable to First Bank. Paid $10,000 on the mortgage principal and $800 of interest expense to Commerce Bank. Recorded and paid the following administrative and selling expenses Administrative & selling costs $12,750 per Apex Payroll Service's invoice No. 18633 (includes payroll and payroll taxes). Office supplies and utilities $450. Payroll services expense $200. MONTH-END ENTRIES 1. The following information about indirect labor comes from the payroll service company on an Employee Time Record Summary Report at the end of the month. (Recall that information about direct labor workers is received weekly on other Employee Time Record Summary Reports). Indirect labor recorded as manufacturing overhead. Two supervisors are paid $60,000 each per year. Their salary is divided evenly between the months and the pay periods. One designer is paid $30 per hour and works 35 hours per week. Assume four weeks in a month. Two inspectors are paid $20 per hour and work 40-hour weeks. Assume four weeks in a month. Payroll taxes for the month were accrued in the amount of $37,215 for workers in the manufacturing process (includes both direct and indirect labor) per Apex Payroll Service's invoice No. 18633. 2. At the end of the month, overhead is accrued for various manufacturing-related expenses (other than indirect labor) in the amount of $15,000. 3. Depreciation on equipment and the building is recorded on December 31. Refer to the Equipment and Building section in the Background material for the annual dollar amounts. Record only the month of December 2019. Separate the charge (debit) between Manufacturing Overhead and Other Selling and Administrative Expenses. Separate the Accumulated Depreciation into Building and Equipment. YEAR-END ENTRIES Gatsby's year-end procedures include determining over- or under-applied manufacturing overhead and adjusting the Cost of Goods Sold for the difference. Gatsby closes out its temporary accounts (i.e., income statement or nominal accounts) to retained earnings in order to start the next accounting period with zero balances in the revenue and cost/expense accounts. Q-2-10. What is the over- or under-applied manufacturing overhead for 2019? P-2-5 General ledger ending cash balance $3,330,793 P-2-6. Prepare all necessary closing journal entries at December 31, 2019, in the General Journal by closing out all temporary accounts to the Income Summary account. Close the Income Summary account to Retained Earnings. Post all of these journal entries in the General Ledger. Date Acct # Account Name Poste d to || Job G/L Debit Credit 11/20/19 10,000 1200 4000 SAMPLE: Accounts Receivable Sales To record delivery of Job Order #202 to customer. Skip this line and start December transactions on next line. 202 || 202 10,000 GENERAL LEDGER P-2-5, P-2-6 1100 - CASH Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 3,515,248 1200 - ACCOUNTS RECEIVABLE Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 225,000 1410 - MATERIALS INVENTORY-DENIM Date Reference Debit Credit Debit Balance 257,700 11/30/19 Balance Forward 1420 - WORK-IN-PROCESS INVENTORY Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 334,500 GENERAL LEDGER 1430 - FINISHED GOODS INVENTORY Date 11/30/19 Reference Debit Credit Debit Balance 160,000 1511 - FIXED ASSETS-SEWING MACHINES Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 300,000 Date 1512 - FIXED ASSETS-WASHERS AND DRYERS Reference 11/30/19 Balance Forward Debit Credit Debit Balance 100,000 1530 - FIXED ASSETS-OTHER EQUIPMENT Date 11/30/19 Balance Forward Reference Credit Debit Balance 100,000 1540 - FIXED ASSETS-COMPUTERS Reference Debit Credit Date 11/30/19 Debit Balance 80,000 Balance Forward 1550 - FIXED ASSETS-BUILDING Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 1,000,000 Date 1601 - ACCUMULATED DEPRECIATION-EQUIPMENT Reference 11/30/19 Balance Forward Debit Credit Credit Balance 319,500 1605 - ACCUMULATED DEPRECIATION-BUILDING Date Reference 11/30/19 Balance Forward Debit Credit Credit Balance 650,000 GENERAL LEDGER 2110 - ACCOUNTS PAYABLE Date 11/30/19 Balance Forward Reference Credit Credit Balance 25,000 2120 - OTHER PAYABLES Date Reference Debit Credit Credit Balance 5,000 11/30/19 Balance Forward 2130 - WAGES PAYABLE Reference Debit Credit Date 11/30/19 Credit Balance 268,700 Balance Forward 2140 - PAYROLL TAXES PAYABLE Date Reference Reference Debit Debit Credit Credit Credit Balance 40,305 11/30/19 Balance Forward 2510 - NOTE PAYABLE-FIRST BANK Date 11/30/19 Balance Forward Reference Debit Credit Credit Balance 470,500 2520 - MORTGAGE PAYABLE-COMMERCE BANK Date Reference 11/30/19 Balance Forward Debit Credit Credit Balance 365,000 GENERAL LEDGER 3100 - CAPITAL STOCK Date 11/30/19 Balance Forward Reference Debit Credit Credit Balance 200,000 3200 - RETAINED EARNINGS Date 01/01/19 Balance Forward Reference Credit Credit Balance 689,110 3300 - INCOME SUMMARY Date Reference Credit Balance 4000 - SALES Date 11/30/19 Balance Forward Reference Debit Credit Credit Balance 12,969,000 5100 - COST OF GOODS SOLD Reference Debit Credit Date 11/30/19 Debit Balance 9,729,500 Balance Forward GENERAL LEDGER 5200 - MANUFACTURING OVERHEAD Date 11/30/19 Balance Forward Reference Credit Debit Balance 30,217 6100 - OFFICE SUPPLIES/UTILITIES EXPENSE Date Reference Debit Credit 11/30/19 Balance Forward Debit Balance 4,950 6200 - PAYROLL SERVICE EXPENSE Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 2,200 6300 - OTHER SELLING AND ADMINISTRATIVE EXPENSE Reference 11/30/19 Balance Forward Date Debit Credit Debit Balance 140,250 6500 - INTEREST EXPENSE Date Reference Debit Credit Debit Balance 22,550 11/30/19 Balance Forward REQUIREMENTS 1. Review the adjusted trial balance as of November 30, 2019, in the Documents Folder. Trace the Inventory and Cost of Goods Sold account balances as of November 30, 2019, to the General Ledger. At the end of this assignment, you will be able to record cost accounting information into the General Journal and then post changes to accounts in the General Ledger and Job Cost Sheets. Core Concept Reviews Accounting Cycle Adjusting Journal Entries Closing Journal Entries Examine the Cost Sheet on page 10 of the Gatsby's Accounting System and Policies section to be sure you understand what it will cost to complete a product. 3. Review steps 1 through 4 in the Core Concept Review-Accounting Cycle for this assignment. Steps 5 through 8 will be used in Assignment 3. Complete the worksheet below related to depreciation expense: MONTHLY Sewing machines Washers and dryers Other equipment Computers Building ANNUAL $15,000 $10,000 $10,000 $10,000 $24,000 Computers Building Production Equipment 100% MOH 75% 25% 75% MOH Administrative MOH Monthly Depreciation Expense: 25% Administrative GATSBY MANUFACTURING INC. ADJUSTED TRIAL BALANCE as of November 30, 2019 Acct No. Account Name Debit Credit 1100 1200 1410 1420 1430 $ 3,515,248 225,000 257,700 334,500 160,000 300,000 100,000 100,000 80,000 1,000,000 1511 1512 1530 1540 1550 1601 1605 2110 2120 2130 2140 2510 2520 3100 3200 4000 Cash Accounts Receivable Materials Inventory-Denim Work-in-Process Inventory Finished Goods Inventory Sewing Machines Washers and Dryers Other Equipment Computers Building Accumulated Depreciation Equipment Accumulated Depreciation - Building Accounts Payable Other Payables Wages Payable Payroll Taxes Payable Note Payable-First Bank Note Payable-Commerce Bank Capital Stock Retained Earnings Sales Cost of Goods Sold Manufacturing Overhead Office Supplies/Utilities Expense Payroll Service Expense Other Selling and Administrative Expenses Interest Expense $ 319,500 650,000 25,000 5,000 268,700 40,305 470,500 365,000 200,000 689,110 12,969,000 5100 5200 6100 6200 6300 6500 9,729,500 30,217 4,950 2,200 140,250 22,550 TOTALS $ 16,002,115 $ 16,002,115 Cost Sheet for One Pair of Jeans Quantity Direct materials - denim Direct labor-sewing Direct labor - finishing Cost per Unit $15 per pair $20 per hour $15 per hour 12 hour per pair V4 hour per pair *For simplicity, the yards of denim needed for each pair of jeans are not provided for this project as that would require more details about each order (e.g., sizes, men/women). Manufacturing overhead is charged to jobs based on a predetermined rate of 20% of direct labor cost. Manufacturing overhead: Designer Factory supervisors Inspectors Quantity 1 person @35 hours per week 2 persons 2 persons @ 40 hours per week Cost per Unit $30 per hour $60,000 per person per year $20 per hour per inspector As seen in the earlier section on Personnel Structure and Responsibilities, 50 employees are sewers and 28 employees are finishers, each of whom work 40 hours per week. The selling price Gatsby charges its customers ranges from $40 to $50 per pair of jeans. Terms are n/30; that is, the full price is expected to be paid within 30 days. Goods are shipped FOB (free on board) shipping point, so the customer assumes legal title and responsibility for shipping and insurance costs as soon as Gatsby places the goods on the carrier. Gatsby prepares a sales invoice sent to the customer when the goods are delivered, which includes the customer's assigned account number. INVENTORY PROCEDURES There is beginning and ending raw materials inventory of denim. The oldest inventory is always used up first. Each job is a custom job that is shipped as soon as it is completed. Gatsby espouses a "lean" management philosophy; however, it does have some space in the production area of the building in case a job is finished in one month and sold and delivered the following month. There is beginning and ending work-in-process inventory each month. Notions used in the production process, such as thread, zippers, snaps, and rivets, are charged to manufacturing overhead as indirect costs as incurred. The quantity of these supplies on hand is relatively stable from month-to-month, and their value is considered nominal; therefore, no suppliesotions inventory is recorded. A box that holds 24 to 36 pair of jeans costs approximately $1.00. The cost of these shipping boxes could be traced directly to each job; however, the costs of doing so seem to outweigh the benefits, so boxes are charged to manufacturing overhead as incurred. No inventory of boxes is recorded. 10 TRANSACTIONS LIST December 1 - 31, 2019 December Paid wages payable and payroll taxes payable electronically. Shipped Job #220 to Abernathy & Fetch with a sales invoice. Paid outstanding accounts payable and other payables that were due in full (paid electronically). Ordered 100 rolls of denim from Denim Inc. using purchase order No. 556. Freight terms are FOB shipping point. Job #221 Whiskey & Soda was completed. Job #221 Whiskey & Soda was packed, shipped, and invoiced. Terms are n/30. Shipping costs paid by customer. Received check from Cool Creed for a shipment made to them in November in the amount of $225,000. Received the 100 rolls of denim that were ordered from Denim Inc. on December 5, 2019, as listed on purchase order No. 556. Denim Inc.'s vendor invoice No. 7423 for $300,000 was received with the goods. Terms are n/30. Received the supplies that were ordered from Notions Inc. on November 30, 2019, as listed on purchase order No. 549. Notions Inc.'s vendor invoice No. 257 for $20,000 was received with the goods. Terms are n/30. Job #222 for K. Brand was completed, packed, shipped, and invoiced. Terms are n/30. A new order from AH was received for 11,000 pairs of jeans. Design work was completed for AH. AH accepted the design work and agreed to a price of $45 per pair. Assigned Job #223 to the AH order. Requisitioned denim into Work-in-Process for the AH order. Requisitioned notions/supplies (indirect materials) for the AH order. Paid Notions Inc. electronically for their Dec 11th invoice. Job #223 for AH was completed. Job #223 for AH was packed, shipped, and invoiced. Packing costs are a part of MOH. Other shipping costs will be paid by the customer. Terms are n/30. A new order for 8,000 pairs of jeans was received from Belt Buckle. Design work was completed for Belt Buckle. They accepted the design work. Belt Buckle was assigned Job #224. Contract price is $45 per pair. A new order for 15,000 pairs of jeans was received from Cool Creed. Denim was requisitioned into Work-in-Process for Belt Buckle Job #224. Requisitioned notions/supplies (indirect materials) for Belt Buckle Job #224. Cool Creed accepted the design work and was assigned Job #225. The contract price is $40 per pair. Completed one-half of the sewing direct labor on Job #224 for Belt Buckle. Job #225 direct materials were requisitioned into Work-in-process. No work has been completed on the iob as of month-end. Paid $25,000 of principal and $1,250 of interest expense on the Note Payable to First Bank. Paid $10,000 on the mortgage principal and $800 of interest expense to Commerce Bank. Recorded and paid the following administrative and selling expenses Administrative & selling costs $12,750 per Apex Payroll Service's invoice No. 18633 (includes payroll and payroll taxes). Office supplies and utilities $450. Payroll services expense $200. MONTH-END ENTRIES 1. The following information about indirect labor comes from the payroll service company on an Employee Time Record Summary Report at the end of the month. (Recall that information about direct labor workers is received weekly on other Employee Time Record Summary Reports). Indirect labor recorded as manufacturing overhead. Two supervisors are paid $60,000 each per year. Their salary is divided evenly between the months and the pay periods. One designer is paid $30 per hour and works 35 hours per week. Assume four weeks in a month. Two inspectors are paid $20 per hour and work 40-hour weeks. Assume four weeks in a month. Payroll taxes for the month were accrued in the amount of $37,215 for workers in the manufacturing process (includes both direct and indirect labor) per Apex Payroll Service's invoice No. 18633. 2. At the end of the month, overhead is accrued for various manufacturing-related expenses (other than indirect labor) in the amount of $15,000. 3. Depreciation on equipment and the building is recorded on December 31. Refer to the Equipment and Building section in the Background material for the annual dollar amounts. Record only the month of December 2019. Separate the charge (debit) between Manufacturing Overhead and Other Selling and Administrative Expenses. Separate the Accumulated Depreciation into Building and Equipment. YEAR-END ENTRIES Gatsby's year-end procedures include determining over- or under-applied manufacturing overhead and adjusting the Cost of Goods Sold for the difference. Gatsby closes out its temporary accounts (i.e., income statement or nominal accounts) to retained earnings in order to start the next accounting period with zero balances in the revenue and cost/expense accounts. Q-2-10. What is the over- or under-applied manufacturing overhead for 2019? P-2-5 General ledger ending cash balance $3,330,793 P-2-6. Prepare all necessary closing journal entries at December 31, 2019, in the General Journal by closing out all temporary accounts to the Income Summary account. Close the Income Summary account to Retained Earnings. Post all of these journal entries in the General Ledger. Date Acct # Account Name Poste d to || Job G/L Debit Credit 11/20/19 10,000 1200 4000 SAMPLE: Accounts Receivable Sales To record delivery of Job Order #202 to customer. Skip this line and start December transactions on next line. 202 || 202 10,000 GENERAL LEDGER P-2-5, P-2-6 1100 - CASH Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 3,515,248 1200 - ACCOUNTS RECEIVABLE Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 225,000 1410 - MATERIALS INVENTORY-DENIM Date Reference Debit Credit Debit Balance 257,700 11/30/19 Balance Forward 1420 - WORK-IN-PROCESS INVENTORY Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 334,500 GENERAL LEDGER 1430 - FINISHED GOODS INVENTORY Date 11/30/19 Reference Debit Credit Debit Balance 160,000 1511 - FIXED ASSETS-SEWING MACHINES Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 300,000 Date 1512 - FIXED ASSETS-WASHERS AND DRYERS Reference 11/30/19 Balance Forward Debit Credit Debit Balance 100,000 1530 - FIXED ASSETS-OTHER EQUIPMENT Date 11/30/19 Balance Forward Reference Credit Debit Balance 100,000 1540 - FIXED ASSETS-COMPUTERS Reference Debit Credit Date 11/30/19 Debit Balance 80,000 Balance Forward 1550 - FIXED ASSETS-BUILDING Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 1,000,000 Date 1601 - ACCUMULATED DEPRECIATION-EQUIPMENT Reference 11/30/19 Balance Forward Debit Credit Credit Balance 319,500 1605 - ACCUMULATED DEPRECIATION-BUILDING Date Reference 11/30/19 Balance Forward Debit Credit Credit Balance 650,000 GENERAL LEDGER 2110 - ACCOUNTS PAYABLE Date 11/30/19 Balance Forward Reference Credit Credit Balance 25,000 2120 - OTHER PAYABLES Date Reference Debit Credit Credit Balance 5,000 11/30/19 Balance Forward 2130 - WAGES PAYABLE Reference Debit Credit Date 11/30/19 Credit Balance 268,700 Balance Forward 2140 - PAYROLL TAXES PAYABLE Date Reference Reference Debit Debit Credit Credit Credit Balance 40,305 11/30/19 Balance Forward 2510 - NOTE PAYABLE-FIRST BANK Date 11/30/19 Balance Forward Reference Debit Credit Credit Balance 470,500 2520 - MORTGAGE PAYABLE-COMMERCE BANK Date Reference 11/30/19 Balance Forward Debit Credit Credit Balance 365,000 GENERAL LEDGER 3100 - CAPITAL STOCK Date 11/30/19 Balance Forward Reference Debit Credit Credit Balance 200,000 3200 - RETAINED EARNINGS Date 01/01/19 Balance Forward Reference Credit Credit Balance 689,110 3300 - INCOME SUMMARY Date Reference Credit Balance 4000 - SALES Date 11/30/19 Balance Forward Reference Debit Credit Credit Balance 12,969,000 5100 - COST OF GOODS SOLD Reference Debit Credit Date 11/30/19 Debit Balance 9,729,500 Balance Forward GENERAL LEDGER 5200 - MANUFACTURING OVERHEAD Date 11/30/19 Balance Forward Reference Credit Debit Balance 30,217 6100 - OFFICE SUPPLIES/UTILITIES EXPENSE Date Reference Debit Credit 11/30/19 Balance Forward Debit Balance 4,950 6200 - PAYROLL SERVICE EXPENSE Date 11/30/19 Balance Forward Reference Debit Credit Debit Balance 2,200 6300 - OTHER SELLING AND ADMINISTRATIVE EXPENSE Reference 11/30/19 Balance Forward Date Debit Credit Debit Balance 140,250 6500 - INTEREST EXPENSE Date Reference Debit Credit Debit Balance 22,550 11/30/19 Balance Forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts