Question: Tron Corp. was authorized to issue $500,000 of face value bonds, as follows: Date of Interest rate authorization January 1, 2020 12% Term 3

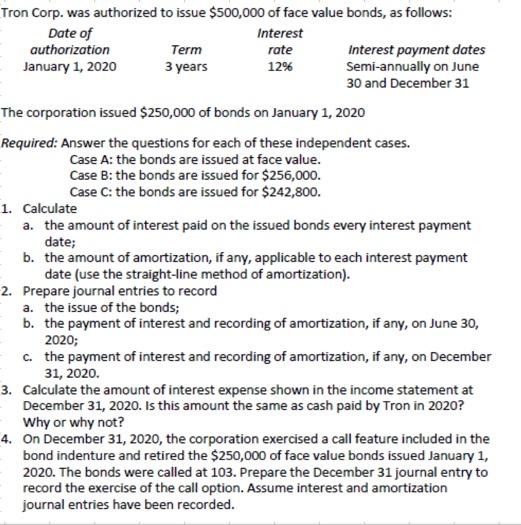

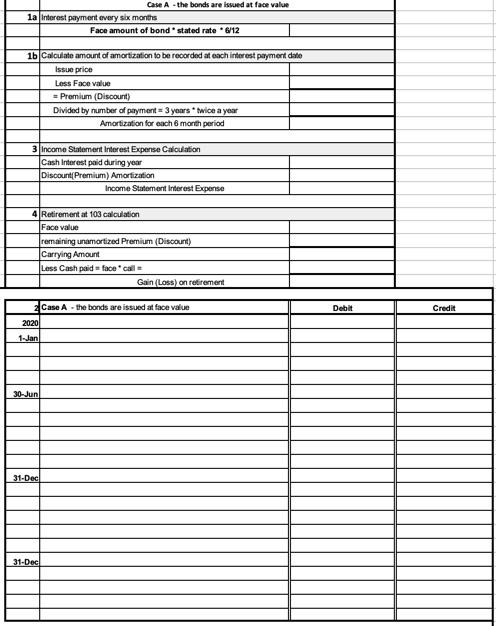

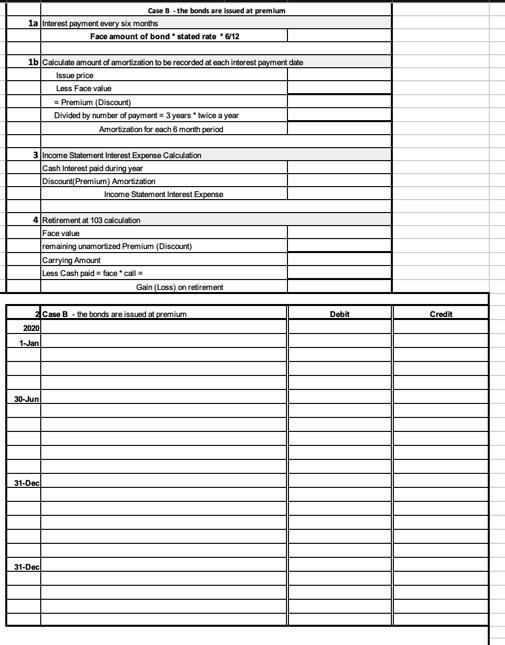

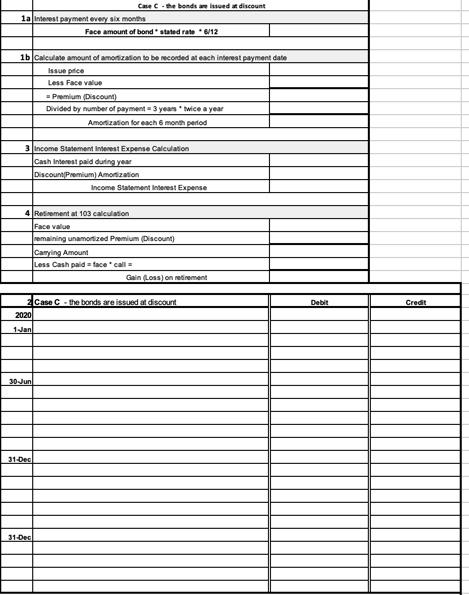

Tron Corp. was authorized to issue $500,000 of face value bonds, as follows: Date of Interest rate authorization January 1, 2020 12% Term 3 years Interest payment dates Semi-annually on June 30 and December 31 The corporation issued $250,000 of bonds on January 1, 2020 Required: Answer the questions for each of these independent cases. Case A: the bonds are issued at face value. Case B: the bonds are issued for $256,000. Case C: the bonds are issued for $242,800. 1. Calculate a. the amount of interest paid on the issued bonds every interest payment date; b. the amount of amortization, if any, applicable to each interest payment date (use the straight-line method of amortization). 2. Prepare journal entries to record a. the issue of the bonds; b. the payment of interest and recording of amortization, if any, on June 30, 2020; c. the payment of interest and recording of amortization, if any, on December 31, 2020. 3. Calculate the amount of interest expense shown in the income statement at December 31, 2020. Is this amount the same as cash paid by Tron in 2020? Why or why not? 4. On December 31, 2020, the corporation exercised a call feature included in the bond indenture and retired the $250,000 of face value bonds issued January 1, 2020. The bonds were called at 103. Prepare the December 31 journal entry to record the exercise of the call option. Assume interest and amortization journal entries have been recorded. 1a interest payment every six months 1b Calculate amount of amortization to be recorded at each interest payment date Issue price Less Face value = Premium (Discount) Divided by number of payment 3 years twice a year Amortization for each 6 month period 3 Income Statement Interest Expense Calculation Cash Interest paid during year Discount(Premium) Amortization 2020 1-Jan Case A-the bonds are issued at face value 4 Retirement at 103 calculation Face value 30-Jun Face amount of bond stated rate *6/12 31-Dec 31-Decl Income Statement Interest Expense remaining unamortized Premium (Discount) Carrying Amount Less Cash paid face call Gain (Loss) on retirement Case A the bonds are issued at face value Debit Credit 1a interest payment every six months Case B-the bonds are issued at premium 1b Calculate amount of amortization to be recorded at each interest payment date Issue price Less Face value Face amount of bond stated rate 6/12 3 Income Statement Interest Expense Calculation Cash Interest paid during year Discount(Premium) Amortization 30-Jun 31-Dec = Premium (Discount) Divided by number of payment 3 years twice a year Amortization for each 6 month period 4 Retirement at 103 calculation Face value remaining unamortized Premium (Discount) Carrying Amount Less Cash paid face call 31-Dec Income Statement Interest Expense 2 Case B-the bonds are issued at premium 2020 1-Jan Gain (Loss) on retirement Debit Credit 1a interest payment every six months Case C-the bonds are issued at discount 1b Calculate amount of amortization to be recorded at each interest payment date Issue price Less Face value Face amount of bond stated rate 6/12 3 Income Statement interest Expense Calculation Cash Interest paid during year Discount(Premium) Amortization 30-Jun 31-Dec Premium (Discount) Divided by number of payment-3 years twice a year Amortization for each 6 month period 4 Retirement at 103 calculation Face value remaining unamortized Premium (Discount) Carrying Amount Less Cash paid face call. 31-Dec Income Statement Interest Expense 2 Case C-the bonds are issued at discount 2020 1-Jan Gain (Loss) on retirement Debit Credit

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts