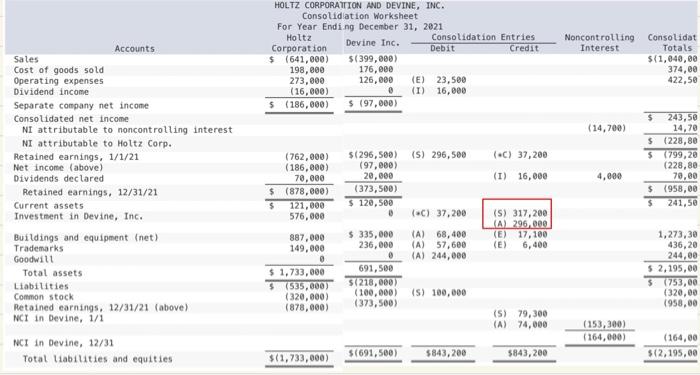

Hello, someone mind explaining to me how they got 317,200 & 296,000 outlined in red? It's a credit to the investment in sub.

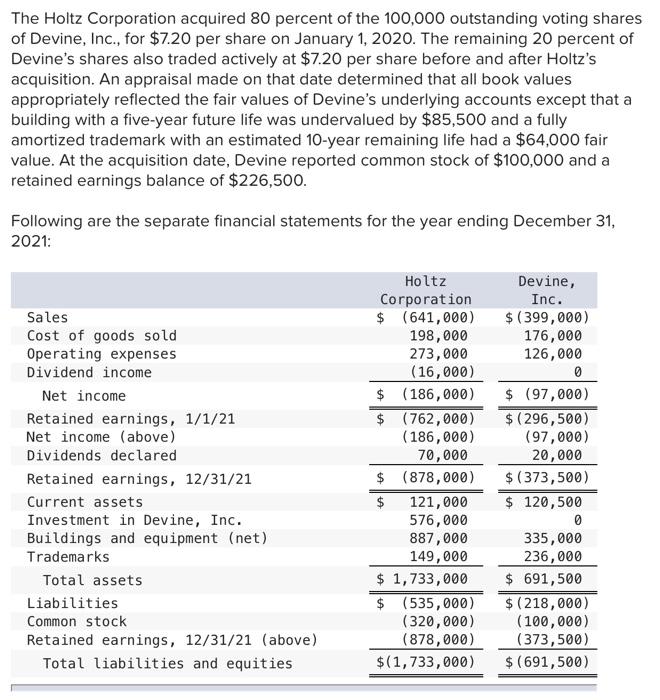

The Holtz Corporation acquired 80 percent of the 100,000 outstanding voting shares of Devine, Inc., for $7.20 per share on January 1,2020 . The remaining 20 percent of Devine's shares also traded actively at $7.20 per share before and after Holtz's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Devine's underlying accounts except that a building with a five-year future life was undervalued by $85,500 and a fully amortized trademark with an estimated 10-year remaining life had a $64,000 fair value. At the acquisition date, Devine reported common stock of $100,000 and a retained earnings balance of $226,500. Following are the separate financial statements for the year ending December 31 , 2021: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Accounts } & \multicolumn{7}{|c|}{\begin{tabular}{l} HOLTZ CORPORATIION AND DEVINE, INC. \\ Consolidlation Worksheet \\ For Year Ending December 31,2021 \end{tabular}} \\ \hline & \multirow{2}{*}{\begin{tabular}{c} Holtz \\ Corporation \end{tabular}} & Devine Inc. & \multicolumn{2}{|c|}{DebitConsolidation} & Creditentries & \multirow[t]{2}{*}{\begin{tabular}{l} Noncontrolling \\ Interest \end{tabular}} & \begin{tabular}{l} Consolidat \\ Totals \end{tabular} \\ \hline Sales & & $(399,000) & & & & & $(1,040,00 \\ \hline Cost of goods sold & 198,000 & 176,000 & & & & & 374,00 \\ \hline Operating expenses & 273,000 & 126,000 & (E) & 23,500 & & & 422,50 \\ \hline Dividend income & (16,000) & 8 & (I) & 16,000 & & & \\ \hline Separate company net income & 5(186,000) & $(97,000) & & & & & \\ \hline Consolidated net income & & & & & & & 243,56 \\ \hline NI attributable to noncontrolling interest & & & & & & (14,700) & 14,70 \\ \hline NI attributable to Holtz Corp. & & & & & & & $(228,80 \\ \hline Retained earnings, 1/1/21 & (762,000) & $(296,500) & (S) & 296,500 & (*C) 37,200 & & 5(799,20 \\ \hline Net income (above) & (186,000) & (97,000) & & & & & (228,80 \\ \hline Dividends declared & 70,000 & 20,000 & & & (I) 16,000 & 4,000 & 70,60 \\ \hline Retained earnings, 12/31/21 & $(878,000) & (373,500) & & & & & $(958,00 \\ \hline Current assets & 5121,000 & $120,500 & & & & & 241,50 \\ \hline Investment in Devine, Inc. & \begin{tabular}{l} 121,000 \\ 576,000 \end{tabular} & o & (c) & 37,200 & \begin{tabular}{l} (S) 317,200 \\ (A) 296,000 \\ \end{tabular} & & \\ \hline Buildings and equipment (net) & 887,000 & $335,000 & (A) & 68,400 & (E) 17,100 & & 1,273,30 \\ \hline \begin{tabular}{l} Trademarks \\ Tranth \end{tabular} & 149,000 & 236,000 & (A) & 57,600 & 6,400 & & 436,20 \\ \hline Goodwitl & 149,000 & 0 & (A) & 244,000 & & & 244,00 \\ \hline Total assets & $1,733,000 & 691,500 & & & & & 52,195,00 \\ \hline Labilities & 55(535,000) & 5(218,600) & & & & & 5:(753,00 \\ \hline Common stock & (320,000) & (100,000) & (s) & 100,000 & & & (320,00 \\ \hline Retained earnings, 12/31/21 (above) & (878,000) & (373,500) & & & & & (958,00 \\ \hline NCI in Devine, 1/1 & & & & & (S) 79,300 & & \\ \hline & & & & & (A) 74,000 & (153,300) & \\ \hline NCI in Devine, 12/31 & & & & & & (164,000) & (164,00 \\ \hline Total liabilities and equities & $(1,733,000) & $(691,500) & & $843,200 & $843,200 & & $(2,195,60 \\ \hline \end{tabular} The Holtz Corporation acquired 80 percent of the 100,000 outstanding voting shares of Devine, Inc., for $7.20 per share on January 1,2020 . The remaining 20 percent of Devine's shares also traded actively at $7.20 per share before and after Holtz's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Devine's underlying accounts except that a building with a five-year future life was undervalued by $85,500 and a fully amortized trademark with an estimated 10-year remaining life had a $64,000 fair value. At the acquisition date, Devine reported common stock of $100,000 and a retained earnings balance of $226,500. Following are the separate financial statements for the year ending December 31 , 2021: \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Accounts } & \multicolumn{7}{|c|}{\begin{tabular}{l} HOLTZ CORPORATIION AND DEVINE, INC. \\ Consolidlation Worksheet \\ For Year Ending December 31,2021 \end{tabular}} \\ \hline & \multirow{2}{*}{\begin{tabular}{c} Holtz \\ Corporation \end{tabular}} & Devine Inc. & \multicolumn{2}{|c|}{DebitConsolidation} & Creditentries & \multirow[t]{2}{*}{\begin{tabular}{l} Noncontrolling \\ Interest \end{tabular}} & \begin{tabular}{l} Consolidat \\ Totals \end{tabular} \\ \hline Sales & & $(399,000) & & & & & $(1,040,00 \\ \hline Cost of goods sold & 198,000 & 176,000 & & & & & 374,00 \\ \hline Operating expenses & 273,000 & 126,000 & (E) & 23,500 & & & 422,50 \\ \hline Dividend income & (16,000) & 8 & (I) & 16,000 & & & \\ \hline Separate company net income & 5(186,000) & $(97,000) & & & & & \\ \hline Consolidated net income & & & & & & & 243,56 \\ \hline NI attributable to noncontrolling interest & & & & & & (14,700) & 14,70 \\ \hline NI attributable to Holtz Corp. & & & & & & & $(228,80 \\ \hline Retained earnings, 1/1/21 & (762,000) & $(296,500) & (S) & 296,500 & (*C) 37,200 & & 5(799,20 \\ \hline Net income (above) & (186,000) & (97,000) & & & & & (228,80 \\ \hline Dividends declared & 70,000 & 20,000 & & & (I) 16,000 & 4,000 & 70,60 \\ \hline Retained earnings, 12/31/21 & $(878,000) & (373,500) & & & & & $(958,00 \\ \hline Current assets & 5121,000 & $120,500 & & & & & 241,50 \\ \hline Investment in Devine, Inc. & \begin{tabular}{l} 121,000 \\ 576,000 \end{tabular} & o & (c) & 37,200 & \begin{tabular}{l} (S) 317,200 \\ (A) 296,000 \\ \end{tabular} & & \\ \hline Buildings and equipment (net) & 887,000 & $335,000 & (A) & 68,400 & (E) 17,100 & & 1,273,30 \\ \hline \begin{tabular}{l} Trademarks \\ Tranth \end{tabular} & 149,000 & 236,000 & (A) & 57,600 & 6,400 & & 436,20 \\ \hline Goodwitl & 149,000 & 0 & (A) & 244,000 & & & 244,00 \\ \hline Total assets & $1,733,000 & 691,500 & & & & & 52,195,00 \\ \hline Labilities & 55(535,000) & 5(218,600) & & & & & 5:(753,00 \\ \hline Common stock & (320,000) & (100,000) & (s) & 100,000 & & & (320,00 \\ \hline Retained earnings, 12/31/21 (above) & (878,000) & (373,500) & & & & & (958,00 \\ \hline NCI in Devine, 1/1 & & & & & (S) 79,300 & & \\ \hline & & & & & (A) 74,000 & (153,300) & \\ \hline NCI in Devine, 12/31 & & & & & & (164,000) & (164,00 \\ \hline Total liabilities and equities & $(1,733,000) & $(691,500) & & $843,200 & $843,200 & & $(2,195,60 \\ \hline \end{tabular}