Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello :> thank you for giving me the answers, solutions and explanations. It would mean a lot to me, and I might also have a

Hello :> thank you for giving me the answers, solutions and explanations. It would mean a lot to me, and I might also have a practice after I take the quiz. Thank you so much.

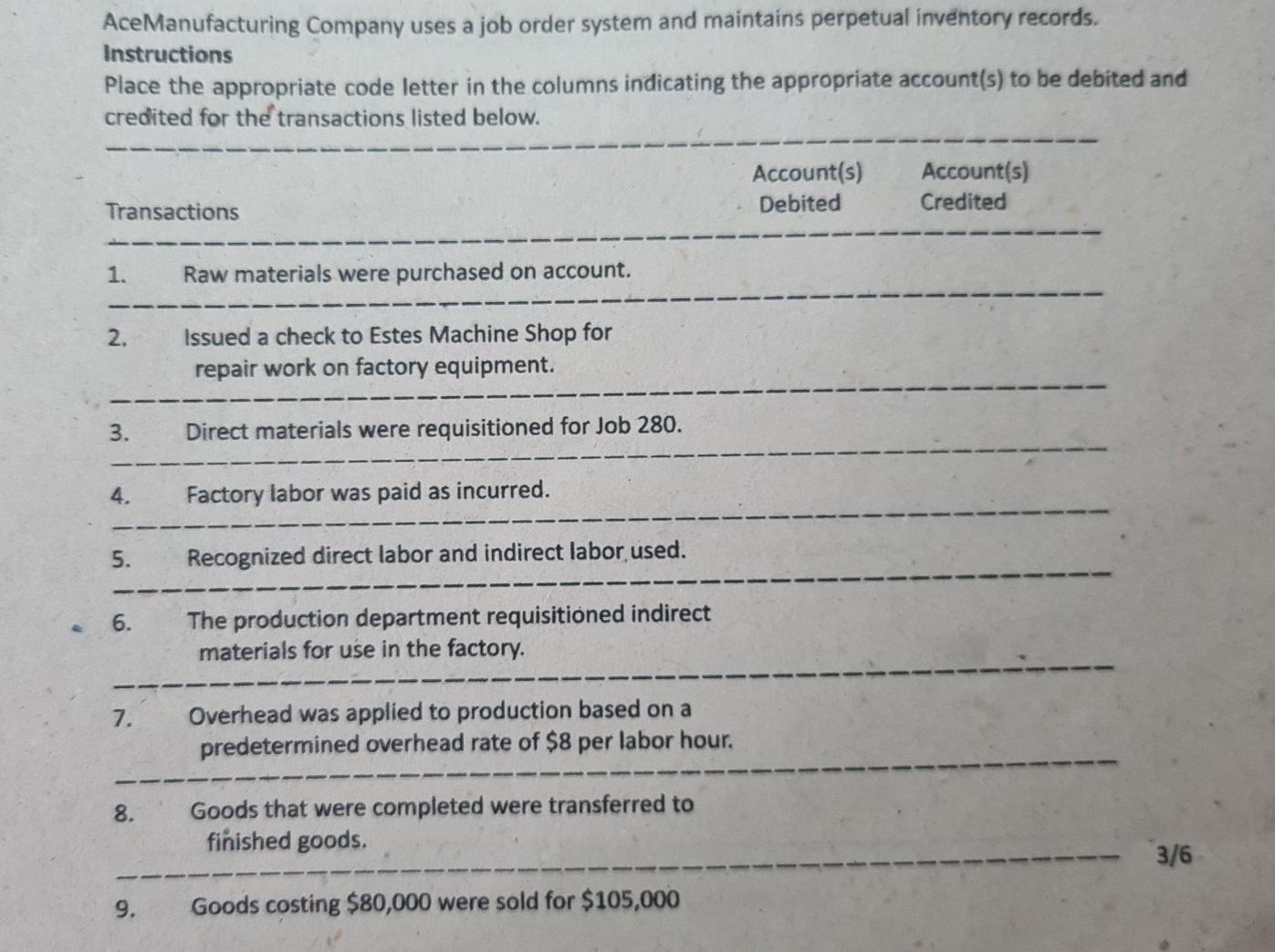

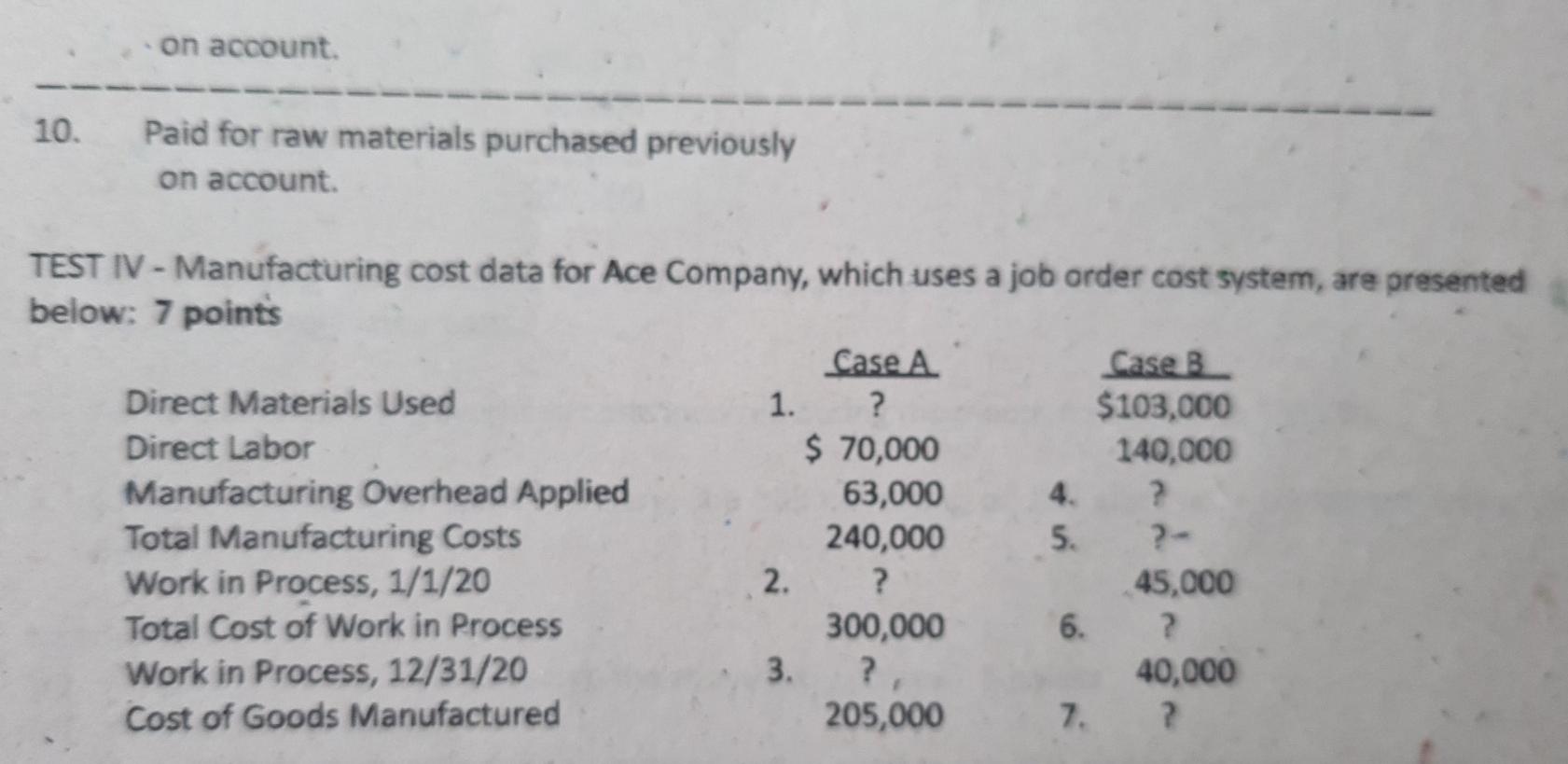

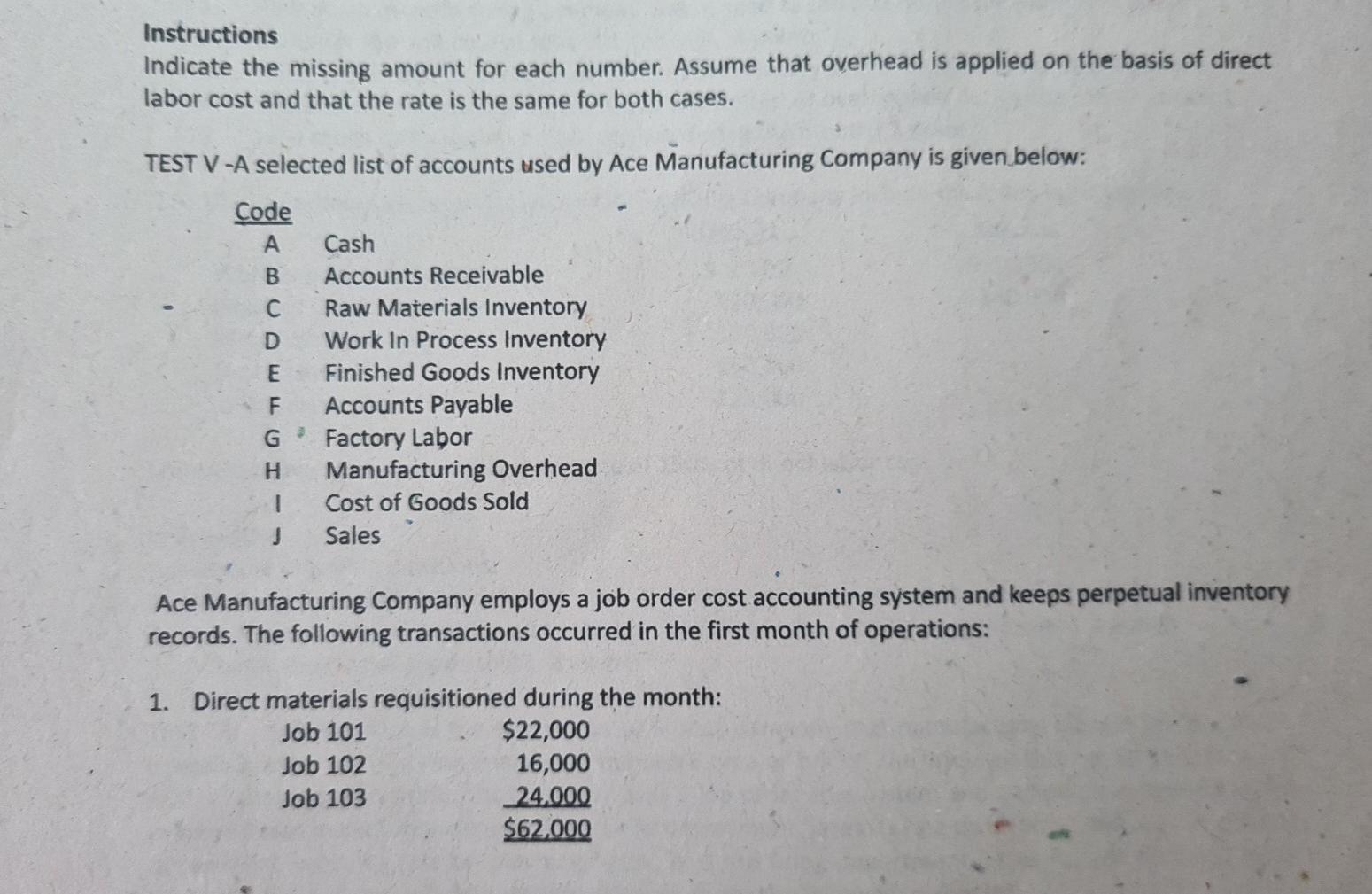

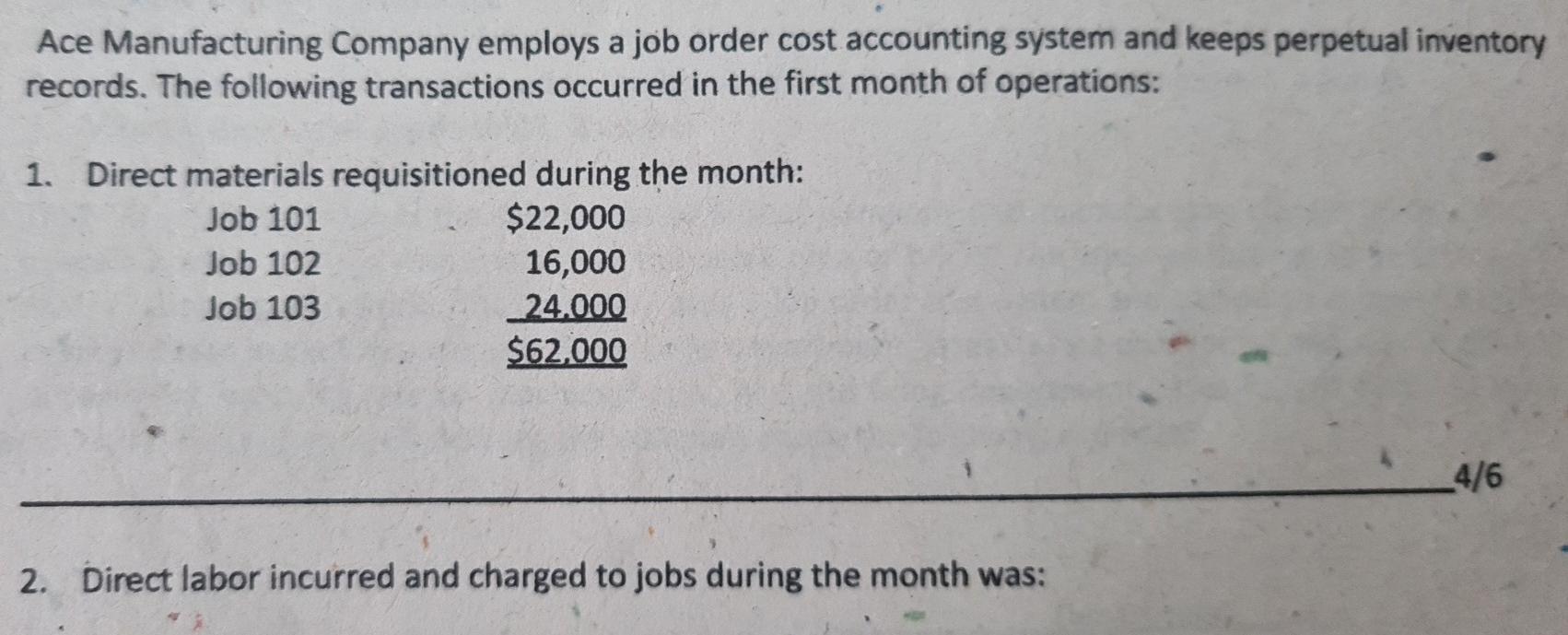

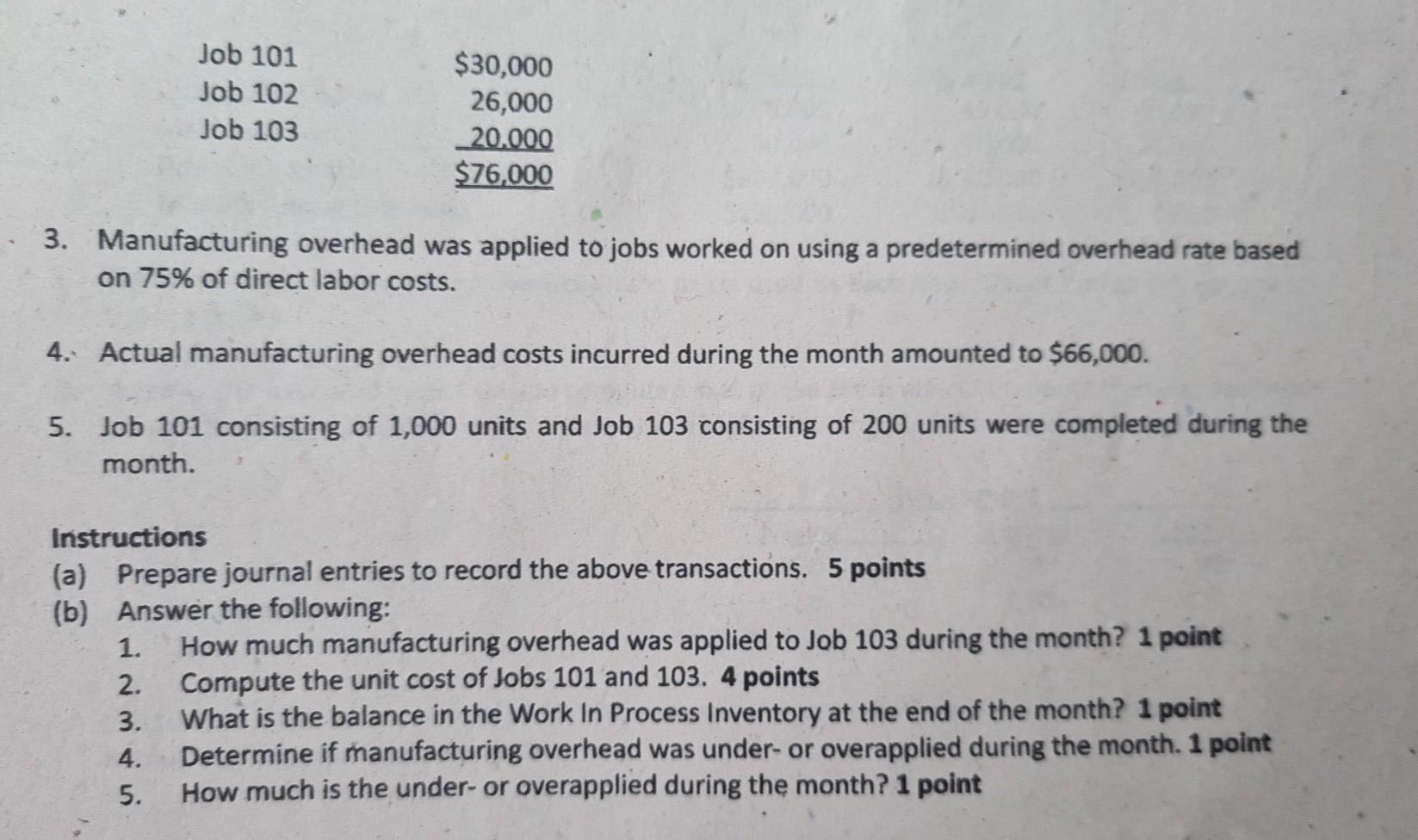

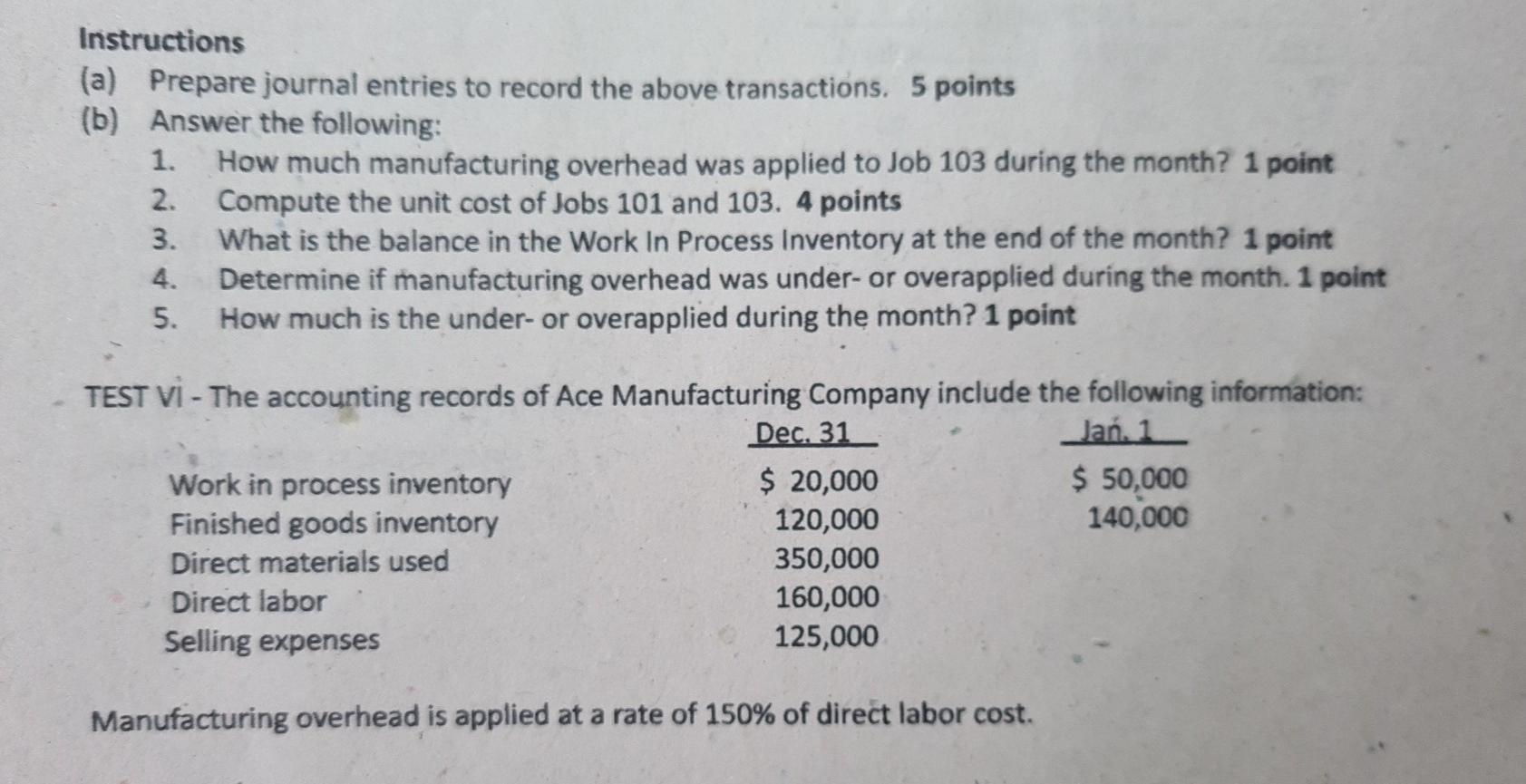

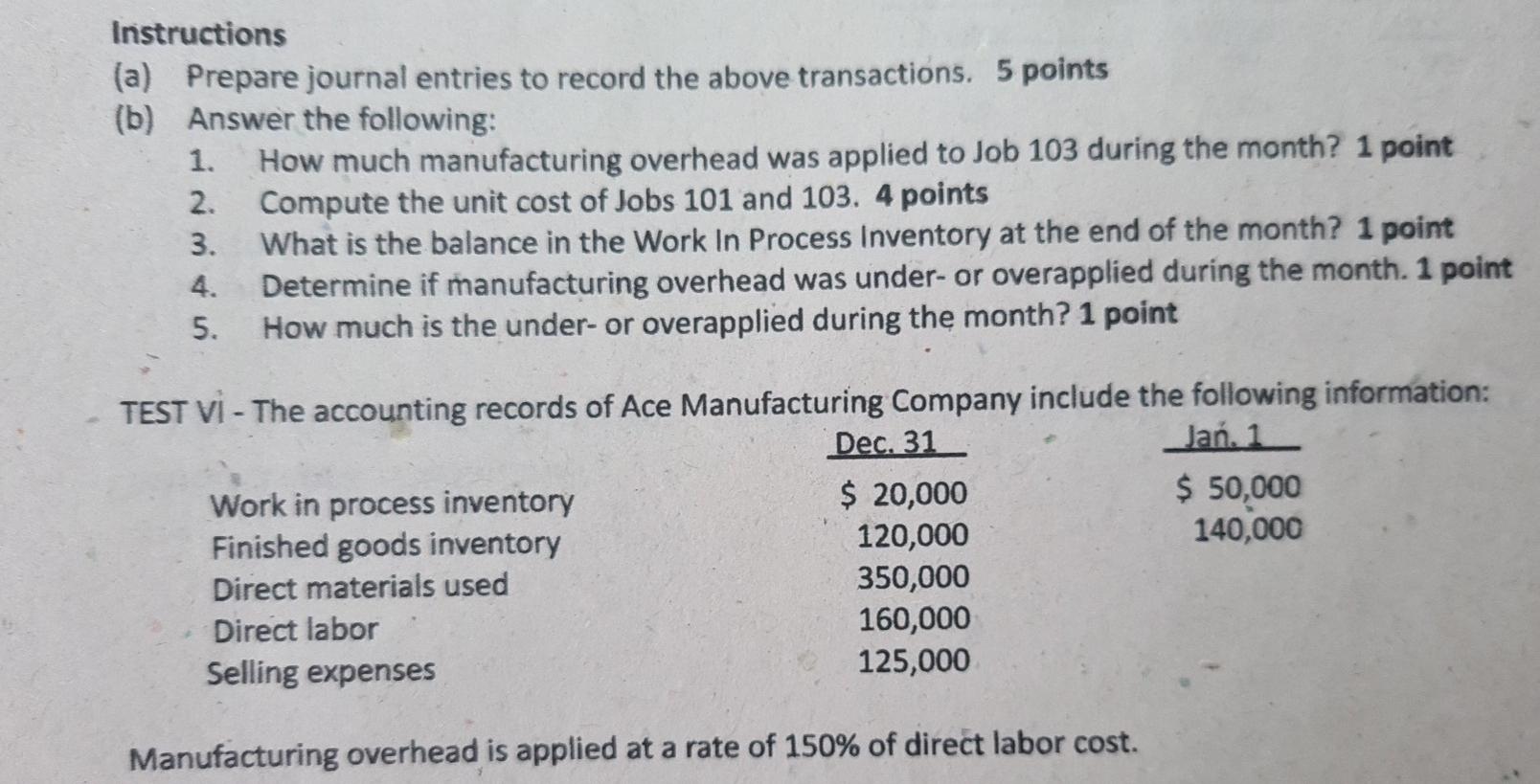

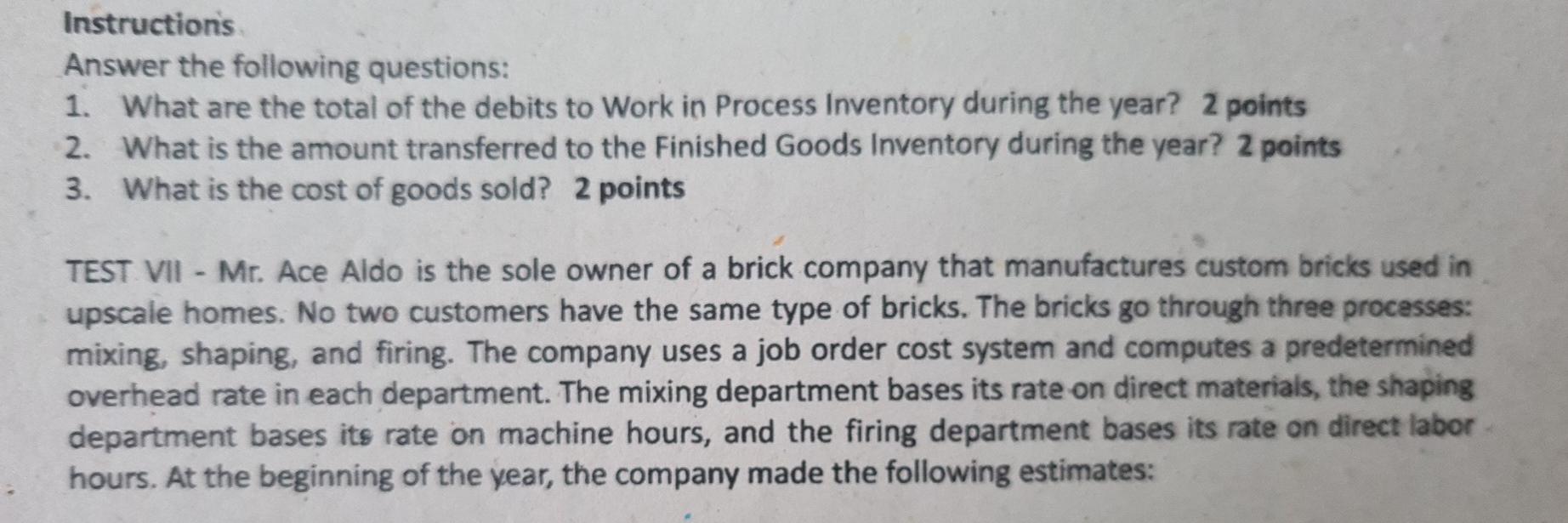

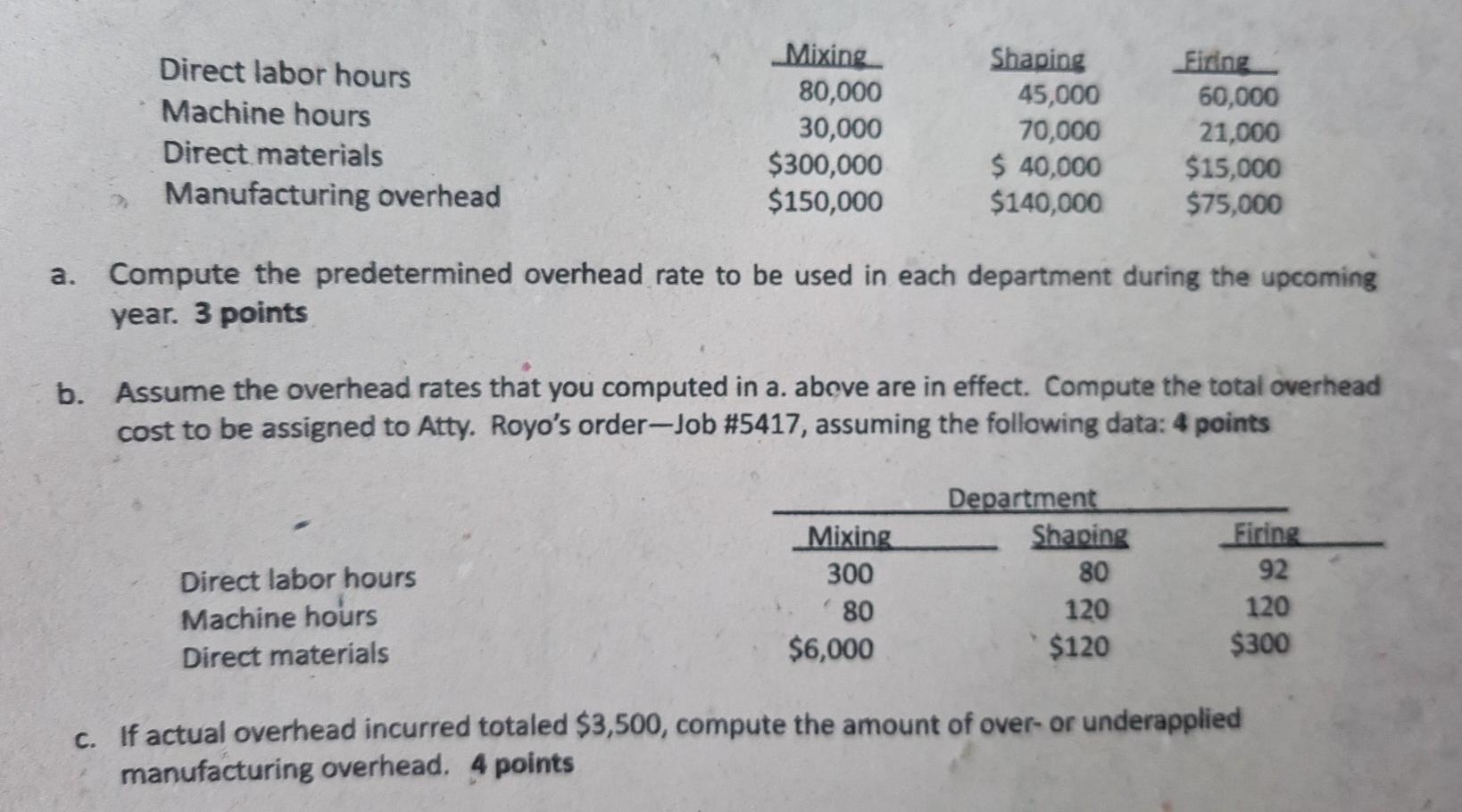

AceManufacturing Company uses a job order system and maintains perpetual inventory records. Instructions Place the appropriate code letter in the columns indicating the appropriate account(s) to be debited and credited for the transactions listed below. Account(s) Debited Account(s) Credited Transactions 1. Raw materials were purchased on account. 2. Issued a check to Estes Machine Shop for repair work on factory equipment. 3. Direct materials were requisitioned for Job 280. 4. Factory labor was paid as incurred. 5. Recognized direct labor and indirect labor used. 6. The production department requisitioned indirect materials for use in the factory. 7. Overhead was applied to production based on a predetermined overhead rate of $8 per labor hour. 8. Goods that were completed were transferred to finished goods. 3/6 9. Goods costing $80,000 were sold for $105,000 - on account. 10. Paid for raw materials purchased previously on account. TEST IV - Manufacturing cost data for Ace Company, which uses a job order cost system, are presented below: 7 points Case A Case B Direct Materials Used 1. ? $103,000 Direct Labor $ 70,000 140,000 Manufacturing Overhead Applied 63,000 4. ? Total Manufacturing Costs 240,000 5. ?- Work in Process, 1/1/20 2. ? 45,000 Total Cost of Work in Process 300,000 6. ? Work in Process, 12/31/20 3. 40,000 Cost of Goods Manufactured 205,000 7. ? ?, Instructions Indicate the missing amount for each number. Assume that overhead is applied on the basis of direct labor cost and that the rate is the same for both cases. TEST V-A selected list of accounts used by Ace Manufacturing Company is given below: Code A B D E Cash Accounts Receivable Raw Materials Inventory Work In Process Inventory Finished Goods Inventory Accounts Payable Factory Labor Manufacturing Overhead Cost of Goods Sold Sales F G H Ace Manufacturing Company employs a job order cost accounting system and keeps perpetual inventory records. The following transactions occurred in the first month of operations: 1. Direct materials requisitioned during the month: Job 101 $22,000 Job 102 16,000 Job 103 24.000 $62,000 Ace Manufacturing Company employs a job order cost accounting system and keeps perpetual inventory records. The following transactions occurred in the first month of operations: 1. Direct materials requisitioned during the month: Job 101 $22,000 Job 102 16,000 Job 103 24.000 $62,000 4/6 2. Direct labor incurred and charged to jobs during the month was: Job 101 Job 102 Job 103 $30,000 26,000 20.000 $76,000 3. Manufacturing overhead was applied to jobs worked on using a predetermined overhead rate based on 75% of direct labor costs. 4. Actual manufacturing overhead costs incurred during the month amounted to $66,000. 5. Job 101 consisting of 1,000 units and Job 103 consisting of 200 units were completed during the month. Instructions (a) Prepare journal entries to record the above transactions. 5 points (b) Answer the following: 1. How much manufacturing overhead was applied to Job 103 during the month? 1 point 2. Compute the unit cost of Jobs 101 and 103. 4 points 3. What is the balance in the Work In Process Inventory at the end of the month? 1 point 4. Determine if manufacturing overhead was under- or overapplied during the month. 1 point 5. How much is the under-or overapplied during the month? 1 point Instructions (a) Prepare journal entries to record the above transactions. 5 points (b) Answer the following: 1. How much manufacturing overhead was applied to Job 103 during the month? 1 point 2. Compute the unit cost of Jobs 101 and 103. 4 points 3. What is the balance in the Work In Process Inventory at the end of the month? 1 point 4. Determine if manufacturing overhead was under-or overapplied during the month. 1 point 5. How much is the under-or overapplied during the month? 1 point TEST VI - The accounting records of Ace Manufacturing Company include the following information: Dec. 31 Jan. 1 Work in process inventory $ 20,000 $ 50,000 Finished goods inventory 120,000 140,000 Direct materials used 350,000 Direct labor 160,000 Selling expenses 125,000 Manufacturing overhead is applied at a rate of 150% of direct labor cost. Instructions (a) Prepare journal entries to record the above transactions. 5 points (b) Answer the following: 1. How much manufacturing overhead was applied to Job 103 during the month? 1 point 2. Compute the unit cost of Jobs 101 and 103. 4 points 3. What is the balance in the Work In Process Inventory at the end of the month? 1 point 4. Determine if manufacturing overhead was under- or overapplied during the month. 1 point 5. How much is the under- or overapplied during the month? 1 point TEST VI - The accounting records of Ace Manufacturing Company include the following information: Dec. 31_ Jan. 1 Work in process inventory $ 20,000 $ 50,000 Finished goods inventory 120,000 140,000 Direct materials used 350,000 Direct labor 160,000 Selling expenses 125,000 Manufacturing overhead is applied at a rate of 150% of direct labor cost. Instructions Answer the following questions: 1. What are the total of the debits to Work in Process Inventory during the year? 2 points 2. What is the amount transferred to the Finished Goods Inventory during the year? 2 points 3. What is the cost of goods sold? 2 points TEST VII - Mr. Ace Aldo is the sole owner of a brick company that manufactures custom bricks used in upscale homes. No two customers have the same type of bricks. The bricks go through three processes: mixing, shaping, and firing. The company uses a job order cost system and computes a predetermined overhead rate in each department. The mixing department bases its rate on direct materials, the shaping department bases its rate on machine hours, and the firing department bases its rate on direct labor hours. At the beginning of the year, the company made the following estimates: Direct labor hours Machine hours Direct materials Manufacturing overhead Mixing 80,000 30,000 $300,000 $150,000 Shaping 45,000 70,000 $ 40,000 $140,000 Fing 60,000 21,000 $15,000 $75,000 a. Compute the predetermined overhead rate to be used in each department during the upcoming year. 3 points b. Assume the overhead rates that you computed in a. above are in effect. Compute the total overhead cost to be assigned to Atty. Royo's order-Job #5417, assuming the following data: 4 points Mixing 300 Direct labor hours Machine hours Direct materials Department Shaping 80 120 $120 Firing 92 120 $300 80 $6,000 c. If actual overhead incurred totaled $3,500, compute the amount of over- or underapplied manufacturing overhead. 4 pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started