Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello there, the question is attached in the file. I am able to find out how to get the other numbers except for PVCCATS. From

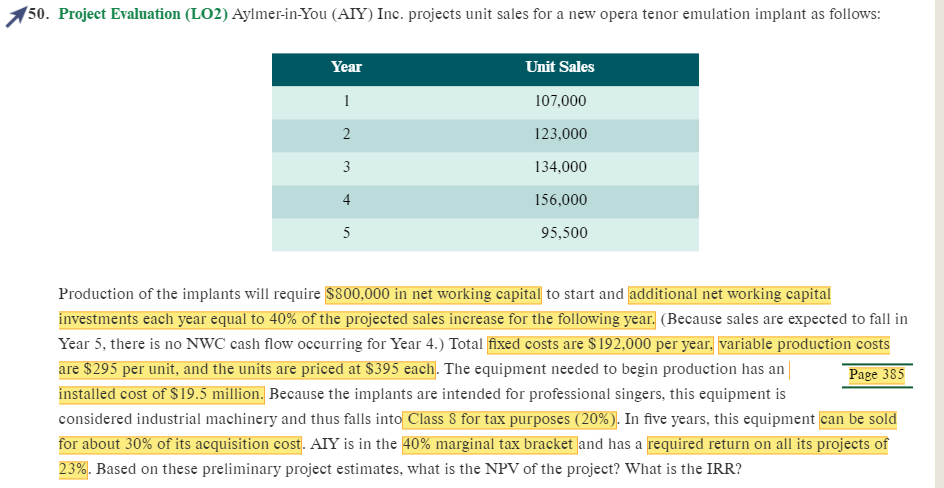

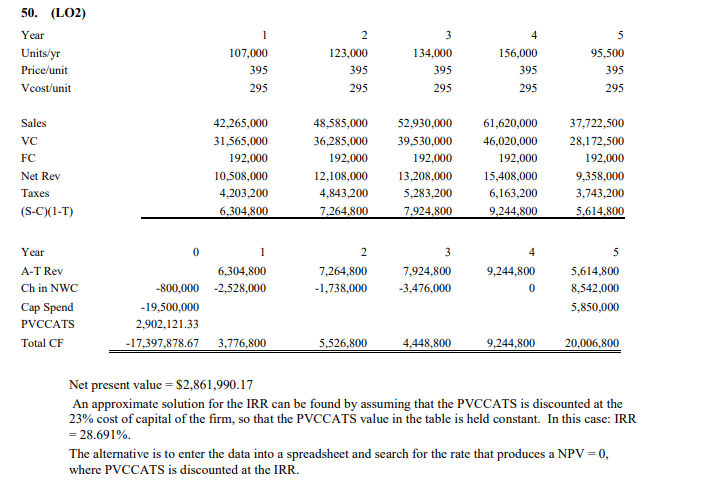

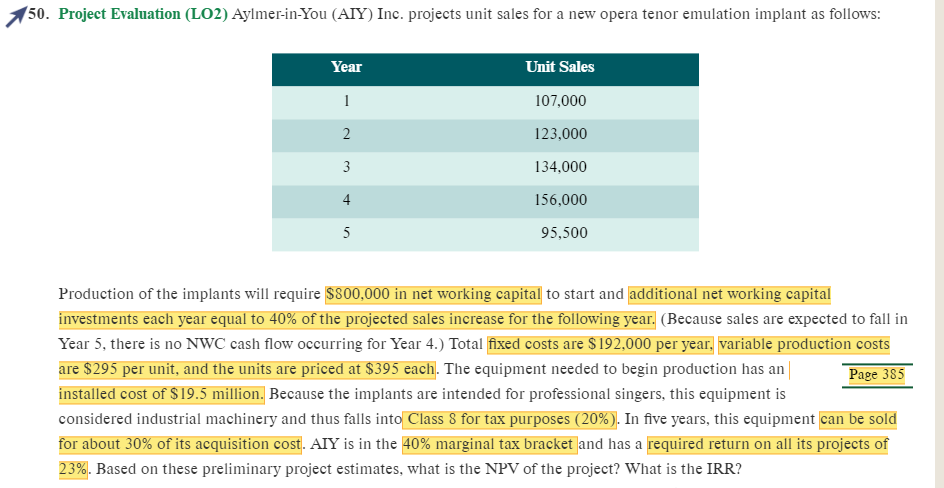

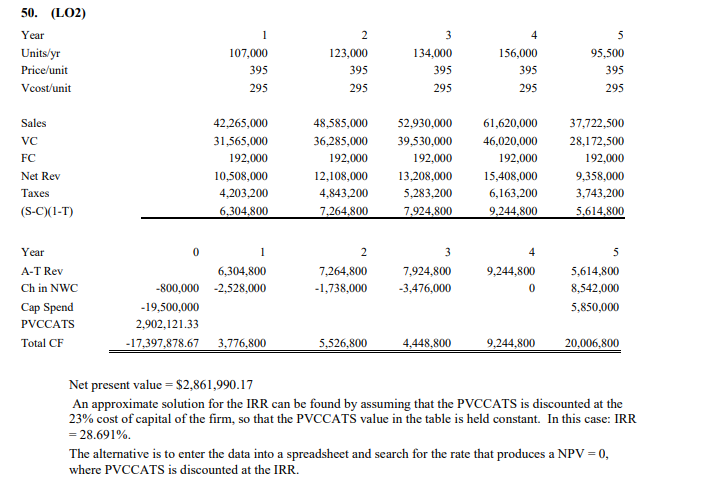

Hello there, the question is attached in the file. I am able to find out how to get the other numbers except for PVCCATS. From my basic understanding, I understand that there is no salvage value in this question, so when i used the formula to calculate it, my numbers do not match. Using the formula, PVCCATS=(IdTc/d+r) x [1+0.5r]/(1+r). In my calculations, I=18,700,000, d=0.2, Tc=0.4, r=0.23 and my answer is 3,153,790.887. The solution shows PVCCATS = 2,902,121.33. I am wondering if you could help me find the value of the PVCCATS.

Thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started