Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. This is a multi-part question that can not be answered with simple AI. I have attached the feedback error for the incorrect question. Can

Hello. This is a multi-part question that can not be answered with simple AI. I have attached the feedback error for the incorrect question. Can I please get assistance. Thank you in adavnce

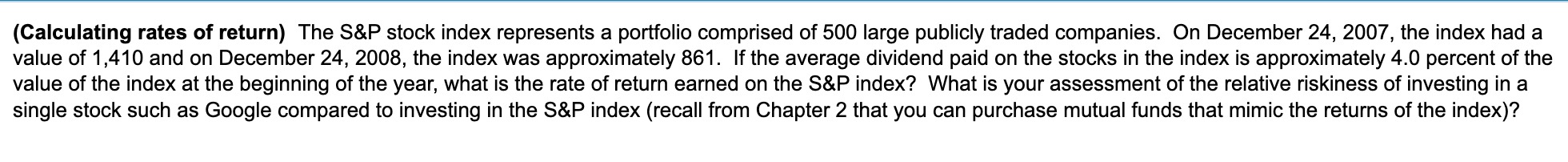

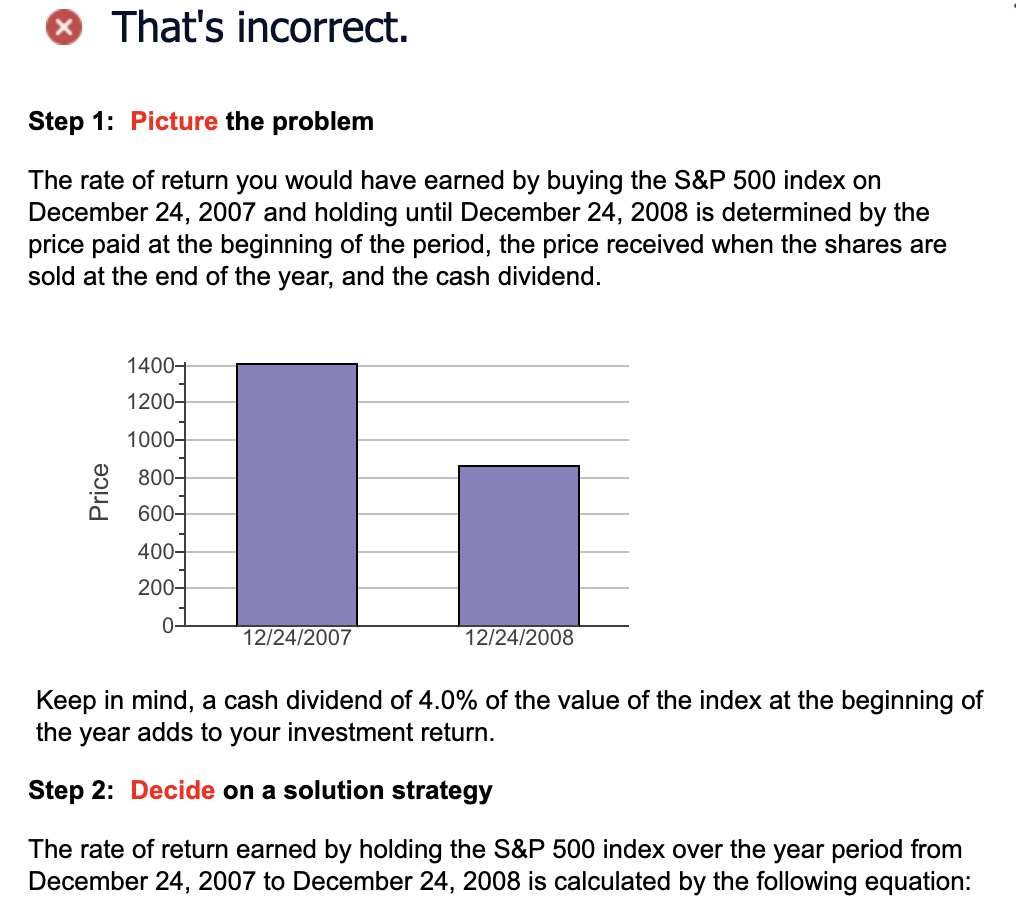

(Calculating rates of return) The S\&P stock index represents a portfolio comprised of 500 large publicly traded companies. On December 24,2007 , the index had a value of 1,410 and on December 24,2008 , the index was approximately 861 . If the average dividend paid on the stocks in the index is approximately 4.0 percent of the value of the index at the beginning of the year, what is the rate of return earned on the S\&P index? What is your assessment of the relative riskiness of investing in a single stock such as Google compared to investing in the S\&P index (recall from Chapter 2 that you can purchase mutual funds that mimic the returns of the index)? That's incorrect. Step 1: Picture the problem The rate of return you would have earned by buying the S\&P 500 index on December 24, 2007 and holding until December 24, 2008 is determined by the price paid at the beginning of the period, the price received when the shares are sold at the end of the year, and the cash dividend. Keep in mind, a cash dividend of 4.0% of the value of the index at the beginning of the year adds to your investment return. Step 2: Decide on a solution strategy The rate of return earned by holding the S\&P 500 index over the year period from December 24,2007 to December 24,2008 is calculated by the following equation: Step 2: Decide on a solution strategy The rate of return earned by holding the S\&P 500 index over the year period from December 24,2007 to December 24, 2008 is calculated by the following equation: Note that the rate of return for holding an investment for a specific period of time is sometimes referred to as the holding period returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started