Hello, this is the question - below are what I have put in - highlighted red is what is wrong - could you please help me through it?

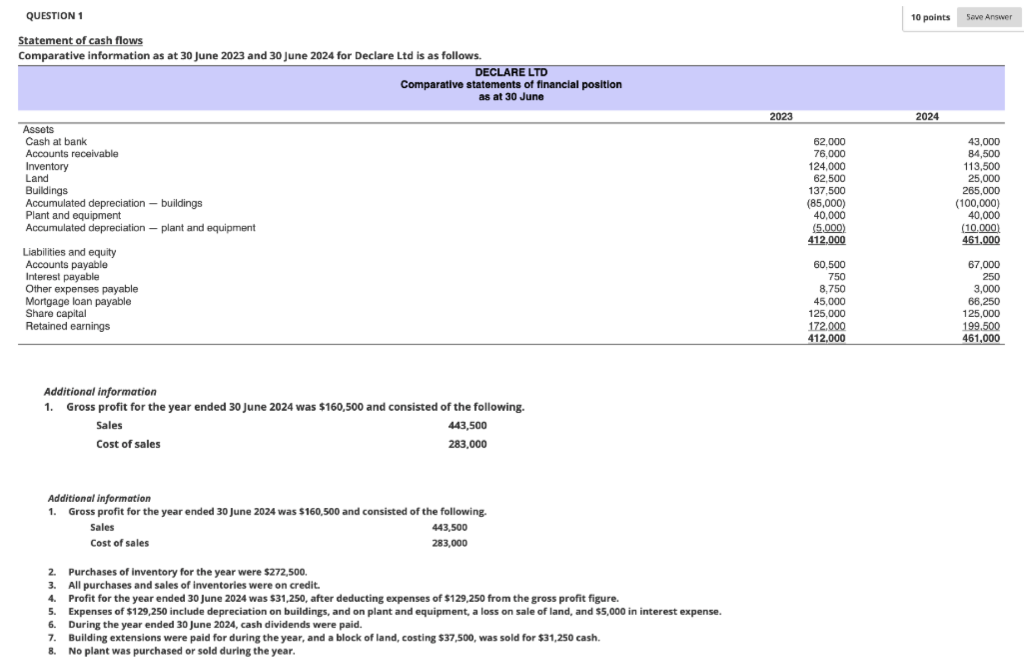

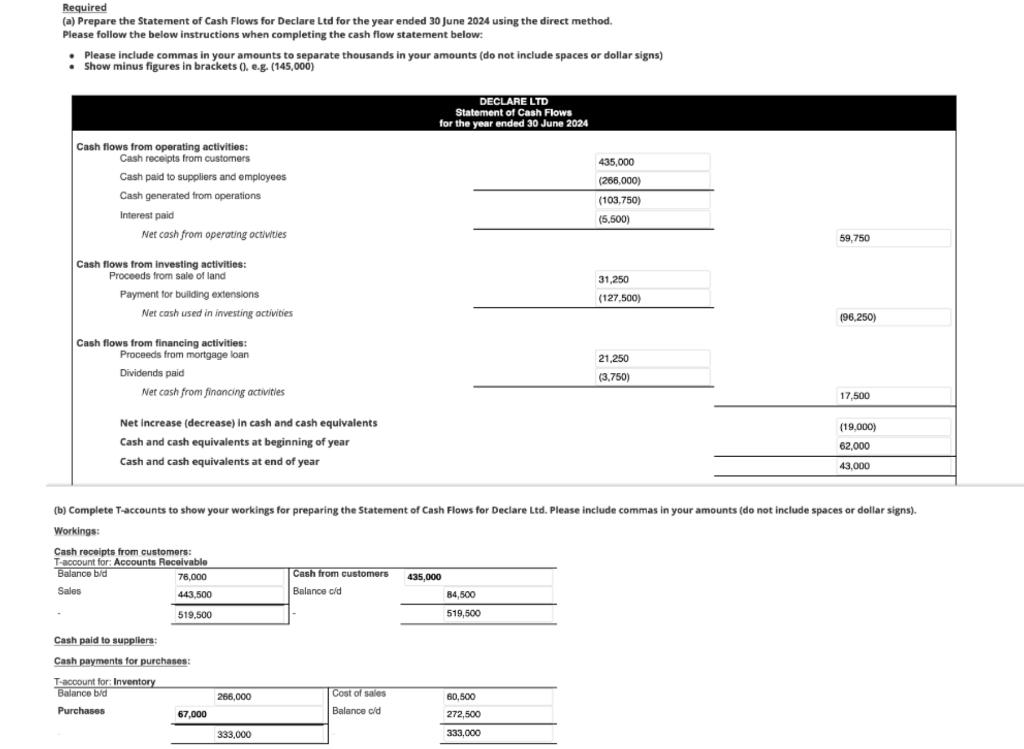

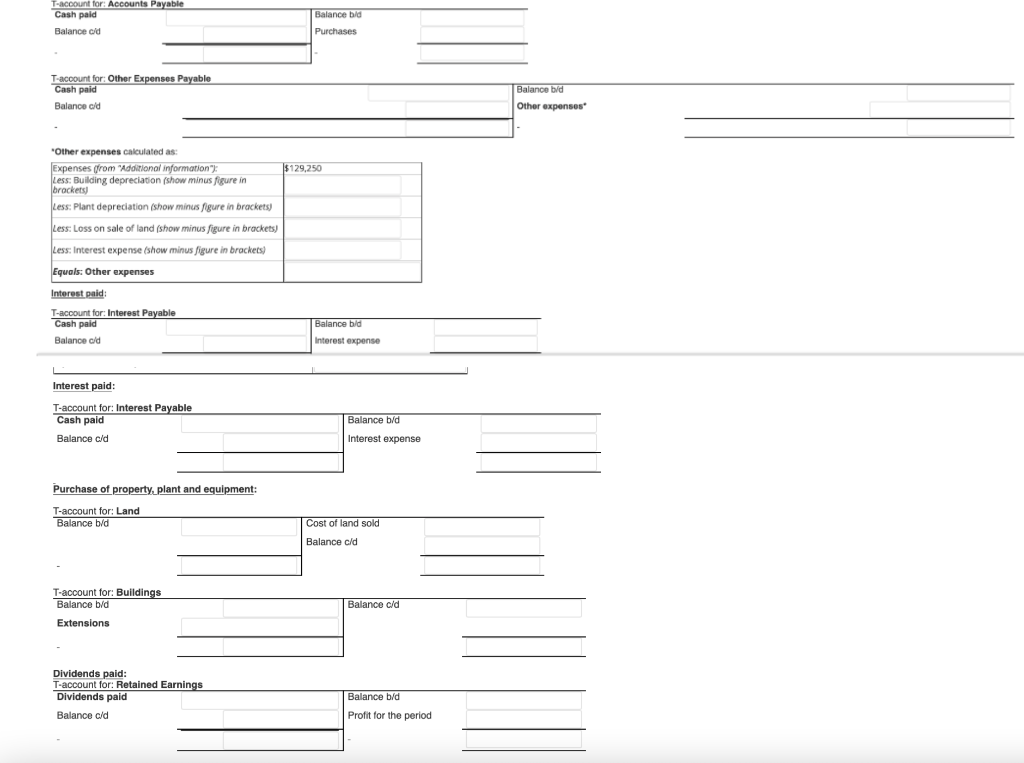

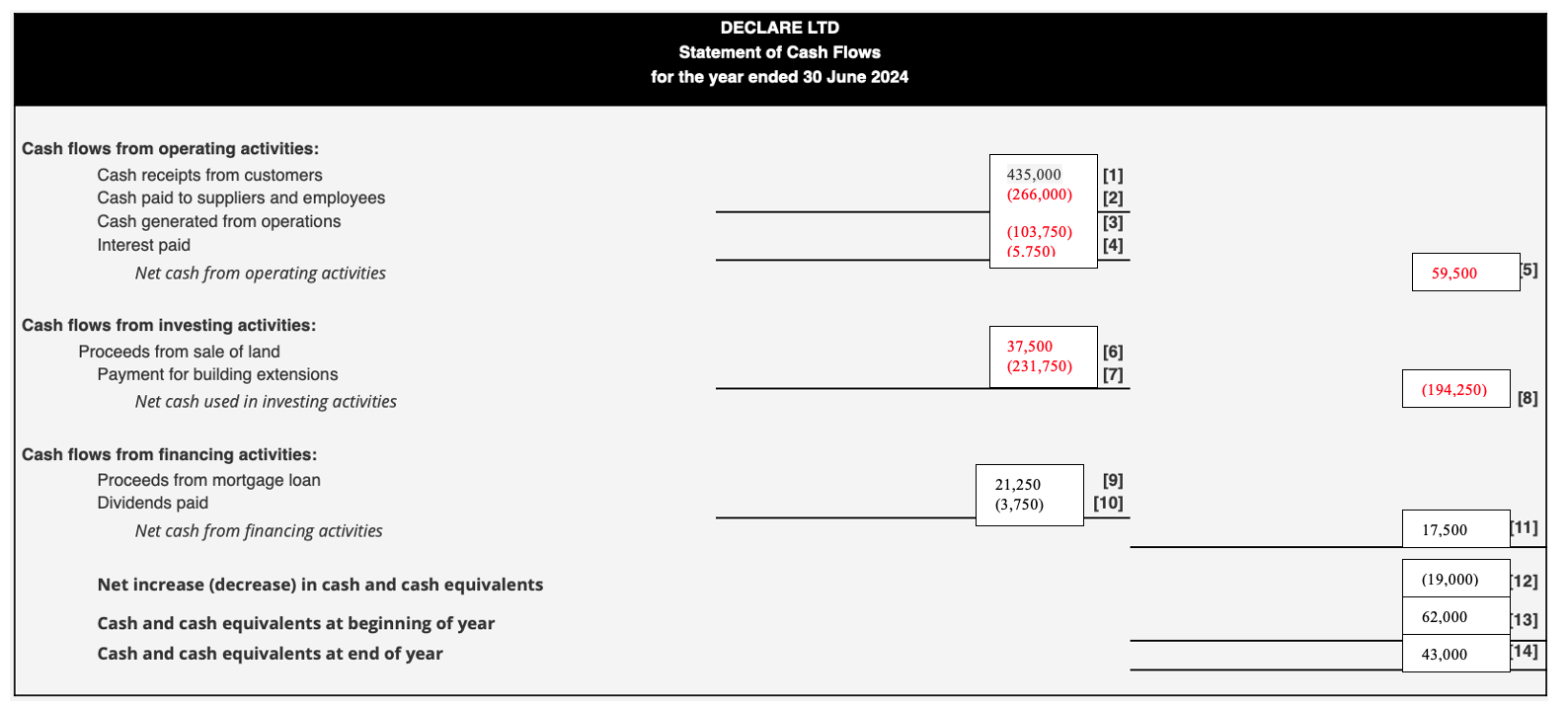

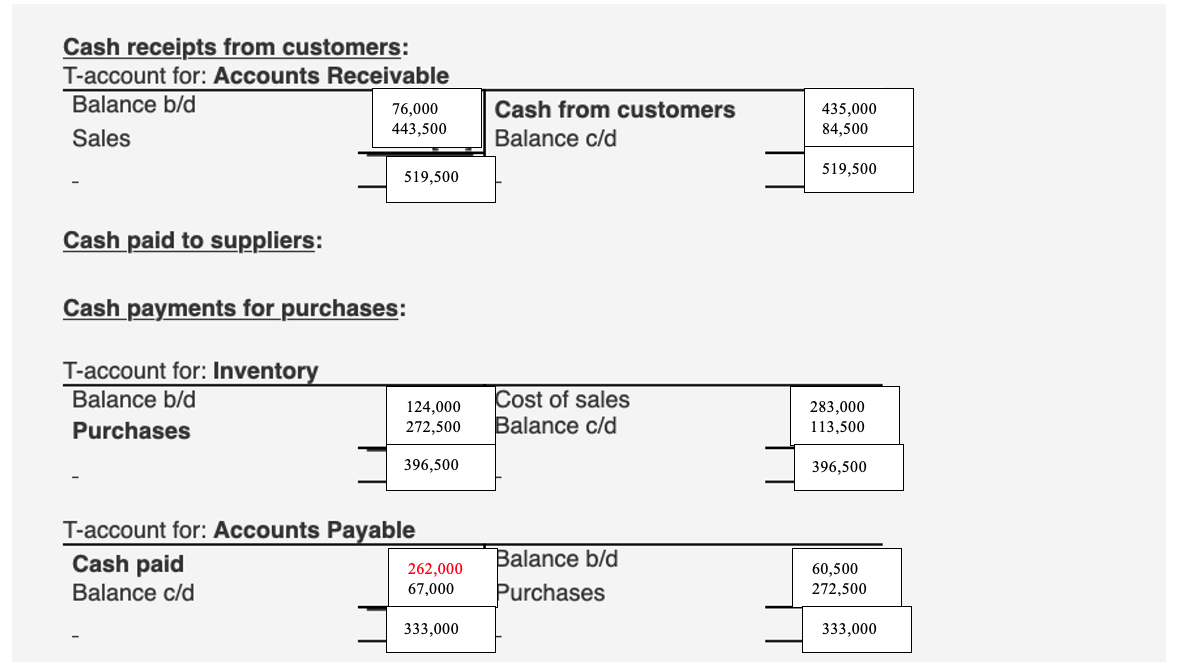

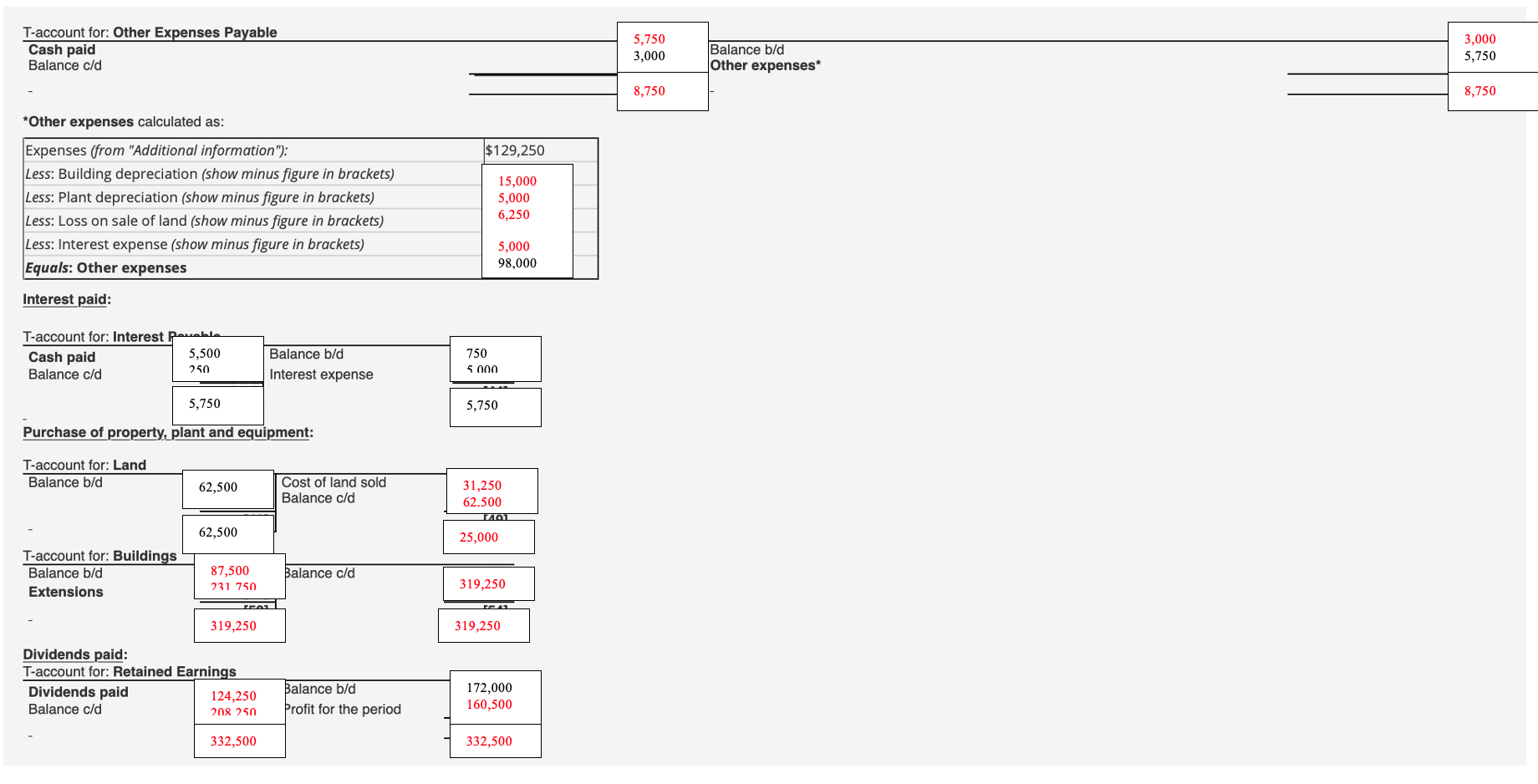

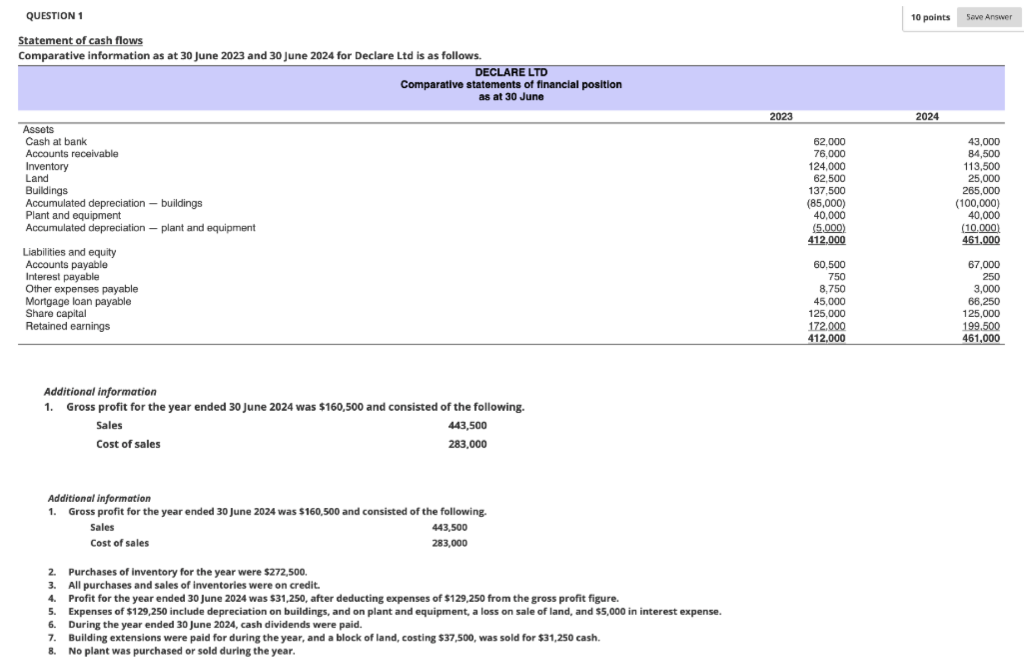

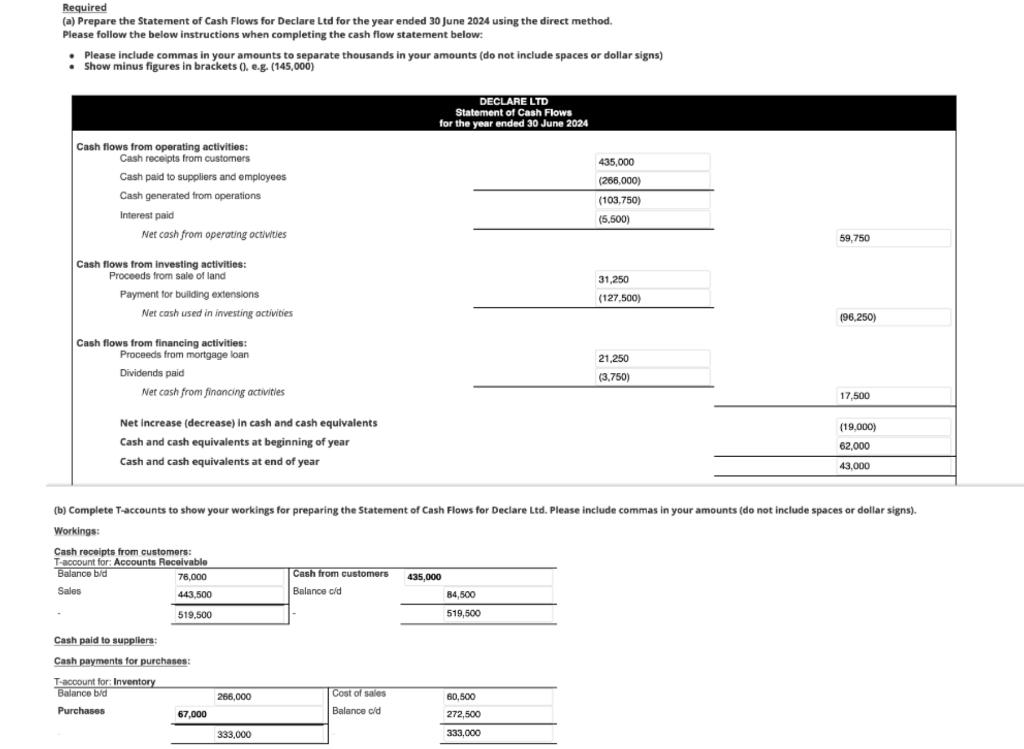

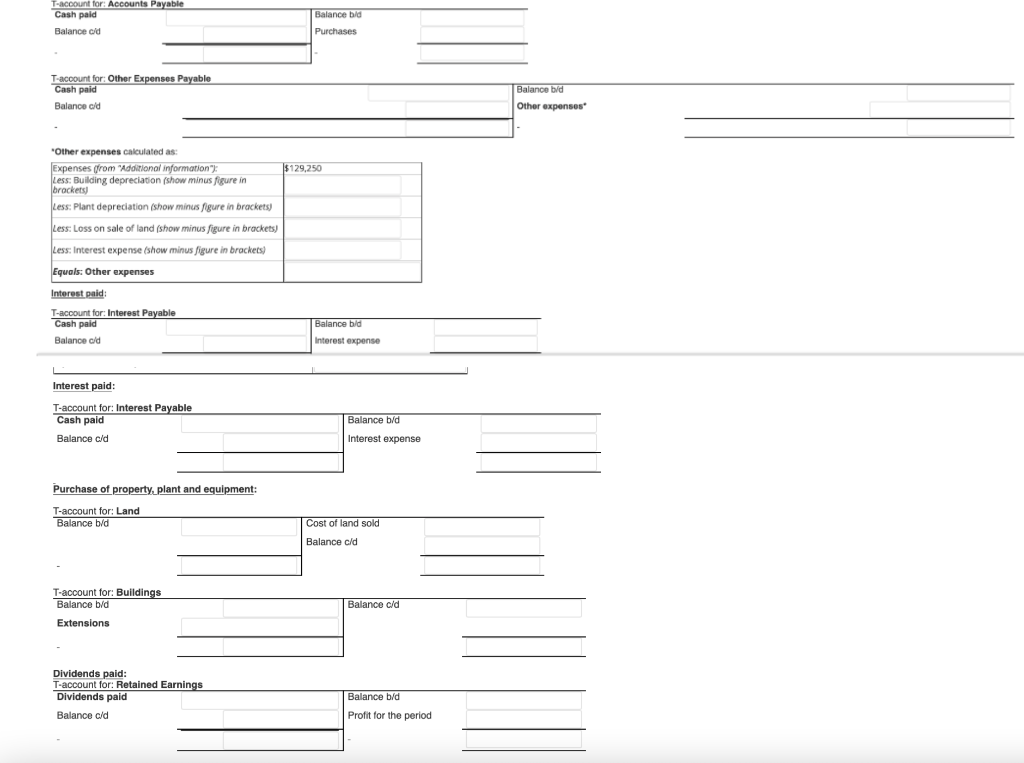

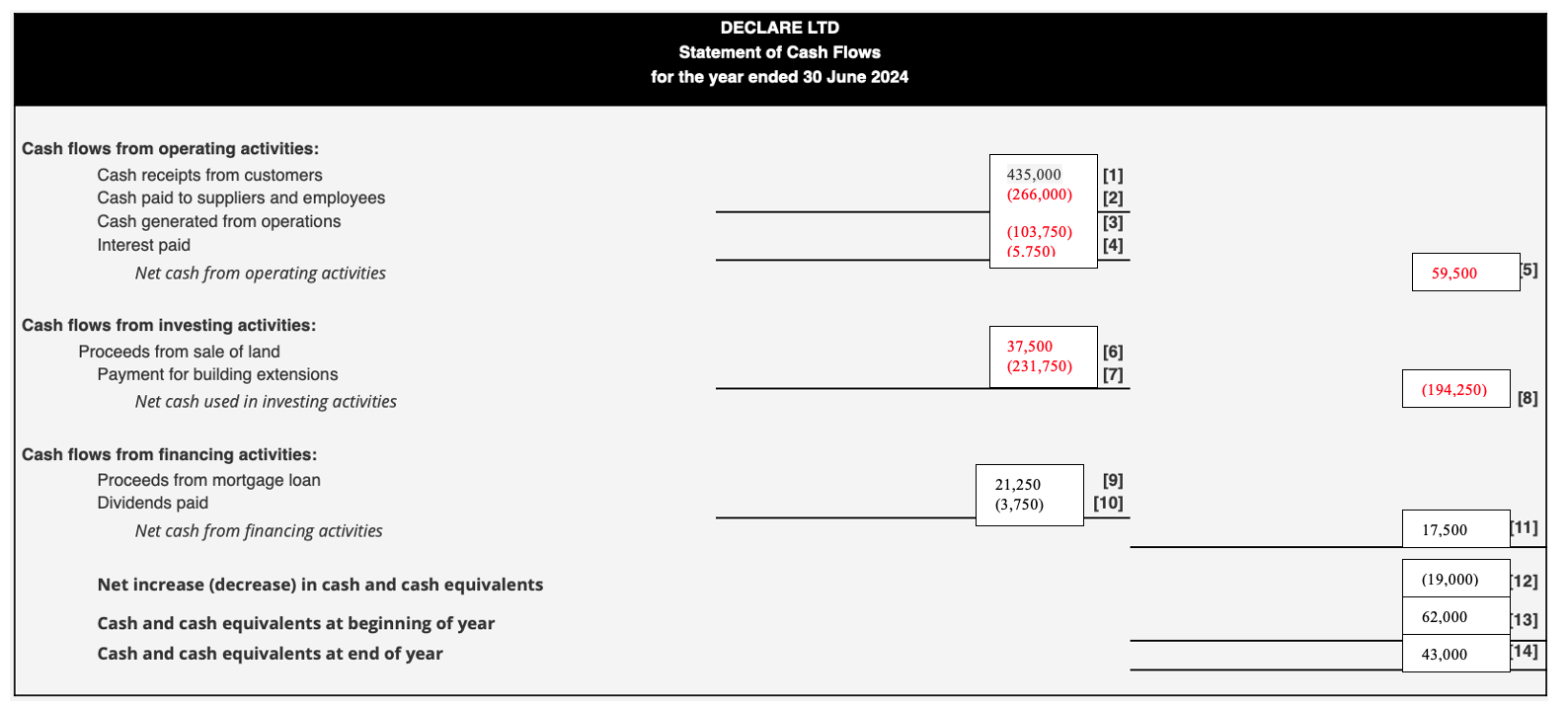

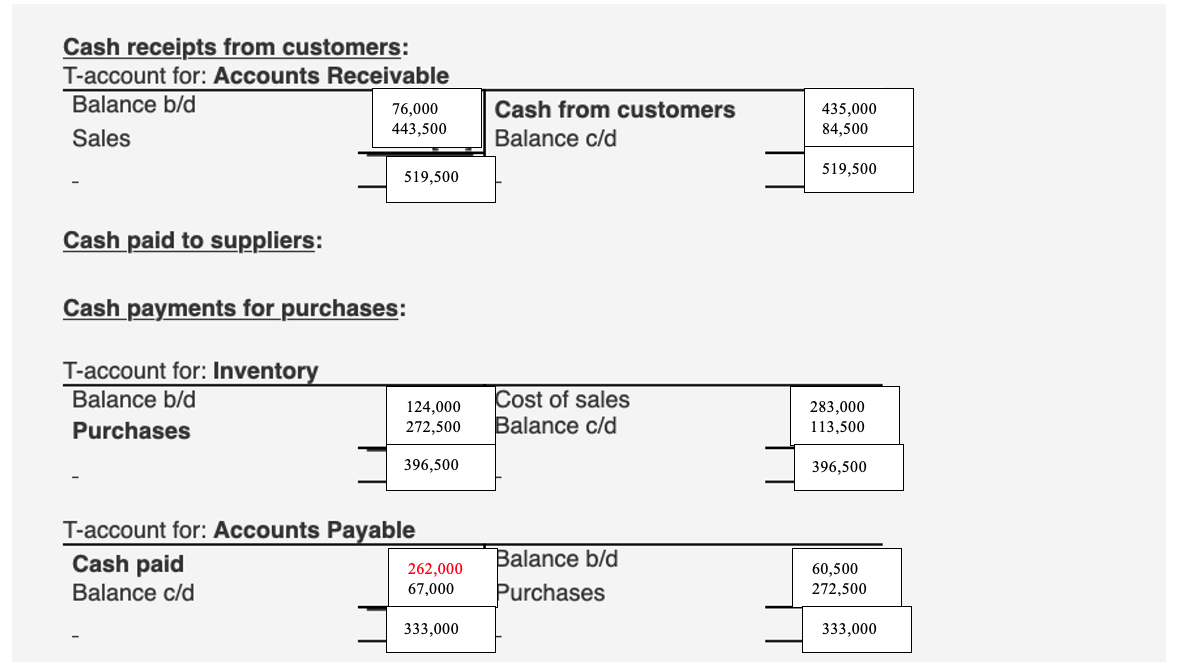

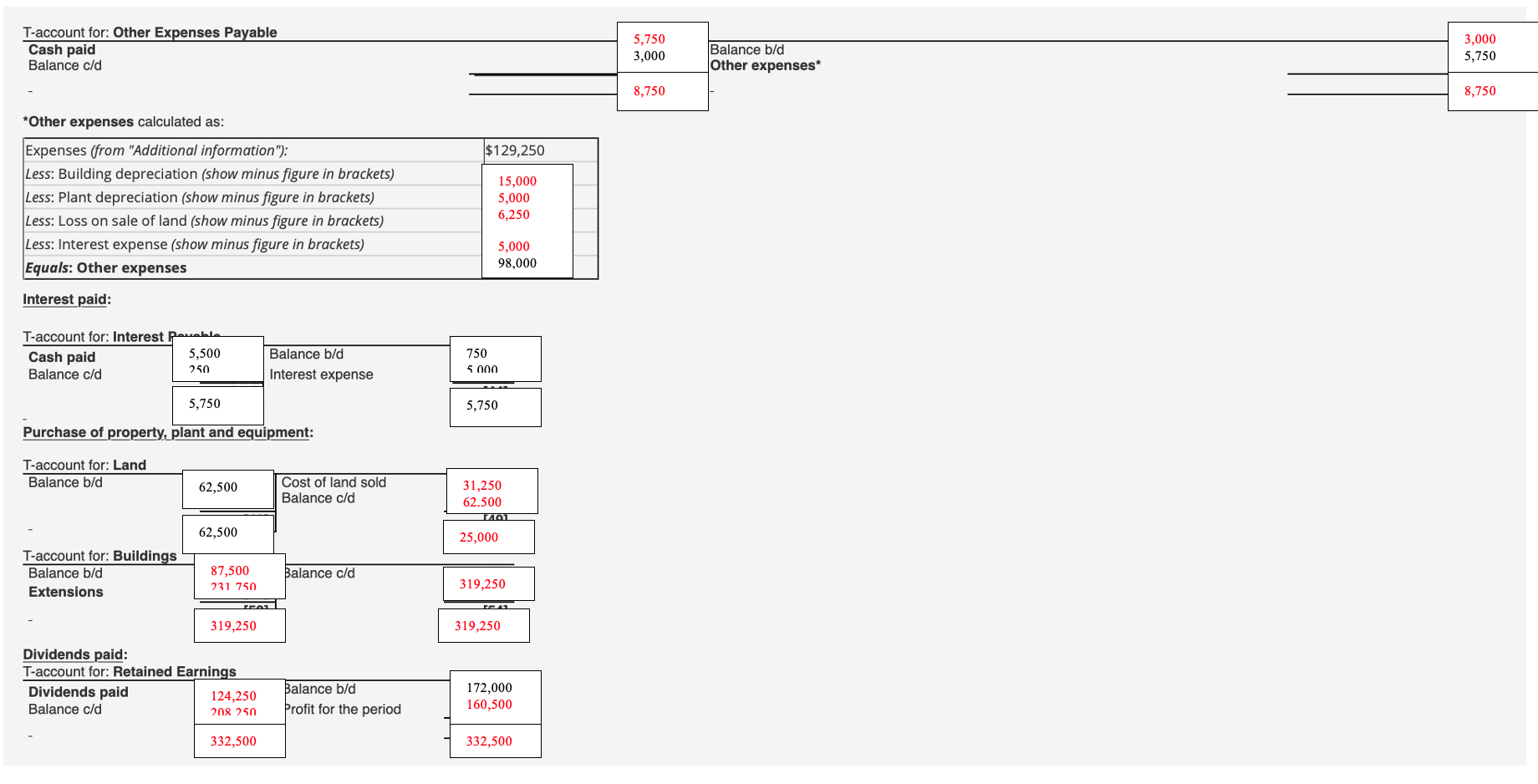

QUESTION 1 Statement of cash flows Comparative information as at 30 June 2023 and 30 June 2024 for Declare Ltd is as follows. Assets Cash at bank Accounts receivable Inventory Land Buildings Accumulated depreciation buildings Plant and equipment Accumulated depreciation - plant and equipment Liabilities and equity Accounts payable Interest payable Other expenses payable Mortgage loan payable Share capital Retained earnings Additional information 1. Gross profit for the year ended 30 June 2024 was $160,500 and consisted of the following. Sales 443,500 283,000 Cost of sales Additional information 1. Gross profit for the year ended 30 June 2024 was $160,500 and consisted of the following. Sales 443,500 283,000 Cost of sales 2. Purchases of inventory for the year were $272,500. 3. All purchases and sales of inventories were on credit. 4. Profit for the year ended 30 June 2024 was $31,250, after deducting expenses of $129,250 from the gross profit figure. 5. Expenses of $129,250 include depreciation on buildings, and on plant and equipment, a loss on sale of land, and $5,000 in interest expense. 6. During the year ended 30 June 2024, cash dividends were paid. 7. Building extensions were paid for during the year, and a block of land, costing $37,500, was sold for $31,250 cash. 8. No plant was purchased or sold during the year. DECLARE LTD Comparative statements of financial position as at 30 June 2023 62,000 76,000 124,000 62,500 137,500 (85,000) 40,000 (5,000) 412.000 60,500 750 8,750 45,000 125,000 172,000 412,000 10 points 2024 Save Answer 43,000 84,500 113,500 25,000 265,000 (100,000) 40,000 (10,000) 461,000 67,000 250 3,000 66.250 125,000 199,500 461,000 Required (a) Prepare the Statement of Cash Flows for Declare Ltd for the year ended 30 June 2024 using the direct method. Please follow the below instructions when completing the cash flow statement below: Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs) Show minus figures in brackets (), e.g. (145,000) DECLARE LTD Statement of Cash Flows for the year ended 30 June 2024 Cash flows from operating activities: 435.000 Cash receipts from customers Cash paid to suppliers and employees (266,000) Cash generated from operations Interest paid (103,750) (5,500) Net cash from operating activities 59.750 Cash flows from investing activities: Proceeds from sale of land 31,250 Payment for building extensions (127,500) Net cash used in investing activities (96,250) Cash flows from financing activities: 21,250 Proceeds from mortgage loan Dividends paid (3,750) Net cash from financing activities 17,500 (19,000) Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year 62,000 Cash and cash equivalents at end of yea 43,000 (b) Complete T-accounts to show your workings for preparing the Statement of Cash Flows for Declare Ltd. Please include commas in your amounts (do not include spaces or dollar signs). Workings: Cash receipts from customers: T-account for: Accounts Receivable Balance bid 76,000 Cash from customers Balance c/d 435,000 Sales 443,500 84,500 519,500 519,500 Cash paid to suppliers: Cash payments for purchases: T-account for: Inventory Balance bid 60,500 Cost of sales Balance c/d Purchases 272,500 333,000 67,000 266,000 333,000 T-account for: Accounts Payable Cash paid Balance c/d T-account for: Other Expenses Payable Cash paid Balance c/d *Other expenses calculated as: Expenses (from "Additional information"); Less: Building depreciation (show minus figure in brackets) Less: Plant depreciation (show minus figure in brackets) Less: Loss on sale of land (show minus figure in brackets) Less: Interest expense (show minus figure in brackets) Equals: Other expenses Interest paid: T-account for: Interest Payable Cash paid Balance c/d Interest paid: T-account for: Interest Payable Cash paid Balance c/d Purchase of property, plant and equipment: T-account for: Land Balance b/d T-account for: Buildings Balance b/d Extensions - Dividends paid: T-account for: Retained Earnings Dividends paid Balance c/d Balance bid Purchases $129,250 Balance b/d Interest expense Balance b/d Interest expense Cost of land sold Balance c/d Balance c/d Balance b/d Profit for the period Balance bid Other expenses Cash flows from operating activities: Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Net cash from operating activities Cash flows from investing activities: Proceeds from sale of land Payment for building extensions Net cash used in investing activities Cash flows from financing activities: Proceeds from mortgage loan Dividends paid Net cash from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year DECLARE LTD Statement of Cash Flows for the year ended 30 June 2024 435,000 [1] (266,000) [2] [3] (103,750) (5.750) [4] 37,500 (231,750) [6] [7] [9] [10] 21,250 (3,750) 59,500 [5] (194,250) [8] 17,500 [11] (19,000) [12] 62,000 [13] 43,000 [14] Cash receipts from customers: T-account for: Accounts Receivable Balance b/d 76,000 443,500 Sales Cash paid to suppliers: Cash payments for purchases: T-account for: Inventory Balance b/d Purchases T-account for: Accounts Payable Cash paid Balance c/d 519,500 124,000 272,500 396,500 262,000 67,000 333,000 Cash from customers Balance c/d Cost of sales Balance c/d Balance b/d Purchases 435,000 84,500 519,500 283,000 113,500 396,500 60,500 272,500 333,000 T-account for: Other Expenses Payable Cash paid Balance c/d *Other expenses calculated as: Expenses (from "Additional information"): Less: Building depreciation (show minus figure in brackets) Less: Plant depreciation (show minus figure in brackets) Less: Loss on sale of land (show minus figure in brackets) Less: Interest expense (show minus figure in brackets) Equals: Other expenses Interest paid: T-account for: Interest Ravabla Cash paid 5,500 Balance b/d 250 Balance c/d Interest expense 5,750 Purchase of property, plant and equipment: T-account for: Land Balance b/d 62,500 62,500 T-account for: Buildings Balance b/d 87,500 231 750 Extensions 319,250 Dividends paid: T-account for: Retained Earnings Dividends paid Balance c/d 124,250 208 250 332,500 TEAT Cost of land sold Balance c/d Balance c/d Balance b/d Profit for the period $129,250 15,000 5,000 6,250 5,000 98,000 750 5.000 5,750 31,250 62.500 T401 25,000 319,250 319,250 172,000 160,500 332,500 5,750 3,000 8,750 Balance b/d Other expenses* 3,000 5,750 8,750