Hello, this is the second time I uploaded the question. Please gives me a better answer and a better explanation regarding the answer. Also, please clarify for each work done. Thank you so much. I hope you have a great day.

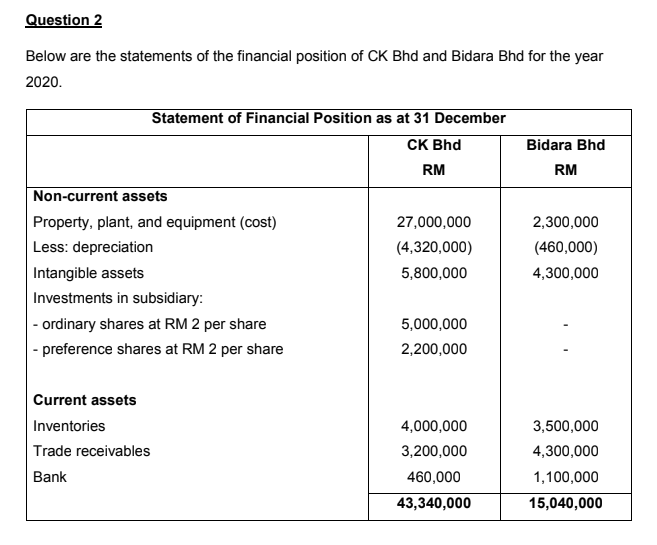

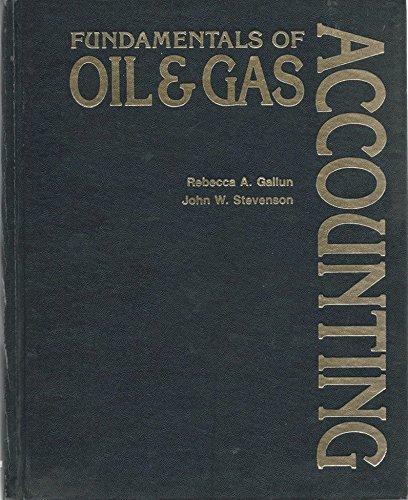

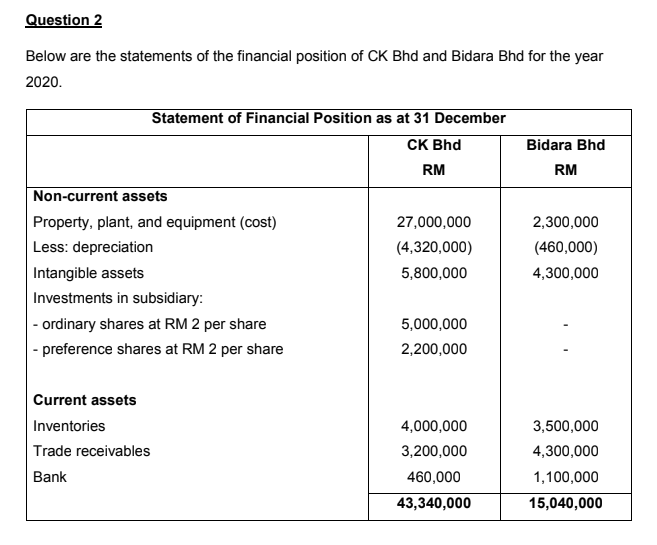

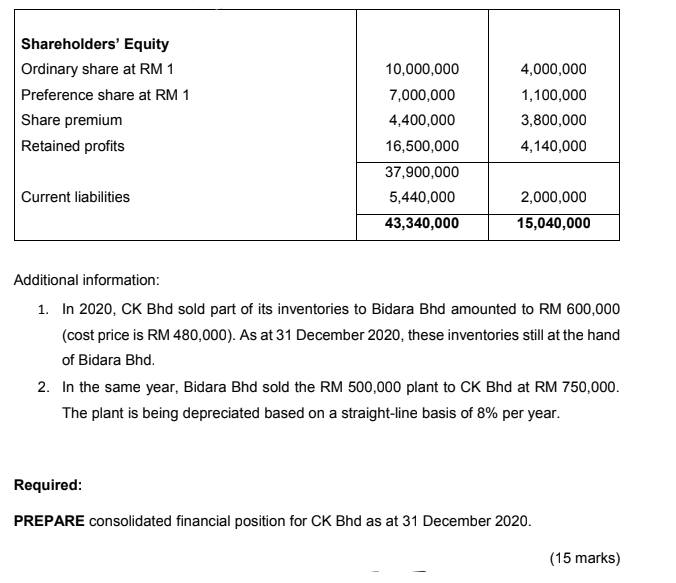

Question 2 Below are the statements of the financial position of CK Bhd and Bidara Bhd for the year 2020. Bidara Bhd RM Statement of Financial Position as at 31 December CK Bhd RM Non-current assets Property, plant, and equipment (cost) 27,000,000 Less: depreciation (4,320,000) Intangible assets 5,800,000 Investments in subsidiary: - ordinary shares at RM 2 per share 5,000,000 - preference shares at RM 2 per share 2,200,000 2,300,000 (460,000) 4,300,000 Current assets Inventories Trade receivables Bank 4,000,000 3,200,000 460,000 43,340,000 3,500,000 4,300,000 1,100,000 15,040,000 Shareholders' Equity Ordinary share at RM 1 Preference share at RM 1 Share premium Retained profits 10,000,000 7,000,000 4,400,000 16,500,000 37,900,000 5,440,000 43,340,000 4,000,000 1,100,000 3,800,000 4,140,000 Current liabilities 2,000,000 15,040,000 Additional information: 1. In 2020, CK Bhd sold part of its inventories to Bidara Bhd amounted to RM 600,000 (cost price is RM 480,000). As at 31 December 2020, these inventories still at the hand of Bidara Bhd. 2. In the same year, Bidara Bhd sold the RM 500,000 plant to CK Bhd at RM 750,000. The plant is being depreciated based on a straight-line basis of 8% per year. Required: PREPARE consolidated financial position for CK Bhd as at 31 December 2020. (15 marks) Question 2 Below are the statements of the financial position of CK Bhd and Bidara Bhd for the year 2020. Bidara Bhd RM Statement of Financial Position as at 31 December CK Bhd RM Non-current assets Property, plant, and equipment (cost) 27,000,000 Less: depreciation (4,320,000) Intangible assets 5,800,000 Investments in subsidiary: - ordinary shares at RM 2 per share 5,000,000 - preference shares at RM 2 per share 2,200,000 2,300,000 (460,000) 4,300,000 Current assets Inventories Trade receivables Bank 4,000,000 3,200,000 460,000 43,340,000 3,500,000 4,300,000 1,100,000 15,040,000 Shareholders' Equity Ordinary share at RM 1 Preference share at RM 1 Share premium Retained profits 10,000,000 7,000,000 4,400,000 16,500,000 37,900,000 5,440,000 43,340,000 4,000,000 1,100,000 3,800,000 4,140,000 Current liabilities 2,000,000 15,040,000 Additional information: 1. In 2020, CK Bhd sold part of its inventories to Bidara Bhd amounted to RM 600,000 (cost price is RM 480,000). As at 31 December 2020, these inventories still at the hand of Bidara Bhd. 2. In the same year, Bidara Bhd sold the RM 500,000 plant to CK Bhd at RM 750,000. The plant is being depreciated based on a straight-line basis of 8% per year. Required: PREPARE consolidated financial position for CK Bhd as at 31 December 2020. (15 marks)