Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello Trying to find the solution to this question. I already found it in Chegg. However, my question is: why Chegg's answer is different from

Hello

Trying to find the solution to this question. I already found it in Chegg. However, my question is: why Chegg's answer is different from the test bank answer?

Link of Chegg's answer: https://www.chegg.com/homework-help/questions-and-answers/1-suppose-5-year-annual-data-excess-returns-fund-manager-s-portfolio-fund-abc-excess-retur-q86888511

Link of test bank: https://pdfcoffee.com/testbankquestionschapter3-pdf-free.html

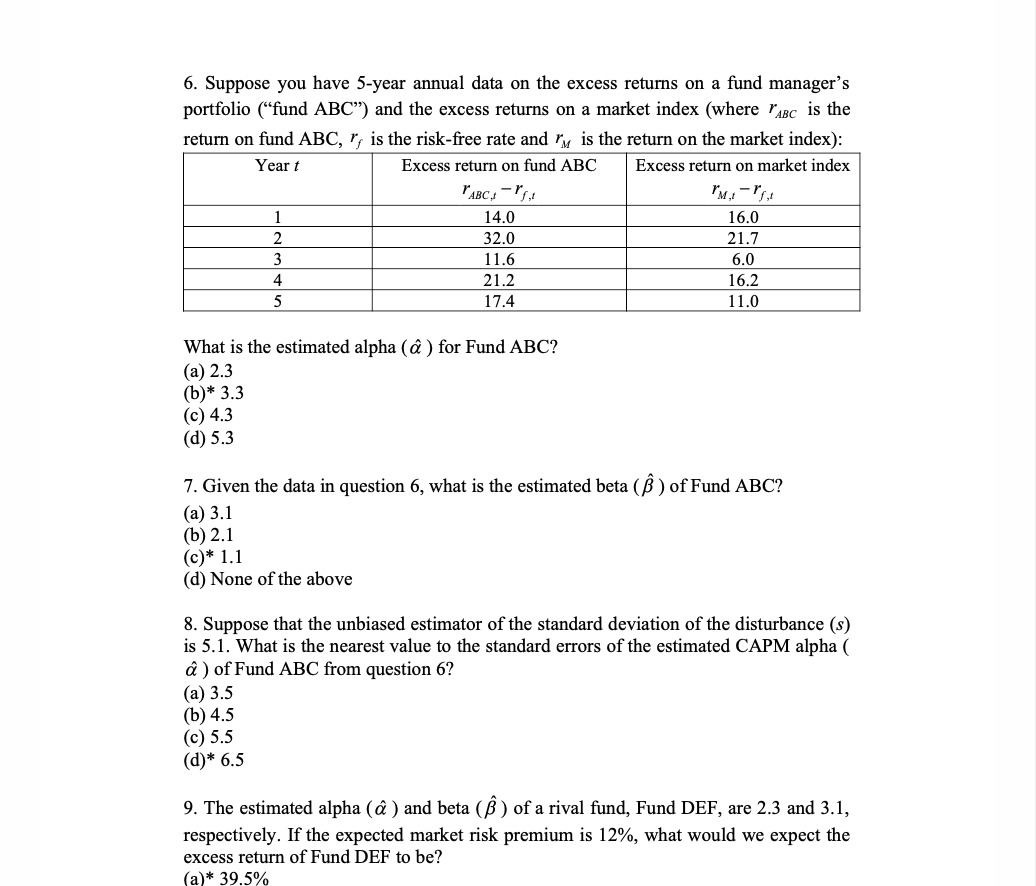

6. Suppose you have 5-year annual data on the excess returns on a fund manager's portfolio (fund ABC) and the excess returns on a market index (where l'ABC is the return on fund ABC, r, is the risk-free rate and rv is the return on the market index): Yeart Excess return on fund ABC Excess return on market index ABC, -1/4 11-14 1 14.0 16.0 2 32.0 21.7 3 11.6 6.0 4 21.2 16.2 5 17.4 11.0 What is the estimated alpha () for Fund ABC? (a) 2.3 (b)* 3.3 (c) 4.3 (d) 5.3 7. Given the data in question 6, what is the estimated beta (B) of Fund ABC? (a) 3.1 (b) 2.1 (c)* 1.1 (d) None of the above 8. Suppose that the unbiased estimator of the standard deviation of the disturbance (s) is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha ( ) of Fund ABC from question 6? (a) 3.5 (b) 4.5 (c) 5.5 (d)* 6.5 9. The estimated alpha ( ) and beta (B) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be? (a)* 39.5% 6. Suppose you have 5-year annual data on the excess returns on a fund manager's portfolio (fund ABC) and the excess returns on a market index (where l'ABC is the return on fund ABC, r, is the risk-free rate and rv is the return on the market index): Yeart Excess return on fund ABC Excess return on market index ABC, -1/4 11-14 1 14.0 16.0 2 32.0 21.7 3 11.6 6.0 4 21.2 16.2 5 17.4 11.0 What is the estimated alpha () for Fund ABC? (a) 2.3 (b)* 3.3 (c) 4.3 (d) 5.3 7. Given the data in question 6, what is the estimated beta (B) of Fund ABC? (a) 3.1 (b) 2.1 (c)* 1.1 (d) None of the above 8. Suppose that the unbiased estimator of the standard deviation of the disturbance (s) is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha ( ) of Fund ABC from question 6? (a) 3.5 (b) 4.5 (c) 5.5 (d)* 6.5 9. The estimated alpha ( ) and beta (B) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be? (a)* 39.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started