Hello Vjvgoe, I need help with my calculations please.

I need help with my calculations.

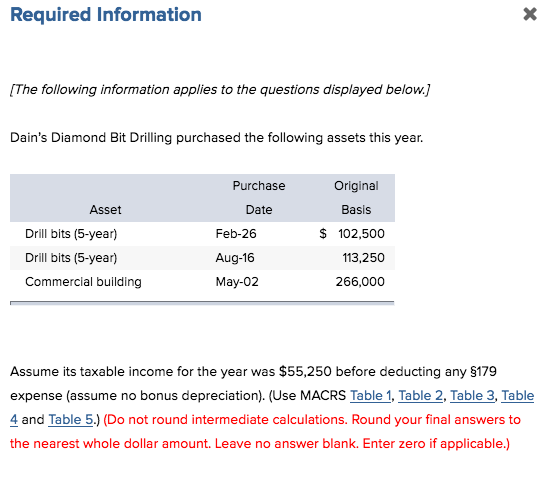

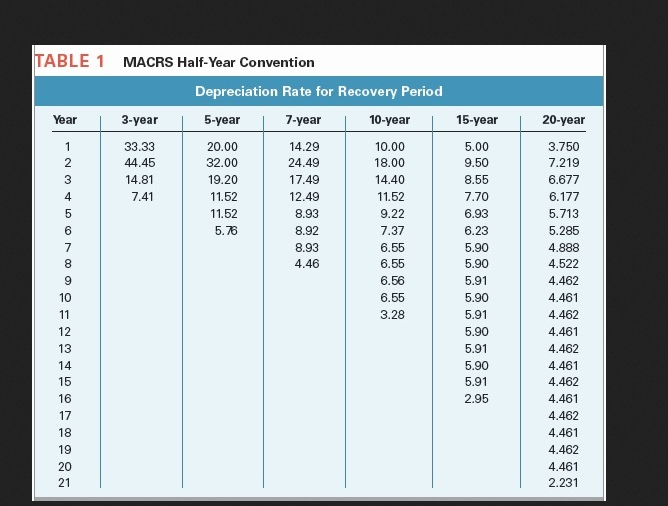

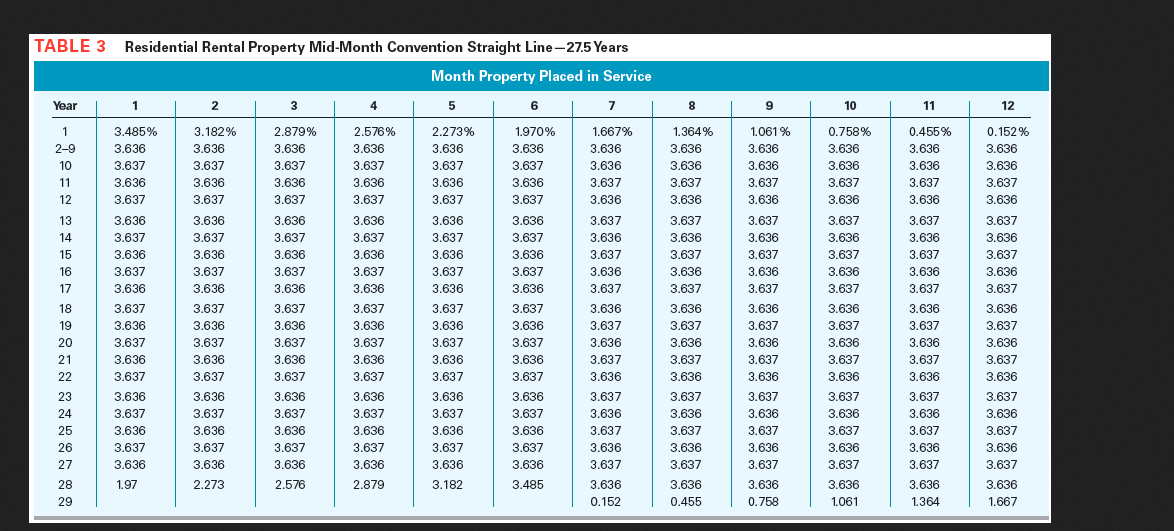

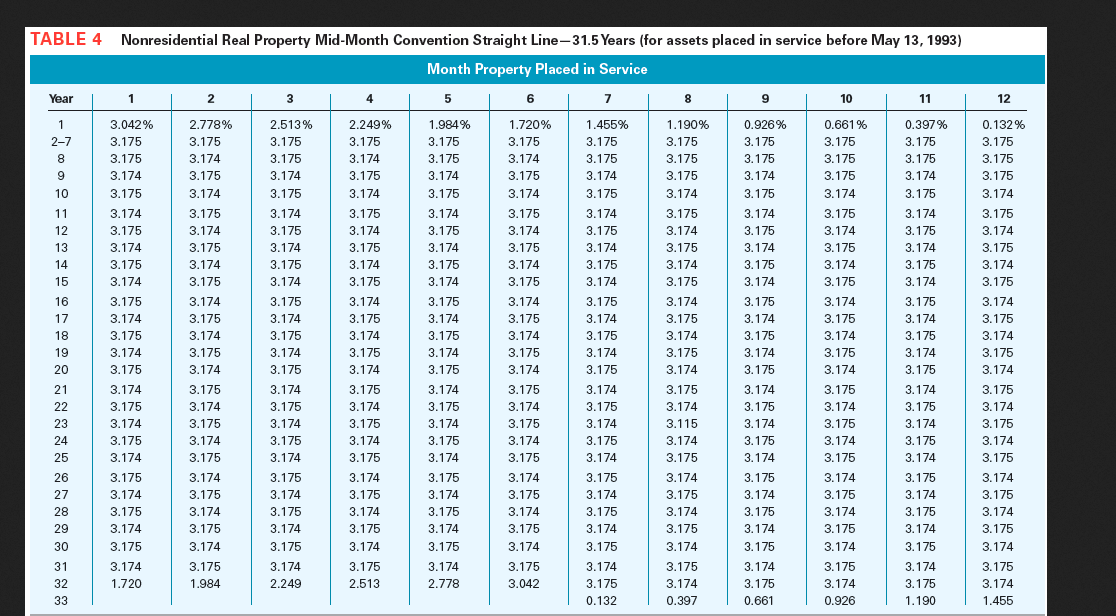

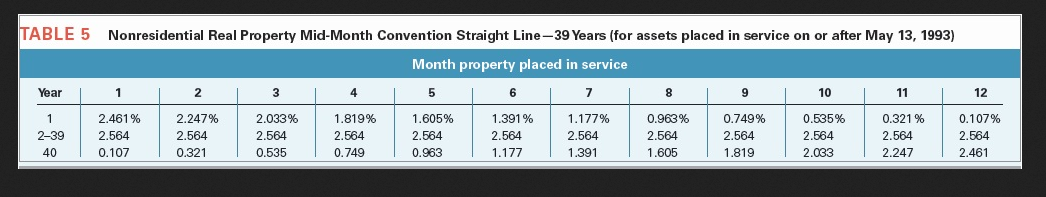

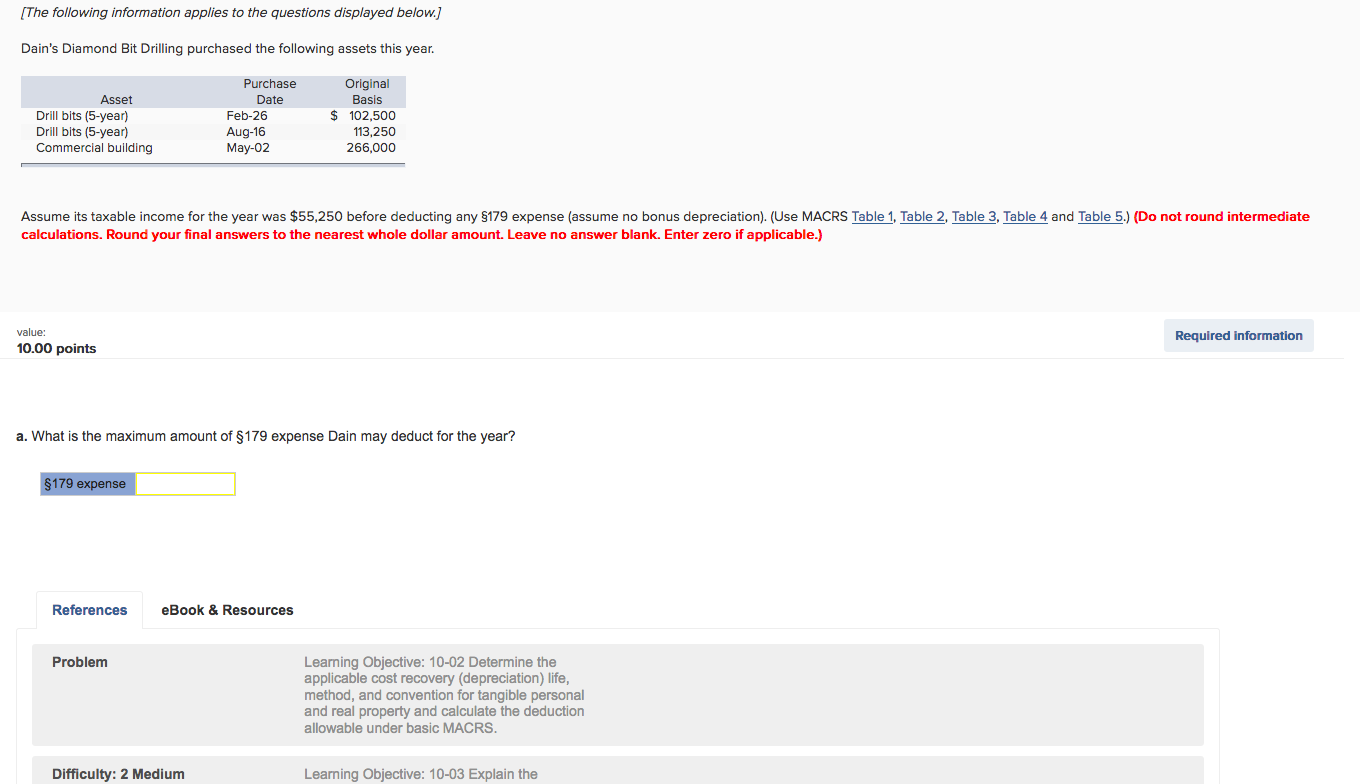

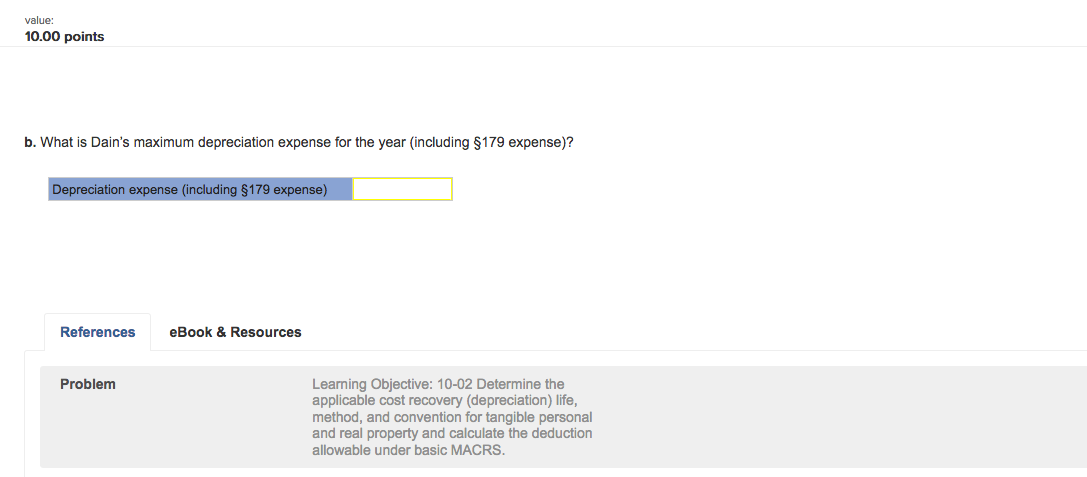

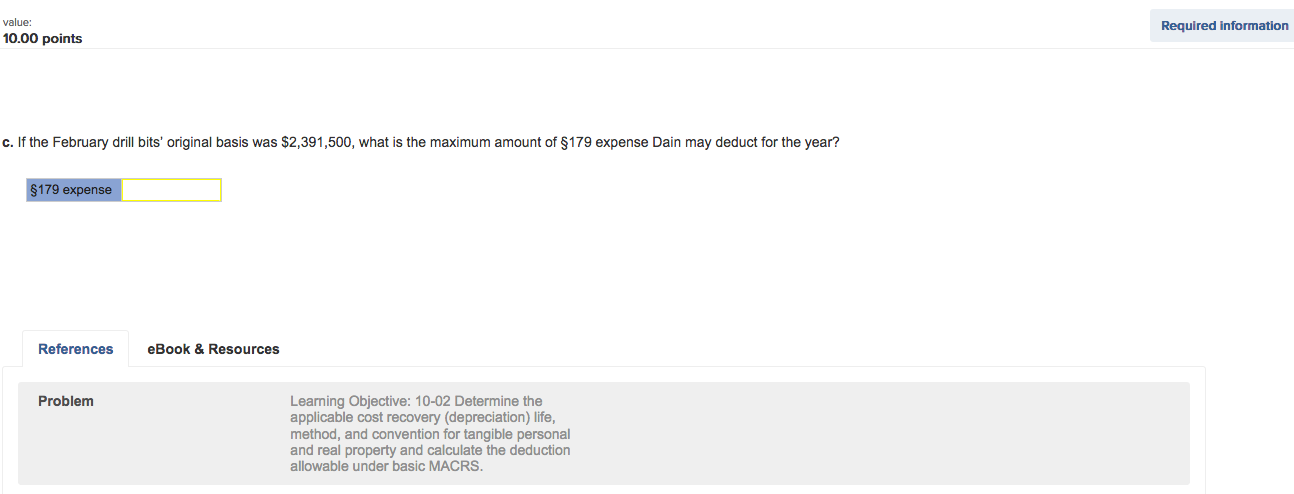

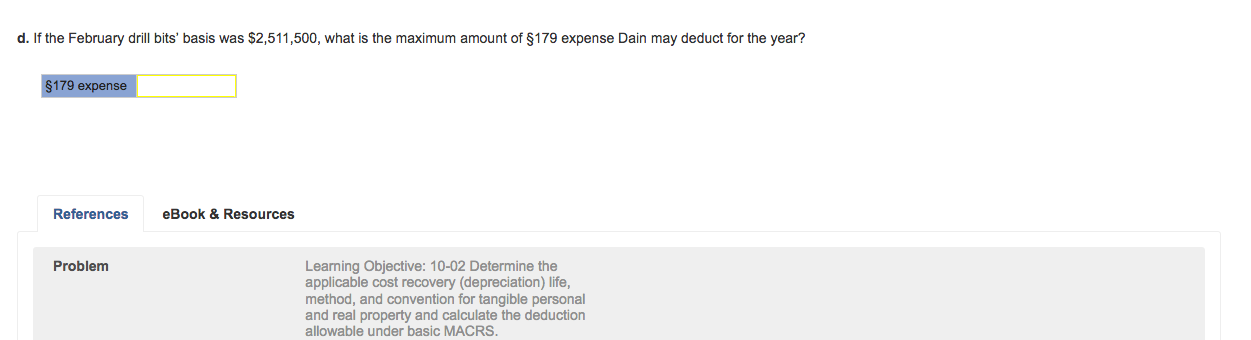

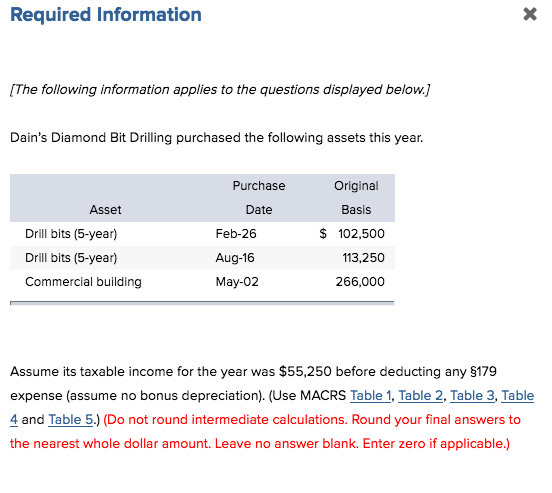

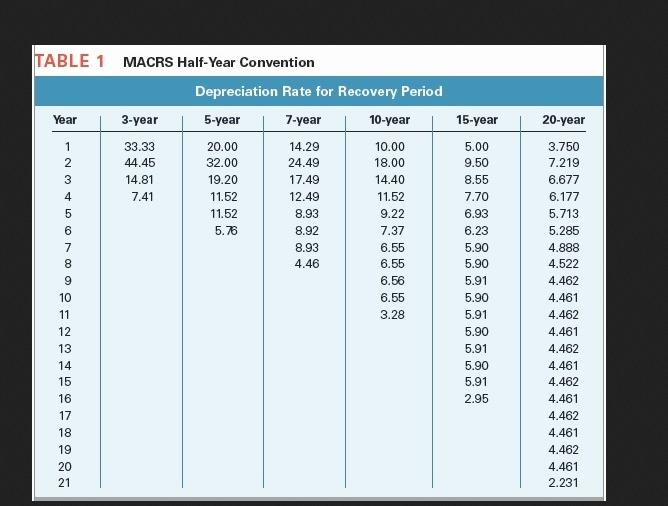

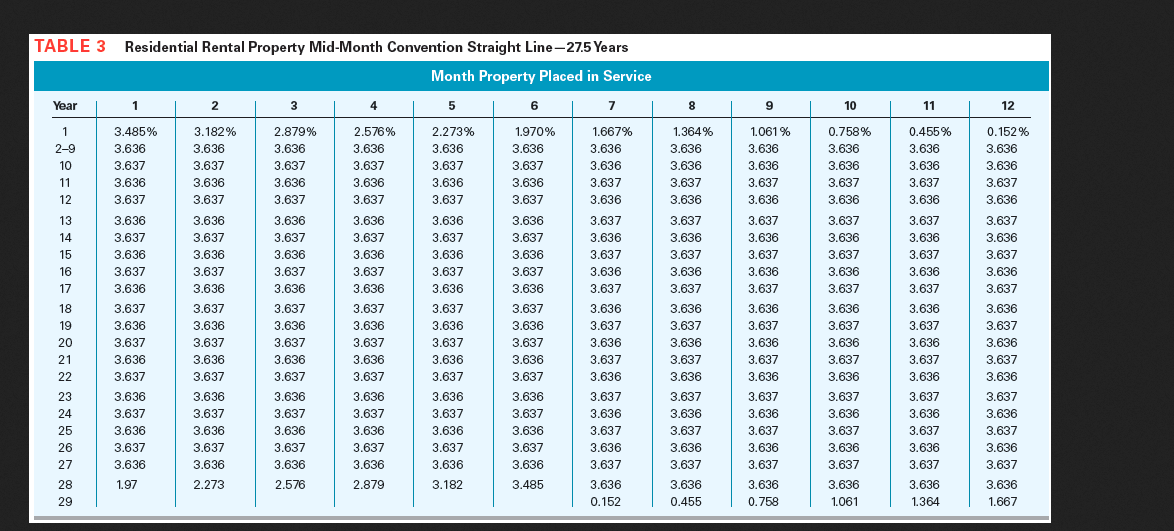

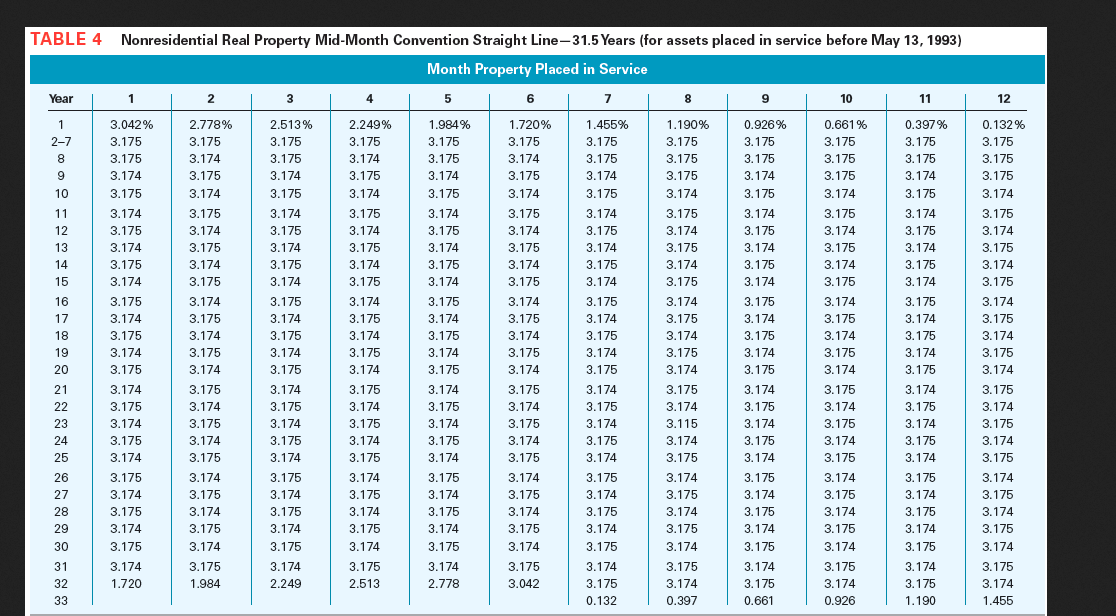

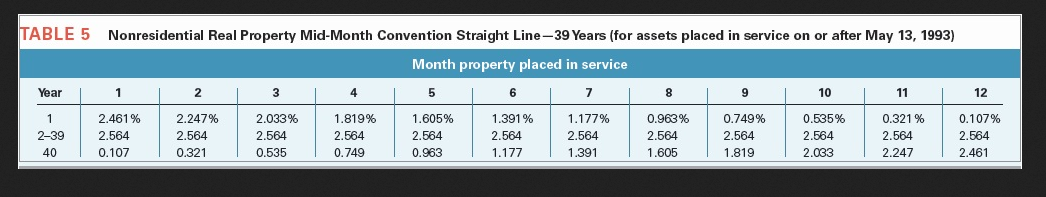

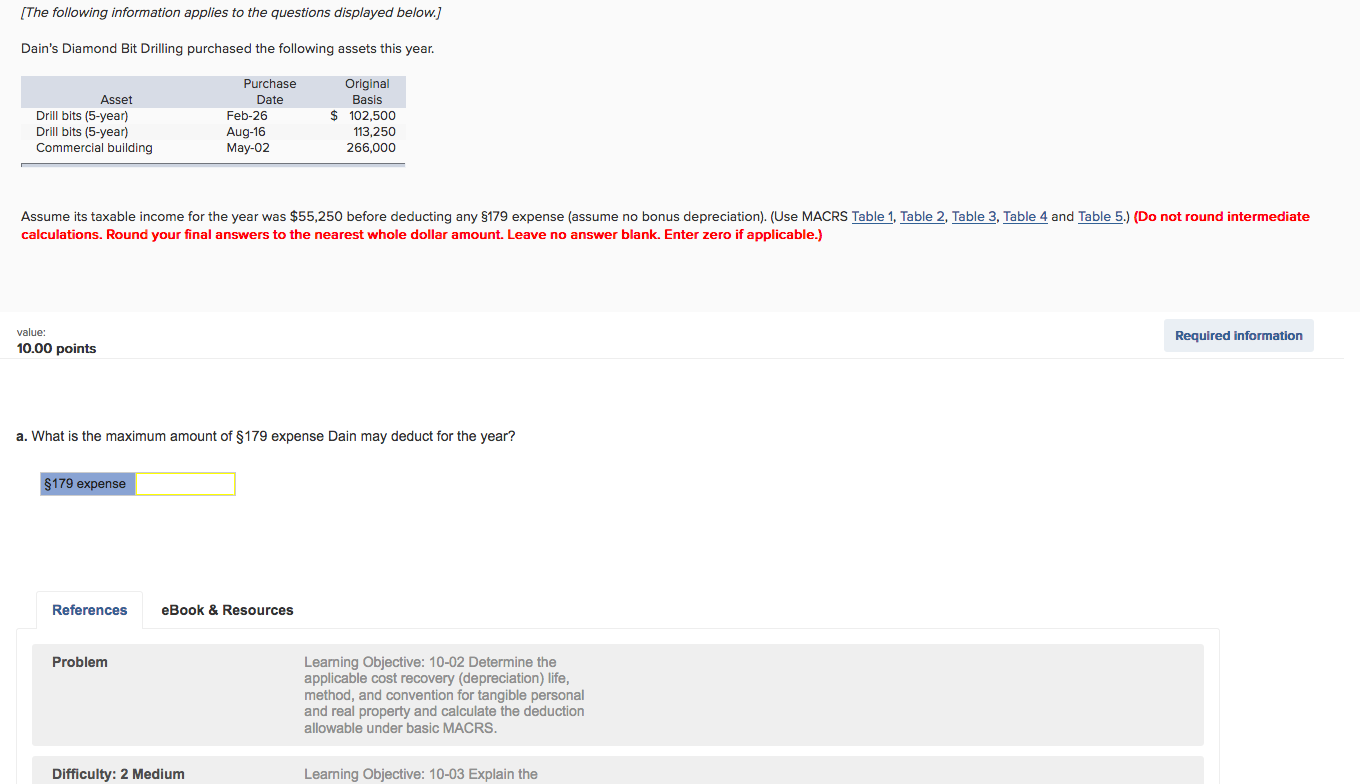

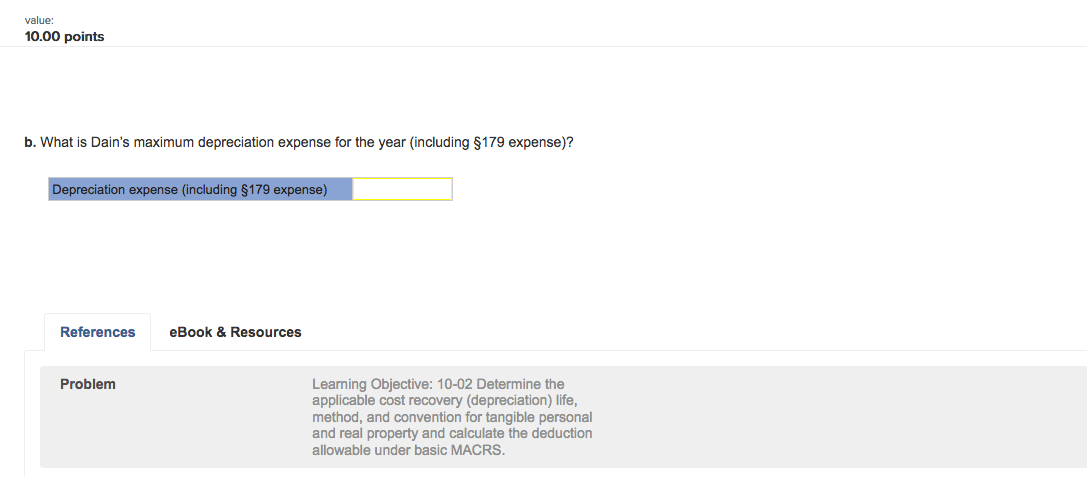

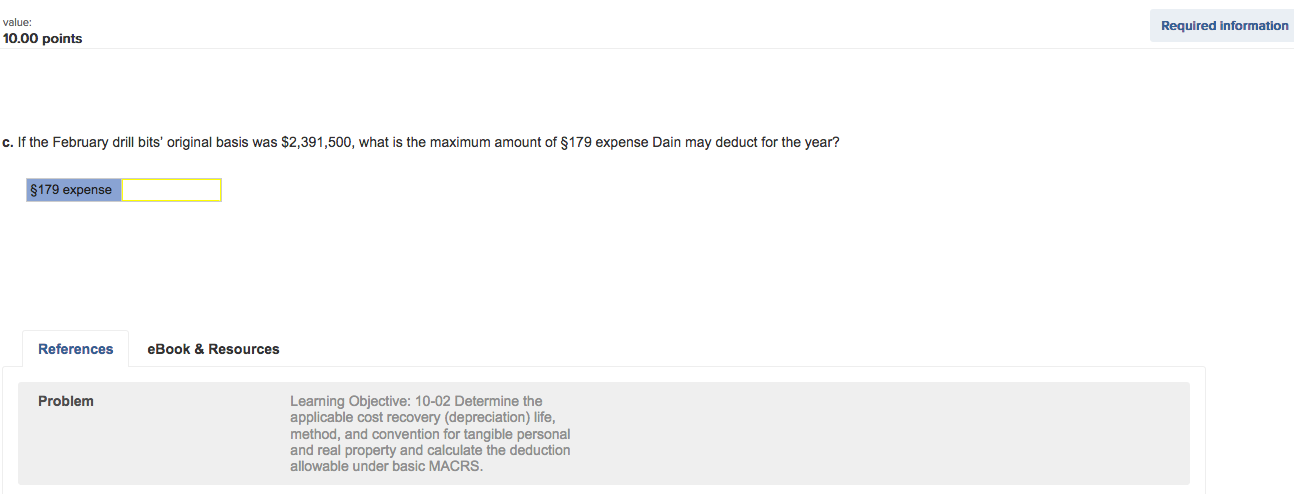

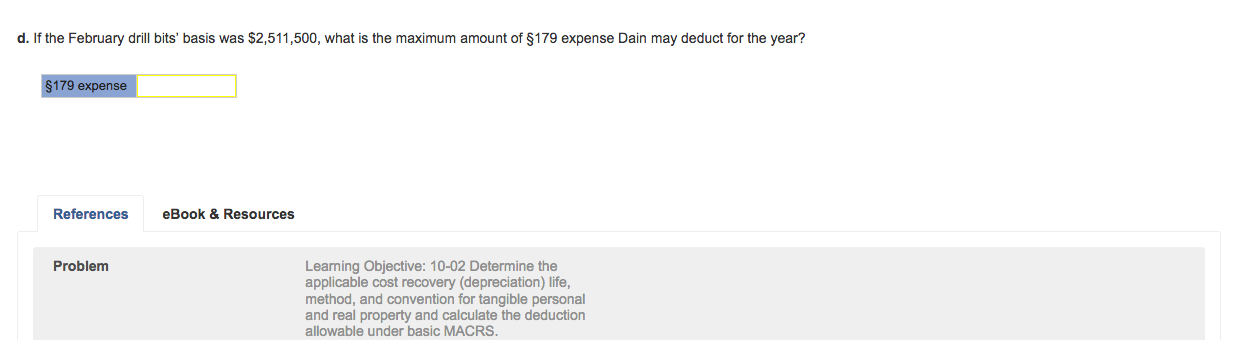

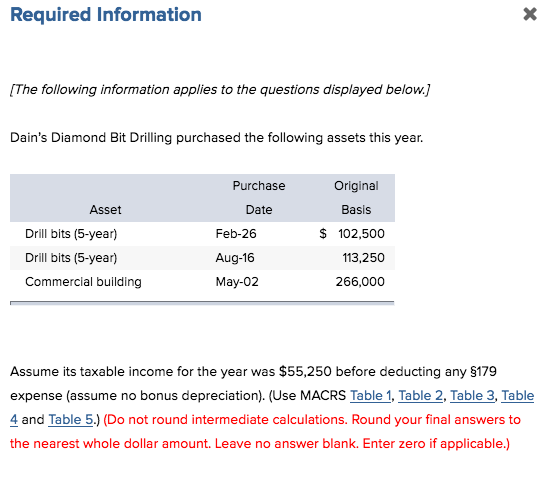

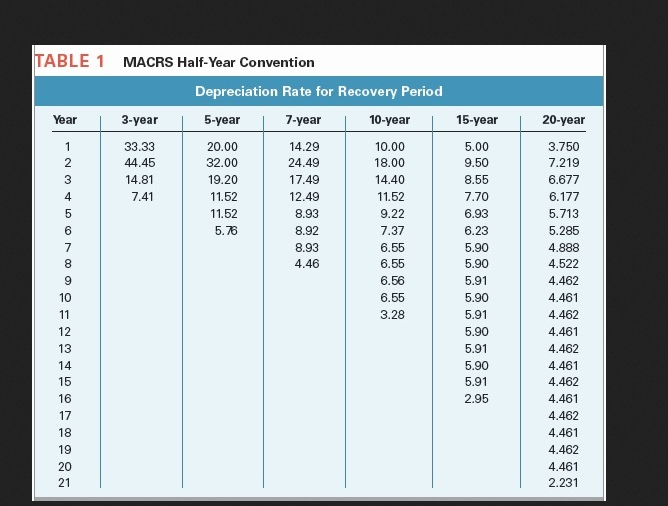

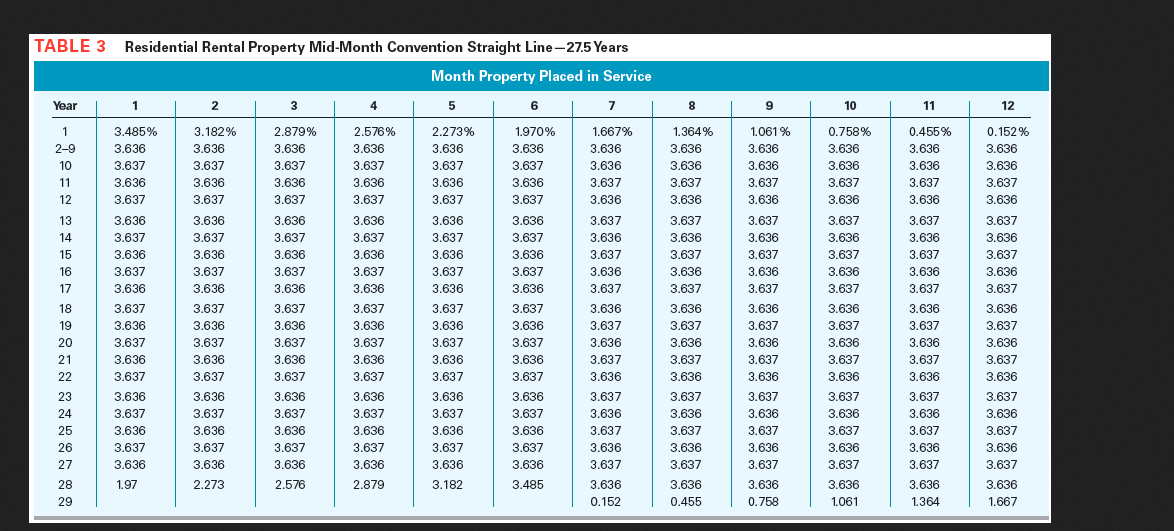

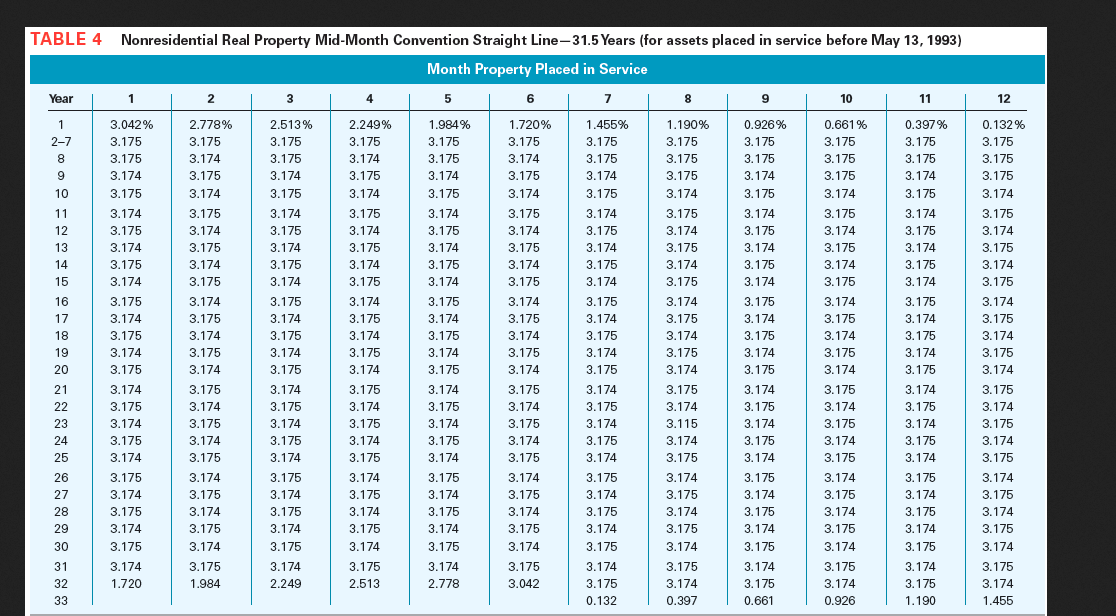

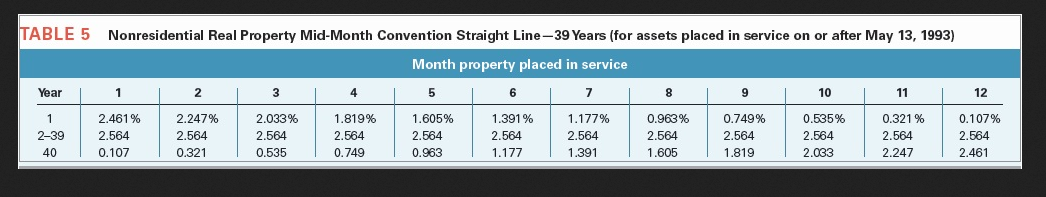

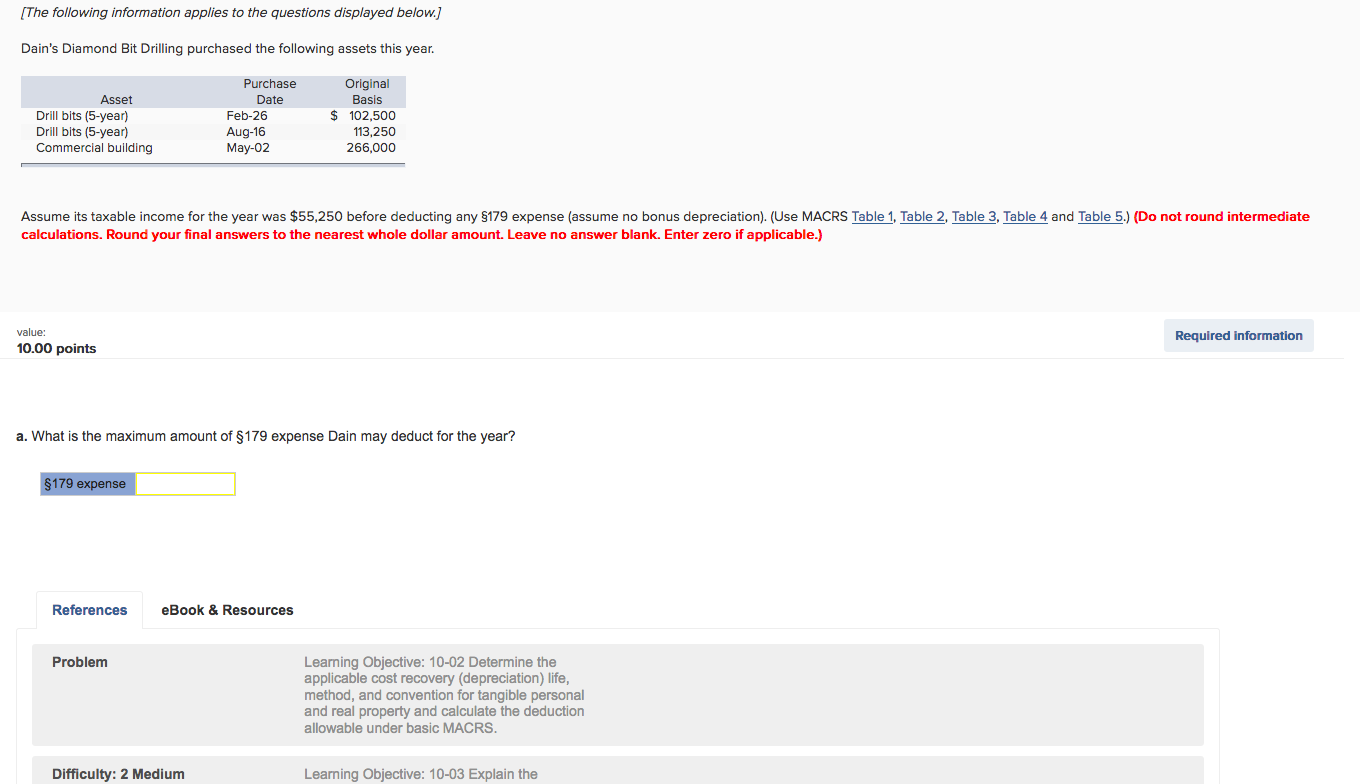

Required lnfarmatian It {The fattening infama tibn appii'es re the quesens displayed bet-em} Dain's Elia mend Bit Drilling purchased the fella-wing assets this year. Purchase Drlglnal Asset. Date Basis Drlll blts {5year} Feb-25 5 MLEDD Drlll blts {5year} Augis 1131250 Cbmmerclal building May-DE 255.300 Assu me its tat-ta ble insame far the year was $55.2 5D befare deducting anyr ans expense [assume nu benus depresiatien}. {Lise MACRS Table 1. Table 2. Table 3. Table & and Table 5.} {De net raunel intermediate calculatibns. Raund y'bur final answers to the nearest wh ele dellar ambunt. Leave ne answer blank. Enter sent: if applicable]; \fTABLE 3 Residential Rental Property Mid-Month Convention Straight Line27.5Years Month Property Placed in Service bar 1 2 3 4 5 B T 8 9 10 11 12 1 29 10 11 12 13 14 15 18 1? 18 19 20 21 22 23 24 25 26 2? 28 29 TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line31.5'I'bars {for assets placed in service before May13,1993) Month Property Placed in Service War 1 2 3 4 5 B T 8 9 1O 11 12 1 3.042% 2.??8'1'5 2.513% 2.249% 1.984% 1.?20'1'5 1 .1155% 1.190% 0.928% 8.881% 0.39?% 8.132% 2? 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 8 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 3.1?5 9 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 10 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 11 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 12 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 13 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 14 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 15 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 18 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 1? 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 18 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 19 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 20 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 21 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 22 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 23 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.115 3.1?4 3.1?5 3.1?4 3.1?5 24 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 25 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 28 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 2? 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 28 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 29 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 30 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 31 3.1?11 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 3.1?4 3.1?5 32 1.? 20 1.9841 2.2119 2.513 2.??8 3.042 3.1 ?5 3.1?4 3.1?5 3.1?11 3.1?5 3.1?11 33 0.132 0.39? 0.881 0.928 1.190 1.1155 ABLE 5 Nonresidential Real Property Mid-Month Convention Straight LineSB'l'ears (for assets placed in service on or after May 13, 1993) Month property placed in service War 1 2 3 3" B 9 1D 12 1 2.461% 2.24?% 2.033% 1.819% 1.605% 1.391% 1.1??% 0.98% 0349!: 0.535% 0.321% 0.10?% 239 2.56! 2.584 2.534 2.584 2.58-1- 2.534 2.584!- 2.534 2.564- 1554 2.564 2.5641 40 0.10? 0.321 0.535 0349 0.353 1.1??? 1.391 1.605 1.819 2&'83 2.24? 2.461 {The folioMng information applies to the questions displayed below] Dain's Diamond Bit Drilling purchased the foiiuwing assets this year. Punch-e Orlglnal Amt Dale Emls Di'III blls (5-yean Feb25 5 102.500 Drlll blls {Eyean Augi16 113.250 Commercial building May-02 266,000 Assume its laxabie inc-me for the year was 355,2 50 before deducting any 179 expense {assume no bonus depreciation). (Use MACRS Table 1, Table 2, Ta bie 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your nal answer: to the nearest whole dollar amount. Leave no answer blank. Enter tern if applicable.) WW liequlred Infonnallon moo paints a. What is the maximum amount of 179 expense Dain may deduct for the year? References eouk In Resources Problem Learning Obiect'we: 10-62 Determine the applicable net recavery (depreciation) life. method. and convention for langlble personal and real property and calcuiale the deducla'on allowable under basic MACRS. Difculty: 2 Medium Learning Objective: 10-03 Explain Ire value: 10.00 points b. What is Dain'a maximum depreciation expense for the year (including 179 expense)? References eBook E Reaou rcee Pmblem Learning Objective: 10-02 Determine the applicable cost recovery (depreciation) life. method. and convention for tanglbta personal and real property and calculate the deduction allowable under basic MACRS. value: 10.00 point e. lfthe February drill bits' original basis was 32.391500, what is the maximum amount of 179 expense Dain may deduct for the year? -: References Problem eook 0. Resources Learnlng Objective: 10-02 Determine the applicable cost recovery (depreciation) ilfe, malhod. and convention for tangible personal and heal property and calculate the deduction allowable under basic MACRS. hiked hfnrllldlon d. If lha Fsbmary dn'll bits' basis was $2,511,500. what is lhe maximum amnunl of 1T9 axpansa Dain may deduct for the year? -: Reflrannas aBoak 8. Resources Problem Learning Objective: 10-02 Datamlne ma appllmbla oust recovery (dapradalinn) life, malhod. and oonvanlion fur tangibia personal and real property and calcuiala the daduc'lion allowable under basic MACRS.