Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello your kind answer no.1 would be very helpful waiting for your positive response thank you 6. Optimal Sharpe Ratio (L03, CFA7) What is meant

hello

your kind answer no.1 would be very helpful

waiting for your positive response

thank you

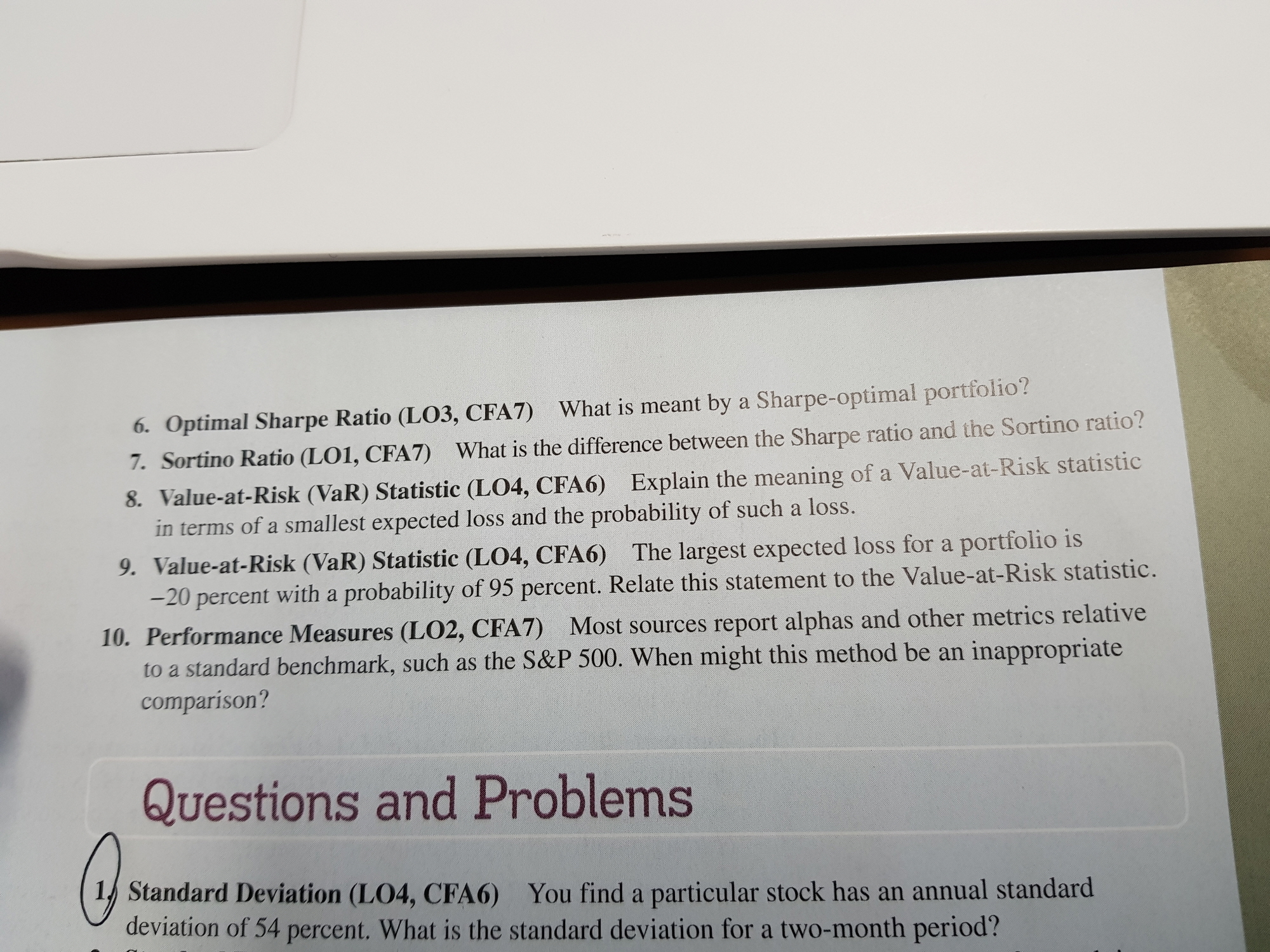

6. Optimal Sharpe Ratio (L03, CFA7) What is meant by a Sharpe-optimal portfolio? 7. Sortino Ratio (LOI, CFA7) What is the difference between the Sharpe ratio and lhe Sortino ratio? S. Value-at-Risk (VaR) Statistic (L04, CFA6) Explain the meaning of a Value-at-Risk statistic in terms ofa smallest expected loss and the probability of such a loss. 9. Value-at-Risk (VaR) Statistic (L04, CFA6) The largest expected loss for a portfolio is 20 percent with a probability of 95 percent. Relate this statement to the Value-at-Risk statistic. 10. Performance Measures (L02, CFA7) Most sources report alphas and other metrics relative to a standard benchmark, such as the S&P 500. When might this method be an inappropriate compari son? Questions and Problems 1 Standard Deviation (L04, CFA6) You find a particular stock has an annual standard deviation of 54 percent. What is the standard deviation for a two-month period?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started