Answered step by step

Verified Expert Solution

Question

1 Approved Answer

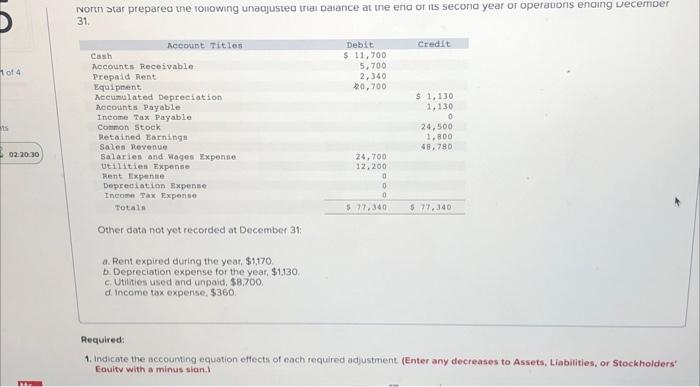

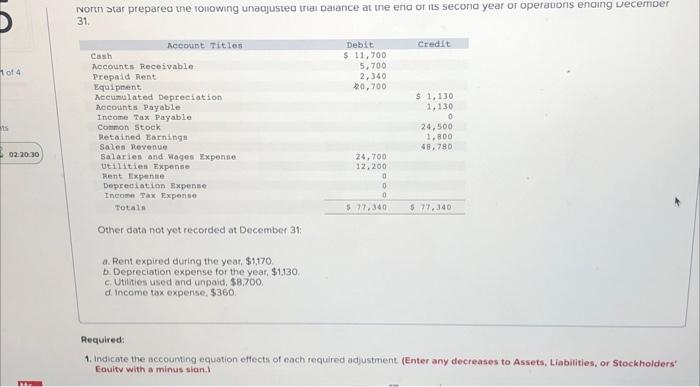

help 1 of 4 ts 02:20:30 T North Star prepared the following unaajusted trial paiance at the ena or its second year or operations ending

help

1 of 4 ts 02:20:30 T North Star prepared the following unaajusted trial paiance at the ena or its second year or operations ending December 31. Account Titles Credit Debit $ 11,700 Cash Accounts Receivable 5,700 2,340 Prepaid Rent Equipment 220,700 Accumulated Depreciation $ 1,130 Accounts Payable Income Tax Payable Common Stock 1,130 0 24,500 1,800 48,780 Retained Earnings Sales Revenue Salaries and Wages Expense 24,700 12,200 Utilities Expense Rent Expense 0 0 Depreciation Expense Income Tax Expense 0 Totals $77.340 $ 77,340 Other data not yet recorded at December 31: a. Rent expired during the year, $1,170. b. Depreciation expense for the year, $1,130 c. Utilities used and unpaid, $8,700, d. Income tax expense, $360.. Required: 1. Indicate the accounting equation effects of each required adjustment (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sian.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started