Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help 1-5 please Required informotion The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a

help 1-5 please

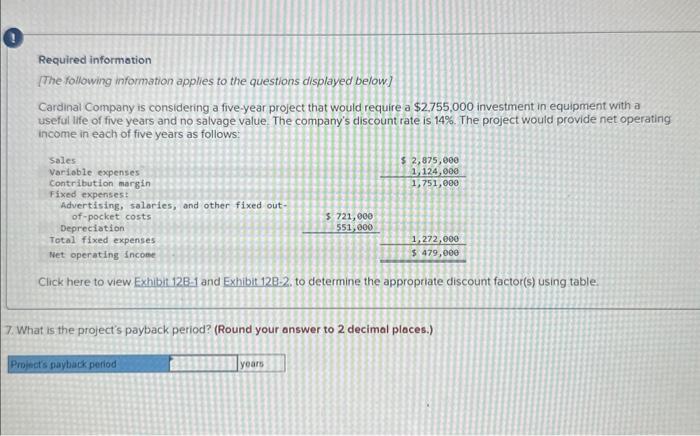

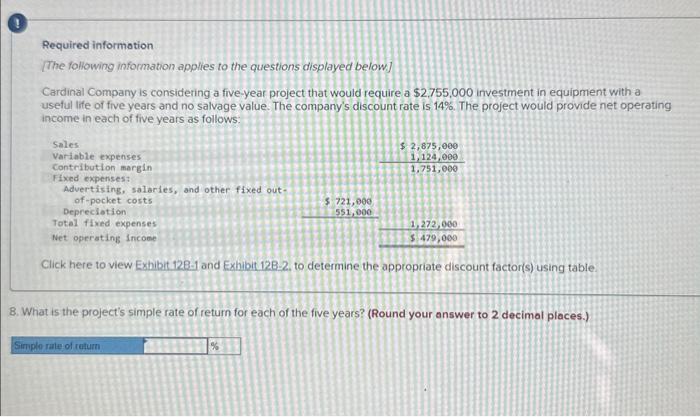

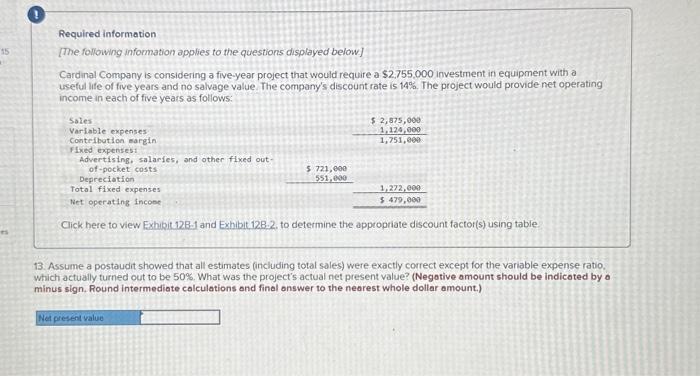

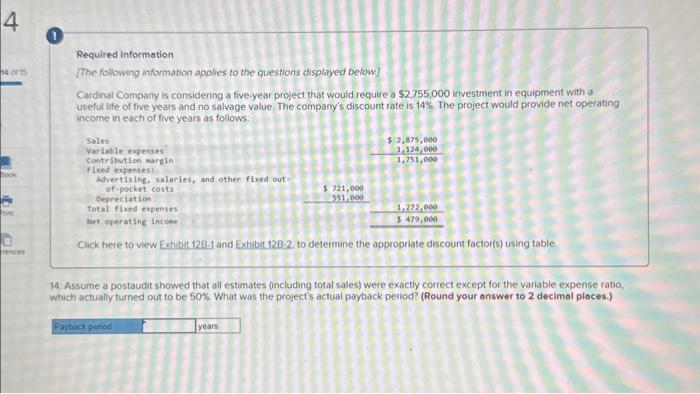

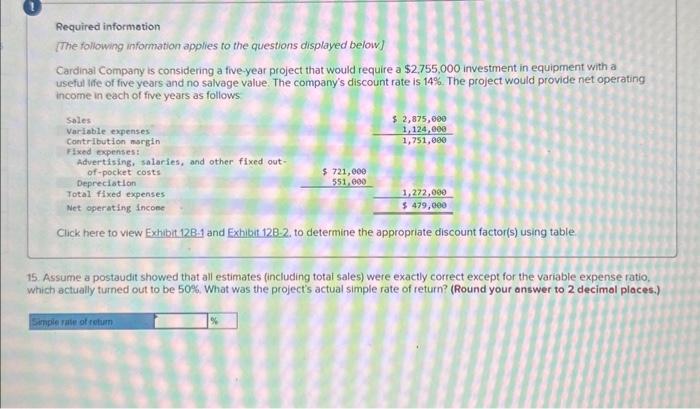

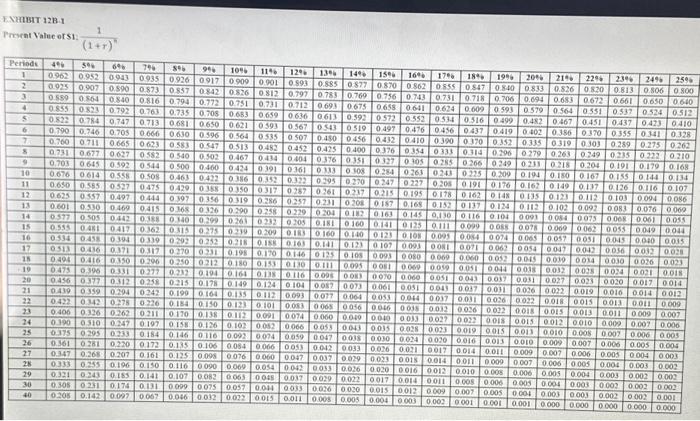

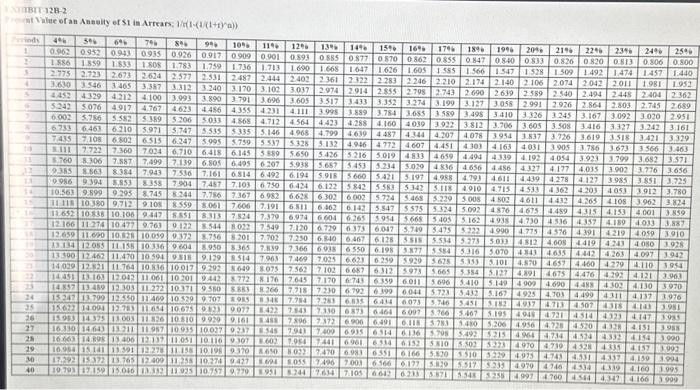

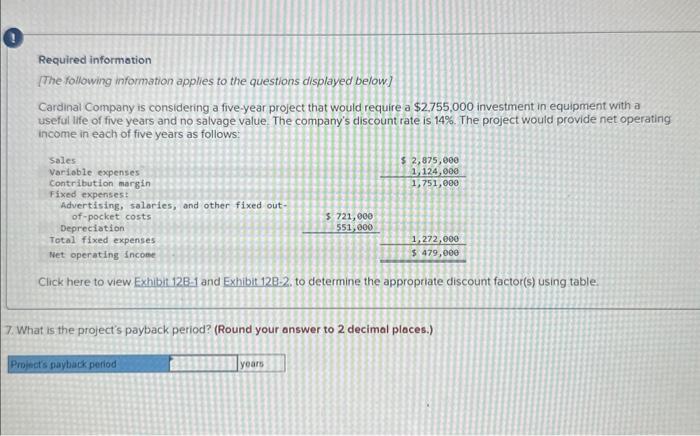

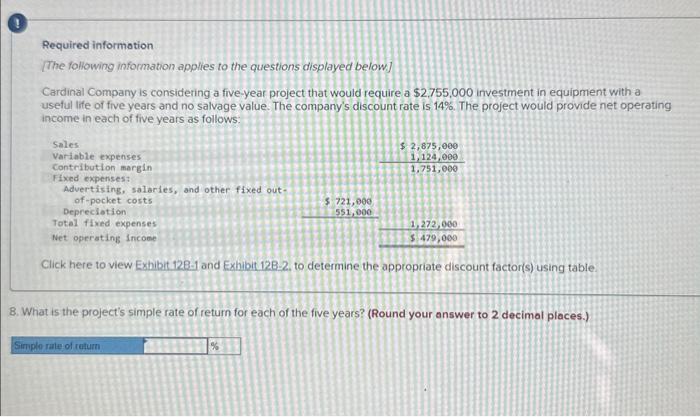

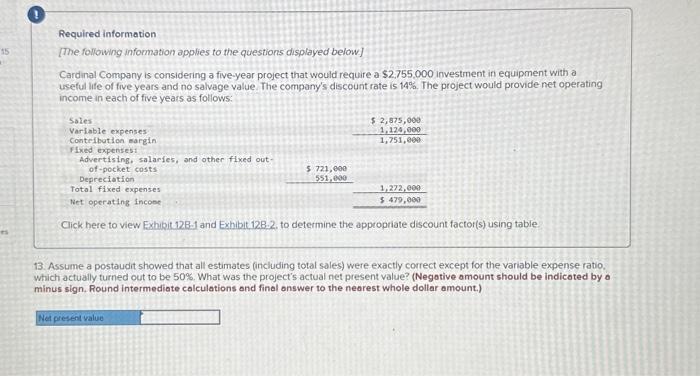

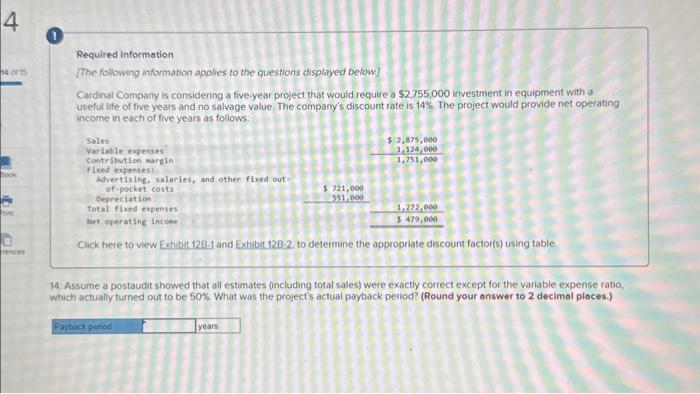

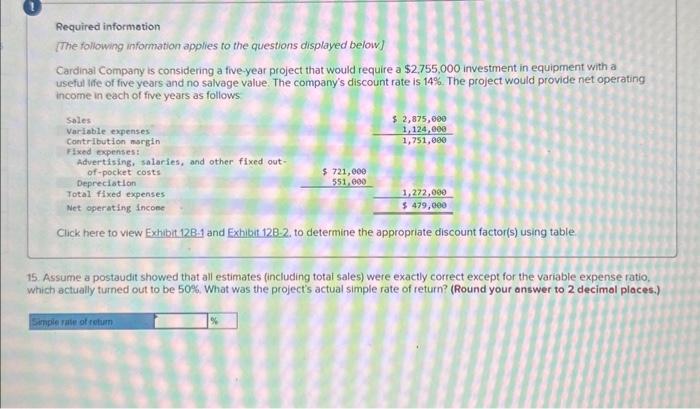

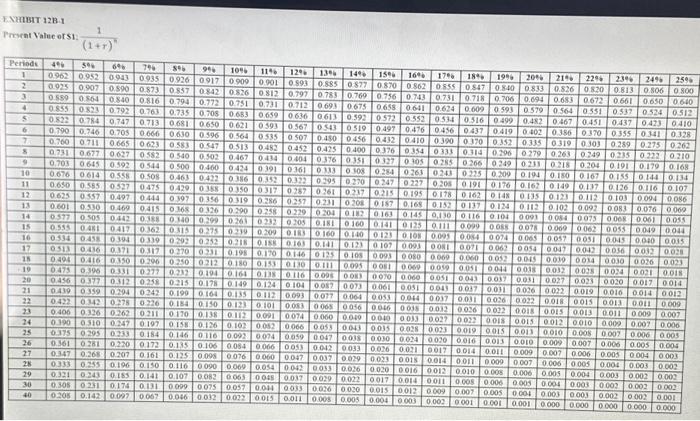

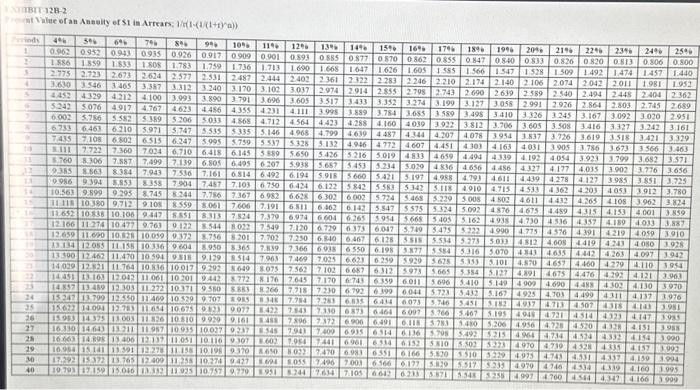

Required informotion The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful Ife of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows Click here to view Exhibit 12B-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%, What was the project's actual simple rate of return? (Round your answer to 2 decimol places.) Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 1281 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. 7. What is the project's payback period? (Round your answer to 2 decimal places.) Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 128-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) 12B-1 ProventValueofs1:(1+x)n1 ABT 12B-2 Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table 13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio. which actually turned out to be 50%. What was the project's actual net present value? (Negotive amount should be indicoted by 0 minus sign, Round intermediate colculations and final answer to the nearest whole dollar amount.) Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a \$2,755,000 investment in equipment with a useful iffe of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Ciack here to view Exh bit 128.1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table. 4. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, Which actually turned out to be 50%. What was the project's actual payback penod? (Round your answer to 2 decimal places.)

Required informotion The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful Ife of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows Click here to view Exhibit 12B-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%, What was the project's actual simple rate of return? (Round your answer to 2 decimol places.) Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 1281 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. 7. What is the project's payback period? (Round your answer to 2 decimal places.) Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 128-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) 12B-1 ProventValueofs1:(1+x)n1 ABT 12B-2 Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,755,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table 13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio. which actually turned out to be 50%. What was the project's actual net present value? (Negotive amount should be indicoted by 0 minus sign, Round intermediate colculations and final answer to the nearest whole dollar amount.) Required information The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a \$2,755,000 investment in equipment with a useful iffe of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Ciack here to view Exh bit 128.1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table. 4. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, Which actually turned out to be 50%. What was the project's actual payback penod? (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started