Help, and if you could explain how you got the answers that would really help.

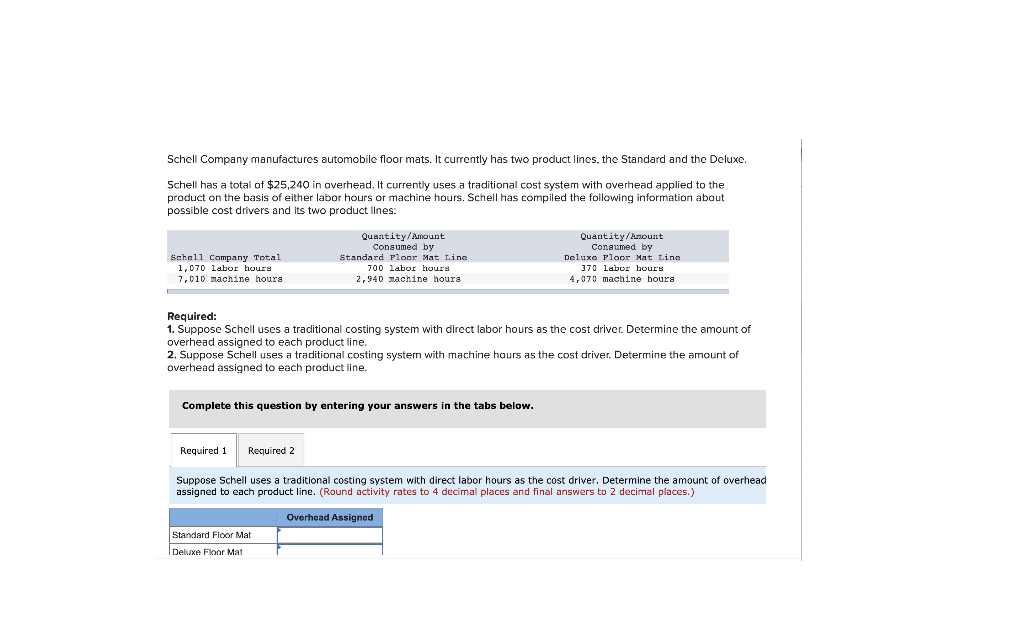

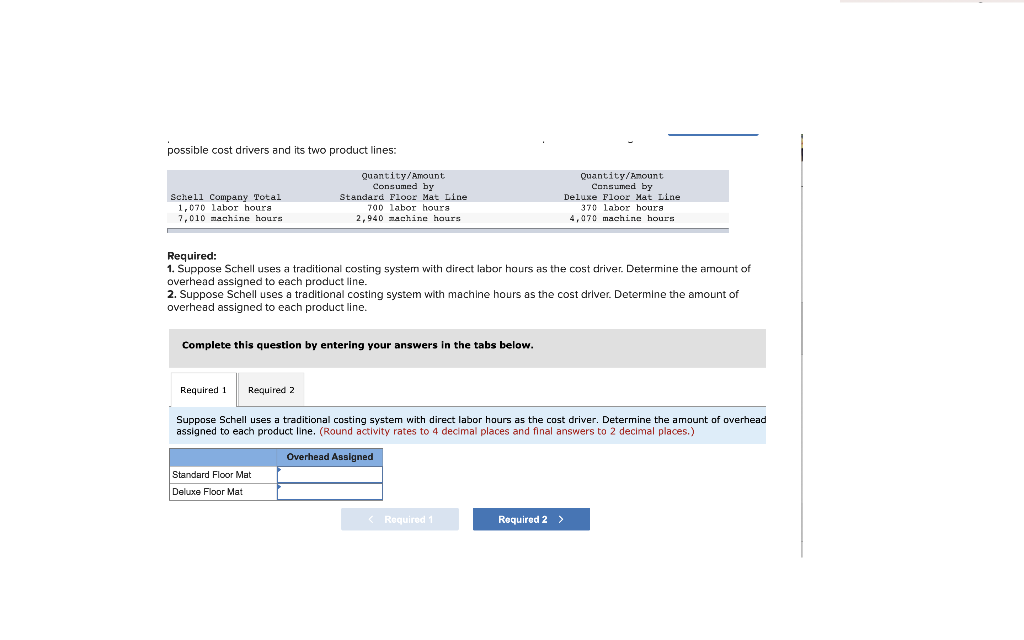

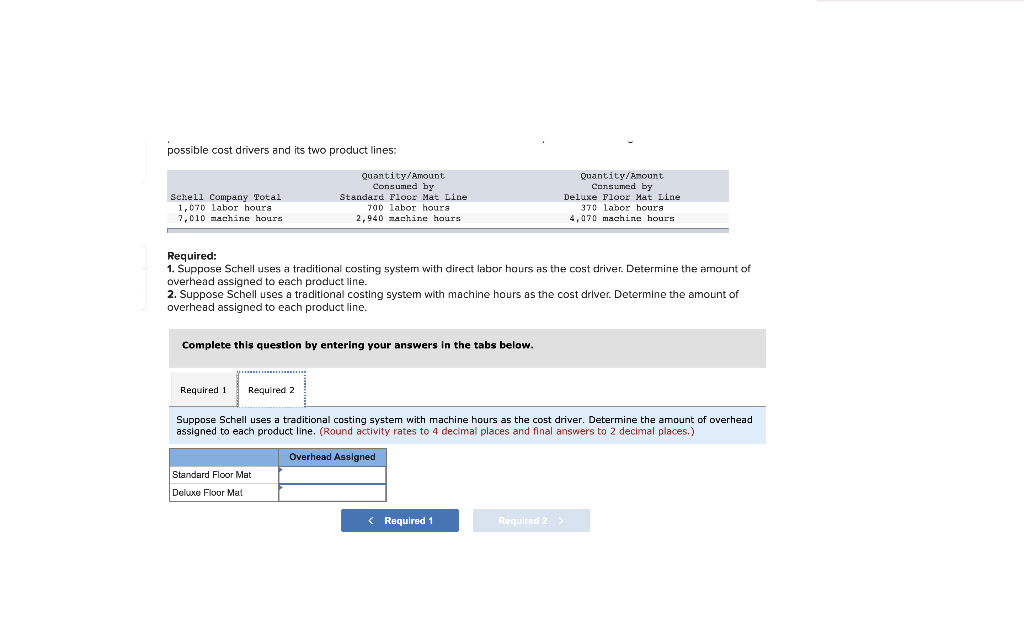

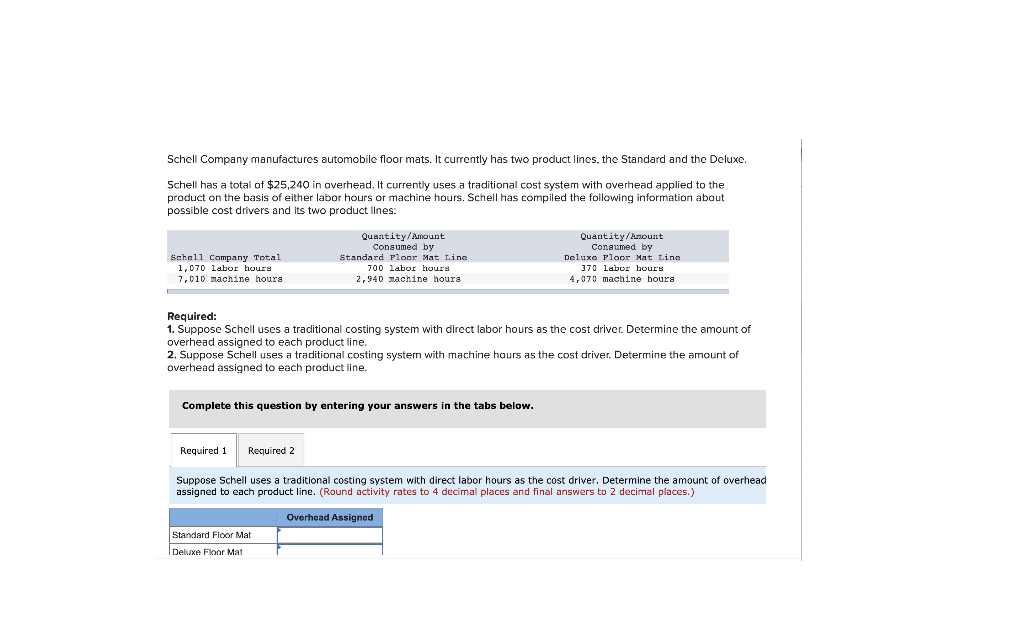

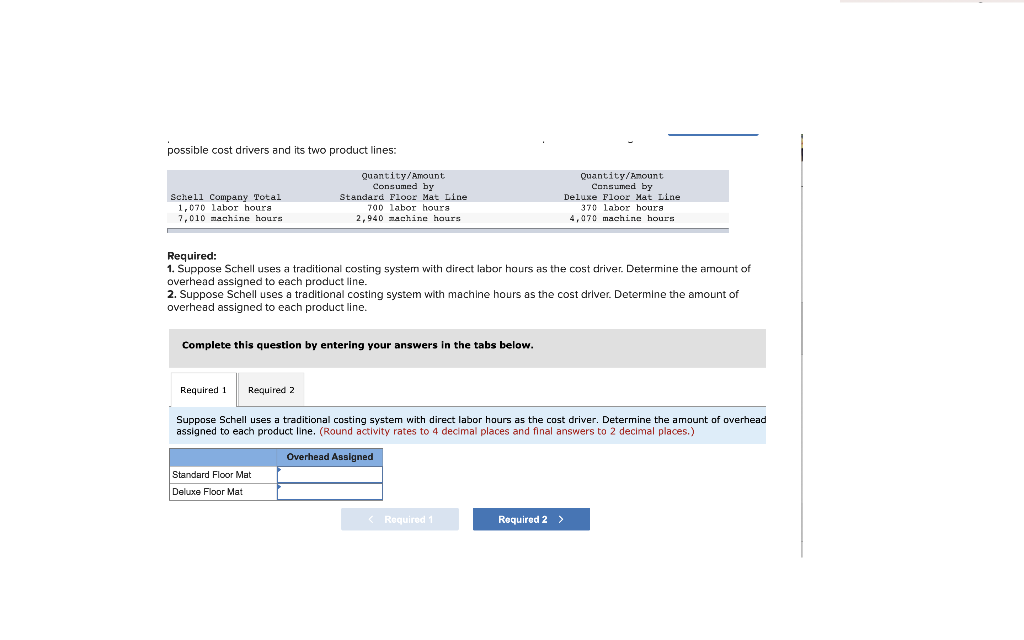

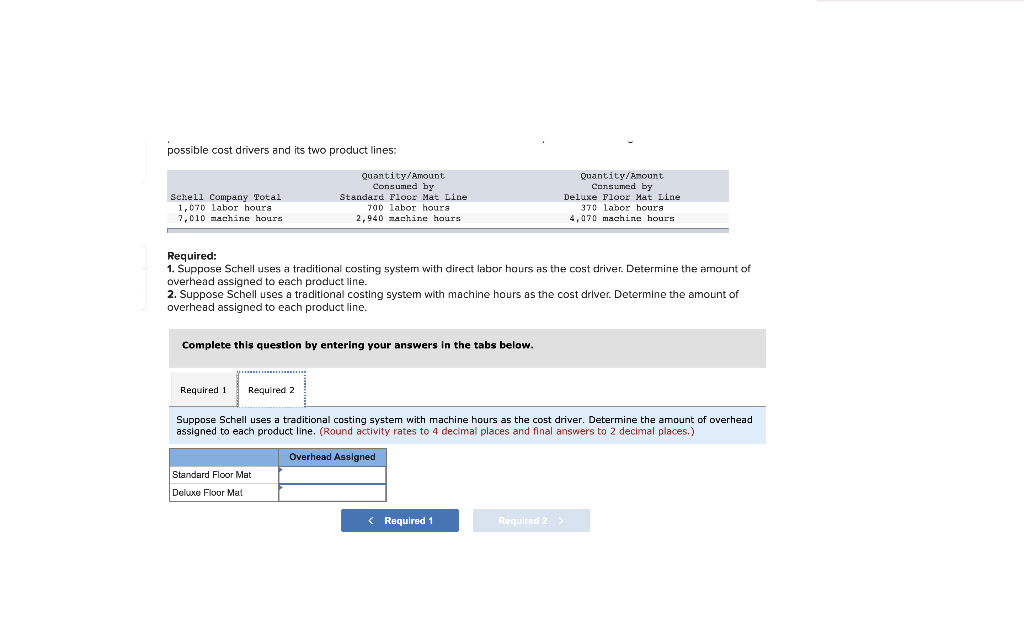

Schell Company manufactures automobile floor mats. It currently has two product lines, the Standard and the Deluxe. Schell has a total of $25,240 in overhead. It currently uses a traditional cost system with overhead applied to the product on the basis of either labor hours or machine hours. Schell has compiled the following information about possible cost drivers and its two product lines: Schell Company Total 1,070 labor hours 7,010 machine houra Quantity/Amount Consumed by Standard Ploor Mat Lina 700 labor hours 2,940 machine hours Quantity/Amount Consumed by Deluxe Ploor Mat Line 370 labor hours 4,070 machine hours Required: 1. Suppose Schell uses a traditional costing system with direct labor hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Suppose Schell uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. Complete this question by entering your answers in tabs below. Required 1 Required 2 Suppose Schell uses a traditional costing system with direct labor hours as the cost driver. Determine the amount of overhead assigned to each product line. (Round activity rates to 4 decimal places and final answers to 2 decimal places.) Overhead Assigned Standard Floor Mat Deluxe Floor Mat possible cost drivers and its two product lines: Schell Company Total 1,070 labor hours 7,010 machine hours Quantity/Amount Consumed by Standard Floor Mat Line 700 labor hours 2,940 machine hours Quantity/Amount Consumed by Deluxe Floor Mat Line 370 labor hours 4,970 machine hours Required: 1. Suppose Schell uses a traditional costing system with direct labor hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Suppose Schell uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Suppose Schell uses a traditional costing system with direct labor hours as the cost driver. Determine the amount of overhead assigned to each product line. (Round activity rates to 4 decimal places and final answers to 2 decimal places.) Overhead Assigned Standard Floor Mat Deluxe Floor Mat possible cost drivers and its two product lines: Schell Company Total 1,070 labor hours 7,010 machine hours Quantity/Amount Consumed by Standard Floor Mat Line 700 labor hours 2,940 machine hours Quantity/Amount Consumed by Deluxe Floor Mat Line 370 labor hours 4,970 machine hours Required: 1. Suppose Schell uses a traditional costing system with direct labor hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Suppose Schell uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Suppose Schell uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Round activity rates to 4 decimal places and final answers to 2 decimal places.) Overhead Assigned Standard Floor Mat Deluxe Floor Mat