Answered step by step

Verified Expert Solution

Question

1 Approved Answer

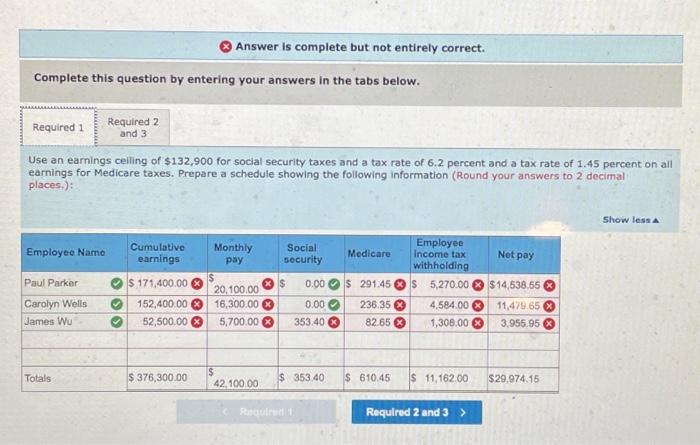

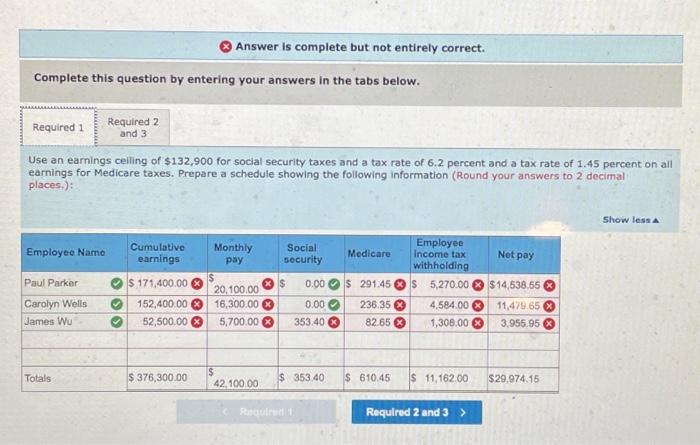

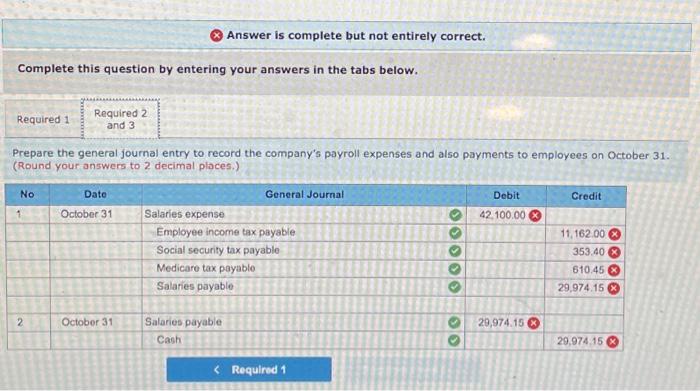

help. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 and 3

help.

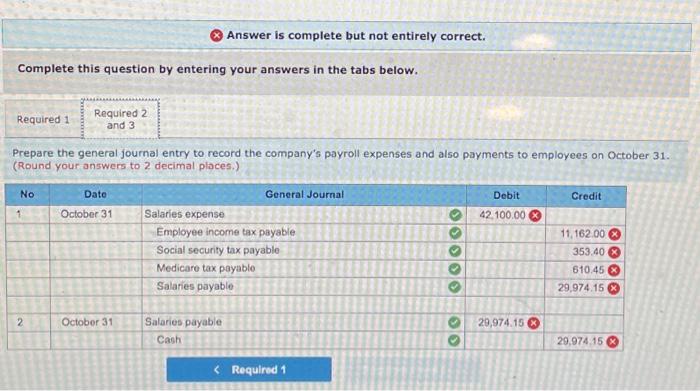

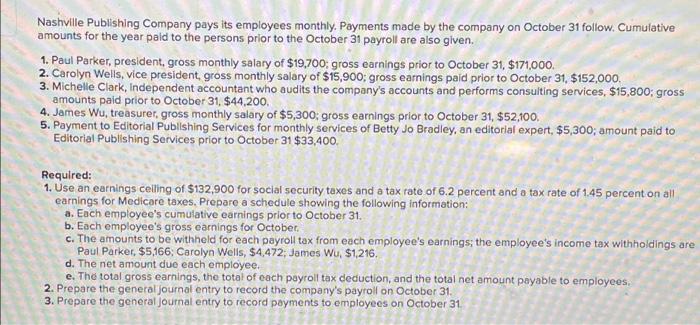

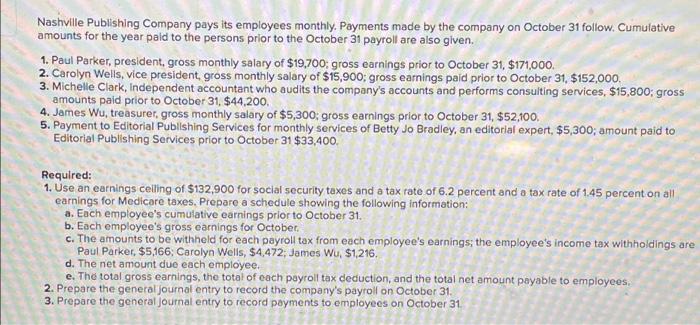

Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 and 3 Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all earnings for Medicare taxes. Prepare a schedule showing the following information (Round your answers to 2 decimal places.): Show less Employee Name Cumulative earnings Monthly pay Social security Net pay 0.00 Paul Parker Carolyn Wells James Wu x Employee Medicare Income tax withholding $ 291.45 $5,270.00 $14,538.65 236.35 3 4,584.00 11,479.65 82.65 1,308.00 3,955.95 $ 171,400.00 152,400.00 52,500.00 20,100.00 16,300.00 5,700.00 0.00 353.40 Totals $ 376,300.00 $ 42.100.00 $ 353 40 $ 610.45 $ 11,162.00 $29,974.15 Required 2 and 3 > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 and 3 No Dato 1 Prepare the general journal entry to record the company's payroll expenses and also payments to employees on October 31. (Round your answers to 2 decimal places.) General Journal Debit Credit October 31 Salaries expense 42.100.00 Employee income tax payable 11,162.00 Social security tax payable 353.40 Medicare tax payablo Salaries payable 29,974.15 OOOOO 610.45 2 October 31 0 29,974.15 Salarios payable Cash 29.974.15 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started