help anyone!

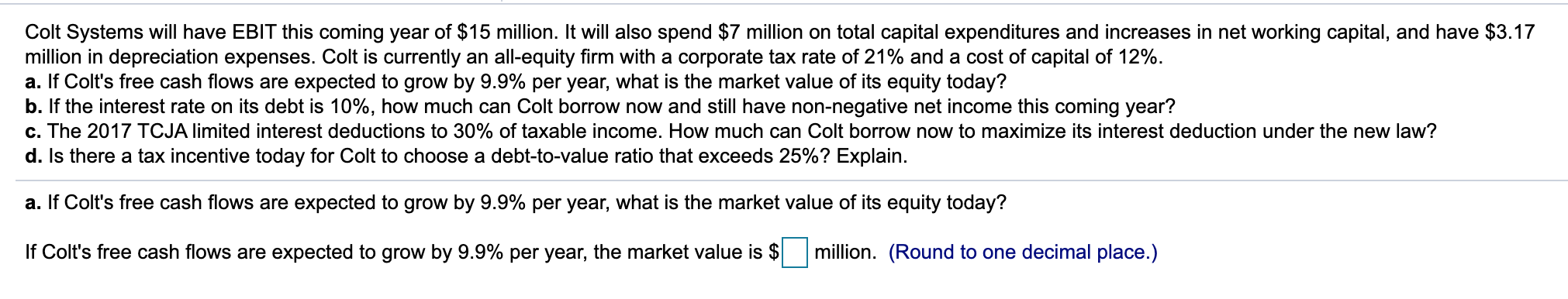

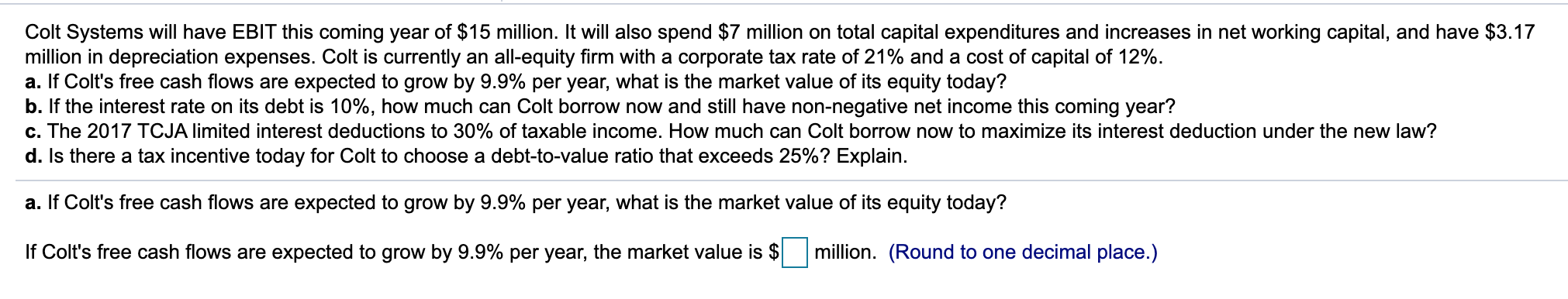

Colt Systems will have EBIT this coming year of $15 million. It will also spend $7 million on total capital expenditures and increases in net working capital, and have $3.17 million in depreciation expenses. Colt is currently an all-equity firm with a corporate tax rate of 21% and a cost of capital of 12%. a. If Colt's free cash flows are expected to grow by 9.9% per year, what is the market value of its equity today? b. If the interest rate on its debt is 10%, how much can Colt borrow now and still have non-negative net income this coming year? c. The 2017 TCJA limited interest deductions to 30% of taxable income. How much can Colt borrow now to maximize its interest deduction under the new law? d. Is there a tax incentive today for Colt to choose a debt-to-value ratio that exceeds 25%? Explain. a. If Colt's free cash flows are expected to grow by 9.9% per year, what is the market value of its equity today? If Colt's free cash flows are expected to grow by 9.9% per year, the market value is $ million. (Round to one decimal place.) Colt Systems will have EBIT this coming year of $15 million. It will also spend $7 million on total capital expenditures and increases in net working capital, and have $3.17 million in depreciation expenses. Colt is currently an all-equity firm with a corporate tax rate of 21% and a cost of capital of 12%. a. If Colt's free cash flows are expected to grow by 9.9% per year, what is the market value of its equity today? b. If the interest rate on its debt is 10%, how much can Colt borrow now and still have non-negative net income this coming year? c. The 2017 TCJA limited interest deductions to 30% of taxable income. How much can Colt borrow now to maximize its interest deduction under the new law? d. Is there a tax incentive today for Colt to choose a debt-to-value ratio that exceeds 25%? Explain. a. If Colt's free cash flows are expected to grow by 9.9% per year, what is the market value of its equity today? If Colt's free cash flows are expected to grow by 9.9% per year, the market value is $ million. (Round to one decimal place.)