Answered step by step

Verified Expert Solution

Question

1 Approved Answer

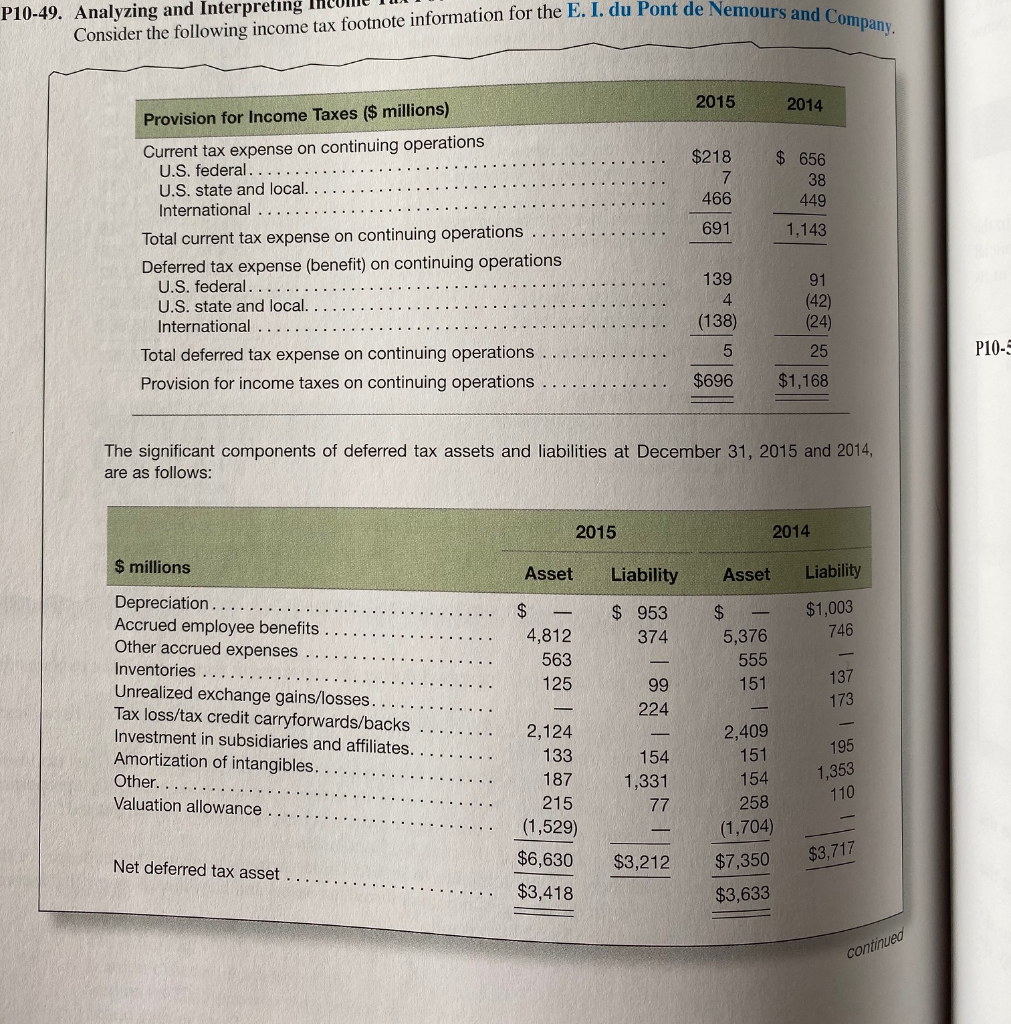

Help appreciated! Please show work when needed. Consider the following income tax footnote information for the E.I. du Pont de Nemours and Company. P10-49. Analyzing

Help appreciated! Please show work when needed.

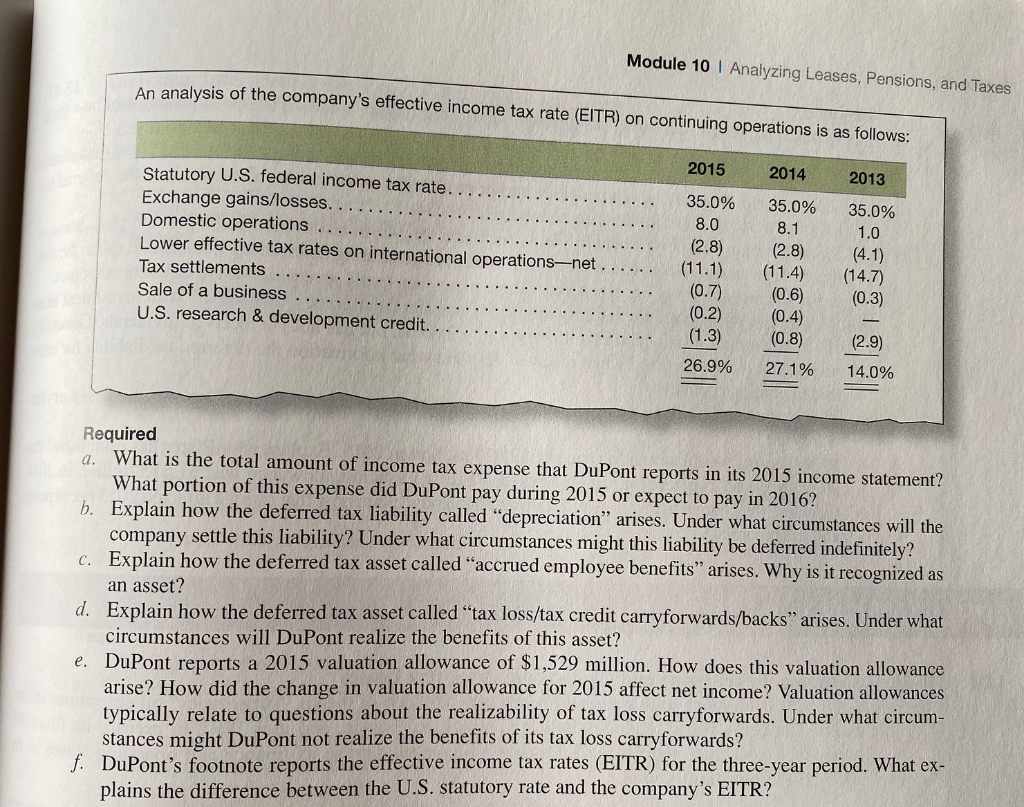

Consider the following income tax footnote information for the E.I. du Pont de Nemours and Company. P10-49. Analyzing and Interpreting the 2015 2014 $218 $ 656 38 449 466 691 1,143 Provision for Income Taxes ($ millions) Current tax expense on continuing operations U.S. federal... U.S. state and local. International Total current tax expense on continuing operations Deferred tax expense (benefit) on continuing operations U.S. federal.. U.S. state and local. International Total deferred tax expense on continuing operations Provision for income taxes on continuing operations 139 4 (138) 91 (42) (24) 5 25 P10-S $696 $1,168 The significant components of deferred tax assets and liabilities at December 31, 2015 and 2014, are as follows: 2015 2014 $ millions Asset Liability Asset Liability $ 953 374 $1,003 746 $ 4,812 563 125 $ 5,376 555 151 Depreciation. Accrued employee benefits Other accrued expenses Inventories Unrealized exchange gains/losses. Tax loss/tax credit carryforwards/backs Investment in subsidiaries and affiliates. Amortization of intangibles.. Other..... Valuation allowance 99 224 137 173 154 2,124 133 187 215 (1,529) $6,630 195 1,353 110 1,331 77 2,409 151 154 258 (1,704) $7,350 $3,633 - Net deferred tax asset $3,212 $3,717 $3,418 continued Module 10 I Analyzing Leases, Pensions, and Taxes An analysis of the company's effective income tax rate (EITR) on continuing operations is as follows: 2015 2014 2013 Statutory U.S. federal income tax rate. Exchange gains/losses. Domestic operations Lower effective tax rates on international operations-net. Tax settlements Sale of a business U.S. research & development credit. 35.0% 8.0 (2.8) (11.1) (0.7) (0.2) (1.3) 35.0% 8.1 (2.8) (11.4) (0.6) (0.4) (0.8) 35.0% 1.0 (4.1) (14.7) (0.3) (2.9) 26.9% 27.1% 14.0% a Required What is the total amount of income tax expense that DuPont reports in its 2015 income statement? What portion of this expense did DuPont pay during 2015 or expect to pay in 2016? b. Explain how the deferred tax liability called "depreciation" arises. Under what circumstances will the company settle this liability? Under what circumstances might this liability be deferred indefinitely? C. Explain how the deferred tax asset called "accrued employee benefits" arises. Why is it recognized as an asset? d. Explain how the deferred tax asset called tax loss/tax credit carryforwards/backs" arises. Under what circumstances will DuPont realize the benefits of this asset? e. DuPont reports a 2015 valuation allowance of $1,529 million. How does this valuation allowance arise? How did the change in valuation allowance for 2015 affect net income? Valuation allowances typically relate to questions about the realizability of tax loss carryforwards. Under what circum- stances might DuPont not realize the benefits of its tax loss carryforwards? f. DuPont's footnote reports the effective income tax rates (EITR) for the three-year period. What ex- plains the difference between the U.S. statutory rate and the company's EITR? Consider the following income tax footnote information for the E.I. du Pont de Nemours and Company. P10-49. Analyzing and Interpreting the 2015 2014 $218 $ 656 38 449 466 691 1,143 Provision for Income Taxes ($ millions) Current tax expense on continuing operations U.S. federal... U.S. state and local. International Total current tax expense on continuing operations Deferred tax expense (benefit) on continuing operations U.S. federal.. U.S. state and local. International Total deferred tax expense on continuing operations Provision for income taxes on continuing operations 139 4 (138) 91 (42) (24) 5 25 P10-S $696 $1,168 The significant components of deferred tax assets and liabilities at December 31, 2015 and 2014, are as follows: 2015 2014 $ millions Asset Liability Asset Liability $ 953 374 $1,003 746 $ 4,812 563 125 $ 5,376 555 151 Depreciation. Accrued employee benefits Other accrued expenses Inventories Unrealized exchange gains/losses. Tax loss/tax credit carryforwards/backs Investment in subsidiaries and affiliates. Amortization of intangibles.. Other..... Valuation allowance 99 224 137 173 154 2,124 133 187 215 (1,529) $6,630 195 1,353 110 1,331 77 2,409 151 154 258 (1,704) $7,350 $3,633 - Net deferred tax asset $3,212 $3,717 $3,418 continued Module 10 I Analyzing Leases, Pensions, and Taxes An analysis of the company's effective income tax rate (EITR) on continuing operations is as follows: 2015 2014 2013 Statutory U.S. federal income tax rate. Exchange gains/losses. Domestic operations Lower effective tax rates on international operations-net. Tax settlements Sale of a business U.S. research & development credit. 35.0% 8.0 (2.8) (11.1) (0.7) (0.2) (1.3) 35.0% 8.1 (2.8) (11.4) (0.6) (0.4) (0.8) 35.0% 1.0 (4.1) (14.7) (0.3) (2.9) 26.9% 27.1% 14.0% a Required What is the total amount of income tax expense that DuPont reports in its 2015 income statement? What portion of this expense did DuPont pay during 2015 or expect to pay in 2016? b. Explain how the deferred tax liability called "depreciation" arises. Under what circumstances will the company settle this liability? Under what circumstances might this liability be deferred indefinitely? C. Explain how the deferred tax asset called "accrued employee benefits" arises. Why is it recognized as an asset? d. Explain how the deferred tax asset called tax loss/tax credit carryforwards/backs" arises. Under what circumstances will DuPont realize the benefits of this asset? e. DuPont reports a 2015 valuation allowance of $1,529 million. How does this valuation allowance arise? How did the change in valuation allowance for 2015 affect net income? Valuation allowances typically relate to questions about the realizability of tax loss carryforwards. Under what circum- stances might DuPont not realize the benefits of its tax loss carryforwards? f. DuPont's footnote reports the effective income tax rates (EITR) for the three-year period. What ex- plains the difference between the U.S. statutory rate and the company's EITR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started