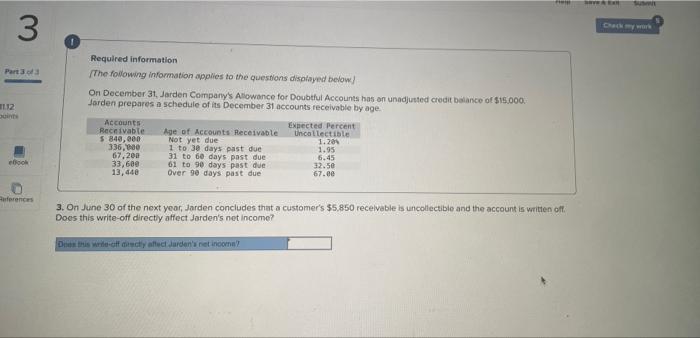

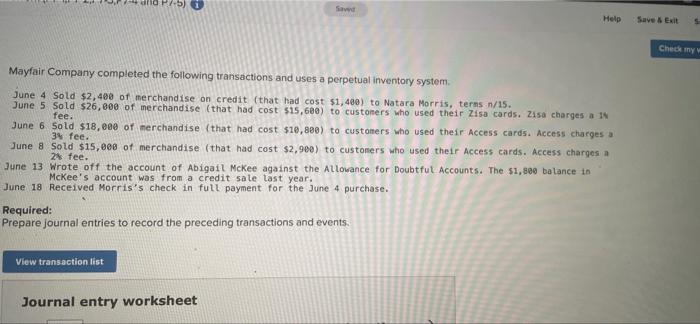

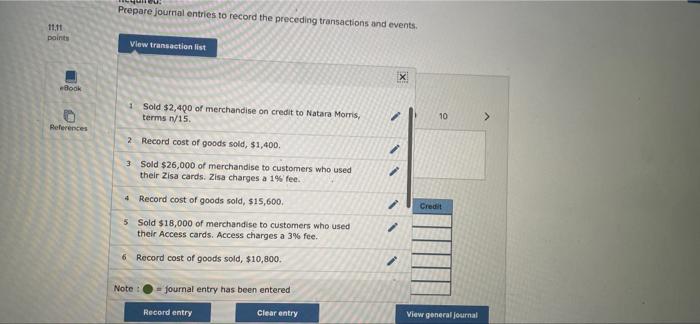

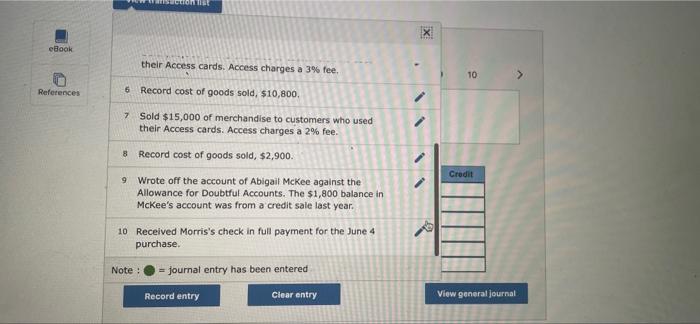

3 Part 3 12 Required information The following information applies to the questions displayed below! On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $15.000 Jorden prepares a schedule of its December 31 accounts receivable by age. Accounts Expected Percent Receivable Age of Accounts Receivable Uncollectible $ 840,000 Not yet due 1.284 336.00 1 to 30 days past due 1.95 67,200 31 to 6 days past due 6.45 33,600 61 to 90 days past due 32.50 13,440 Over 90 days past due 67.ee ook References 3. On June 30 of the next year, Jarden concludes that a customer's 55.850 receivable is uncollectible and the account is written off Does this write-off directly affect Jarden's net income? De this way afectadens net income Save Help Save & Exit 5 Chemy Mayfair Company completed the following transactions and uses a perpetual Inventory system June 4 Sold $2,400 of merchandise on credit (that had cost 51,400) to Natara Morris, terms n/15. June 5 Sold $26,800 of merchandise that had cost $15,600) to customers who used their Zisa cards. Zisa charges a 1 fee. June 6 Sold $18,000 of merchandise (that had cost $10,890) to customers who used their Access cards. Access charges 34 fee. June 8 Sold $15,000 of merchandise (that had cost $2,900) to customers who used their Access cards. Access charges a 2% fee. June 13 Wrote off the account of Abigail Mckee against the Allowance for Doubtful Accounts. The $1,800 balance in McKee's account was from a credit sale last year. June 18 Received Morris's check in full payment for the June 4 purchase. Required: Prepare journal entries to record the preceding transactions and events. View transaction list Journal entry worksheet Prepare journal entries to record the preceding transactions and events, 11.11 points View transaction list Book 0 Sold $2,400 of merchandise on credit to Natara Morris, terms 1/15 10 > References 2 Record cost of goods sold, $1,400. 3 Sold $26,000 of merchandise to customers who used their Zisa cards. Zisa charges a 1% fee. 4 Record cost of goods sold, 515,600. Credit 5 Sold $18,000 of merchandise to customers who used their Access cards. Access charges a 3% fee. 6 Record cost of goods sold, $10,800. Note: - Journal entry has been entered Record entry Clear entry View general Journal X eBook their Access cards. Access charges a 3% fee. 10 > References 6 Record cost of goods sold, $10,800 7 Sold $15,000 of merchandise to customers who used their Access cards. Access charges a 2% fee. 8 Record cost of goods sold, $2,900. Credit 9 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $1,800 balance in McKee's account was from a credit sale last year. 10 Received Morris's check in full payment for the June 4 purchase. Note : = journal entry has been entered Record entry Clear entry View general journal