Answered step by step

Verified Expert Solution

Question

1 Approved Answer

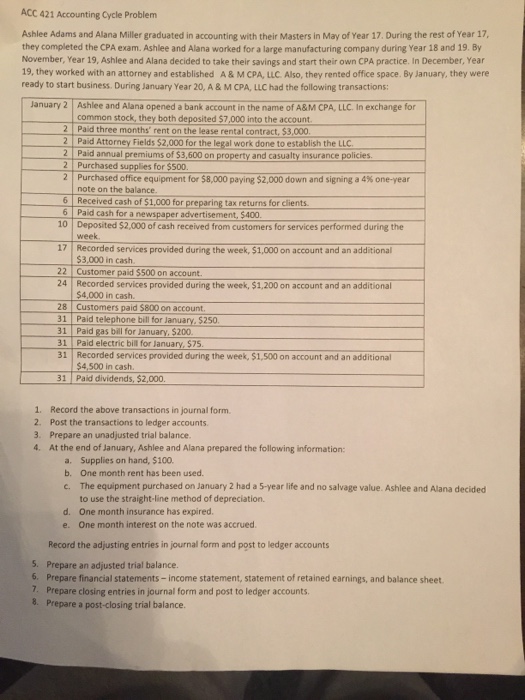

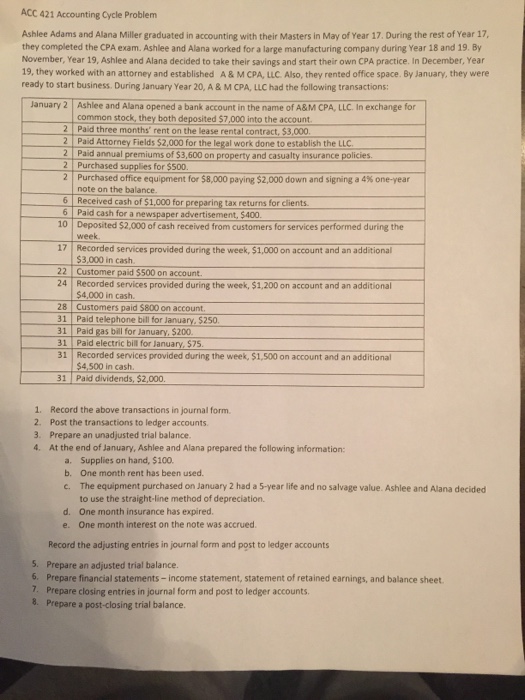

Help ASAP !! Ashlee Adams and Alana Miller graduated m accounting with their Masters In May of Year 17. During the rest of Year 17.

Help ASAP !!

Ashlee Adams and Alana Miller graduated m accounting with their Masters In May of Year 17. During the rest of Year 17. they completed the CPA exam. Ashlee and Alana worked for a large manufacturing company during Year 18 and 19 By November. Year 19. Ashlee and Alana decided to take their savings and start their own CPA practice In December. Year 19. they worked with an attorney and established A & M CPA, U C Also, they rented office space By January, they were read/to start business Dunng January Year 20, A & M CPA. ILC had the following transactions: Record the above transactions m journal form Post the transactions to ledger accounts Prepare an unadjusted trial balance. A t the end of January, Ashlee and Alana prepared the following information. Supplies on hand. $100 b. O n e month rent has been used.. The equipment purchased on January 2 had a 5-year life and no salvage value Ashlee and Alana decided to use the straight method of depreciation. O ne month Insurance has eipired. One month interest on the note was accrued Record the adjusting entries in journal form and post to ledger accounts Prepare an adjusted trial balance Prepare financial statements - income statement, statement of retained earnings, and balance sheet Prepare closing entries in journal form and post to ledeer accounts Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started