HELP ASAP

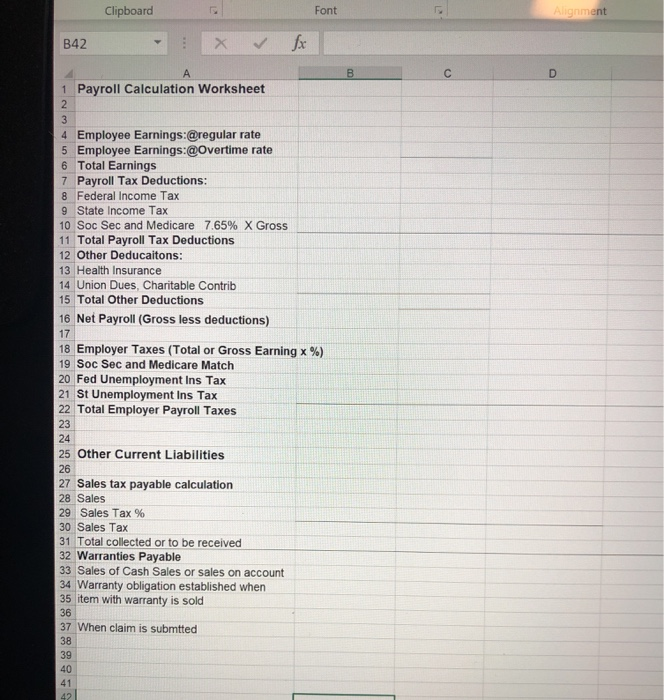

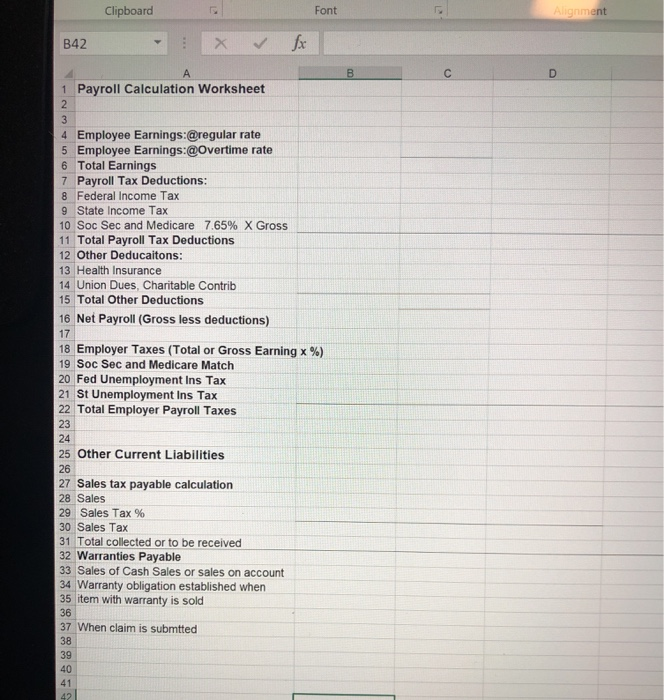

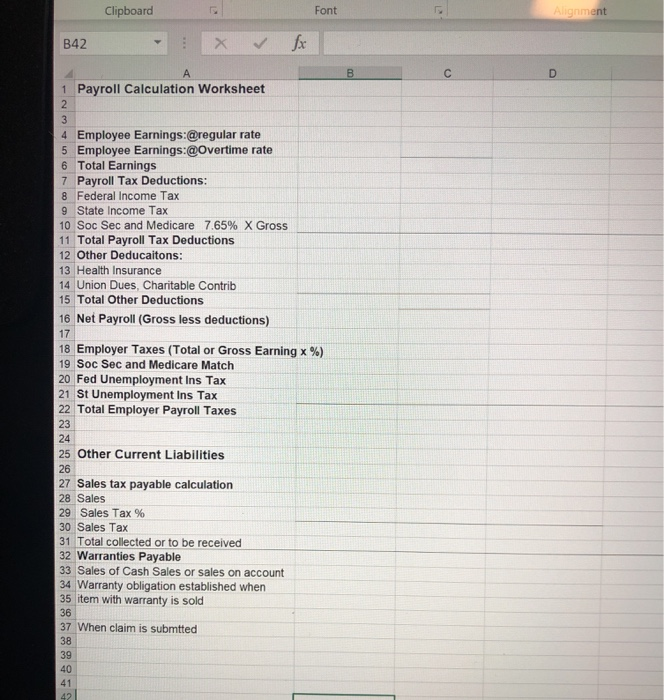

Clipboard Font Alignment B42 x & fx B D 1 Payroll Calculation Worksheet 2 3 4 Employee Earnings:@regular rate 5 Employee Earnings:@Overtime rate 6 Total Earnings 7 Payroll Tax Deductions: 8 Federal Income Tax 9 State Income Tax 10 Soc Sec and Medicare 7.65% X Gross 11 Total Payroll Tax Deductions 12 Other Deducaitons: 13 Health Insurance 14 Union Dues, Charitable Contrib 15 Total Other Deductions 16 Net Payroll (Gross less deductions) 17 18 Employer Taxes (Total or Gross Earning x %) 19 Soc Sec and Medicare Match 20 Fed Unemployment ins Tax 21 St Unemployment Ins Tax 22 Total Employer Payroll Taxes 23 24 25 Other Current Liabilities 26 27 Sales tax payable calculation 28 Sales 29 Sales Tax % 30 Sales Tax 31 Total collected or to be received 32 Warranties Payable 33 Sales of Cash Sales or sales on account 34 Warranty obligation established when 35 item with warranty is sold 36 37 When claim is submtted 38 39 40 41 42 File Home Insert Draw Formulas Data Page Layout xur Arial - A A Custom 2 Wrap Text Merge & Center Insert Del - Paste Format Painter BIU- A E $ . % *88 Conditional Formatas Cell Formatting Table Styles Styles Cel Number Clipboard Font Alignment B22 H 9 D F G 1 You can use this to Amortize Notes Payable 2 DDD Co took out a $20,000 loan for a piece of equipment at a rate of 6% to be paid back 3 annually in 5 years in equal installments of $4748 Amount 5 Principal Interest Interest Payment Applied to 6 Payment Balance Rate Expense Amount Principal 7 1 $ 20,000 6% $ 1,200 $ 4,748 $ 3,548 8 2 $ 16,452 6% $ 987 $ 4,748 $ 3,761 3 $ 12.691 6% S 761 $ 4,748 $ 3,987 10 4 $ 8,705 6% $ 522 $ 4,748 $ 4,226 11 5 $ 4,479 6% $ 269 $ 4.748 $ 4,479 12 13 14 15 16 17 18 You can use this for the Bonds Payable 19 Bond Payable Issue Bond Proceeds Premium Interest Interest Term 20 Rate or Discount Rate Paid 21 given given given given 22 A 23 24 B 25 26 C 27 28 29 30 Clipboard Font Alignment B42 x & fx B D 1 Payroll Calculation Worksheet 2 3 4 Employee Earnings:@regular rate 5 Employee Earnings:@Overtime rate 6 Total Earnings 7 Payroll Tax Deductions: 8 Federal Income Tax 9 State Income Tax 10 Soc Sec and Medicare 7.65% X Gross 11 Total Payroll Tax Deductions 12 Other Deducaitons: 13 Health Insurance 14 Union Dues, Charitable Contrib 15 Total Other Deductions 16 Net Payroll (Gross less deductions) 17 18 Employer Taxes (Total or Gross Earning x %) 19 Soc Sec and Medicare Match 20 Fed Unemployment ins Tax 21 St Unemployment Ins Tax 22 Total Employer Payroll Taxes 23 24 25 Other Current Liabilities 26 27 Sales tax payable calculation 28 Sales 29 Sales Tax % 30 Sales Tax 31 Total collected or to be received 32 Warranties Payable 33 Sales of Cash Sales or sales on account 34 Warranty obligation established when 35 item with warranty is sold 36 37 When claim is submtted 38 39 40 41 42 File Home Insert Draw Formulas Data Page Layout xur Arial - A A Custom 2 Wrap Text Merge & Center Insert Del - Paste Format Painter BIU- A E $ . % *88 Conditional Formatas Cell Formatting Table Styles Styles Cel Number Clipboard Font Alignment B22 H 9 D F G 1 You can use this to Amortize Notes Payable 2 DDD Co took out a $20,000 loan for a piece of equipment at a rate of 6% to be paid back 3 annually in 5 years in equal installments of $4748 Amount 5 Principal Interest Interest Payment Applied to 6 Payment Balance Rate Expense Amount Principal 7 1 $ 20,000 6% $ 1,200 $ 4,748 $ 3,548 8 2 $ 16,452 6% $ 987 $ 4,748 $ 3,761 3 $ 12.691 6% S 761 $ 4,748 $ 3,987 10 4 $ 8,705 6% $ 522 $ 4,748 $ 4,226 11 5 $ 4,479 6% $ 269 $ 4.748 $ 4,479 12 13 14 15 16 17 18 You can use this for the Bonds Payable 19 Bond Payable Issue Bond Proceeds Premium Interest Interest Term 20 Rate or Discount Rate Paid 21 given given given given 22 A 23 24 B 25 26 C 27 28 29 30