help asap ...

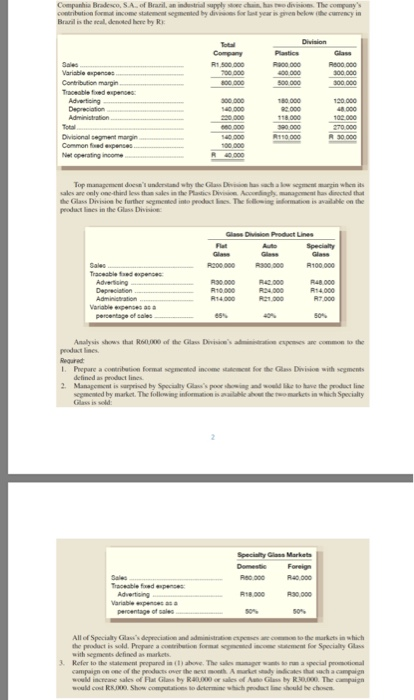

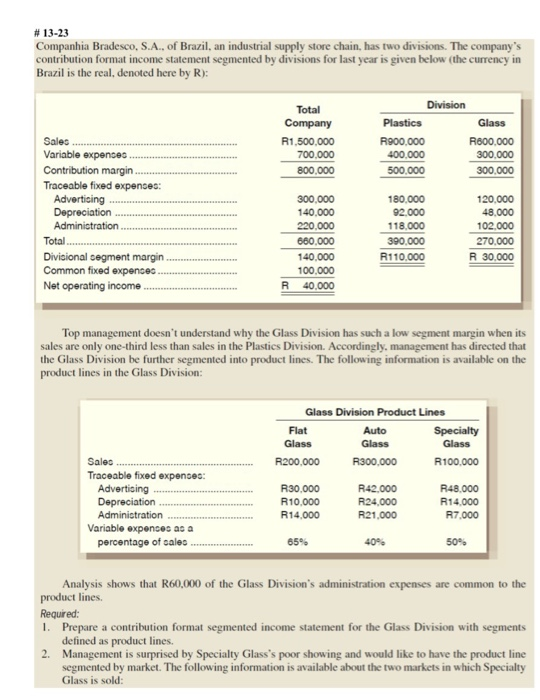

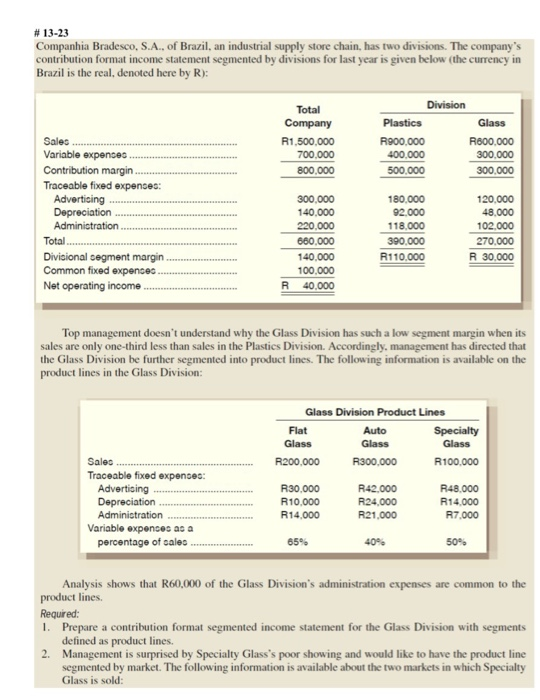

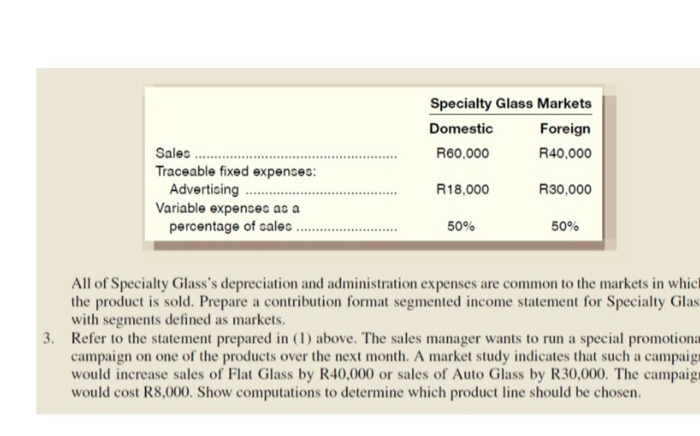

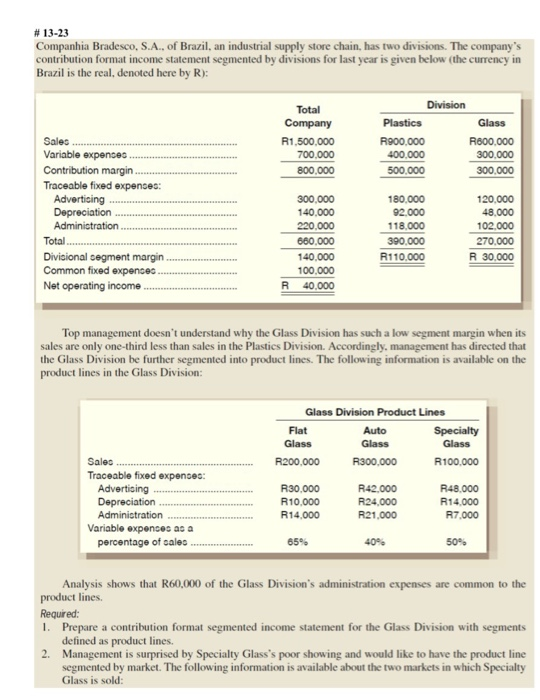

Companhia Bradesco, S.A. of Braril, an industrial supply soee chain has two division The compuny's contribution formt income statement sepmented by divios for last year is piven below ohe cumency in Branil is the seal, denoted here by Ri Division Total Company Plastics Glass R1 500 000 he 0.000 Sales Variable axpance Contribution margin Traceable fixed expenses Advertising Depreciation Raco 000 Reoo 000 400.000 300 000 s00.000 s00 000 300.000 200 000 180 000 120 000 48.000 40.000 000 Administration 20.000 118.000 102 000 e0 000 390 000 R110 000 270.000 R 30 000 Total Divisional segment margin Common fad expenses 140.000 00.000 R4.000 Net operating inoome Top manapement doesn't undentand whry the Glas Diviion has sach a low segment margin when its sales ane only one-third less than sales in the Plastics Divisicn Accoedingly, munagement has dinectod that the Glass Divisioe be further segmented into prodact lnes. The following infomation is available on the peoduct lines in the Glass Division Glass Division Product Lines Speciality Glass Flat Auto Glass Sales. Traceable fredepences Advesing Depreciation Adminictration R200000 R100.000 R300000 R30000 R42.000 R48.000 R10000 R4000 R14.000 R14000 R21.000 R7000 Variable epenses as a percentage of sales es% 40 50% Analysis shows that R60000 of the Glass Division's adminirtion espees are common to the peodact lines Requred I. Prepare a comribution format segmeted income statcmst for the Glass Division with segments defined as product lines 2 Management is sarprised by Specialty Glass's poor showing and would like to have the peodact line sepmented by market. The following indomation is aailable aot the twomarkets in which Specialty Glass is sold: Speciality Glass Markats Domestic Foreign Sales Reo000 Ra0.000 Traceable fed expenses Advertising R18.000 R30,000 Variable penses as percentage of sales so% All of Specialy Glass's depreciation and administratice eapeses are comoe to the markcts in which the product is sold. Propare a costribution format sepmed income stment for Speciality Glass with seements defined as markets Refer to the statement peepared in () above. The sales mager wants to nan a special promoticnal campaign on one of the peoducts over the aest mooth A market stady indicates that sach a campaign wold increase sales of Flat Glass by R40000 or sales of Ato Glass by R30,000 The campaign would cot RK00o Show computatioes to determine whiich prodact line should be chosen #13-23 Companhia Bradesco, S.A., of Brazil, an industrial supply store chain, has two divisions. The company's contribution format income statement segmented by divisions for last year is given below (the currency in Brazil is the real, denoted here by R): Division Total Company Plastics Glass Sales R1,500,000 R900,000 R600,000 300,000 Variable expences 700,000 400,000 Contribution margin 300,000 800,000 500,000 Traceable fixed expenses: Adverticing Depreciation 300,000 180,000 120.000 140,000 92.000 48,000 Adminictration 220,000 118,000 102,000 390,000 R110.000 Total Diviaional cegment margin Common fixed expences Net operating income 660,000 270,000 R 30,000 140,000 100,000 R 40,000 Top management doesn't understand why the Glass Division has such a low segment margin when its sales are only one-third less than sales in the Plastics Division. Accordingly, management has directed that the Glass Division be further segmented into product lines. The following information is available on the product lines in the Glass Division: Glass Division Product Lines Flat Speciality Auto Glass Glass Glass R200,000 R300,000 R100,000 Salec Traceable fixed expenses: Adverticing Depreciation R30,000 R42,000 R24,000 R48,000 R14.000 R10,000 R14,000 Adminictration R21,000 R7,000 Variable expences as a percentage of calec 65% 50% Analysis shows that R60,000 of the Glass Division's administration expenses are common to the product lines. Required: 1. Prepare a contribution format segmented income statement for the Glass Division with segments defined as product lines. 2. Management is surprised by Specialty Glass's poor showing and would like to have the product line segmented by market. The following information is available about the two markets in which Specialty Glass is sold: Speciality Glass Markets Domestic Foreign Sales R60,000 R40,000 Traceable fixed expenses: Advertising Variable expencec ac a percentage of calec.. R18,000 R30,000 50% 50% All of Specialty Glass's depreciation and administration expenses are common to the markets in which the product is sold. Prepare a contribution format segmented income statement for Specialty Glas with segments defined as markets. 3. Refer to the statement prepared in (1) above. The sales manager wants to run a special promotiona campaign on one of the products over the next month. A market study indicates that such a campaig would increase sales of Flat Glass by R40,000 or sales of Auto Glass by R30,000. The campaigt would cost R8,000. Show computations to determine which product line should be chosen