Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help asap please!!!! This is question 2 Now suppose that Small's Business, Inc. (from Question 2) negotiates a payment schedule with the bank so that

Help asap please!!!!

This is question 2

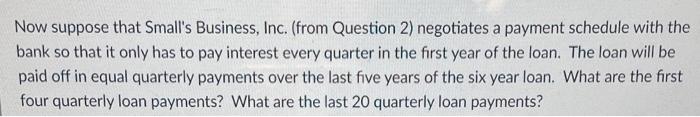

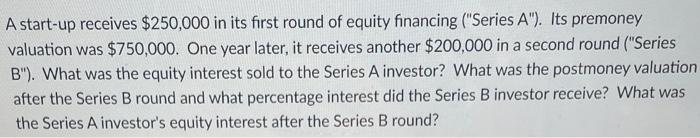

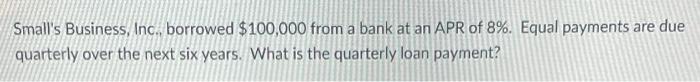

Now suppose that Small's Business, Inc. (from Question 2) negotiates a payment schedule with the bank so that it only has to pay interest every quarter in the first year of the loan. The loan will be paid off in equal quarterly payments over the last five years of the six year loan. What are the first four quarterly loan payments? What are the last 20 quarterly loan payments? A start-up receives $250,000 in its first round of equity financing ("Series A ). Its premoney valuation was $750,000. One year later, it receives another $200,000 in a second round ("Series B"). What was the equity interest sold to the Series A investor? What was the postmoney valuation after the Series B round and what percentage interest did the Series B investor receive? What was the Series A investor's equity interest after the Series B round? Small's Business, Inc., borrowed $100,000 from a bank at an APR of 8%. Equal payments are due quarterly over the next six years. What is the quarterly loan payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started