Help ASAP PLS

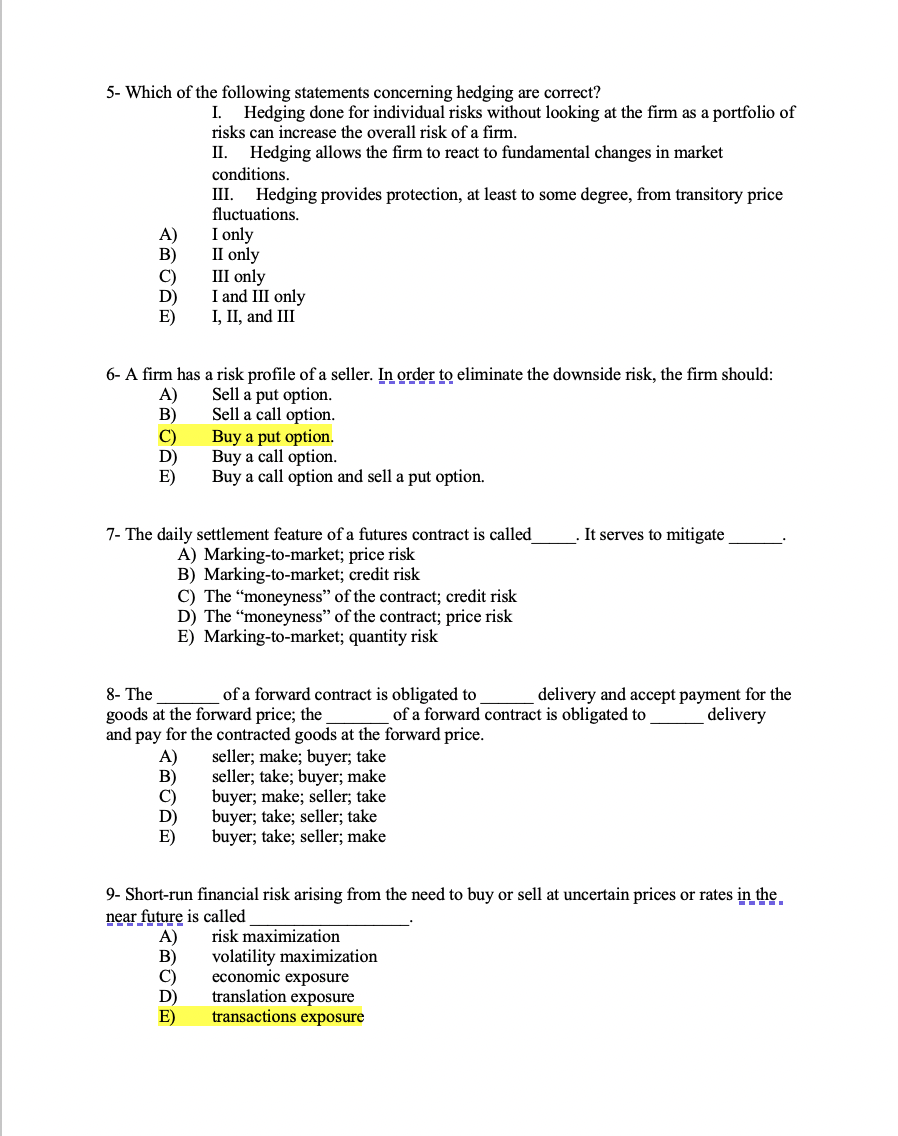

5- Which of the following statements concerning hedging are correct? I. Hedging done for individual risks without looking at the firm as a portfolio of risks can increase the overall risk of a firm. II. Hedging allows the firm to react to fundamental changes in market conditions. III. Hedging provides protection, at least to some degree, from transitory price fluctuations. A) I only B) C) III only D) I and III only E) I, II, and III II only 6- A firm has a risk profile of a seller. In order to eliminate the downside risk, the firm should: A) Sell a put option. B) Sell a call option. C) Buy a put option. D) Buy a call option. E) Buy a call option and sell a put option. It serves to mitigate 7- The daily settlement feature of a futures contract is called A) Marking-to-market; price risk B) Marking-to-market; credit risk C) The moneyness" of the contract; credit risk D) The "moneyness" of the contract; price risk E) Marking-to-market; quantity risk 8- The of a forward contract is obligated to delivery and accept payment for the goods at the forward price; the of a forward contract is obligated to delivery and pay for the contracted goods at the forward price. A) seller; make; buyer, take B) seller; take; buyer, make C) buyer; make; seller, take D buyer; take; seller; take E) buyer; take; seller; make 9- Short-run financial risk arising from the need to buy or sell at uncertain prices or rates in the. near future is called A) risk maximization B) volatility maximization economic exposure D) translation exposure E) transactions exposure 5- Which of the following statements concerning hedging are correct? I. Hedging done for individual risks without looking at the firm as a portfolio of risks can increase the overall risk of a firm. II. Hedging allows the firm to react to fundamental changes in market conditions. III. Hedging provides protection, at least to some degree, from transitory price fluctuations. A) I only B) C) III only D) I and III only E) I, II, and III II only 6- A firm has a risk profile of a seller. In order to eliminate the downside risk, the firm should: A) Sell a put option. B) Sell a call option. C) Buy a put option. D) Buy a call option. E) Buy a call option and sell a put option. It serves to mitigate 7- The daily settlement feature of a futures contract is called A) Marking-to-market; price risk B) Marking-to-market; credit risk C) The moneyness" of the contract; credit risk D) The "moneyness" of the contract; price risk E) Marking-to-market; quantity risk 8- The of a forward contract is obligated to delivery and accept payment for the goods at the forward price; the of a forward contract is obligated to delivery and pay for the contracted goods at the forward price. A) seller; make; buyer, take B) seller; take; buyer, make C) buyer; make; seller, take D buyer; take; seller; take E) buyer; take; seller; make 9- Short-run financial risk arising from the need to buy or sell at uncertain prices or rates in the. near future is called A) risk maximization B) volatility maximization economic exposure D) translation exposure E) transactions exposure