Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help ASAP!!!#1 and #3 Please (#2 goes w/ 3). Attached is the given trial balance + then the questions. Thanks so much I need help

Help ASAP!!!#1 and #3 Please (#2 goes w/ 3). Attached is the given trial balance + then the questions. Thanks so much

I need help with #1 (Constructing T-accounts) and #2 prepare the adjusting journal entries. Thanks in advance

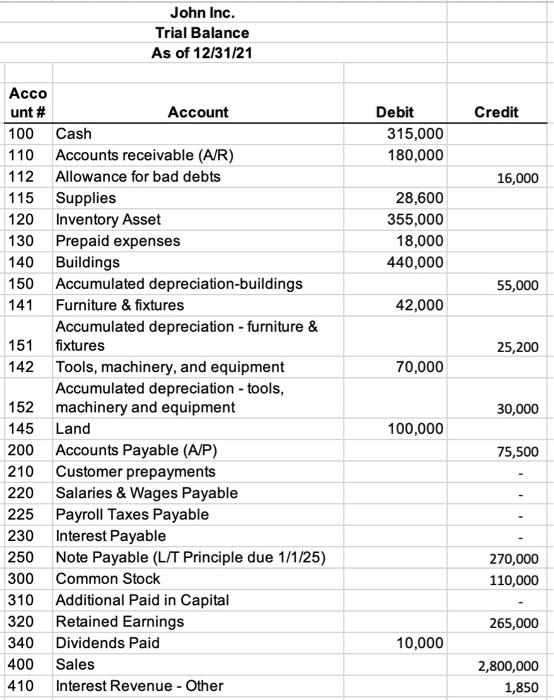

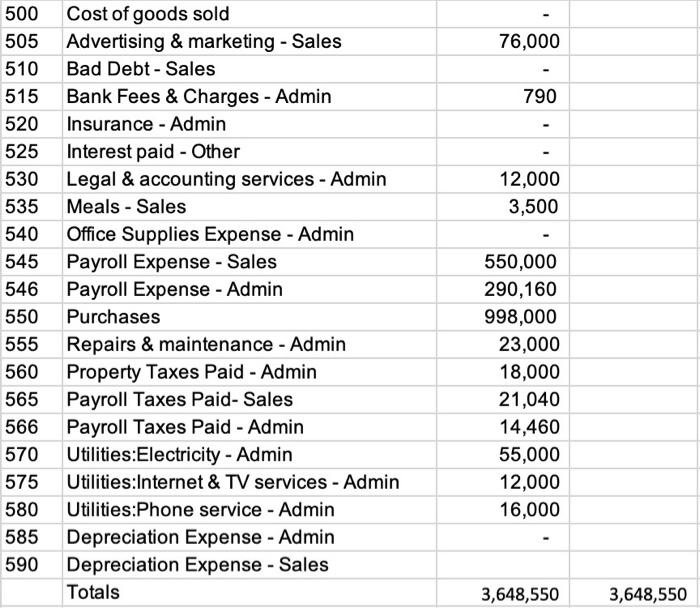

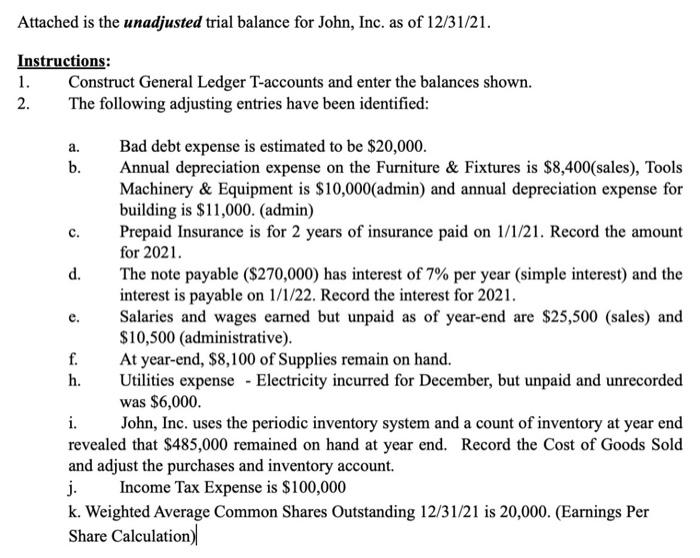

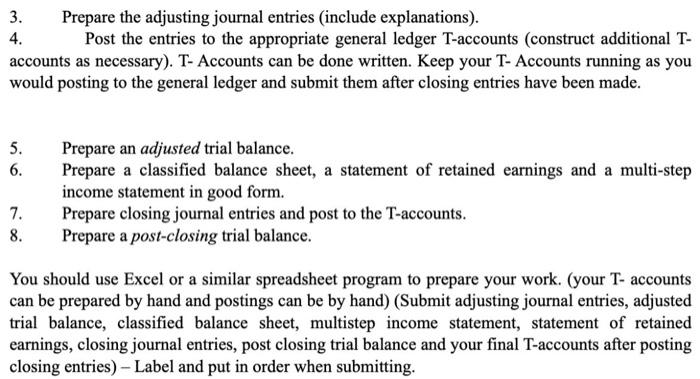

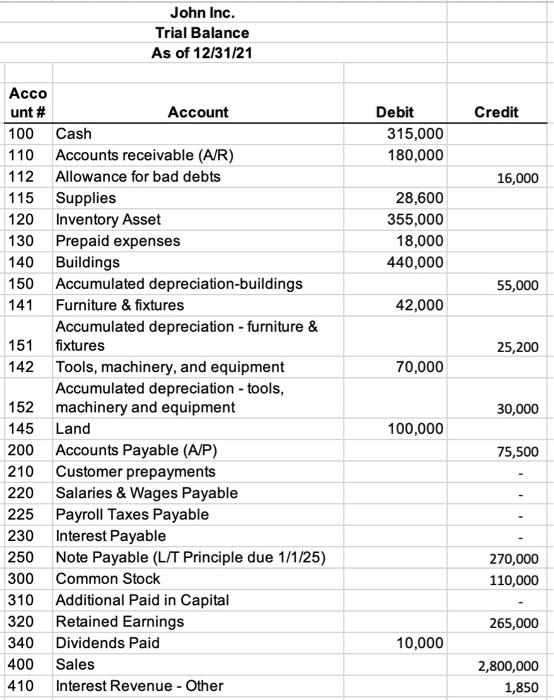

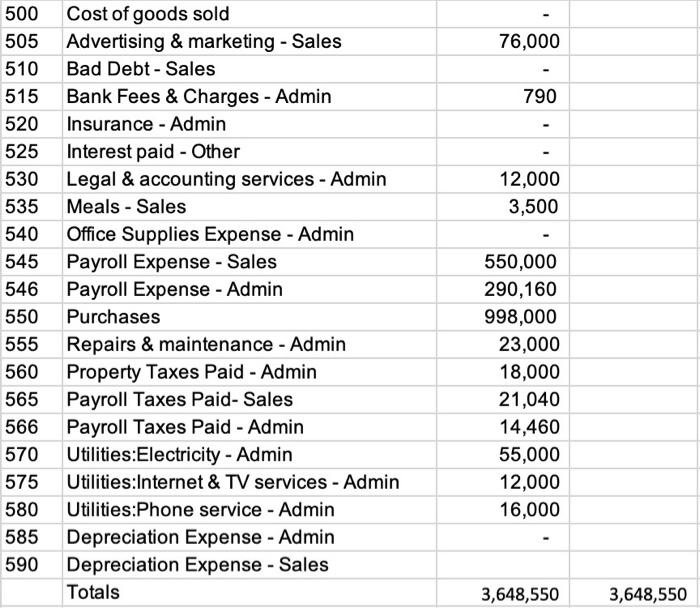

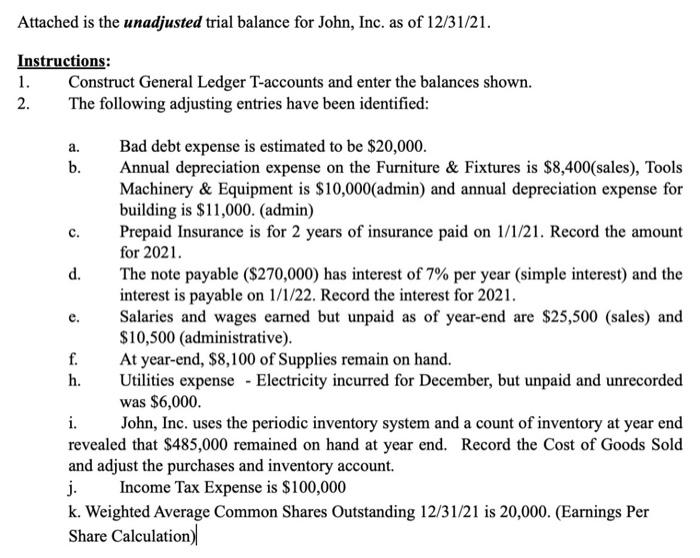

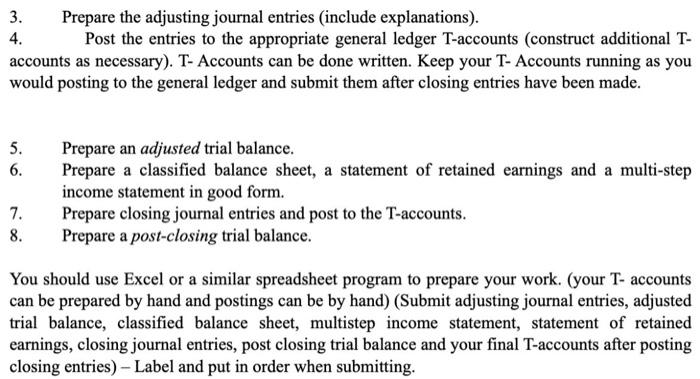

Construct General Ledger T-accounts and enter the balances shown. The following adjusting entries have been identified: a. Bad debt expense is estimated to be $20,000. b. Annual depreciation expense on the Furniture \& Fixtures is $8,400 (sales), Tools Machinery \& Equipment is $10,000( admin) and annual depreciation expense for building is $11,000. (admin) c. Prepaid Insurance is for 2 years of insurance paid on 1/1/21. Record the amount for 2021 . d. The note payable ($270,000) has interest of 7% per year (simple interest) and the interest is payable on 1/1/22. Record the interest for 2021 . e. Salaries and wages earned but unpaid as of year-end are $25,500 (sales) and $10,500 (administrative). h. Utilities expense - Electricity incurred for December, but unpaid and unrecorded was $6,000. i. John, Inc. uses the periodic inventory system and a count of inventory at year end revealed that $485,000 remained on hand at year end. Record the Cost of Goods Sold and adjust the purchases and inventory account. j. Income Tax Expense is $100,000 k. Weighted Average Common Shares Outstanding 12/31/21 is 20,000. (Earnings Per Share Calculation) 3. Prepare the adjusting journal entries (include explanations). 4. Post the entries to the appropriate general ledger T-accounts (construct additional Taccounts as necessary). T- Accounts can be done written. Keep your T- Accounts running as you would posting to the general ledger and submit them after closing entries have been made. 5. Prepare an adjusted trial balance. 6. Prepare a classified balance sheet, a statement of retained earnings and a multi-step income statement in good form. 7. Prepare closing journal entries and post to the T-accounts. 8. Prepare a post-closing trial balance. You should use Excel or a similar spreadsheet program to prepare your work. (your T- accounts can be prepared by hand and postings can be by hand) (Submit adjusting journal entries, adjusted trial balance, classified balance sheet, multistep income statement, statement of retained earnings, closing journal entries, post closing trial balance and your final T-accounts after posting Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started