Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asapp Problem None-Constant Growth Corporation is a young start-up company and just paid dividend of $2.50 (D.). The firm is projecting the dividend to

help asapp

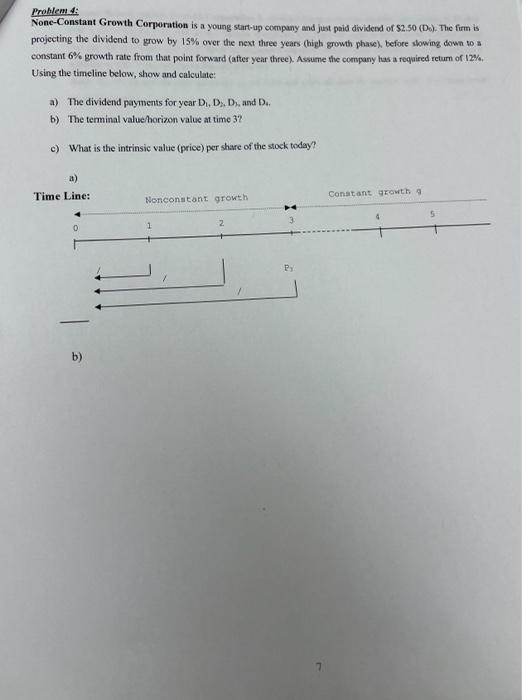

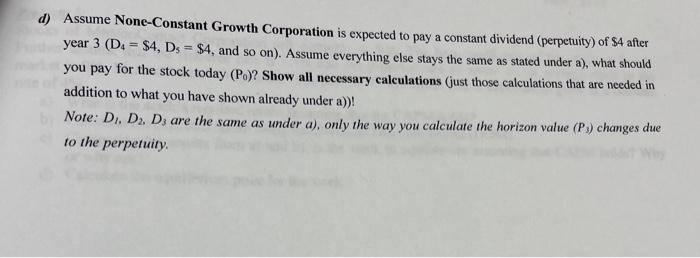

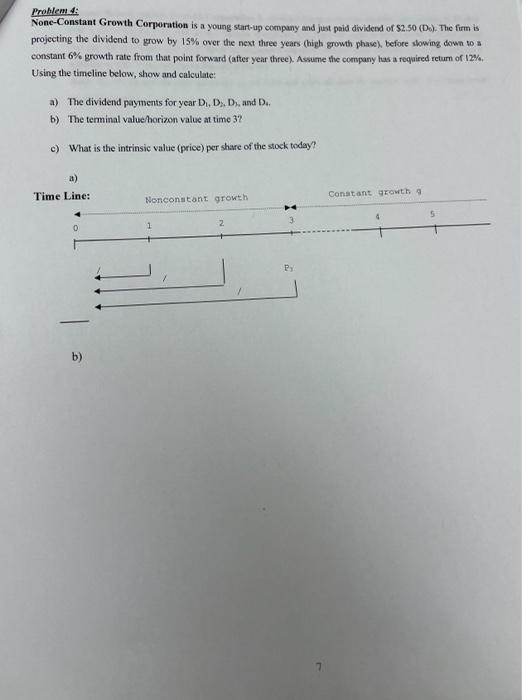

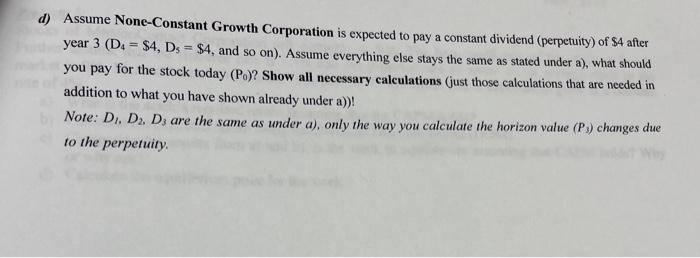

Problem None-Constant Growth Corporation is a young start-up company and just paid dividend of $2.50 (D.). The firm is projecting the dividend to grow by 15% over the next three years Chigh growth phase), before slowing down to a constant 6% growth rate from that point forward (after year three). Assume the company has a required return of 12% Using the timeline below, show and calculate: a) The dividend payments for year D, DD, and D. b) The terminal value horizon value at time 37 c) What is the intrinsic value (price) per share of the stock today! a) Time Line: Constant growth Nonconstant growth 5 1 2. b) d) Assume None-Constant Growth Corporation is expected to pay a constant dividend (perpetuity) of $4 after year 3 (Du = $4, Ds = $4, and so on). Assume everything else stays the same as stated under a), what should you pay for the stock today (P.)? Show all necessary calculations (just those calculations that are needed in addition to what you have shown already under a))! Note: D. D. D; are the same as under a), only the way you calculate the horizon value (P) changes due to the perpetuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started