help assp

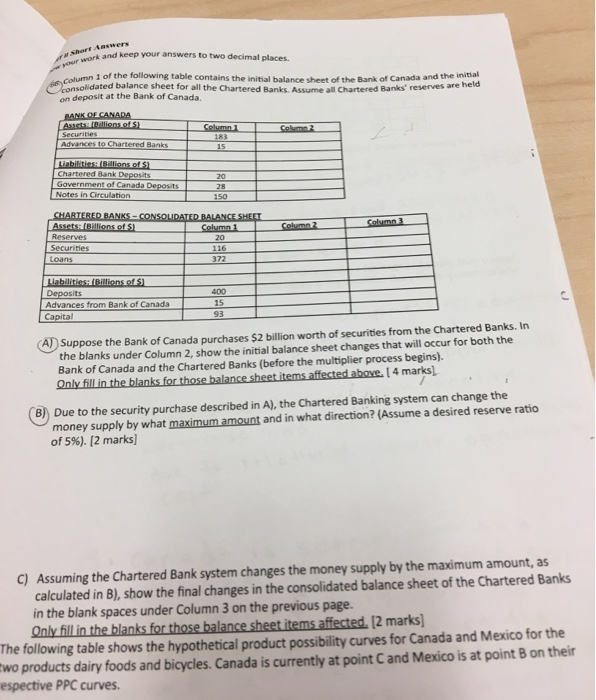

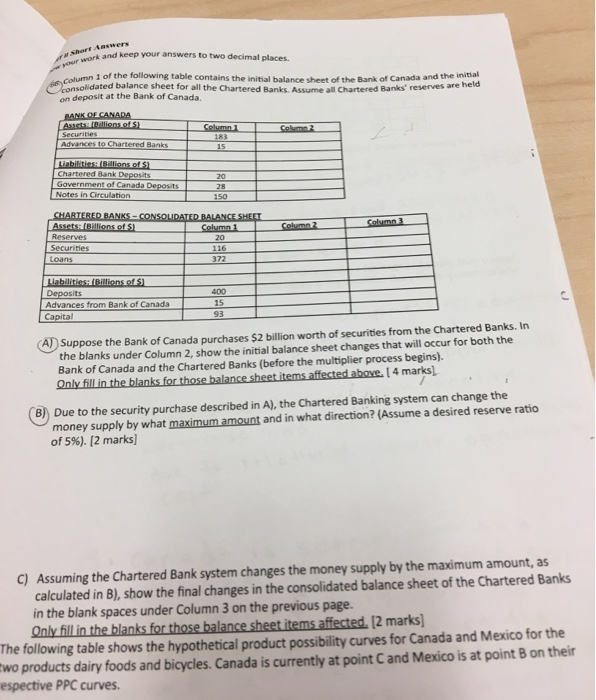

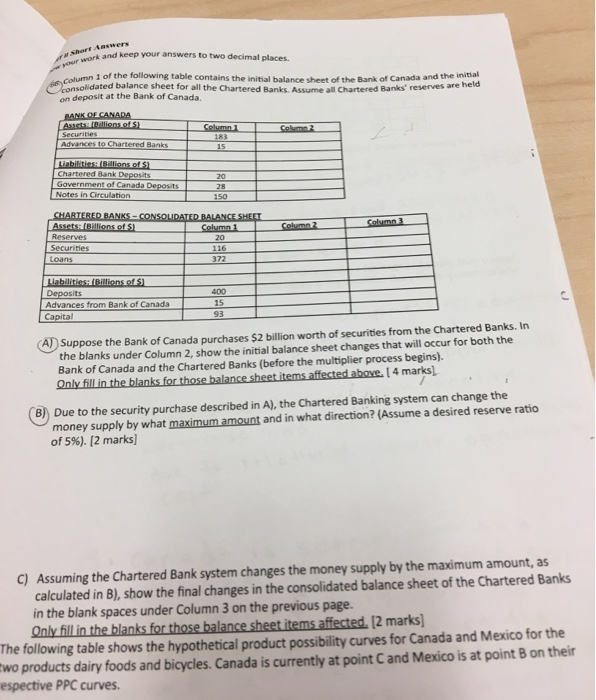

r short k and keep your answers to two decimal places. wor 1 of the following table contains the initial balance sheet of the Bank of Canada and the initial Column consolidated balance sheet for all the Chartered Banks. Assume all Chartered Banks' reserves are hel held on deposit at the Bank of Canada. Chartered Banik Notes in Circulation Reserves 372 400 15 Advances from Bank of Canada Capital 93 A) Suppose the Bank of Canada purchases $2 billion worth of securities from the Chartered Banks. In the blanks under Column 2, show the initial balance sheet changes that will occur for both the Bank of Canada and the Chartered Banks (before the multiplier process begins). Only fill in the blanks for those balance sheet items affected above. [ 4 marks) ) Due to the security purchase described in A), the Chartered Banking system can change the money supply by what maximum amount and in what direction? (Assume a desired reserve ratio of 5%). [2 marks] C) Assuming the Chartered Bank system changes the money supply by the maximum amount, as calculated in B), show the final changes in the consolidated balance sheet of the Chartered Banks in the blank spaces under Column 3 on the previous page Only fill in the blanks for those balance sheet items affected.12 marks) The following table shows the hypothetical product possibility curves for Canada and Mexico for the wo products dairy foods and bicycles. Canada is currently at point C and Mexico is at point B on their espective PPC curves r short k and keep your answers to two decimal places. wor 1 of the following table contains the initial balance sheet of the Bank of Canada and the initial Column consolidated balance sheet for all the Chartered Banks. Assume all Chartered Banks' reserves are hel held on deposit at the Bank of Canada. Chartered Banik Notes in Circulation Reserves 372 400 15 Advances from Bank of Canada Capital 93 A) Suppose the Bank of Canada purchases $2 billion worth of securities from the Chartered Banks. In the blanks under Column 2, show the initial balance sheet changes that will occur for both the Bank of Canada and the Chartered Banks (before the multiplier process begins). Only fill in the blanks for those balance sheet items affected above. [ 4 marks) ) Due to the security purchase described in A), the Chartered Banking system can change the money supply by what maximum amount and in what direction? (Assume a desired reserve ratio of 5%). [2 marks] C) Assuming the Chartered Bank system changes the money supply by the maximum amount, as calculated in B), show the final changes in the consolidated balance sheet of the Chartered Banks in the blank spaces under Column 3 on the previous page Only fill in the blanks for those balance sheet items affected.12 marks) The following table shows the hypothetical product possibility curves for Canada and Mexico for the wo products dairy foods and bicycles. Canada is currently at point C and Mexico is at point B on their espective PPC curves