Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP! Can someone help me with this? I asked previously on chegg and it was answered by an expert partially incorrect and incomplete. Two Independent

HELP! Can someone help me with this? I asked previously on chegg and it was answered by an expert partially incorrect and incomplete.

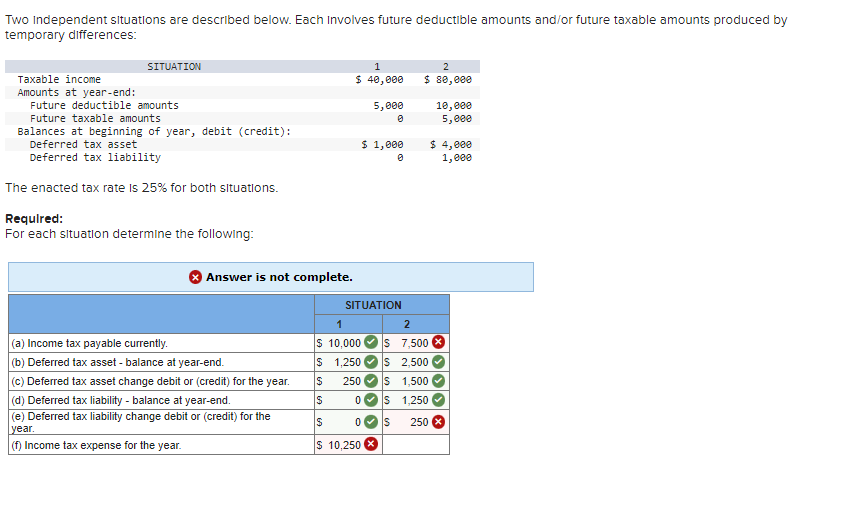

Two Independent situations are described below. Each Involves future deductlble amounts andor future taxable amounts produced by

temporary differences:

The enacted tax rate is for both situations.

Required:

For each situation determine the following:

Answer is not complete.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started